Do You Have Other Negative Information Affecting Your Credit

Do you have other negative marks on your credit reports? Or maybe you dont want to bother disputing inquiries on your own? If so, you can retain a credit repair company that can do the work more efficiently and effectively for you.

A professional performs these tasks hundreds of times a day. However, when investigating credit repair companies, be sure to look for a firm with many years of experience and many happy clients.

Check out our Lexington Law Firm Review to find out more about the company that has over 28 years of experience and hundreds of thousands of happy clients, or call for a free consultation to see how they can improve your credit score.

Search For Unauthorized Hard Inquiries

Once you have copies of your credit reports, review them for mistakes, errors, and fraud. Search for credit accounts you dont recognize, incorrect credit reporting on valid accounts , and other mistakes. Finally, check your credit reports for unauthorized inquiries.

If you discover inquiries you dont recognize on your credit report, it could be a sign of identity theft. Make a list of any suspicious inquiries you find. Youll need this information to complete the next step.

Send A Dispute Letter To The Credit Bureaus

If you canât get satisfaction from the creditor who is listed as making the inquiry, your next move is to reach out to Equifax and/or TransUnion directly and lodge an official about the hard pull. By law, a credit bureau must investigate any information on your credit report that you allege is an error.

Recommended Reading: How To Remove A Repo Off Your Credit

Why You Can Trust Bankrate

At Bankrate, we have a mission to demystify the credit cards industry regardless or where you are in your journey and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

- Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

- Consistently provide up-to-date, reliable market information so you\’re well-equipped to make confident decisions.

- Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next.

Q Does Adding A Fraud Warning Prevent Information From Updating To My Credit File

A. A fraud flag does not prevent changes from being made to your file without your authorization. In Ontario, the legislation mandates that financial institutions upon receipt of a fraud warning, take reasonable steps to identify the consumer that they are entering into specific transactions with. These reasonable steps may include contacting the consumer by phone or other steps, as determined by each financial institution. If you wish to monitor changes to your credit file, we recommend a visit to our website at www.transunion.ca for more information about our Credit Monitoring product. Please note that there is a fee for enrolling in this service.

Read Also: How To Get Repossession Off Credit

Hard Vs Soft Credit Inquiries

Hard inquiries are the only type of credit pull that can affect your credit score, and they’re the only ones that businesses will see on your credit report. Credit inquiries that don’t affect your score and don’t appear on your report are called soft pulls. Examples of soft inquiries include you checking your own report and a potential employer accessing it during a background check. And credit card issuers may do soft inquiries when they are preparing promotional card offers.

Credit inquiries carried out by insurance companies when you’re seeking quotes for various kinds of policies are considered soft inquiries and do not show up on your credit report.

Q How Do I Remove Or Update My Potential Fraud Alert

A.There are three ways you can remove or update a Potential Fraud Alert on your credit file:

- Online: to visit our self-service website. To promote our online Potential Fraud Alert service, sign-up is free for a limited time.

- Over the telephone: simply call 1-800-663-9980 to reach one of our TransUnion representatives for assistance.

- In writing: for mailing instructions and TransUnion requirements.

Also Check: Does Paypal Credit Report To Bureaus

Q Will Transunion Accept Tty & Trs

Once all required elements have been met, the standard operating procedure for handling Consumer calls will apply.

Look For Inaccurate Hard Inquiries

Once you get the report, look over the whole thing. There should be a hard inquiries section. Make sure you recognize each hard inquiry on your report. But dont jump to conclusions if you see any information you dont recognize.

Often, companies will outsource their credit checks to other companies. This usually happens with store credit cards, so do a quick Google search to see if the name listed on the hard inquiry matches up with a company you recognize.

Also Check: Increase Credit Score By 50 Points

Should I Dispute Credit Online Or By Mail

Experts recommend that it is best to dispute credit by mail. It will allow you to attach additional evidence and you will have proof of the mail you sent the credit bureau.

All reviews, research, news and assessments of any kind on The Tokenist are compiled using a strict editorial review process by our editorial team. Neither our writers nor our editors receive direct compensation of any kind to publish information on tokenist.com. Our company, Tokenist Media LLC, is community supported and may receive a small commission when you purchase products or services through links on our website. Click here for a full list of our partners and an in-depth explanation on how we get paid.

About the author

How Long Do Hard Inquiries Stay On A Credit Report

Hard inquiries typically stay on your credit report for two years but some credit reporting bureaus may not factor it into your score after a year. You may also find that some credit scoring companies only consider hard inquiries from the past twelve months.

Are you comparing rates for auto loans, credit cards or more? When hard inquiries are pulled during a short period amount of time, credit reporting agencies generally recognize this as one event.

Unlike a soft inquiry, a hard inquiry should not be performed without your consent. If you’ve noticed a recent hard inquiry that you did not authorize, you can reach out to your credit reporting bureau. Once you contact them, you can find out more information on how to file a report and start the process of removing that inquiry from your report.

Don’t Miss: What Credit Bureau Does Affirm Use

When Should You Not Focus On Removing Inquires

If your credit score is below 680, it is probably due to prior negative payment history, collections or public records. You would need to address these items first with and either debt validation or pay for deletions for collections and engaging .

Additionally, other factors linked to high credit utilization, the age of your credit accounts and lack of revolving credit may also be suppressing your score.

Is It Possible To Remove A Hard Inquiry

I started this column out by saying that removing accurate and timely information from your report is generally not possible. This is true for hard inquiries as well. If you did apply for creditagain, whether or not you were approvedthose inquiries will show up on your credit report and affect your credit score.

However, there is one big fat exception to this: identity theft. In the case of identity theftwhere someone else applied for credit in your name without your knowledge or approvalthose inquiries can and should be removed.

This can be a detailed process, but the Federal Trade Commission has listed out the necessary steps here. As with all disputes, keep good records and in the case of identity theft, be sure to get a police report documenting the theft.

Recommended Reading: Transunion Account Locked

How Do Credit Inquiries Affect Your Credit

Hard credit inquiries have a negative impact on your credit score.

When a hard inquiry appears on your report, it will reduce your credit score by a few points, usually no more than five to 10 points.

Other factors on your credit report can influence how much each inquiry reduces your score. If you have strong credit, an inquiry will likely have a smaller impact than if you already have poor credit.

Each hard inquiry affects your credit score. If one inquiry drops your score by 5 points, then having two might reduce it by 10, and having four on your report could drop it by about 20.

As time passes, the impact that each hard inquiry has on your credit score decreases. After a few months, youll likely regain most of the lost points, assuming the rest of your credit history remains positive.

File A Dispute With The Credit Reporting Agency

Once you have your report, make sure to look through each account and see if there are creditors you dont recognize. Its also important to check whether older derogatory items are still being reported.

If you do find errors in your reports, its time to initiate a dispute directly with the reporting bureau through its website or by mail. This will prompt an investigation on the bureau’s part.

Bear in mind that you have to dispute the entry with each agency to make sure the removal is complete across the board.

How to file a dispute online

Each bureau Equifax, Experian and TransUnion has a section dedicated to walking consumers through the online dispute process. Once you create an account, you can file as many disputes as you need and check their status, for free.

How to file a dispute letter

You can also send a dispute letter to the bureaus, detailing any inaccuracies you’ve found in your credit file. When writing your letter, provide documentation that supports your claim and be precise about the information you are challenging. The Consumer Financial Protection Bureau recommends enclosing a copy of your report with the error circled or highlighted.

Depending on the information being disputed, these are some of the documents you can provide to help aid the investigation:

- Copies of checks

Include this dispute form with your letter.

Also Check: What Card Is Syncb/ppc

How To Minimize Credit Score Damage From Hard Inquiries

As I mentioned earlier, you should avoid making several inquiries in a short period of timeunless you are shopping for a student loan, a mortgage or car loan. The credit scoring algorithms take into account that people tend to rate shop for these purchases. In these instances, as long as you keep the inquiries within a certain time window, they will only count as one in your score calculation.

The elves at FICO look at your credit report for rate-shopping inquiries. If they find some, they will consider inquiries that fall in a typical shopping period as just one inquiry. Older versions of the FICO score use a shopping period of 14 days. Newer versions use a shopping period of 45 days.

Each lender may use a different version of the FICO scoring formula to calculate your FICO scores. VantageScore 3.0 counts all car or mortgage loan inquiries made within a 14-day period as just one inquiry on your credit report. They will all show up on your credit report, but they will be grouped all together for the purpose of calculating your score.

As with all things credit-score related, there are tried-and-true methods for minimizing damage when your score has been negatively affected in any way:

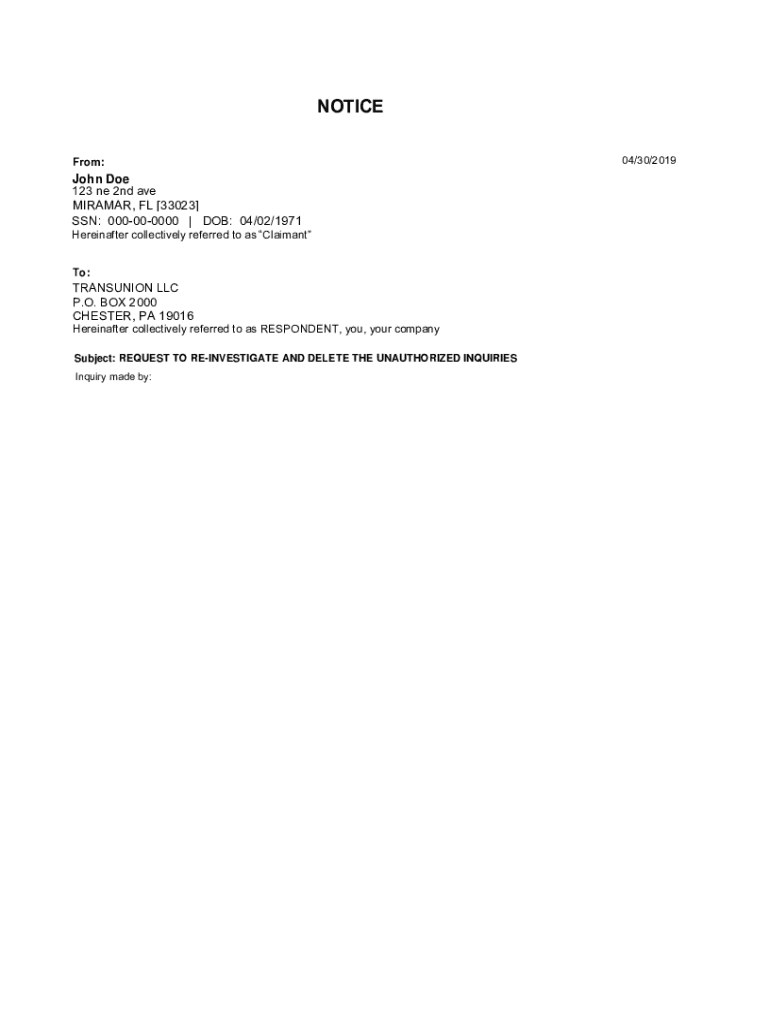

File A Dispute With The Credit Bureaus

If your creditor wont remove the hard inquiry from your report, contact the credit bureau that provided the report with the mistaken inquiry and dispute your credit report.

File your dispute in writing by sending a dispute letter. You can either file online or by sending an actual letter. If you file your dispute by mail, keep another copy for your records. Doing so provides you with documentation, which makes it easier to take legal action later if you need to.

You can also file a dispute over the phone, but this makes it harder to document the process, so it usually isnt advisable.

You can get a dispute letter template from the Federal Trade Commission.

Use this to file a dispute directly with one of the credit bureaus. Mistakes in your personal information , as well as credit accounts that you dont recognize, should usually be disputed with the bureaus. Often theyre the result of the bureau confusing you for someone else.

Be sure to include the following items and information in your letter:

- Your name, address, Social Security number, and date of birth

- The date that you wrote the letter

- Details of the dispute

- A description of the inquiry

- The credit report in question with the inquiry clearly indicated

- A request for prompt removal

Read Also: Unlock Transunion Credit Lock

How To Monitor Your Business Credit And Personal Credit

Its wise to claim your free credit reports once every 12 months from the consumer credit bureaus. But an annual credit check may not be enough to alert you if a problem arises . Instead, youll be better off checking your credit more frequently perhaps on a quarterly or even monthly basis.

Theres also no law that currently gives you free access to your business credit reports. You can, however, keep a closer eye on your credit historybusiness and/or personalif you sign up for a credit monitoring service.

Some credit monitoring services give you access to one or more of your personal credit reports. Others may allow you to access one or more of your business reports. With Nav, you can review business and personal credit information in one location.

Navs Final Word: Removing Inquiries from Your Report

The best way to prevent inquiries from hurting your credit scores is to apply very carefully, and only for loans or credit cards you think you are likely to get. If you are shopping for a vehicle, for example, get preapproved for a car loan ahead of time from a reputable lender. Dont let the dealership shop your credit application to dozens of lenders unless you want the risk of multiple inquiries on your credit reports.

On the other hand, unauthorized inquiries can be a sign of a serious problem. If you suspect that someone has been applying for new credit in your name or your companys name without your permission, its critical to take action right away.

Q How Long Does A Fraud Alert Stay On My Credit File

A. The statement remains on your file for a period of 6 years from the date reported. The statement requests that creditors viewing your complete report contact you before making a decision to extend credit based on the information in your credit report.The protective statement is applied to your credit file and a copy of your report will be mailed to you upon receipt of proper identification.

Also Check: How Do I Notify Credit Bureaus Of A Death

How To Remove Inquiries From Your Credit Report On Your Own

Under most circumstances, you will not be able to remove legitimate hard inquiries that you made or approved from your credit report on your own. Although these inquiries will have an impact on your credit report until they resolve themselves, they will usually only remain on your credit report for two years. While this is a much shorter amount of time than many other categories remain on your credit report, you should not have to deal with them for two years if they were the result of identity theft, mistakes, or other types of fraud.

Attempting to deal with credit companies on your own can be a lengthy and difficult process. If you have experienced identity theft or otherwise do not recognize a particular inquiry, you may be able to have it removed by getting in touch with the lender or credit company and providing sufficient evidence that you did not request or approve a particular inquiry.

Hard Inquiries Should Be Removed After 2 Years

The only way that a dispute will work is if the inquiry appears in error on your credit report. Fortunately, hard inquiries only appear for two years on your credit report. Most other negative information will remain for seven years. A Chapter 7 bankruptcy remains for up to 10 years, though its effects on your credit score are much more short-lived.

Read Also: How Long Will A Repo Stay On My Credit

Q How Do I Know If Im A Victim Of Fraud

A. If a creditors fraud department, government agency or law enforcement agency referred you to the TransUnion Fraud Victim Assistance Department , you may already know that you are a fraud victim. Otherwise, you may merely suspect that fraud has occurred. If you are the victim of a credit fraud crime, you should take certain steps to protect yourself and your rights.Common Signs of FraudSigns of Fraud can vary but typical indicators of fraud and / or stolen identity include:

- One of your creditors informs you that they have received an application for credit with your name, address and/or Social Insurance Number.

- Telephone calls or letters state that you have been approved or declined by a creditor to which you never applied.

- You no longer receive your credit card statements or you notice pieces of mail are no longer delivered to you.

- Your credit card statement includes unusual purchases.

- A collection agency informs you they are collecting for a defaulted account that has been established with your identity but not opened by you.