What Credit Score Is Used When Buying A Car

Different car lenders check different credit scores, so you won’t know for sure which one they will look at when determining your auto loan application. Your best bet, however, would be to check something called an industry-specific score.

FICO provides industry-specific scores that consumers can refer to when making certain purchases like a car or home. Just like a standard credit score, your industry-specific score helps determine future loan terms and interest rates.

The FICO Auto Score considers your usual credit behaviors but puts more emphasis on how you’ve managed auto loan payments in the past. It considers things like: have you consistently made your loan payments, and on time? FICO Auto Scores range from 250 to 900 and have several versions, including FICO Auto Scores 2, 4, 5 and 8. The easiest way to check all four FICO Auto Scores at the same time is through FICO’s credit monitoring service.

Knowing your auto-related credit score can be useful when financing a car, since it can affect your loan terms and rates. Any increase in your interest rate can lead to a higher monthly payment and paying thousands of dollars more over the course of a loan.

What Credit Score Do I Need To Refinance My Car Loan

Considering an auto refinance loan but nervous about your credit score? Dont worry, there are other factors that can work in your favor.

Are you in the market for a new auto loan? If so, youve probably wondered, What does my credit score need to be to refinance a car?

Much to the surprise of many vehicle owners, theres no true minimum credit score to qualify for auto loans or refinancing. There are plenty of subprime lenders that offer loans to borrowers with bad credit even if your credit score is well below 600.

However, dont get tunnel vision and solely focus on your credit score its only one factor that auto lenders consider when deciding whether to issue you a new loan. Lenders also look at your income, debt, existing car loan, and vehicle.

2022 Auto Refinance Rates

How To Improve Your Credit Score Before Buying A Car

If you dont have a perfect credit score just yet, dont worryyoure not alone. There are plenty of steps you can take to improve your credit score before applying for an auto loan. Here are some things you can do that will increase your score relatively quickly:

- Catch up on paying off any past-due debts.

- Check your credit report and dispute any inaccurate marks on your file.

- Pay down as much revolving debt as possible.

- Avoid any hard credit checks, such as those from applying for new credit or services.

- Avoid closing old credit cards you dont use, as long as they dont carry an annual fee.

- Request credit limit increases on your credit cards (and dont use that extra credit if its not needed.

Here are some things you can do to improve your credit score in the long run:

- Always pay your bills on timeset up autopay so youre worried you might forget.

- Open new types of loans and credit as you need them, such as student loans or credit cards, to diversify the types of credit you have.

Building your credit score to a level that qualifies you for an affordable car loan can take a long time in some cases. But its well worth it because youll be able to get the best car possible at a price that wont drain your bank account.

Read Also: How To Remove A Repo From Credit

How To Check Your Credit Score For Free

Many people are in the dark about their credit because theyre under the assumption that you have to pay for your credit score, which just isnt true. There are several ways you can find out your credit score for free.

One of the best ways to prepare for an auto loan is by getting your credit score and credit reports. We’ll show you how to stay on top of your credit reports all year long at no cost, too.

Advantages Of A Fico Auto Score

FICO auto scores are a great way for auto-industry-specific lenders to understand how trustworthy you are when it comes to managing car payments. Even if youve lacked in other credit areas but you managed to stay on top of your auto payments, then your FICO auto score may be higher than your base score.

Recommended Reading: How To Get Public Records Removed From Credit Report

Can I Sell My Car With A Loan

It is possible to sell your car with an outstanding loan, but you may have to go through a few extra steps. If your car is worth less than what you currently owe on the loan, you have what’s known as negative equity meaning you may need to pay the difference out of pocket or refinance the remaining amount with a different type of loan.

If your car is worth more than what you currently owe, on the other hand, you may be able to pocket the difference in cash when you sell the car. Whatever your situation, reach out to your lender about your options, as each lender sets different rules for selling a car with a loan.

The Auto Credit Score: What Is It

The Auto Credit Score also called an auto-enhanced credit score is a scoring model auto lenders use to determine your eligibility for a loan. Your automotive-weighted score places more emphasis on your payment history with auto loans and leases. So, if youve had past auto loans and you were on time with your payments, the lender will see a higher auto score compared to your regular FICO score. On the other hand, if you were delinquent with any past auto loans, this negatively affects your automotive-weighted score, and lenders could see a score thats below your regular FICO score.

Automotive lenders take this weighted credit score seriously, as it helps them determine if youre prone to delinquency and gives them an idea of how you might pay your next car loan.

You May Like: Is Credit Wise Score Accurate

Other Ways To Monitor Your Credit

There are a number of sites online that offer free credit scores. Though these offers may be legitimate, not all of them provide you with your FICO score. Just be aware of this fact, and take a closer look at exactly what they’re providing. If you’re preparing to take out a loan or another line of credit, try to get your FICO score, as this is what the lender that’s evaluating your application is likely going to pull.

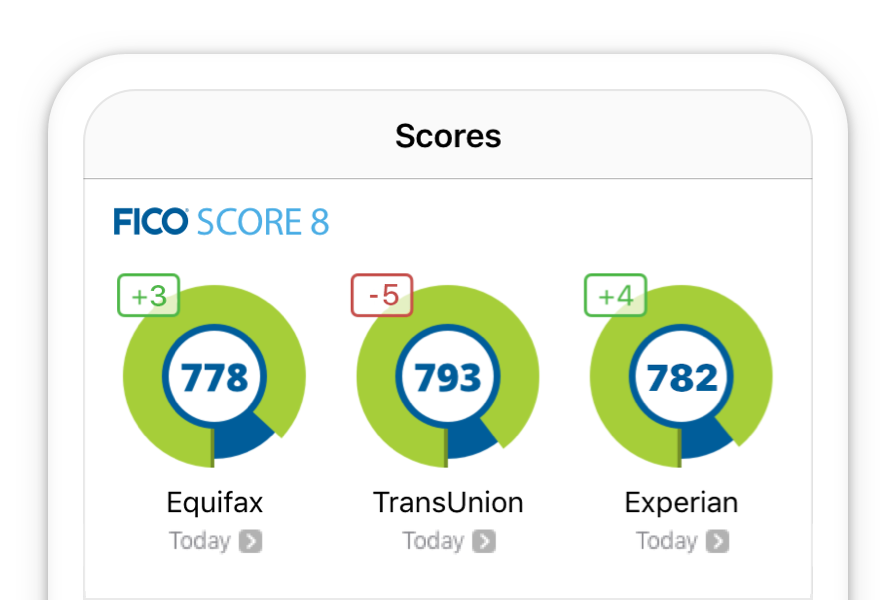

For example, the three major credit bureaus TransUnion, Experian, and Equifax offer you credit scores based on their credit scoring system, called VantageScore. VantageScores are calculated differently, so don’t be surprised if it differs from your FICO score. Other free online credit score providers, such as Credit Karma, Credit Sesame, and Credit.com, may also not be providing you with your FICO score.

Even though the initial credit check through some of these sites are free, they sometimes require you to . These services can help you keep better track of your credit, but they can be expensive and not worth it to you.

As we mentioned, its a good idea to keep up with both your credit score and credit reports. For your credit reports, youre allowed one copy from each credit bureau once every 12 months, thanks to the Fair Credit Reporting Act. In order to request them, simply visit www.annualcreditreport.com.

You Can Improve Your Fico Auto Score

Even if you have a couple of derogatory marks or late payments on your auto loan credit report, you can still improve your FICO auto score with help from MoneyLion. Our help you improve your credit score over 12 months with monthly credit bureau reporting and expert tips to increase your credit score.

Don’t Miss: What Credit Bureau Does Usaa Use

How Can Gettel Chevrolet Buick Help

But we’re here for you. We have a knowledgeable and understanding finance department that will work with you, not against you. Here at Gettel Chevrolet Buick, we will shift through all your available options and recommend the best choice for you. We see our goal as to get you the best terms for your financing as possible.

Shop Around For A Preapproval

Each lender can look at your credit history in slightly different ways and offer you a different loan APR. Thats why its best to shop around for any type of loan you want. Dont rely on a dealership to do this for you. As the middleman, car dealers can raise your APR up to two percentage points. Instead, look at the best auto loans for bad credit and especially consider applying at your local credit union.

| Lender | |

|---|---|

| $7,500 or more | Refinance loans |

It does not hurt your credit to apply to multiple lenders the major credit bureaus allow consumers a two-week window to rate-shop. If you do all loan applications within 14 days, your credit isnt harmed any more than it is when you apply for one loan.

Borrower Beware:

Read Also: Apple Card Experian

What Is A Credit Score

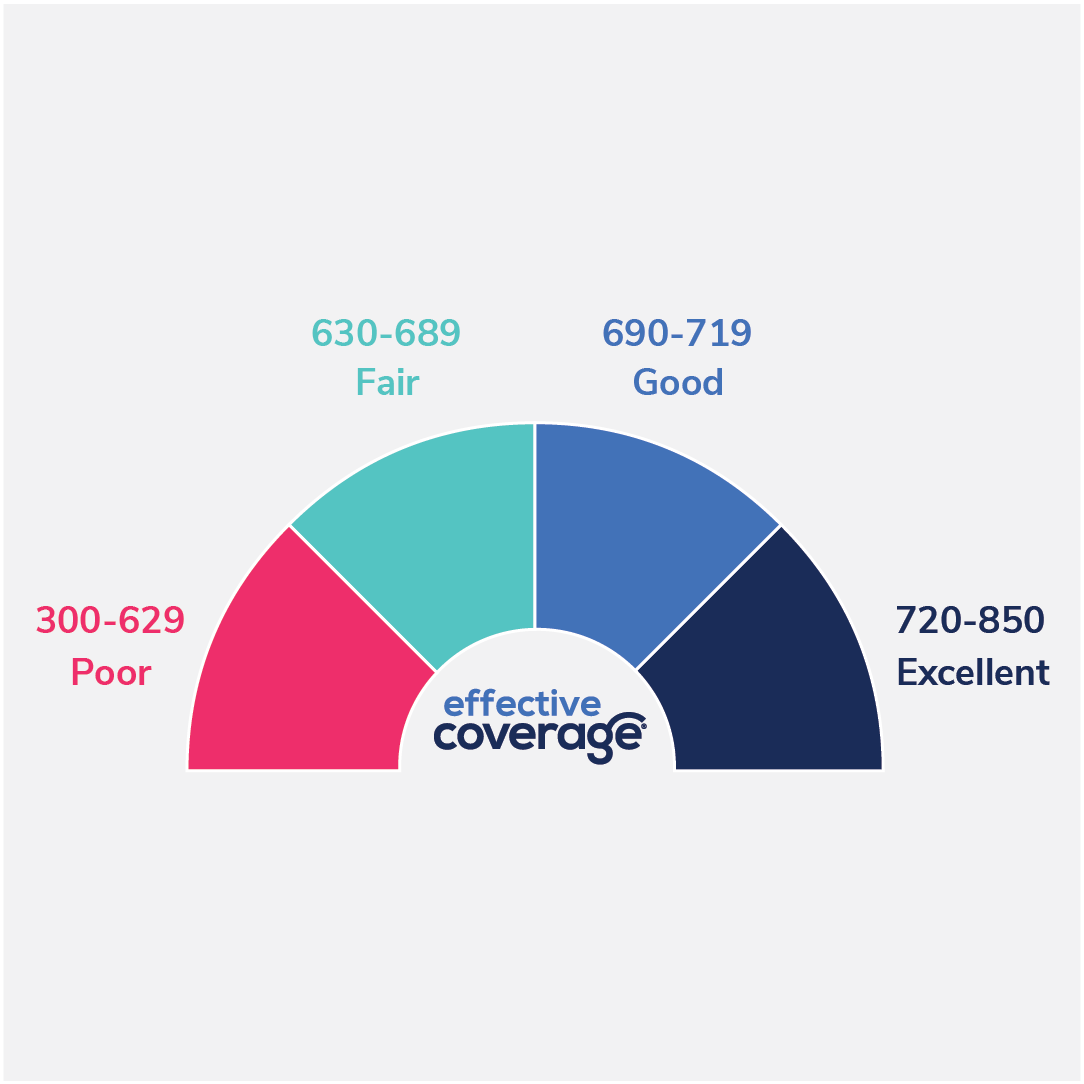

A is a number between 300 and 850 that determines your creditworthiness. This score develops from various factors that help creditors decide whether you are a high or low lending risk.

Creditors use your history, your income, and the number of current credit lines to figure out your debt to income ratio.

Your credit score is the number that gives them a summary of this information so they can quickly decide whether they should grant you the loan for which you applied.

This credit score is often called a FICO Score. When it comes to auto loans, though, even though they are directly related to your credit score, they work a little differently than traditional credit inquiries.

FICO Score

FICO stands for Fair Isaac Corporation. This abbreviation exists because this corporation was the first to extend credit using the numerical risk model that is now the standard for credit lenders.

Yet, what many people do not realize is that your true FICO Score is not precisely the score that is used when you try to obtain an auto loan. Instead, there is a secondary FICO Score, called an Auto FICO Score. This specific score only determines your eligibility for buying a vehicle.

Auto FICO Score

Your Auto FICO Score differs from your generic FICO Score in that it is tailored towards your creditworthiness of purchasing an automobile. While your FICO Score ranges from 300 to 850, respectively, your Auto FICO Score ranges from 250 to 900.

Bottom Line: Keep Track Of Your Credit

Now that you know what an auto dealer looks at when determining your credit, how do you make sure that your score is good? And how can you ensure that other factors the auto dealer might consider are all in order? By keeping track of your credit score with weekly credit reports, of course.

There are multiple portals online that allow you to monitor your credit daily. All of the three major credit bureaus have an online portal that you can check on a regular basis. Tracking your credit, keeping good credit card balances, and consolidating your credit are smart ways to make sure you walk into the dealership with more knowledge of your credit than the people offering you a loan.

Also Check: Klarna Credit Approval Odds

How Much Will A Car Loan Drop My Credit Score

Before you sign on the dotted line to finance, you have to fill out a loan application.

When you apply for a loan, lenders perform a credit check, which in turn produces a “hard inquiry” on your credit report.

While a hard inquiry reduces your credit score by around five to 10 points, the reduction only lasts for about a year.

But if you’re simultaneously seeking financing for more than one major purchase â like a house and a car â multiple hard inquiries could negatively affect your eligibility for loans.

For that reason, it’s wise to purchase a car or a house in different years, so you end up with the best credit score possible and qualify for ideal loan terms.

However, major credit bureaus like Transunion or Experian realize that consumers are sometimes in the market for a car and a house. Because of that, they treat multiple inquiries within 14-45 days as a single one.

In contrast, a “soft inquiry” on your credit report does not affect your creditworthiness. A “soft inquiry” is usually done when you research your credit score independently, or a lender does so for marketing purposes.

Wed Like To Introduce Ourselves

Were Kasasa® a financial and technology services company. We believe that small banks and credit unions supply critical resources to drive the growth of businesses and families. Nobody knows your communitys needs the way you do.

At Kasasa®, we also partner with institutions like yours, providing our relationship platform, Kasasa, as a comprehensive strategy. It begins with innovative banking products and includes marketing, training, compliance, research, support, and consulting.

Together we can show the next generation of banking customers an experience the mega-banks will never match.

Recommended Reading: Suncoast Credit Union Truecar

What Is A Good Credit Score For An Auto Loan

If youre thinking about what is a good credit score to finance a car, heres the answer: 660 or above, according to Equifax. If youre around that range, most of your car loan applications can be accepted effortlessly.

According to the same source, if your credit score is between 725-759, its considered very good. Anything above that enters the realm of excellence in credit score. As you can imagine, the better the credit score, the more beneficial the deal will be for you.

A well-managed and well-maintained credit score will allow you to set foot onto a dealerships floor and instantly have everyone trying to be at the top of their game to get you to buy your dream car from them.

There are some great options out there, but we cant help but recommend Symple Loansunsecured personal loans. Rather than taking out a loan that puts your vehicle up as security or locks you into a fixed term, you might just be better off with an unsecured car loan that you can pay back any time without fees or penalties.

To get the best value for your money, you can always go for faster, easier AND affordable loan options to finance your car, like Symple Loans.

How Do Auto Loan Rates Work

Auto loan interest rates are determined through risk-based pricing. If a lender determines you’re more at risk of defaulting on your loan because of your credit score and other factors, it will typically charge a higher interest rate to compensate for that risk.

Factors that can impact your auto loan interest rate include:

Whatever auto loan interest rate you qualify for, it’ll be represented in the form of an annual percentage rate , which may include the cost of both interest and fees. The lender uses your interest rate to amortize the cost of the loan. This means that you’ll pay more interest at the beginning of the loan’s term than at the end.

Recommended Reading: What Does Serious Delinquency Mean On Credit Report

What Is A Good Insurance Score

First, its important to note that FICO, TU, and LexisNexis all have slightly different score ranges.

- FICO: 250-900

- TU: 300-850

- LexisNexis: 500-997

Scores that are 700 and up are generally considered good and can result in lower rates, according to Investopedia. Anything above 800 is considered little risk to an insurance company and may qualify a driver for discounts.

Consider Bringing Your Own Financing

While dealerships do provide financing, checking with your local bank or credit union is a good idea, too. You can even compare car loan rates online. Compare quotes from the top potential lenders and, once youve settled on your top choice, you can get preapproved to make the process run smoothly,

Keep in mind that getting financing results in a hard pull on your credit. It helps to cluster applications closely together when rate-shopping for a loan.

If you end up with a loan with a higher rate than you wanted, keep an eye on your scores. You may be able to refinance your auto loan at a lower rate after youve made on-time payments for six to 12 months.

Don’t Miss: Affirm Delinquent Loan

Which Fico Score Version Is Important To Me

Consider these guidelines:

Financing a new car? You’ll likely want to know your FICO® Auto Scores, the industry specific scores used in the majority of auto financing-related credit evaluations.

Applying for a credit card? You’ll likely want to know your FICO® Bankcard Scores or FICO Score 8, the score versions used by many credit card issuers.

Purchasing a home or refinancing an existing mortgage? You’ll likely want to know the base FICO® Score versions previous to FICO Score 8, as these are the scores used in the majority of mortgage-related credit evaluations.

For other types of credit, such as personal loans, student loans and retail credit, you’ll likely want to know your FICO® Score 8, which is the score most widely used by lenders.

Estimate your FICO Score range

Answer 10 easy questions to get a free estimate of your FICO Score range

What Does That Mean For You

In general, it means that although different lenders use different measures, people with exceptional credit scores may qualify for the lowest rates, while people with lower credit scores will often qualify only for loans with higher rates.

High Credit Score Low Interest Rate Lower Credit Score Higher Interest Rate

Read Also: Does Qvc Easy Pay Report To Credit Bureaus