Monitor Your Credit With Free Tools

Your free credit reports are helpful, but they dont include your actual credit score.

Luckily, there are several free credit monitoring tools to help you track your credit score from month to month. Your bank or credit union might offer free credit scores as a benefit of your credit card or bank account.

You can also use a service like LendingTree to check up on your score, track your progress and receive strategies on how to build credit.

Tips On How To Build Credit Fast

Would you be surprised to learn that you can build credit today quicker than ever before? By becoming an authorized user on anothers existing credit card, you can begin to take control of your credit rating. And you can also leverage the payments youre making monthly from rent to utility bills by getting those details to credit reporting agencies.

To help you build your credit history, well explore how to increase credit scores by opening a line of credit with a secured credit card or a secured loan. So, on to the big question: how can you improve your credit score, quickly? Weve got 14 tips on how to raise your credit score fast that are sure to help.

Get Added As An Authorized User

If you have a friend or family member with good credit who is willing to help you out, taking advantage of their positive credit history could be the fastest way to increase your own score.

To help quickly increase your credit score, a loved one could add you to one of their credit cards as an authorized user. Ideally, you’d want to be added as an authorized user on a credit card with a long history of positive payments, a large credit line, and a low credit card balance.

The credit card that you have been added as an authorized user on will show up on your credit report and the entire credit history on the card will appear as if it is your own. This can increase your score by a lot if it makes your credit record look more established and convinces lenders you’ve made lots of on-time payments.

As an authorized user, you’ll also be allowed to use the credit card but won’t have any obligations to make payments. Ideally, you actually won’t charge anything on the card at all — and your friend or family member who adds you to the card doesn’t even need to actually give you access to it if they don’t want to. But for the entire time you’re named as an authorized user on the card, it can give your score a quick and sometimes substantial boost.

Also Check: How Many Years Does An Eviction Stay On Your Record

How Long Does It Take To Improve Credit Score

The answer depends on the conditions of your debt and overall payment history. If your FICO score took a hit when you opened a new credit card or maxed one out that can usually be resolved within a few months.

But if youve made a habit of missing payments, you may be looking at a couple of years of making steady payments to get your credit score back on track. No matter where youre at on that scale, theres a lot you can do to improve your credit score quickly.

How Do I Get My Credit Score Up 100 Points In One Month

Increasing your credit score by 100 points in a single month is almost impossible, especially if youre starting from nothing. However, if you have a significant mistake on your credit report, like a default that never happened or a credit card that doesnt belong to you, removing it can boost your score significantly.

Recommended Reading: Credit Report Without Ssn Or Itin

Become An Authorized User

If a relative or friend has a credit card account with a high credit limit and a good history of on-time payments, ask to be added as an . That adds the account to your credit reports, so its credit limit can help your utilization. You also benefit from their positive payment history. The account holder doesnt have to let you use the card or even give you the account number for your credit to improve.

Make sure the account reports to all three major credit bureaus to get the best effect most credit cards do.

Impact: Potentially high, especially if you are a credit newbie with a thin credit file. The impact will be smaller for those with established credit who are trying to offset missteps or lower credit utilization.

Time commitment: Low to medium. You’ll need to have a conversation with the accountholder you’re asking for this favor, and agree on whether you will have access to the card and account or simply be listed as an authorized user.

How fast it could work: Fast. As soon as you’re added and that credit account reports to the bureaus, the account can benefit your profile.

How To Get Your Fico Score For Free

Understand the reasons that help or hurt your FICO® Score, including your payment history, how much credit you are using, as well as other factors that influence your overall credit.

- Which Debts Should I Pay Off First to Improve My Credit?: Prioritizing certain bills can be important when you’re trying to increase your credit scores.

- : Learn the truth and don’t get caught off guard.

Recommended Reading: Aargon Agency Payment

Pay Off Any Existing Debt

To reduce your credit utilization ratio quickly and improve your score, use the debt avalanche or debt snowball method to pay down existing debt:

- With the debt avalanche method, you focus on paying off your highest-interest debt first, followed by the debt with the next highest interest rate, and so on. However, be sure to make the minimum payments on any other cards in the process to avoid any penalties.

- The debt snowball method, on the other hand, focuses on paying off your smallest balances first while still meeting the minimum payment requirements for your other cards. This method is meant to help build momentum as you get a sense of achievement from paying off one card after another.

Be Mindful When Opening New Accounts

If youre wondering how to increase your credit score, one of the first things that might come to mind is opening different types of credit.

But dont be tempted to open too many new credit accounts at once just to achieve that. This can have the opposite effect and harm your score.

Sure, your credit mix has a small but significant effect on your credit score. Having different types of credit shows lenders you can handle debt well.

That said, opening a new account lowers your score.

Why?

Because if you’ve just taken on more debt, you might not be able to repay another one so soon.

Granted, your credit score will bounce back and even increase in time if you’re making regular payments and maintaining a low utilization rate. Its one of the good strategies to improve your credit score in the long term.

But if you already have a lot of debt or are planning to apply for a loan soon, this will be more harmful than beneficial.

Read Also: Syncb Ppc Closed

Why Did My Credit Score Go Down After Paying Off Collections

The most common reasons credit scores drop after paying off debt are a decrease in the average age of your accounts, a change in the types of credit you have, or an increase in your overall utilization. It’s important to note, however, that credit score drops from paying off debt are usually temporary.

Tips To Increase Your Credit Score

If you are like many consumers and dont know your credit score, there are several free places you can find it. The Discover Card is one of several credit card sources that offer free credit scores. Discover provides your FICO score, the one used by 90% of businesses that do lending. Most other credit cards like Capital One and Chase give you a Vantage Score, which is similar, but not identical. Same goes for online sites like Credit Karma, Credit Sesame and Quizzle.

The Vantage Score comes from the same place that FICO gets its information the three major credit reporting bureaus, Experian, TransUnion and Equifax but it weighs elements differently and there could be a slight difference in the two scores.

Once you get your score, as Homonoff suggested, you might be surprised if its not as high as you expected. These are ways to improve the score.

Recommended Reading: How Long Does Repossession Stay On Credit Report

How To Improve Your Credit Score By 100 Points In 30 Days

As a member, I frequently check in to see how my credit is doing and make sure theres nothing suspicious going on there.

I really like Credit Karma, because its free and provides detailed information about changes to your credit score. Also, you can link all your accounts to monitor your debt-to-savings ratio.

Another feature I like to play around with is my spending. When I connect my bank account, I can categorize each transaction and see where all my money is going, which gives me a clear view of my spending habits.

One day when I logged in to my account, I was very excited to see that my credit score had increased by almost 100 points! I had managed to raise my credit score by 92 points in just one month.

In this article, Im going to share with you the steps I took to improve my credit.

Open A New Credit Account

To some extent, you can help raise your credit score by opening a new credit account a new credit card account, a personal loan, an auto loan, an installment loan, refinancing a student loan, etc. This helps in a couple of ways, but only in small doses:

- CUR reduction: By getting a new revolving credit card account, the CUR denominator increases. For this to have the desired effect, you should not carry a balance on the new credit card, which would offset the gain by increasing the CURs numerator .

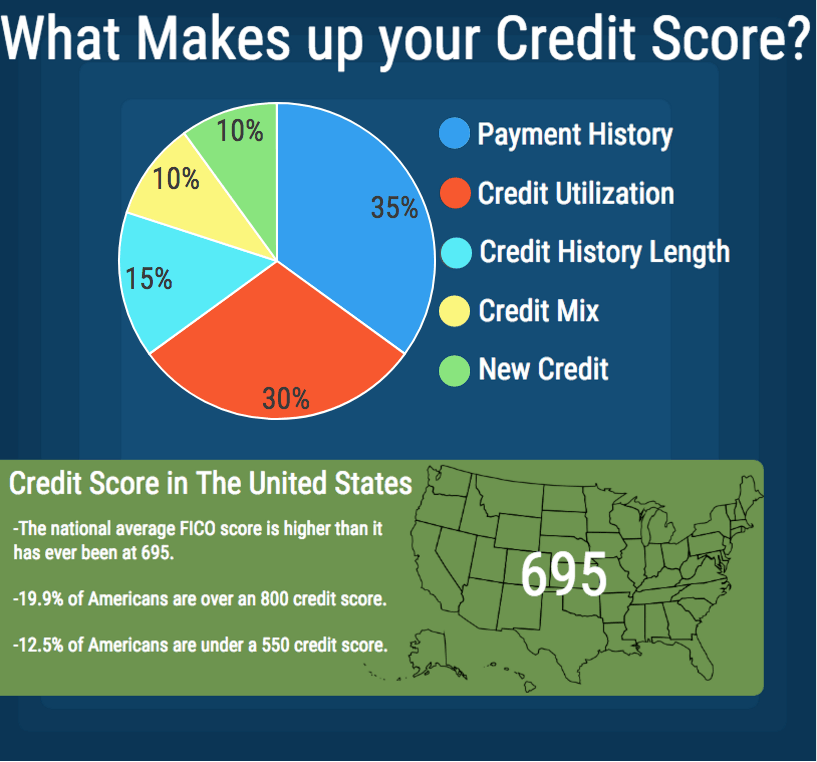

- Increase credit mix: Ten percent of your FICO score stems from your mix of different credit types: an auto loan, credit cards, mortgages, online loans, retail accounts, and finance company accounts. FICO reasons that you are more creditworthy if you can successfully juggle multiple account types. But dont open a new account just for FICOs sake, as this is only a minor factor.

The problem with opening new accounts is that the benefits just described are somewhat offset by the hard credit inquiries required for new credit, a 10% component of your FICO score. For a single new account, the impact is minor: A five-to-10-point drop in your credit score for up to one year.

Opening a new account is probably a net positive, but multiple new accounts in a relatively short time frame may do more harm than good.

Also Check: Report Death To Credit Bureaus

Make The Most Of A Thin Credit File

Having a thin credit file means that you dont have enough credit history on your report to generate a credit score. An estimated 62 million Americans have this problem. Fortunately, there are ways to fatten up a thin credit file and earn a good credit score.

One is Experian Boost. This relatively new program collects financial data that isnt normally in your credit report, such as your banking history and utility payments, and includes that in calculating your Experian FICO credit score. Its free to use and designed for people with limited or no credit who have a positive history of paying their other bills on time.

UltraFICO is similar. This free program uses your banking history to help build a FICO score. Things that can help include having a savings cushion, maintaining a bank account over time, paying your bills through your bank account on time, and avoiding overdrafts.

A third option applies to renters. If you pay rent monthly, there are several services that allow you to get credit for those on-time payments. For example, Rental Kharma and RentTrack will report your rent payments to the credit bureaus on your behalf, which in turn could help your score. Note that reporting rent payments may only affect your VantageScore credit scores, not your FICO score. Some rent-reporting companies charge a fee for this service, so read the details to know what youre getting and possibly purchasing.

File An Official Request

Every credit card company has a different procedure for increasing your credit limit, but the details differ a bit from issuer to issuer. Most allow you to apply for a credit limit increase online via a simple form, but you may need to call a customer representative instead. The details should be available on the back of your credit card or via your account’s online dashboard.

Also Check: Zebit Report To Credit Bureau

Use Your Credit Card Responsibly

Getting a credit card is easier than getting a loan, so it’s a great first step in achieving a good score.

But simply having it is not enough.

You need to use your credit card regularly and pay off the balance in full every month.

That way, you show you can handle debt responsibly. Plus, this will keep your credit utilization low.

You might also want to check when theyre updating your report and pay before that.

What Credit Score Is Needed To Buy A House

Buying a home usually ranks as the largest financial investment in a familys lifetime. You and your loved ones may need to save up for a 20 percent down payment and draft a monthly budget before applying for a mortgage to ensure the place you call home remains affordable.Working families may want to consider their ideal mortgage program when wondering what credit score is needed to buy a house. Although your credit score likely opens the door to a variety of loan products, higher credit scores can be a key to selecting top-tier options. If you are thinking about purchasing a family home and applying for a mortgage, these are specific loan requirements to consider concerning your credit score.

These and wide-reaching other mortgage programs task professionals with weighing the risk involved in approving an application. Their professional decision has a great deal to do with your FICO score. Depending on approval, denial, or the interest rate, your family will be affected by how much money goes towards the loan payment for many years.

For tips on how your credit score impacts your monthly mortgage payment, review our blog, “What Credit Score is Needed to Buy a House?”

You May Like: Can A Closed Account On Credit Report Be Reopened

How Many Points Can Credit Score Increase In A Month

Asked by: Carole Zulauf DVM

For most people, increasing a credit score by 100 points in a month isn’t going to happen. But if you pay your bills on time, eliminate your consumer debt, don’t run large balances on your cards and maintain a mix of both consumer and secured borrowing, an increase in your credit could happen within months.

Pay All Your Bills On Time

On-time payment history is the most important factor when building credit. Your payment history, which is one factor that makes up your FICO score, accounts for 35% of your FICO credit score. This means you should always aim to pay your bills on or before the due date.

Setting up automatic payments is the easiest way to pay bills on time. Youll connect your bank account to the provider, who will automatically charge your account on or before the due date. Creating automatic payments means you wont have to worry about missing a payment, as long as you have enough money in your bank account to cover the bill.

If you choose to not use autopay and realize youve missed a payment, contact the lender or bill provider and rectify it as soon as possible. Only late payments over 30 days are reported to the credit bureaus. The later the payment, the more it will impact your score.

Recommended Reading: Do Klarna Report To Credit Bureaus

9 Dispute Negative Info

To have erroneous information on a credit report corrected, consumers must file a formal request in writing. Although you might want to call up and give someone an earful, that wont help improve your credit score. Instead, type out precisely what the negative information involves. Explain why its wrong or why it should be posted more favorably. For example, an old bankruptcy might still show up even though it has legally timed out. For more information, the Federal Trade Commission consumer advice platform has detailed information and forms available for all three reporting bureaus.

What Is The Quickest Way To Build Your Credit

The fastest way to build a credit score from scratch is to open a credit card, maintain a credit utilization ratio below 10% and pay it off every month.

If you already have a credit card, aim for a credit utilization below 10% and never miss a payment. If you have a loan, like an auto loan or student loan, make payments on time and avoid opening new loans. It will still take several months to build your credit, so follow the steps above and be patient.

Don’t Miss: Aargon Agency Debt Collector

Fastest Ways To Improve Your Credit

It’s unlikely you’ll be able to get your credit score to where you want it in just 30 days, but there are some actions you can take that can improve your score more quickly than others:

Again, improving your credit can be a long process, but taking these steps can give you a head start and give you the chance to see improvements early on in the process.