Negotiate With The Collection Agency

If your previous landlord turned your debt to collection agencies, you should contact the respective agency regarding this. You can then negotiate with them and have the eviction information and collection account removed from your credit records.

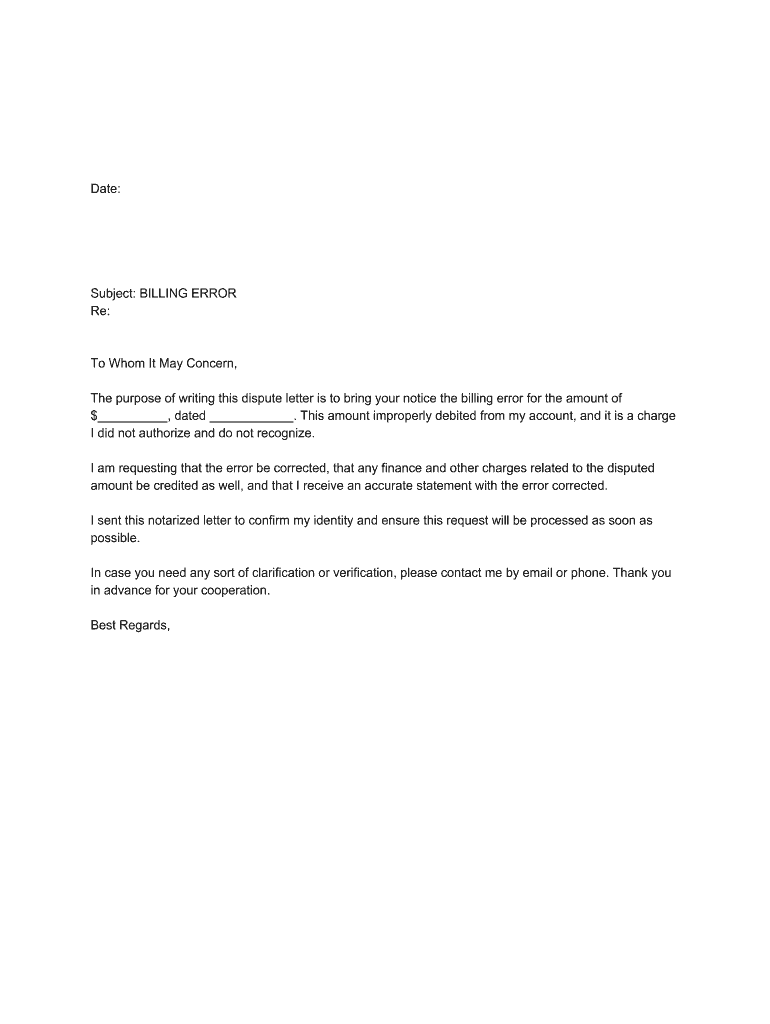

Removing a collection from your credit report can be done by offering a pay-for-delete agreement to the agency. You can also clear up your past dues in exchange for the removal of negative remarks from your credit history.

Again, it would help if you asked everything in writing to save yourself from being cheated and have proof for future reference.

Seek Free Legal Assistance

If you can’t pay your rent and your landlord files an eviction lawsuit, you’ll need to file a response with the court within a certain time frame, either on your own or with the help of an attorney. Contact the court to find out how to do this. You can find free legal help in your area through the American Bar Association, the Legal Service Corp. and LawHelp.org.

Request A Debt Validation

The Fair Debt Collection Practices Act grants you rights as a consumer. As mentioned above, a collector must validate the debt within 5 days of contacting you as outlined in the FDCPA. If they don’t hear back from you in 30 days, they will assume that the debt is valid. So, you should always send a Debt Validation Letter to the collection agency within 30 days of their initial contact, especially if you feel like something is fishy about the debt they claim you owe.

A Debt Validation Letter is an official, legal demand that declares your rights under the FDCPA. Most debt collectors simply give up after receiving a Debt Validation Letter because it takes time and resources to validate a debt. SoloSuit can help you draft a Debt Validation Letter in minutes. Requesting a debt validation can get debt collectors off your back, prevent a debt lawsuit, and protect your credit score.

Here’s the timeline you should follow when looking for debt verification and sending a Debt Validation Letter:

Don’t Miss: What Is Attcidls On My Credit Report

Can I Still Rent With A False Eviction On My Record

Whether your eviction is lawful or false, it will jeopardize your ability to secure a lease. While some landlords won’t take the time to hear your story or to look at the evidence explaining the error behind your eviction, others may be sympathetic to your plight. Above all else, you should be upfront and truthful with any potential landlords. Let them know your previous landlord is happy to discuss the situation, especially if you are up to date on all debts or the eviction was an error.

Procedure For Removing Past Eviction From Record

Court records showing rental eviction cases are usually available for viewing to the public for 10 years. Oftentimes, landlords perform background checks on new, prospect tenants, and sometimes landlords take a peek on court records just to check on previous rental eviction cases that their tenants have been involved in. There are certain screening companies, too, that offer this service for a charge. It can therefore be difficult but very possible, to have ones eviction record sealed or expunged so that screening companies or landlords will not be able to view the record of the cases,

Dont Miss: How To Unlock My Transunion Credit Report

Don’t Miss: How To Get Bankruptcy Off Credit Report Early

Who Can See If I Have An Eviction On My Record

Evictions first require the landlord to obtain a civil judgment against you. The civil judgment is recorded on your public record and can remain there forever if no action is taken to have it removed. Public records, as the name suggests, are available to the public. Pulling individual public records is impractical however, since credit reports contain a “Public Records” section, the civil judgment will often show up there. Also of note, even if seven years have passed and the eviction is gone from your public records, the civil judgment may still show up on your credit report.

How To Get An Eviction Off Your Record: 6 Steps

If you’ve ever been evicted, looking for a new place to live can be intimidating. You may wonder how to get an eviction off your record, or whether it’s even possible to have an eviction expunged.

The good news is that while renting after an eviction is challenging, it’s not impossible. When you need a place to live but you have an eviction on your record, knowing where you stand and what information appears on your rental history can help you correct inaccuracies or even remove the eviction altogether.

Read Also: Is 700 A Good Credit Score To Buy A Car

What Are Acceptable Reasons For Eviction

As a tenant you have a right to dispute any false evictions. However, there are valid reasons your landlord can evict you. Here are some of the most common valid reasons for eviction:

-

Failure to pay rent

-

Violations to the rental agreement

-

Property damage

-

Infringements against health and safety

-

Not leaving the premises after the lease expired

Failure to pay rent

This is perhaps the most common reason. This is when the tenant is late on the rent or refuses to pay the rent. Tenants may feel that they are justified in withholding the rent for one reason or another, but the courts may rule otherwise.

Violations to the rental agreement

Common violations to a rental agreement include people moving in without the landlordâs permission, owning pets or specific types of pets , and subleasing the rental unit without the landlordâs permission.

Property damage

Damaging the rental unit on purpose or by accident can lead to you being evicted from the unit, especially if the tenant refuses to cover damages that are her or his fault.

Infringements against health and safety

The tenant is required to regularly clean the rental unit. Failure to do that can result in infringements against health and safety.

Not leaving the premises after the lease expired

If You Believe You Were Wrongfully Evicted Take It To Court

Eviction laws vary by state, so check with the agency that governs renter’s rights in your state by searching “landlord tenant laws.” Let’s say your property manager didn’t follow proper eviction procedures, or you can prove that you didn’t violate the terms of your lease agreement. You may be able to petition the court to remove the eviction from your public record. The legal aid organization in your area may be able to help with your case if your income is below a certain threshold.

Also Check: What Is Collections On Credit Report

Other Places Where The Negative Information Is Reported

- Tenant screening reports: Rental history reports can be obtained through rental screening companies hired by potential landlords for tenant verification.

- Court records: This includes any information regarding judicial trials and judgments against the tenant. The information related to the eviction judgment appears in the public records section of the credit report.

- Rental background checks: This includes police verification of the tenants past eviction information and history, along with the data collected from the three major credit bureausTransUnion, Equifax, and Experian.

How Much Damage Can An Eviction Do To My Credit

While an eviction does not directly affect your credit score, many evictions involve owing money to the landlord. This might be unpaid rent or damage to the property. Unlike other debts, your landlord will not typically report your rent history or late payments to a credit bureau.

What may impact your credit score is when the landlord sends unpaid debts to collections. A collections account can potentially reduce your credit score hundreds of points, depending on where you started. The impact lessens over time, and many newer scoring models ignore the collections account once paid back in full.

The court may also enter a civil judgment for rent, other charges, or court costs. Court judgments no longer appear on your credit report. Therefore, the court judgment itself may not lower your credit score. You may only see a score drop if the landlord also sent the debt to collections.

Also Check: Is An 850 Credit Score Possible

Do Bankruptcies Clear Evictions

Evictions are often caused by an individuals inability to pay rent or mortgage. But, if they are bankrupt they may be able to avoid eviction.

A bankruptcy can stop an eviction by stopping foreclosure proceedings a debtor goes through in order to keep their home. This is because the debtors property may become exempt from asset seizures. As well as, being exempt from seizure for use of back taxes or debts owed to the government.

Even if a person does not file for bankruptcy, but still has their home foreclosed upon, this may also prevent their eviction as it will no longer be under the control of the lender that initiated foreclosure proceedings.

Donât Miss: Keyword

Faqs About How To Get An Eviction Off Your Credit History

If youâre worried about how a past eviction will impact your odds of buying a house today, educate yourself about the eviction process and your credit report. Here are all the answers to your questions.

An eviction isnât something to take lightly. It can cause problems for years to come, both when renting again and in other areas. For potential homeowners, having an eviction on your record can hurt your credit while trying to get pre-approved fora mortgage.

What are your options?

An experienced real estate agent can help you evaluate your chances of being able to buy with negative information on your credit. It could impact your rates, terms, and the amount of a down payment youâll need.

Here are a few things you should know about evictions.

JUMP TO SECTION

Also Check: What Credit Score Do You Need For A Kohls Card

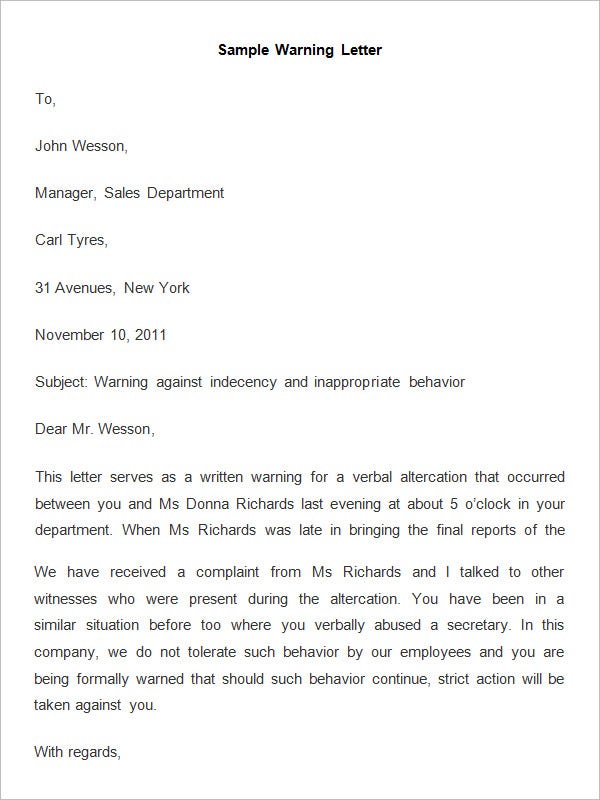

Here Are The Steps To Dispute A Rental Collection:

The ACA estimates that 11% of tenant debt goes to a collection agency. The landlord or any collection agency hired can sue you to collect the debt. If the judge favors the creditor, the court will issue a civil judgment to the landlord or the collection agency. In some states, a debt collection judgment can stay in effect for a decade or more, and the creditor may garnish your wages and freeze your bank account.

Can A Lawyer Remove An Eviction

Many people donât think that lawyers can remove an eviction, but they can. In order for a lawyer to remove an eviction, they need to go through the eviction court and have a judge sign off on their paperwork. This process is also known as a âmotion to vacate order.â

The only way a lawyer can stop the eviction is to show that there is some legal reason behind it. For example, if they find that the landlord does not have a right to evict them, they can file a complaint and take it up with the court.

Don’t Miss: Does Free Annual Credit Report Give Fico Score

Your Rights With Landlords And Eviction Notices

Many states require the landlord to send an eviction notice alerting the tenant of the issue that may trigger an eviction. Then the tenant has a short period of time before the eviction process is in full effect â typically anywhere from three days to one month â to resolve it. During this phase of the legal process, the tenant should seek legal advice if thereâs an interest in challenging the eviction.

If the tenant canât catch up on rent payments or otherwise fix the problem, the landlord files the eviction paperwork in housing court. The housing court then provides a hearing date to both the landlord and tenant.

At the eviction lawsuit hearing, the landlord and tenant can present their cases and provide supporting documentation, including the original lease, correspondence between the landlord and tenant, etc.

If the landlord wins the eviction lawsuit, the renter will receive a court order to move out. The deadline to move out varies by state but is usually anywhere from a couple of days to a few weeks.

Getting A Proper Resolution

If the bureau investigates and doesnt agree with you, tell the bureau to include a record of the dispute in your report. After you ask the landlord for a correction, he also has to acknowledge the dispute if he provides information about you to credit bureaus again. If the bureau fails to remove clearly incorrect eviction data, you can take the bureau to court. If you win, you may be able to collect court costs, legal fees and damages for pain and suffering.

Should you have trouble navigating the legal system on your own, you can contact and hire an eviction removal lawyer. Keep in mind that eviction removal services only benefit you if there was an error in the reporting, or youve paid off any debts in full.

You May Like: What Credit Score Does Comenity Bank Use

Don’t Miss: How To Raise Credit Score To 800

Whats The Potential Fallout From An Eviction On Your Credit Report

If eviction-related activity appears on your credit report, you could have trouble qualifying for loans or renting another property.

For instance, if you apply for a mortgage and a collections action appears on your report, thats a red flag, said Corey Vandenberg, a mortgage consultant with Platinum Home Mortgage, who reviews credit reports as part of the mortgage application process. There can be problems obtaining a home loan if youve had an eviction and theres a collection hanging out there.

Plus, landlords often run credit checks on prospective tenants. While eviction records arent noted on consumer credit reports, they may be reported to Experian RentBureau, which collects tenant payment history for tenant screening reporting companies.

Does An Eviction Show Up On Your Credit Report

While positive rental payment history may be included in your Experian credit report, your report will not show eviction information. Eviction records can be found via a , which can be obtained through a tenant screening company or through Experian RentBureau.

Your landlord or apartment complex may also file a civil suit and win a judgment against you for the unpaid debt. Judgments are not part of a credit report, but they are a matter of public record and may be included in other kinds of consumer reports, so they could affect personal and business decisions.

Although your credit report will not show an eviction, it could include a collection account for any unpaid rent and fees, if the apartment complex felt that you owed them money and sold the past-due debt to a collection agency. The collection account should show the name of the original creditor who sold them the debt.

Collection accounts remain on your credit report for seven years from the original missed payment date that led up to the collection status. Collection accounts are considered derogatory and can have a substantial impact on credit scores, especially if left unpaid.

Although a paid collection account is still considered negative, some newer credit scoring models don’t include paid collection accounts in the score calculation, so paying off an outstanding collection account could help improve certain credit scores.

You May Like: Is 756 A Good Credit Score

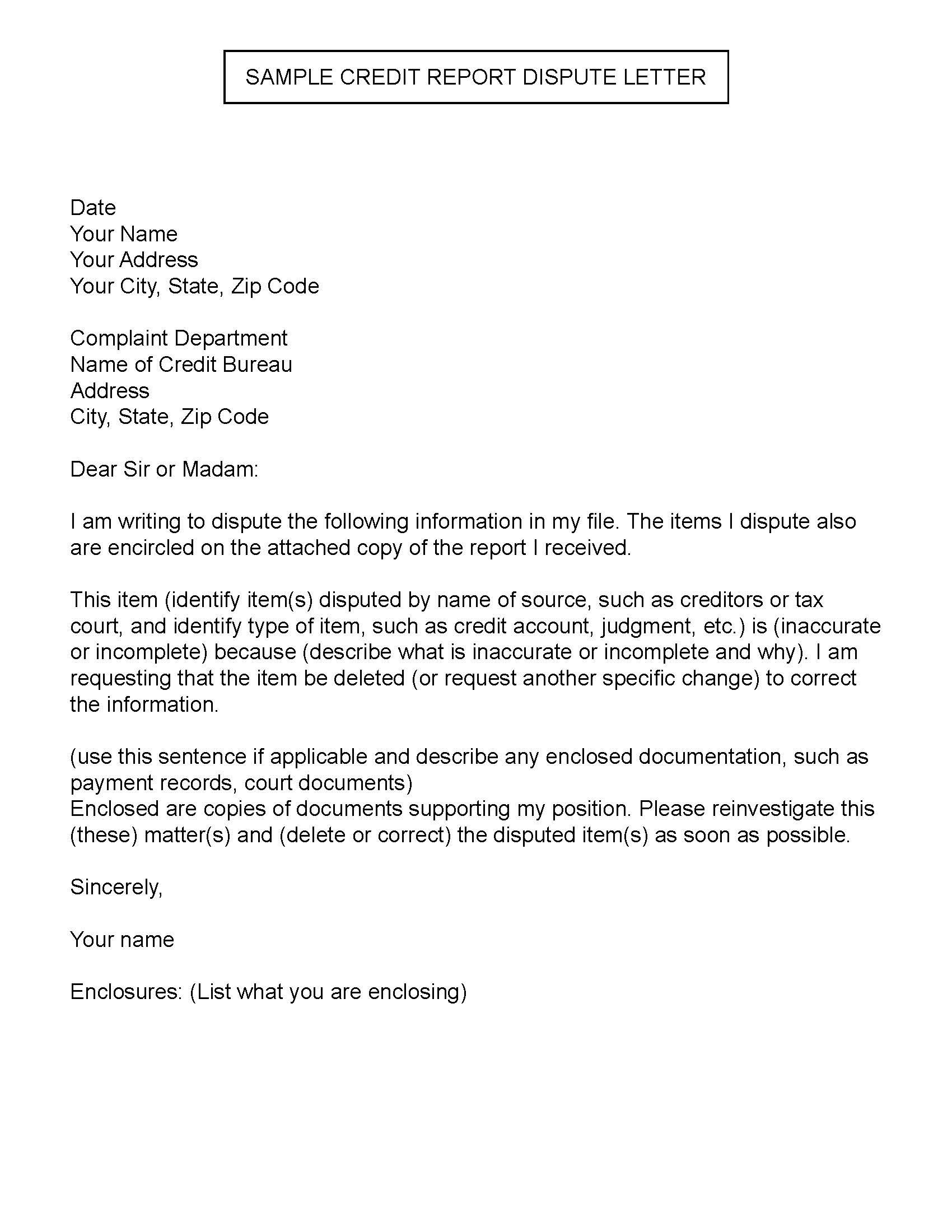

How Do I Get A Copy Of My Credit Report

- You can get a free copy of your credit reports from the big three nationwide consumer reporting agencies TransUnion, Experian, and Equifax – free every week until December 31, 2022 at annualcreditreport.com. You can do this any time, to check your credit information before you apply for new rental housing. If you find errors, you can dispute them.

- Find more information about consumer reporting companies and requesting your consumer reports.

How Do I Contest A False Eviction On My Credit Report

If a civil judgment or eviction is incorrectly listed on your record, you can petition the court in the county where the case was filed to have the record expunged or sealed. Generally, if you can provide evidence that proves the eviction should never have been entered into your public record, it will be expunged. If you feel the eviction was entered under false or fraudulent pretenses, you can still attempt to have it expunged or seal, but you will most likely need an attorney’s help to fight the falsified eviction.

When you file a petition with the court to have the eviction removed, you will need to pay a filing fee and prepare for your time in front of the judge. If the civil case against you from your current or previous landlord resulted in a civil judgment but did not result in an eviction, your chances of getting the judge to expunge the eviction are higher.

You May Like: How Do You Unlock Experian Credit Report

How To Prevent Eviction In The First Place

Whether youre currently facing a potential eviction or youve dealt with eviction in the past and dont want it to happen again, these three tips can help you stay on good terms with your landlord and avoid getting evicted:

1. Speak to your landlord if youre struggling financially

If youre struggling and think youll miss one of your rent payments, contact your landlord and explain your financial situation. This might help you stay on good terms with them.

Most landlords arent in the position to simply waive your rent payments , but in some cases, they might be willing to temporarily lower your rent or at least postpone it.

Remember that the consequences of you failing to pay are time-consuming, stressful and expensive for landlords too. If theres a way to reach a compromise, many landlords will prefer that.

2. Know where you stand

Before youre evicted, your landlord will send you either a curable eviction notice telling you how you can avoid eviction or an incurable notice asking you to move out by a certain date.

3. Dont be afraid to downsize

If youre struggling to make ends meet, consider finding a more affordable apartment. Your landlord may be willing to let you out of your lease if you find someone else to take over, or they may allow you to sublet your apartment.