Request A Credit Report After A Loan Denial

If you have applied for a consumer loan or a credit card and have been denied, or have been denied for a request to increase your credit limit based on information in your credit report, you will be given the name of the company that supplied your credit report so you can request a free copy of the report. Youll also get a disclosure of the credit score used in the decision.

These notices dont apply to business credit, however. In fact, its entirely possible you wont know why you were turned down for business financing. Thats why its so important to be proactive about reviewing your business credit.

What Makes Up Your Fico Score

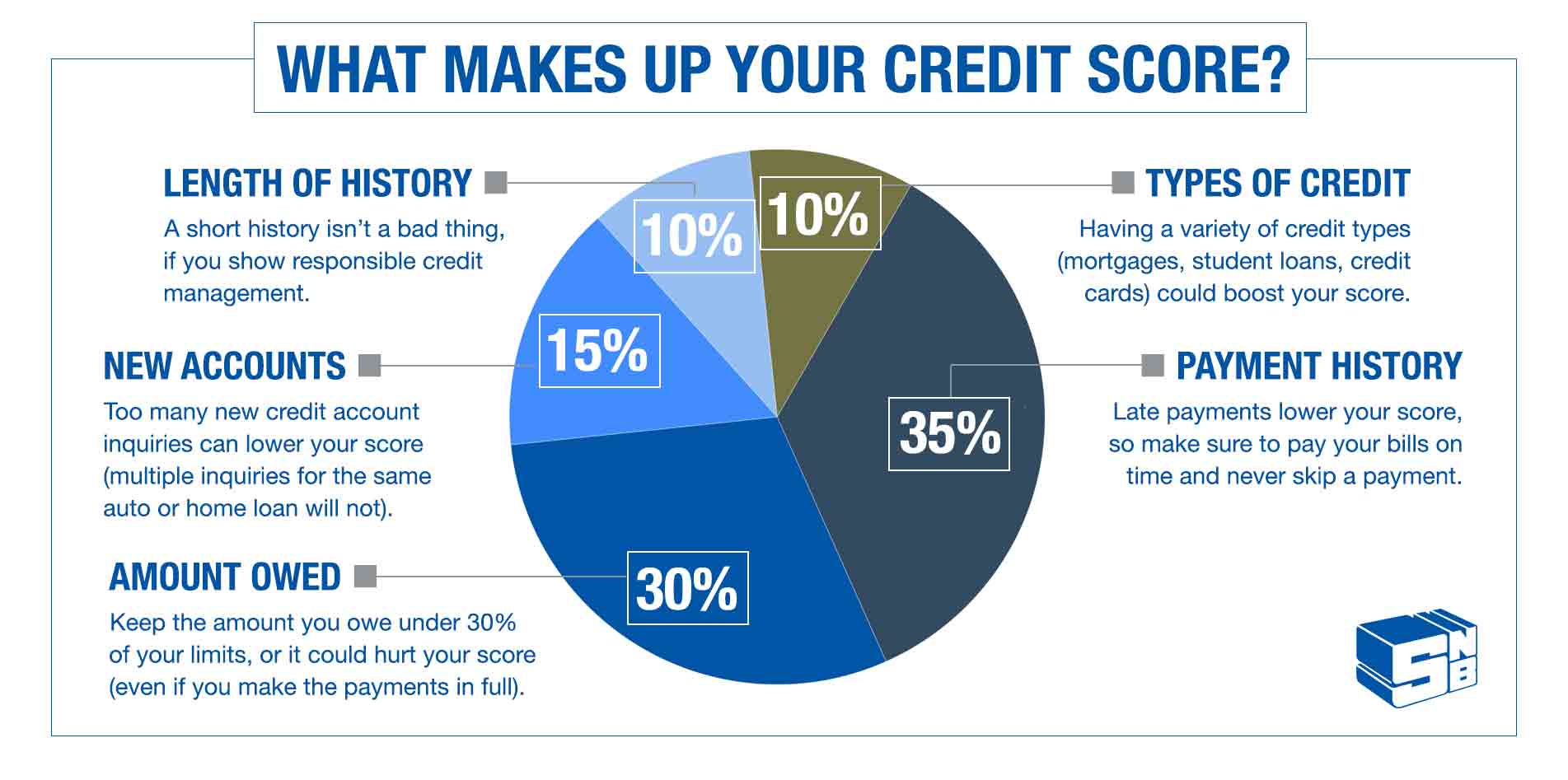

According to myFICO, an individuals score is an aggregate of five differently-weighted categories of information:

- Payment history: 35%

- Length of credit history: 15%

- New credit: 10%

As you can see, the lions share of your score is accounted for by payment history and the amount currently owed, also known as . Its important to note, however, that FICO values the amount owed, as a percentage of the total credit available to you, not simply as a raw number.

In other words, having a balance of $2,000 is much better if your credit limit is $20,000 than if its $3,000 because your credit utilization would be 10% vs. 66%, respectively. As a general rule, you should aim to keep this credit utilization below 30% both overall and on each individual card.

Vantagescore 30 Credit Score Factors

Different credit scores can have a lot in common under the hood, but each individual scoring modeluses its own combination of factors to determine your score.

Here are the major factors that determine your VantageScore 3.0 credit scores.

Payment history The biggest factor in your scores is your history of paying bills on time. Late or missed payments in your credit history could affect your scores significantly.

Age and type of credit A longer credit history, particularly with the same accounts, shows lenders that youve been able to stick with your accounts over time. Lenders may also consider it a plus if you have a mix of credit accounts with positive use.

Your measures the amount of credit you use relative to the amount available to you. Most experts recommend shooting for a rate below 30%, meaning you use less than 30% of your available credit.

Balances Similar to credit utilization, this factor takes into account your total balances across your accounts but in terms of the dollar amount and not the percentage. If you already owe a fair amount elsewhere, lenders may be less inclined to extend more credit to you.

Read Also: How To Get Public Record Off Credit Report

Also Check: Is 524 Bad Credit

Does Checking My Credit Report Hurt My Credit Score

Checking your credit report is a soft credit check so it doesn’t affect your credit score. A soft credit check occurs when you check your own credit report or a creditor or lender checks your credit for pre-approval. A hard credit check occurs when a company checks your report when you apply for a line of credit.

Annualcreditreport.com is the only website legally authorized to fill orders for your free annual credit report. Any other website claiming to offer free credit reports” could be falsely claiming to be part of the free annual credit report program. Be mindful of websites trying to trick you with subtle differences.

Which Credit Card Issuers Offer Free Scores

|

Issuer |

|

|---|---|

|

FICO |

Customers with consumer credit accounts |

|

Note: FICO scores provided by different credit card issuers may vary. That’s because issuers get FICO scores from different consumer credit bureaus. Each bureau collects consumer account data independently, and it calculates scores based only on the data it has collected. |

As the table shows, some issuers are even going beyond their own cardholders. Capital One offers free VantageScores to anyone, and Discover gives free FICO scores to anyone.

» MORE:What is a credit score, and what are the ranges?

Read Also: What Does Public Record Mean On Your Credit Report

See Your Latest Credit Information

See the same type of information that lenders see when requesting your credit.

Your Credit Report captures financial information that lenders use to determine your creditworthiness. This includes the type of credit accounts, current balances, payment history, and any derogatory items you may have. You will also get a summary of your account totals, total debt, and personal information.

How Do I Fix Inaccuracies On My Credit Report

If you see something on your report that you believe is inaccurate, it may be a good idea to contact the business that reported the account, as they are the ones who can provide you more details. Your other option is to start a dispute with the credit reporting agency that issued the credit report. To start a dispute with TransUnion, visit transunion.com/disputeonline and well start an investigation.

Read Also: Sync Ppc Credit Card

Things You Need To Know About Your Fico Score

Here are a few quick basics to consider before pursuing your free FICO credit score.

1. Your FICO Score isnt your only credit score youve got a lot of them but its one of the most important. When making lending decisions, 90% of top lenders use FICO Scores when deciding whether or not to loan you money, and at what interest rate.

2. The history behind the move from fee to free began with something called FICO Score Open Access. Fair Isaac Corp. creator of the FICO Score launched the policy in 2013 to educate consumers and increase access to credit scores. It encouraged financial institutions to provide credit scores for free to their customers.

3. A general rule about credit scores: the higher your score, the better. This chart shows how your base FICO Score breaks down in a range of 300-850.

Here are the FICO credit score ranges:

- 800-850: Exceptional

- 580-669: Fair

- 300-579: Poor

4. Identity theft can be a serious threat to your FICO Score. For instance, a thief who uses your identity to open a new credit card, rack up purchases, and skip out on the bill can push down your credit score. Thats big, since your credit score can influence whether you can get a credit card, mortgage, auto loan, or job.

5. Its smart to pay attention to your FICO Score, and its nice to be able to do it for free.

What Can I Do To Improve My Credit Score

When you get your credit score, you might get information on how you can improve it. Improving your score a lot is likely to take some time, but it can be done. Under most scoring systems, focus on paying your bills in a timely way, paying down any outstanding balances, and staying away from new debt.

Don’t Miss: Credit Inquiry Removal In 24 Hour Free

How To Get Free Credit Reports From Each Of The Three Credit Bureaus

The Fair Credit Reporting Act requires each of the three credit bureaus to provide consumers with one free credit report per year. Federal law also entitles consumers to receive free credit reports if any company has taken adverse action against them. This includes denial of credit, insurance or employment, as well as other reports from collection agencies or judgments. But consumers must request the report within 60 days from the date the adverse action occurred.

In addition, consumers who are on welfare, unemployed people who plan to look for a job within 60 days and victims of identity theft are also entitled to a free credit report from each of the credit bureaus.

Why Should I Check My Credit Report

Your credit report has information that can affect whether youre approved for a loan or credit card and the amount youll be approved for. Getting a copy of your credit report is valuable to:

- Make sure the information is accurate, complete and updated before applying for a line of credit

- Help protect yourself from identity theft

Read Also: Does Wells Fargo Business Secured Credit Card Report To Bureaus

A Better Credit Score Means A Better Financial Future

Staying on top of your finances and credit score will help you build a better future! Your FICO Scores are used by 90% of top lenders to decide your creditworthiness. Take action to monitor and clean up your credit report so you dont have to worry about not being approved for loans or paying high-interest rates. Remember, if a website asks you for your credit card number before providing your score, expect to find a fee on your bill in the upcoming weeks. Avoid these predatory practices and get real expert advice and guidance from MoneyLion!

You may like

What Does A Credit Report Show

Your credit report will show personal information that identifies you like your date of birth, social security number, address, previous addresses, phone numbers, credit accounts and payment history. It may also include things like collections, repossessions, foreclosures and bankruptcy filings. Credit reports also have records of who has accessed your credit information. This can consist of the names of your creditors and marketers.

You may find two types of inquiries on your credit report and its beneficial to know the difference between the two. The two types are hard inquiries and soft inquiries. Hard inquiries on your credit report indicate that a lender checked your credit report and typically involves a decision about loaning money or extending credit. Hard inquiries can show up on your credit report for up to two years and could potentially affect your credit score. Soft inquiries are simple reviews of your credit and dont affect your credit score or appear on the credit reports that potential lenders view.

Keep in mind, your credit report wont include information about your marital status, income, level of education or checking or savings account balance. It could, however, include your spouses name if its been reported by a creditor.

Dont Miss: Experian Temporary Unlock

You May Like: Credit Karma Rapid Rescore

Is My Fico Score The Same As My Credit Score

Your FICO Score and credit score are both ways to determine your creditworthiness and the likelihood that you will fall 90 days behind on a bill within the next 24 months. FICO offers a specific brand of credit score that many lenders use when determining how much risk theyre taking by giving you a loan or credit card. Some lenders choose to make their scoring models or will use competitors credit scores.

FICO Scores are determined using complex algorithms based on information in your credit report from the three major credit bureaus: Experian, TransUnion, and Equifax. Periodically FICO also releases new versions of its scores or creates different versions to work with each credit bureaus database, so you can have multiple FICO Scores.

FICO credit scores range from 300 to 850 and group consumers by credit scoring ranges. For example, 800 to 850 is considered exceptional, while anything below 670 is considered poor. Each scoring model FICO uses takes a unique approach and may result in a different score depending on the bureaus theyre working with.

Where To Get Your Free Business Credit Report Right Now

So now you understand a bit about why both your business credit report and credit score are so important to monitor. Youre ready to start managing your business credit, arent you?

As of right now, there are a few places where you can get your free annual business credit report. Some require more interaction with the company than others, and some provide more details on your credit history than others.

Also Check: How To Get A Repo Removed From Your Credit

Fico Vs My Annual Credit Report Scores

Hello,

Can anyone explain why my fico scores are drastically higher than the scores reported on my free annual report? It recommended that I pull them to cross reference them. I just received my EQ score from Kia last wk fico Auto was which was the same as my fico but on the annual free report site my EX is 647.

As of 1/30/2018 My Fico is EQ 670/TU 650/EX 664

As of 1/30/2018 My free report is EQ 647/TU 582/ EX/608

I was so bumped out by this! Should I be? I realize that there are many different scoring models but I thought Fico was most widely used. NFCU rep told me to check the alternate site as they recommend members to that as a comparison.

Who Can Request A Copy

- lenders and creditors

- landlords

- potential employers

If a person denies you credit or increases a charge or fee and if you request it within 60 days you must be told:

- the nature and the source of the information

- the name and address of the consumer reporting agency reporting the information

Also Check: Raise Credit Score 50 Points In 30 Days

Recommended Reading: Removing Repossession From Credit Report

What Is A Fico Score

FICO, a product of the Fair Issac Corporation, is the credit score that 90% of lenders use to make credit decisions. There are three credit bureaus that report FICO scores: Transunion, Experian and Equifax. You will often have three different FICO scores, one with each credit bureau. The score difference can range from a few points to 100 points depending on the information the credit bureaus have. In addition to three credit bureaus with different scores, there are 19 different FICO scoring models commonly used by lenders.

Your FICO score is based on five categories. The categories are not given equal weight in calculating the score. The categories and weights are:

35% Payment History

15% Length of Credit History

10% New Credit

10% Types of Credit in Use

Which Cards Give Free Equifax Fico

I’m ending my relationship with DCU and losing their free Equifax FICO. I have other accounts with free FICOs from TU and Experian, but Equifax FICOs seem harder to come by. Do you guys know of any credit cards that include a free Equifax FICO?

Edit: I’m looking for one with EQ 08 instead of EQ Bankcard .

You May Like: How To Get A Repo Off Your Credit

Why You Should Care About Your Business Credit Score

So now you know why your business credit report is important, but what about your credit score? Well, that score will determine whether you qualify for any kind of small business financing, whether thats a business loan, line of credit, or business credit card. So keeping track of yours and making sure it continues to rise is key.

There are actually several different business credit score models:

- Dun & Bradstreet PAYDEX

- FICO® LiquidCredit® Small Business Scoring Service

- Equifax Business Delinquency Risk Score

Those are just a few of the commercial credit scores available. Different lenders use different scores, but not all are available to business owners.

You may assume you have a great score, but if youve made a few late payments to your credit cards, it could dip. Even if you pay your bill late only once, your score can be negatively impacted. If youre a victim of identity theft , your score could be affected. If you have tax liens, it influences your score. If you have several credit checks because youve been applying for loans all over townyep. You guessed it. Your credit score will be impacted.

The best way to ensure you have a good credit score is to stay on top of what it is. Once you sign up with one of the services well address in this article, check in on a regular basis and set up alerts to let you know if yours declines. Just keep in mind that dips are normal. If your scores change dramatically, though, you will want to dig deeper.

Why Should You Check Your Score

Knowing your FICO score has a number of benefits. First, most lenders in the United States use FICO scores when deciding whether to extend credit. With access to a score based on the same models that bankers and card issuers use, youll have a better sense of where you stand in their eyes.

Also, if youre working to improve your credit, checking your FICO score every month is a great way to gauge your progress. Its gratifying to see that your hard work is paying off. On the flip side, itll be easier to spot credit mistakes when you make them and adjust your habits accordingly.

Finally, keeping an eye on your FICO score is a good way to spot trouble. Your FICO score is determined by the information on your credit report. If you fall victim to identity theft or a credit reporting error, this will likely show up in your FICO score. Although it will still be beneficial to check your three credit reports at least once per year which you can also do for free at AnnualCreditReport.com seeing your FICO score every month is a good early warning system if things start going off the rails.

NerdWallet, too, offers a free credit report.

You May Like: Who Is Cbcinnovis On My Credit Report

What Is Fraud Alert

A fraud alert is used to inform creditors that you may be a victim of fraud. A fraud alert can make it harder for an identity thief to open accounts in your name. The fraud alert requires creditors to verify that you are the person adding new credit accounts or changing limits on existing credit accounts by contacting you at a phone number you have provided.

There are three types of alerts you can place on your file:

- Initial fraud alert – if you suspect that you have become or are about to become a victim of fraud or identity theft

- Extended fraud alert – if you are a victim of fraud or identity theft requires a copy of the identity theft report

- Active duty military alert – if you are in the military and want to minimize your risk of fraud or identity theft while you are deployed .

Contact any one of the credit reporting companies to place a fraud alert. They will share your request with the other credit reporting companies.