How Your Credit Impacts Your Mortgage Approval

Good credit is key to buying a home. That’s because lenders see your credit score as an indication of how well you handle financial responsibility. That three-digit number gives them an idea of how risky it is to lend to you after all, they want to make sure you pay back what you borrow, especially for a large purchase like a house. Your score could be the difference between getting an approval for a mortgage and getting turned down.

Your credit also impacts your mortgage approval another way: it might be used to help determine the rate and terms of your mortgage. If you have a higher credit score, you might get a lower interest rate or more flexible payment terms.

Check Your Credit Score Regularly

Habitually checking your credit score is a reliable way to pinpoint financial weaknesses so you can create a solid plan to combat them. Plus, it allows you check for statement errors. To correct any inaccuracies, send a dispute letter to either the credit reporting company or the information provider.

Note that checking your credit reports will not harm your credit score. Doing this is a soft inquiry — the information is only for you — as long as you request this information from an authorized credit reporting agency. The Fair Credit Report Act requires reporting companies, including Equifax, Experian and TransUnion to provide free credit reports every 12 months.

Ranked #1 In Financial Services On Hellopeter

Average rating of 4.82 from over 3 000 reviews

Simply The Best

Ooba home loans services are simply the best. My Consultant Bianca Dancer was so hands on and helpful from the get go. She guided me through the entire process and put me at ease being a first time buyer. I highly recommend their services.

Tia J

Excellent Service

Jay Govender and Maleshini Reddy from OOBA provided outstanding assistance and guidance in securing our home loan. Response times were excellent and they were professional and friendly.

Brice G

Bond Application

Estelle Vorster was really helpful in securing the best deal for my home loan, she not only negotiated a lower interest rate she went as far as securing 50% discount on the transfer costs.

Butana M

Also Check: How To Get Collections Off Of Your Credit Report

How To Boost Your Credit Score

Boosting your credit score isn’t something you should expect to happen overnight. But in time, you may be able to raise that number quite nicely.

There are different ways you can raise your credit score, but a good place to start is paying all of your bills on time. Your payment history carries more weight when calculating your credit score than any other factor.

You can also raise your score by paying off some existing credit card debt. is another big factor that determines your score, and it speaks to how much of your total revolving credit you’re using at once.

If paying off a chunk of credit card debt isn’t possible, you can lower your utilization by asking for an increase in your credit card limits. Your credit card issuers may oblige if you’ve been an account holder in good standing for a while or if you can show proof of a higher income than you had when you first applied for your cards.

Finally, it always pays to check your credit report for errors. You’re entitled to a free copy from each major reporting bureau once a year. Right now, credit reports are free on a weekly basis through April. If you spot a mistake on your credit report that could be bringing your score down, like a debt in your name you never took on, getting it corrected could give your score a relatively quick boost.

Minimum Credit Score Required For Mortgage Approval In 2022

Join millions of Canadians who have already trusted Loans Canada

Getting approved for a mortgage these days can be a real challenge, especially with housing prices constantly on the rise. In Toronto, for instance, youll be paying over $820,000 for a home, which is nearly $100K more than the average price the year before.

Unless youre rolling in cash, thats a lot of money to have to come up with in order to purchase a home. Moreover, a lot goes into getting a mortgage. Lenders look at a number of factors when theyre assessing a borrower for a mortgage such as a sizeable down payment, good income and, of course, high credit scores.

High credit scores, in particular, will not only get you approved for the mortgage but a favourable interest rate as well. Being that credit scores are such a significant part of the lending process, its no wonder that we get so many inquiries about what qualifies as an acceptable score in terms of getting approved for a mortgage.

Read Also: Does American Express Report To Business Credit Bureaus

Can I Get A Mortgage If My Credit Score Is: : :

Because credit reference agencies have different scoring systems, it can be hard to understand what credit score you need to get a mortgage. Generally, most lenders prefer a high credit score categorised as being good or excellent than a low credit score categorised as being fair or poor.

For example, a high credit score if you check your credit score with Experian would be between 881 and 999. If you checked with TransUnion, a high credit score 604 to 710. And if you checked with Equifax, a high credit score would be anywhere between 410 and 700.

If you have a fair or poor credit score, you can still get a mortgage, but youll have less options of mortgage lenders willing to give you a mortgage. Read our Guide on How to improve your credit score before you apply for a mortgage if you want to know how to improve it before applying. If you need to get a mortgage soon and are worried you wont be able to due to a poor credit score, get in touch with us for expert bad credit mortgage advice.

What Are Usda Loans

Buyers searching for homes in rural areas potentially qualify for United States Department of Agriculture loans. For these, 640 is the minimum recommended credit score.

Like FHA loans, both VA and USDA loans are backed by the government. You go to an approved lender to get your loan, and then the government in turn guarantees it for the bank from which you borrowed.

You May Like: What Makes A Good Credit Score

Avoid Opening New Accounts Too Often

Every time you have a hard inquiry on your credit, your score drops. This is exactly why mortgage lenders recommend avoiding new debt when youre applying to buy a home. Because if you apply for a credit card or loan within that same period, and your score drops, it could put your loan in jeopardy.

To avoid being seen as risky in the eyes of lenders, avoid any new accounts or new debt unless you have to get it.

Of course, we cant always control when our car completely breaks down or we need to get a new line of credit because of hospital bills. But, by being smart about new accounts, you can avoid your credit taking. a hit too often. Experts recommend no more than five new accounts or inquiries per year.

Related: What Are Inquiries On My Credit Report?

What Credit Rating Do You Need To Buy A House

Youve spent years saving up your deposit for a new home. Youve waited for the right moment. Now its here. The only thing left is to secure your mortgage. We can help show you how.

If youre thinking of buying a home, youll need a credit rating thats good enough to secure a mortgage. Your credit rating is a snapshot of how youve managed money in the past including past borrowing, repayments, how much of your available credit you routinely use, how many payments youve missed and several other factors to create a score. The higher the score, the better your chance of being offered a better deal on your mortgage.

There are three major credit reference agencies each with a slightly different scoring system. So its a good idea to check your credit rating with all three to find out how you rate. That way, youll know whether youre likely to get a mortgage.

Recommended Reading: Is 524 A Bad Credit Score

The Basics What Is A Credit Score

Your credit score isnt just for getting a mortgage. It paints an overall financial picture. The term credit score most commonly refers to a FICO score, a number between 300 and 850 that represents a persons creditworthiness the likelihood that, if given a loan, she will be able to pay it off. A higher number corresponds to higher creditworthiness, so a person with a FICO score of 850 is almost guaranteed to pay her debts, whereas a person with a 300 is considered highly likely to miss payments.

The formula for calculating a FICO score was developed by Fair, Isaac and Company , and while the specifics remain a secret so that no one can game the system, FICO has made the components of the score public. The formula takes into account the following factors, in descending order of importance:

Check Your Credit And Monitor Your Progress

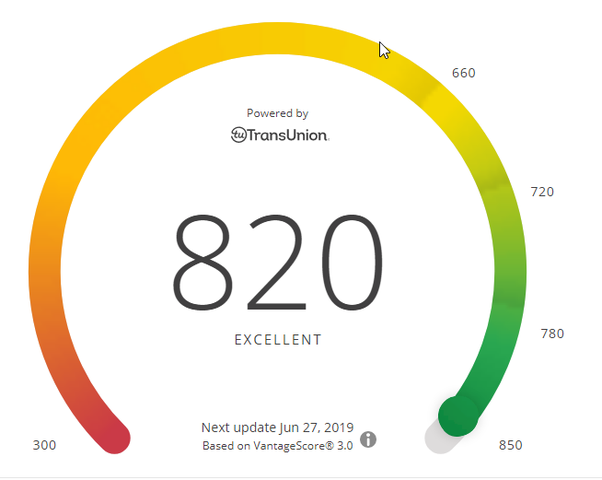

While you’re working your way toward the credit score needed to buy a house, check your progress with a free score some credit cards and many personal finance websites offer them.

Free credit scores often are VantageScores, a competitor to FICO. Either type of score can be used to track your progress they both emphasize the same factors, with slight differences in weighting, so they tend to move in tandem.

Mortgage lenders check older versions of the FICO score . If you want to see where you stand on those so you know exactly what mortgage lenders will see, youll have to purchase a comprehensive FICO report. You can do that at myFICO.com, then cancel the monthly service rather than pay an ongoing fee. Be sure to cancel before the next billing cycle starts the monthly subscription fee will not be prorated.

However, if youre near or in the excellent credit score range on a free score source, you dont need to pay to check your FICO scores. You almost certainly have good enough credit to qualify for the best rates.

Don’t Miss: Will Increasing Credit Limit Hurt Score

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Do Pay Down Your Credit Card Debt

Your credit utilization rate, also referred to as credit utilization ratio, is a significant factor in determining your credit score.

You must keep your credit utilization below 30%. Below that 30%, further improvements will earn you only a few points. But a few points is a lot in these circumstances. By coincidence, 30% is also the proportion of your score that credit card balances influence.

Don’t Miss: Why Is Your Credit Score Important

How Credit Scores Affect Mortgage Interest Rates

Your credit score can have a major impact on the overall cost of your loan. FICO publishes data that shows how your credit score could affect your interest rate and payment. Below is a snapshot of the monthly cost of a $300,000, 30-year fixed-rate mortgage in July 2022:

| 6.595% | $1,915 |

That’s an interest variance of over 1% and a $296 difference in monthly payment from the 620 to 639 credit score range to the 760+ range.

Those differences can really add up over time. According to the Consumer Financial Protection Bureau , a mortgage with a 5.25% interest rate costs over $43,000 more overall over 30 years than a mortgage with a 4.125% interest rate.

Pay Off Debt/keep Utilization Low

Since the amount you owe counts for 30% of your score, you want to pay off debt and keep credit card usage as low as possible.

Of course, its best to not carry a balance on your credit cards at all, if you can help it. But I know thats not always possible.

So, if you cant completely pay off your cards, try to at least keep them at 30% utilization or lower. In other words, if you have a credit card with $10,000 on it, try not to have a balance over $3,000 at any time.

If you have student loans, a car loan, a mortgage, or a personal loan, try paying them off as fast as possible. The faster these debts are paid, the less you owe and the faster your score will boost.

Not everyone can pay off their student loans or mortgage right away, so focus on smaller debts and paying them off first.

Related: What To Do After Paying Off Credit Cards

Read Also: How To Increase Credit Score

What Credit Score Is Needed To Buy A House

You dont need flawless credit to get a mortgage. But because credit scores estimate the risk that you wont repay the loan, lenders will reward a higher score with more choices and lower interest rates.

For most loan types, the credit score needed to buy a house is at least 620. However, a higher score significantly improves your chances of approval, as borrowers with scores under 650 tend to make up just a small fraction of closed purchase loans. Applicants with scores of 740 or higher will also get the lowest interest rates.

Build Your Credit Mix

We generally dont recommend taking out a potentially expensive loan just to build your credit scores. But its true that having a mix of different types of credit can benefit your scores over the long term. Types of credit include revolving credit and installment credit .

But theres a wrinkle: Applying for new credit can lead to a hard inquiry on your credit reports, which can have a negative impact on your scores. While this impact is typically minor, too many hard inquiries in a short time period can be a red flag to lenders. Thats why its important to have a general sense of how likely it is that youll be approved before you apply for a credit card or loan.

Don’t Miss: What Is My Business Credit Score

How Does A Credit Score Impact Home Buying

Mortgage lenders use your FICO Score to calculate interest rates and the fees youâll pay through the life of your mortgage. Itâs an important factor in determining what you can qualify for and how much youâll pay on top of the loan itself, but itâs not the end-all-be-all.

Lenders also assess your income, property type, assets, and debt levels to decide on a loan. Since those factors can all vary significantly, thereâs really no precise credit score you need to qualify for a loan. Still, there is good and bad.

Can I Buy A House With A 700 Credit Score

A 700 credit score meets the minimum requirements for most mortgage lenders, so it’s possible to purchase a house when you’re in that range.

However, lenders look at more than just your credit score to determine your eligibility, so having a 700 credit score won’t guarantee approval. A credit score of 700 also might not qualify you for the best interest rate on your mortgage loan, you may still want to work on improving your credit scores to save on interest.

Here’s what you need to know about the credit requirements for a mortgage loan.

You May Like: When Do Credit Cards Report To Agencies

How Can I Get A 700 Credit Score

To hit 700, you dont have to be perfect, but you have to be “good” in every category that comprises this credit rating.

You can hit a 700 in a variety of different ways, but if your credit is currently low and you want to get a 700 credit score, youll have to work at improving your credit.

The good news is that you can always work to make your credit score higher. The bad news is that sometimes it takes time to do so. For example, if you have more than three hard inquiries, you may want to wait before applying for new credit to limit new inquiries on your credit report, or wait for an existing inquiry to “roll off,” which can take up to 24 months.

There are ways to see faster score improvements: an individual can pay down balances to lower debt-to-income and credit utilization ratios and see an improvement within just a few months.

Since credit utilization makes up the largest percentage of your score, the less debt used out of the total amount available to you, the higher your credit score will be.

For the other components of a credit score: limiting new credit applications, having a nice mix of credit and keeping your oldest lines of credit open and active will all have positive impacts on your score.

Since these items in total only account for 30% of your overall score, it is more important to pay off debt and pay on time than to worry about your credit mix and opening new lines of credit, but it all counts.