Standard & Poors Cuts Uks Credit Rating By Two Notches After Brexit

The AAA rating is assigned by credit ratings agencies to countries seen as the most stable politically, economically and financially. The current list of countries given that rating by all the major agencies includes Australia, Canada, Denmark, Germany, Hong Kong, Liechtenstein, Luxembourg, Netherlands, Norway, Singapore, Sweden and Switzerland. Of the group, only Germany has an economy that is larger than Canadas.

Not only has the AAA-rated club become more exclusive in recent years, it has also lost members with some of the largest and most liquid bond markets. S& P downgraded the U.S. in 2011 following a bitter dispute in Congress about raising the debt ceiling .

Definition And Example Of A Triple

A bond is a debt instrument, similar to a loan. An entity issues a bond, which an investor buys with the expectation of being paid back in the future, plus interest. Bond rating agencies determine the rating of each bond.

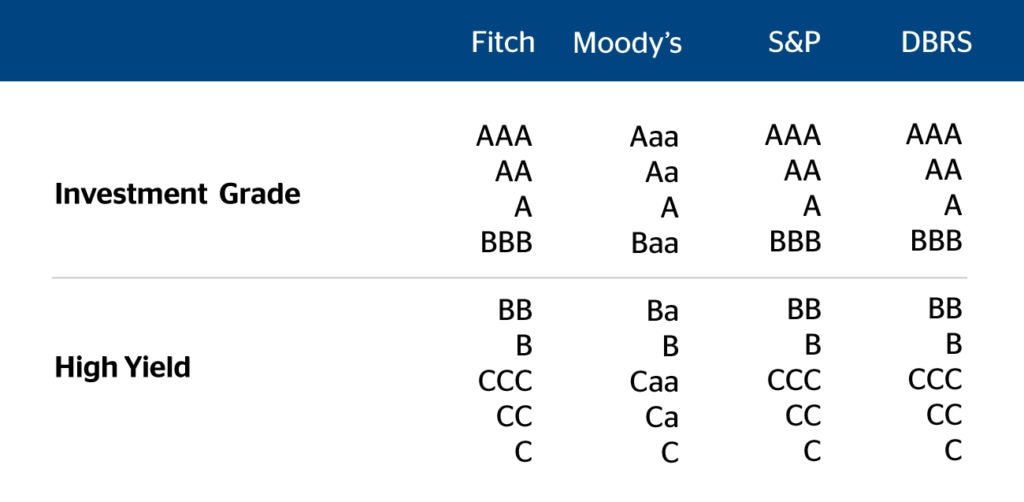

AAA bonds are considered the absolute safest by the three primary bond rating agencies: Fitch, Moody’s, and Standard & Poor’s. Grades go as low as “D” for Fitch and Standard & Poor’s. The lowest rating Moody’s grants is “C.”

It is extraordinarily difficult to achieve an AAA rating. U.S. companies that have maintained their AAA ratings include Johnson & Johnson and Microsoft Corporation.

What Is A Triple

Charlene Rhinehart is an expert in accounting, banking, investing, real estate, and personal finance. She is a CPA, CFE, Chair of the Illinois CPA Society Individual Tax Committee, and was recognized as one of Practice Ignition’s Top 50 women in accounting. She is the founder of Wealth Women Daily and an author.

A Triple-A bond rating is the highest rating that bond agencies award to an investment that is considered to have a low risk of default, thereby making it the most creditworthy.

Read Also: Does Carmax Take Credit Cards

Is Aaa A Good Car Insurance

AAA has been insuring American drivers for over a century. For some, it might not be worth it to pay a membership fee for car insurance but AAAs discounts and general benefits might balance out membership costs. Overall, AAA might not be the best choice for someone looking for bare-bones coverage, considering the added cost of a membership fee however, if you want full coverage, policy bundle options and extra perks, AAA might meet your needs.

Who Is This Card Best For

The AAA Member Rewards Visa Signature® Card is best for people who dont spend heavily on their credit cards and would prefer not to pay an annual fee, but still want to earn cash back on their purchases.

This card is great for frequent travelers and of course, for AAA members. With $0 foreign transaction fees and 3% cash back on eligible travel and AAA purchases, this card is made for travelers who want a high-earning, straightforward everyday card.

You May Like: Opensky Credit Card Delivery

Company With A Aaa Rating May Not Be A Good Investment

& #151 — Q: How can shares of a company that has a AAA rating fall?

A: Don’t get your ratings confused.

There are many ways to rate companies and stocks. Buy, hold and sell ratings from stock brokerage firms, for example, are evaluations of stocks and whether you should buy them. There are corporate governance ratings that tell you how well a company protects shareholder interests. The rating I believe you’re talking about is the credit or debt rating.

A company’s credit rating is quite different from its stock rating. Credit ratings are used by bond analysts to measure how likely a company is to pay back its debt. That is valuable information to investors who buy a company’s commercial paper, bonds or other debt and want to make sure they get their money back.

A company with a AAA credit rating, and that’s a small club, is considered highly likely to have the financial resources to repay its debts. Debt issued by these companies is sought after, which means they don’t have to pay high interest rates to attract investors. Companies with lower ratings will pay proportionately higher rates, or what’s called a risk premium.

The bottom line: Credit ratings and stock ratings are not the same thing. And, as we found out in the subprime debacle, credit ratings may not be all that reliable, either.

Whats In A Credit Rating

Nina Boyarchenko and Or Shachar

Update: Clarifying text regarding the net leverage chart, as well as an additional chart, have been added to the bottom of this post.

Rising nonfinancial corporate business leverage, especially for riskier high-yield firms, has recently received increased public and supervisory scrutiny. For example, the Federal Reserves May 2019 Financial Stability Report notes that growth in business debt has outpaced GDP for the past 10 years, with the most rapid growth in debt over recent years concentrated among the riskiest firms. At the upper end of the credit spectrum, investment-grade firms have also increased their borrowing, while the number of higher-rated firms has decreased. In fact, there are currently only two U.S. companies rated AAA: Johnson & Johnson and Microsoft. In this post, we examine recent trends in the issuance of investment-grade corporate bonds and argue that the combination of increased BAA issuance and virtually nonexistent AAA issuance both reduces the usefulness of the BAAAAA spread as a credit risk indicator and poses a financial stability concern.

The Changing Investment-Grade Landscape

The next chart shows that the increases in BAA issuance occurred across industry groups. Thus, while all of the corporate AAA issuance is concentrated in just two firms, BAA issuance is more widespread, creating a potential mismatch in issuer characteristics between AAA bonds and BAA bonds.

Implications for Financial Stability

Recommended Reading: How To Check My Itin Credit Score

Other Things To Consider

- AAA Membership Not Required: Although this cards application includes a field for your AAA membership number, filling it in is optional. You dont actually have to be a AAA member to apply for this card, which is a good thing considering that many nonmembers would love to earn 3% back on travel and 2% on gas, groceries, wholesale clubs and drug-store buys.But with that being said, most people are unlikely to gravitate to AAA-branded plastic unless they at least have an interest in joining, and this card really shines in the hands of a AAA member. So if youre wondering about the cost of membership, you can join AAA for as little as $52 per year.

- 25% To 75% Bonus For Preferred Rewards Members: If you have at least $20,000 in total balances in a Bank of America bank account and/or Merrill Lynch investment account, you will qualify for Bank of Americas Preferred Rewards program and your credit-card rewards will become more valuable. Here are the details:

Combined Balance

Ad Disclosure: Certain offers that appear on this site originate from paying advertisers, and this will be noted on an offers details page using the designation “Sponsored”, where applicable. Advertising may impact how and where products appear on this site . At WalletHub we try to present a wide array of offers, but our offers do not represent all financial services companies or products.

Users Of Credit Ratings

Credit ratings are used by investors, intermediaries such as investment banksList of Top Investment BanksList of the top 100 investment banks in the world sorted alphabetically. Top investment banks on the list are Goldman Sachs, Morgan Stanley, BAML, JP Morgan, Blackstone, Rothschild, Scotiabank, RBC, UBS, Wells Fargo, Deutsche Bank, Citi, Macquarie, HSBC, ICBC, Credit Suisse, Bank of America Merril Lynch, issuers of debt, and businesses and corporations.

- Both institutional and individual investors use credit ratings to assess the risk related to investing in a specific issuance, ideally in the context of their entire portfolio.

- Intermediaries such as investment bankers utilize credit ratings to evaluate credit risk and further derive pricing of debt issues.

- Debt issuers such as corporations, governments, municipalities, etc., use credit ratings as an independent evaluation of their creditworthiness and credit risk associated with their debt issuance. The ratings can, to some extent, provide prospective investors with an idea of the quality of the instrument and what kind of interest rate they should be expecting from it.

- Businesses and corporations that are looking to evaluate the risk involved with a certain counterparty transaction also use credit ratings. They can help entities that are looking to participate in partnerships or ventures with other businesses evaluate the viability of the proposition.

Read Also: Can Someone Check Your Credit Without Permission

Is Visa Signature A Good Card

Yes, we believe the AAA Member Rewards Visa Signature® Card is a good card. It has lots of valuable benefits that dont come at a high cost. Especially if youre a frequent traveler who loves earning cash back on their purchases, this can be an extremely good card.

For rates and fees of Blue Cash Preferred® Card from American Express, please click here.

The information related to AAA Member Rewards Visa Signature® Card has been independently collected by ValuePenguin and has not been reviewed or provided by the issuer of this card prior to publication. Terms apply to American Express credit card offers. See americanexpress.com for more information.

These responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Advertiser Disclosure: The products that appear on this site may be from companies from which ValuePenguin receives compensation. This compensation may impact how and where products appear on this site . ValuePenguin does not include all financial institutions or all products offered available in the marketplace.

Aaa Discounts And Extras

The discounts that come with AAA membership vary. Popular discounts include:

-

Cellular service .

-

Electronics from select companies, up to 35% off.

-

Car and moving truck rentals, 20% or more off.

-

Amusement parks, museums and other entertainment.

-

Movie tickets, dining and flower delivery services.

AAA certifies auto repair shops that meet its standards for equipment, customer satisfaction and technician expertise. Members get 10% off repairs, up to $50, at these locations. Most repairs are guaranteed for two years or 24,000 miles, whichever comes first.

AAA still offers paper maps to its members, but its storied TripTik travel planner you may remember the detailed, customized spiral-bound guides has moved online. AAA travel professionals can help plan the route and assist with car rental and hotel reservations.

Also Check: How Long Do Repossessions Stay On Your Credit

Maintaining The Aaa Rating

More than three decades ago, the Texas Legislature decided to put aside a portion of state revenue from oil and natural gas severance taxes to be deposited into the Economic Stabilization Fund .

The ESF was intended as a hedge against revenue swings due to economic downturns, giving the state a rainy day fund to manage its finances in times of trouble.

But what started as a budget management tool has grown to an enormous asset to the state. The Comptrollers recently released Biennial Revenue Estimate says that, absent any appropriations by the Legislature, the ESF balance is expected to be $15.4 billion at the end of the 2020-21 biennium.

Most of the ESF simply isnt being used by the state, and the majority of it is invested in a way that in recent years hasnt even kept up with inflation. Thats not much better than burying the money in a hole on the Capitol lawn.

The Comptroller is proposing an alternative to amassing so much tax revenue in the ESF. It calls for creating a special endowment, the Texas Legacy Fund, with part of the ESF balance.

This idea wouldnt reduce the sufficient balance that must be kept in the ESF . That amount would still be readily available to access. It wouldnt affect the portion of oil and gas revenue dedicated to the State Highway Fund, either.

Money in the Texas Legacy Fund would be invested in a way that could yield billions of dollars in future years to meet the states long-term obligations.

| Year |

|---|

Secured Vs Unsecured Bonds

Issuers can sell both secured and unsecured bonds. Each type of bond carries with it a different risk profile. A secured bond means that a specific asset is pledged as collateral for the bond, and the creditor has a claim on the asset if the issuer defaults. Secured bonds may be collateralized with tangible items such as equipment, machinery, or real estate. Secured collateralized offerings may have a higher credit rating than unsecured bonds sold by the same issuer.

Conversely, unsecured bonds are simply backed by the issuer’s promised ability to pay, therefore the credit rating of such instruments relies heavily on the issuer’s income sources.

Read Also: Navy Federal Car Loan Credit Score

Aaa Auto Insurance Reviews

A link has directed you to this review. Its location on this page may change next time you visit.

- 3,522,762 reviews on ConsumerAffairs are verified.

- We require contact information to ensure our reviewers are real.

- We use intelligent software that helps us maintain the integrity of reviews.

- Our moderators read all reviews to verify quality and helpfulness.

For more information about reviews on ConsumerAffairs.com please visit ourFAQ.

Page 1Wynter of Marina, CA Verified Reviewer

My vehicle was hit by a driver who was driving out of a space in December. He was at a fault. I reported the incident to AAA, and the initial contact person was kind. He gave me a list of repair places to get the vehicle fixed, and because it was late in December, I proceeded to go and get it dropped off. At the repair place they suggested I contact the adjustor to get a claim code for a rental, however, the adjuster did not call me back. I figured it was the holidays, and they would get back to me later. They never did. So no rental.

Tony of Fredericksburg, VA Verified Reviewer3 people

Thank you, you have successfully subscribed to our newsletter! Enjoy reading our tips and recommendations.

Kenneth of Candler, NC Verified Reviewer6 peopleMilisa of Cincinnati, OH Verified Reviewer3 peopleJeff of Vallejo, CA Verified Reviewer2 peopleMontez of Lexington, KY Verified Reviewer12 peopleTina of Savannah, GA Verified Reviewer6 peopleSabrina of Tulsa, OK Verified ReviewerAmanda of New Haven, IN

Aaa Member Rewards Visa Signature Card Vs Blue Cash Preferred Card From American Express

More cash back at U.S. supermarkets and U.S. gas stations

The Blue Cash Preferred® Card from American Express is among our favorite cashback cards, and for good reason. The card gives users an outstanding 6% Cash Back at U.S. supermarkets on up to $6,000 per year in purchases , 6% Cash Back on select U.S. streaming subscriptions, 3% Cash Back at U.S. gas stations and on transit , 1% Cash Back on other purchases. Terms apply.

With this card, consumers will earn rewards in nearly every major shopping category besides travel. The Blue Cash Preferred® Card from American Express has a $0 introductory annual fee for the first year, then $95.

The card offers double the cash back and in more categories than the AAA Member Rewards Visa Signature® Card this makes the Blue Cash Preferred® Card from American Express the better option.

For rates and fees of Blue Cash Preferred® Card from American Express, please click here.

Recommended Reading: What Is Thd Cbna On My Credit Report

Could Uk Benefit From A Eurozone Fallout

One possibility, is that if there was great volatility in the Eurozone, investors may decide the UK is one of best places for putting funds. Investors need to put their savings some-where, the UK could be seen as least worse option. To some extent this has already occurred, and is one reason behind the low UK bond rates.

Answer. Yes, it should. But, if there is a major banking crisis in Europe or persistent depression, this could change.

Related

Why Does A Credit Rating Matter

The interest rate nation states are forced to offer to attract sufficient lenders when taking out multi-billion euro loans depends, in part, on their credit rating. France, Germany, the Netherlands, Luxembourg, Finland and Austria have enjoyed the highest rating throughout the crisis, keeping their borrowing costs low. The AAA grade by the three ratings agencies Standard & Poor’s, Fitch, and Moody’s is considered the gold standard.

Recommended Reading: Chase Sapphire Preferred Score

Aaa Credit Card Review: Our Thoughts On The Aaa Member Rewards Visa Signature Card

Regardless of whether youre an American Automotive Association member, the AAA Member Rewards Visa Signature® Card is an excellent choice for your wallet.

This card allows you to earn 3% cash back on eligible travel and AAA purchases 2% back on gas, grocery store, wholesale club and drugstore purchases and 1% back on everything else.

These rates are better than what several competing cashback credit cards provide in similar categories. Though other rewards credit cards may offer comparable earning rates with larger sign-up bonuses, those cards tend to come with annual fees and bonus requirements which involve high amounts of spending in order to qualify.

Bank of Americas Preferred Rewards members will get the most bang for their buck with this card, as you can earn 25% to 75% more points on every purchase, depending on which tier your spending falls into. Note that while this card is co-branded with AAA, you dont have to be a member to apply. That means the AAA Member Rewards Visa Signature® Card is available to anyone who meets its minimum FICO requirements. Excellent/Good credit is required.

Aaa Member Rewards Visa Signature Card Vs Capital One Savorone Cash Rewards Credit Card

Higher earnings on gas and groceries

The Capital One SavorOne Cash Rewards Credit Card is a $0-annual-fee card that lets you earn unlimited 3% Cash Back on dining and entertainment 3% Cash Back on popular streaming services 3% Cash Back at grocery stores 1% Cash Back on all other purchases. Plus, earn 8% cash back on tickets at Vivid Seats through January 2023. Youll also Earn a one-time $200 cash bonus after you spend $500 on purchases within the first 3 months from account opening.

While the Capital One SavorOne Cash Rewards Credit Card comes out ahead of the AAA Member Rewards Visa Signature® Card with a higher earning rate on gas, groceries and its other bonus categories, the AAA Member Rewards Visa Signature® Card still takes the lead for travel and AAA purchases. However, though the two cards offer comparable sign-up bonuses, the Capital One SavorOne Cash Rewards Credit Card requires you to spend half as much to earn the bonus, making this the better deal.

In choosing between these two cards, youll have to consider which categories you tend to spend the most in to find the card that will offer you the most value. However, generally, we feel that the Capital One SavorOne Cash Rewards Credit Card is the better option overall.

You May Like: What Credit Bureau Does Paypal Credit Use