Your Income And Expenses Matter Too

Your credit score isnt the only important thing when it comes to getting approved for a card. Your income and expenses will play a role too.When you apply for a card, Capital One will ask you about your annual income and monthly housing payments.

This is because lenders really only care about getting paid back for loans they make.

If you make $1,000 per month and spend $750 on housing, its unlikely you can pay the bills on a new credit card. If you make $10,000 a month and spend $4,000 on housing, theres a much better chance you can make payments.

Ive had good luck with an increased income increasing my luck with card companies. I have a Capital One Quicksilver card, which I use because it doesnt charge a foreign transaction fee. One day when I logged into my account, it asked me to update the annual income listed for me in the companys records.

Once, I had provided my updated income after receiving a raise, and a few weeks later Capital One offered to increase my credit limit due to my higher income. This caused a small jump in my credit score.

Its clear that making more money and spending less means its easier for you to pay your debts. Thats exactly what Capital One wants to see. Just be sure, to tell the truth about your application because Capital One will occasionally request proof of income or housing expenses.

When Do Your Credit Scores Get Updated

Since your are based on the information in your , your scores can be updated whenever your reports are updated. And how often your reports are updated might depend on how often the three major credit bureausâEquifax®, Experian® and TransUnion®âreceive information from lenders.

Every lender has its own schedule for reporting information to the credit bureaus. And lenders typically donât report information to each of the credit bureaus at the same time. But information is typically reported every 30 to 45 days. And your scores could change every time new informationâlike new accounts or changes to your account balancesâis reported by a lender and reflected in your credit reports.

Because every lender has its own reporting schedule and policies, your credit scores can change oftenâeven multiple times a day. Itâs normal for your scores to fluctuate a little.

And keep in mind that you have many different credit scores. Thatâs because there are many credit-scoring modelsâmathematical formulas used to calculate credit scores. And each formula is a little different. Formulas can use information from just one credit report or a combination of different reports. Then, each formula might assign different levels of importance to that information.

Frankie Solomon Wallethub Analyst

The Capital One CreditWise score is your TransUnion VantageScore 3.0 score. So yes, they accurately retrieve that data. As for how accurate is CreditWise from Capital One vs. FICO, it’s really hard to determine. The methods they use aren’t that clear. But the results are extremely close for both scoring models.

Ad Disclosure:

You May Like: Does Comenity Bank Report To Credit Bureaus

How Accurate Is Capital One Auto Pre Approval

Youve probably heard of Capital One, which offers credit cards, auto loans, and home loans. If so, youre probably wondering if this companys pre-approval process is accurate. The good news is that Capital One accepts credit ratings as low as 500 and can provide you with flexible terms. Whether youre a first-time car buyer or have a poor credit history, Capital One has a loan for you.

Capital One Offers Auto Loans Credit Cards And Home Loans

![Capital One Credit Wise Review: Accurate? [2020] Capital One Credit Wise Review: Accurate? [2020]](https://www.knowyourcreditscore.net/wp-content/uploads/capital-one-credit-wise-review-accurate-2020-uponarriving.png)

To see if you qualify for a Capital One auto loan, visit their Auto Navigator site. There, you can prequalify for a single car loan. You will be asked a few questions to determine your financial situation and credit. Once you answer the questions, Capital One will initiate a soft inquiry into your credit file. While this inquiry will not have any impact on your credit score, you will be given an auto loan pre-qualification offer. This pre-approval will be valid for 30 days and will show you estimated payments and interest rates. Capital One does not charge an application fee to use its Auto Navigator tool.

Capital One Auto Finance offers financing for new and used cars, and refinancing for your existing auto loan. When you apply for a loan, you fill out a form with your personal information, including your Social Security number and bank account information. When you are approved, youll see several offers that youve qualified for based on your credit report. Once you accept an offer, a hard inquiry will occur.

How accurate is Capital One auto pre approval? is a popular tool for prequalifying for a car loan. While you may find a better interest rate from a different financial institution, Capital Ones auto prequalification process is quick and easy to use. If you have a good credit score, you can shop around to find the best loan terms and conditions. With their online application, youll be able to find a car that fits your budget and your lifestyle.

Also Check: Credit Score To Be Approved For Care Credit

How Often Do Issuers Report To Credit Bureaus

Broadly speaking, all issuers have a vested interest in keeping credit profiles current . So they tend to report on a regular basis. Capital One’s reporting rate is not out of the ordinary.

This does not mean, however, that they always do so. There is no legal mandate to report cardholder activity, and there are issuers out there that don’t bother. Additionally, some credit card issuers report to one bureau, or two, but not all three.

So at the end of the day, there is no single reporting standard. Different issuers report at different paces, and at different times.

Nevertheless there are numerous situations in which you might want to know this information, like when you’re:

- About to apply for a job that requires a credit check

- Trying to get a mortgage

- Thinking about applying for a new credit card

In such instances, it’s good to know when those reporting dates occur . Take a few moments to contact your issuer to learn these particulars, then try to pay off chunks of your debt in advance of the reporting date if you have the means. Reducing balances always makes your credit file look better. It should also help raise your score.

Joseph Bulebush Wallethub Analyst

Capital One CreditWise is good because its a free way to check your credit score anytime. It will also send you email alerts when theres important activity on your credit report, such as a hard credit inquiry or a new credit card account. Plus, its available to everyone who signs up on the CreditWise website, not just Capital One customers. The credit score you get is the VantageScore 3.0 model, based on your TransUnion credit report.

Many credit card issuers including American Express and Barclaycard have added free credit tracking services that send your credit score once a month or a week, like Capital One. But CreditWise goes beyond that and not only alerts you to new credit activity, it also provides a lot of information on what affects your score, as well as easy ways you can improve it.

For example, CreditWise offers a credit score simulator, with which you can see how decisions like paying off abalance, opening a new credit card, or making a late payment could affect your credit.

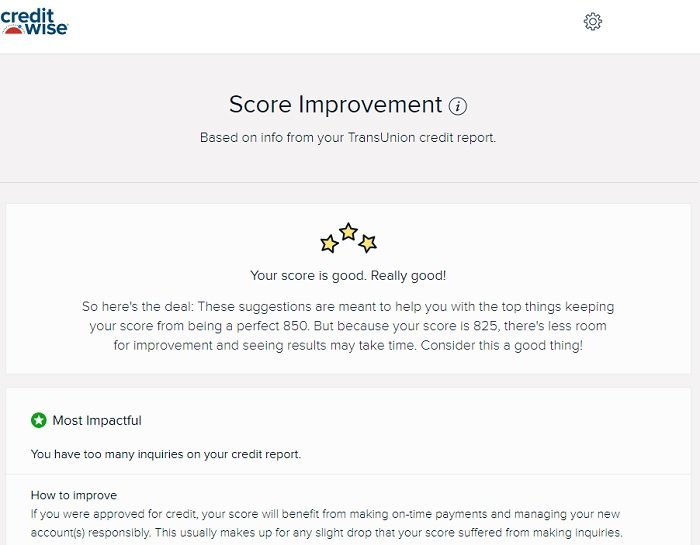

Youll receive a score in each of the sections below average, average, good, or excellent. And CreditWise tells you how much each section impacts your overall score. For instance, On-time Payments has the greatest impact on your score, while Available Credit has the least impact. Theres also a Score Improvement section where you can find personalized suggestions for improving your credit score.

Recommended Reading: Disputing Old Addresses Credit Report

How Often Capital One Reports To Credit Bureaus

According to Capital One, it typically provides your credit information to all three bureaus every 30 to 45 days.

The company doesn’t specify exactly when it does this, but it’s normal for creditors to report your data at the end of every billing cycle.

Capital One also doesn’t specify what exactly it reports, but based on a review of the information that shows up on a credit report, you can reasonably guess that Capital One reports:

- Your payment history for two years

- Your balance

- The amount of your last payment

- The past amount due

- The account status

- The date the account was open

- Who is responsible for the account

Other information may be reported, depending on your individual circumstances. Also, Capital One says that your credit report will show when the issuer provided your data to each bureau.

One key piece of data is your balance. With this information, plus your credit limit, a credit bureau can determine your utilization ratio. More on this all-important ratio in a moment.

Your Fico Score May Differ

On the customer review site ConsumerAffairs, some people have reported that their Credit Karma score is quite a bit higher than their FICO scores. Whether these posts are reliable is unknown, but it is worth noting.

If your Credit Karma score isn’t accurate, the problem is probably elsewhere. That is, one of the bureaus made an error or omitted information. Or, the information might have been reported to one bureau but not others.

Using Credit Karma won’t hurt your credit score. Your search is a self-initiated inquiry, which is a “soft” credit inquiry, not a “hard” inquiry.

Also Check: Affirm Delinquent Loan

Increase Your Credit Limit

Raising your credit limit isn’t a particularly daunting task. Although methods vary from issuer to issuer, a few clicks within your account management portal can usually lead you to a limit raise request. You can also typically ask for an increase via phone, or with a written request.

Oftentimes, your issuer will offer a credit increase in exchange for a small piece of information or two. It’s common for issuers to bump the limit for cardholders that update their annual income figure, for instance.

It’s also worth noting that your account needs to be in good standing to get a limit bump. Issuers won’t increase their exposure to you as a lender if you haven’t demonstrated you can pay your statements on time or be disciplined about your spending.

What Can You Do With A 700 Credit Score

Instead of focusing only on whether a 700 score is good or not, consider whether it will allow you to reach your goals, said Victoria Sechrist, certified financial trainer at The Financial Gym.

For example, some mortgage refinance lenders are requiring a minimum of 700, Sechrist said. Some credit card issuers say they want people with 720-plus to get their top tier cards. That doesnt mean you cant get approved for credit cards or a mortgage refinance it just means you may have to shop around more to find a lender with lower credit requirements. If youre looking for a personal loan or a 0 percent balance transfer credit card to refinance higher interest debt, then 700 should be good enough for you to qualify.

In the 700 club, your will likely be close to the average credit limit of $4,200, said Ted Rossman, senior industry analyst at Bankrate. That limit can vary based on income and other debt.

With an average credit score, expect to pay around the average credit card interest rate of 16 percent, Rossman said. Thats better than the 20 percent or 25 percent those with lower scores will pay, but not as nice as the 7 percent or 10 percent people with scores of 740 and higher might achieve.

Also Check: 728 Fico Score

Where Credit Scores Come From

Lenders use the credit scores issued by the Fair Isaac Corporation or other credit scoring models to determine how loan-worthy a potential borrower is. The number, ranging from 300 to 850 for FICO scores, is taken as an indicator of how well you can manage loans, mortgages and credit cards. Although it may not be perfect, its nonetheless how creditors assess risk the higher your score, the more responsible you appear.

VantageScore, launched in 2006 by the three major credit reporting bureaus , is another commonly used scoring model. It also ranges from 300 to 850, but its calculated a little differently than FICO. Well explore these differences shortly.

Optimizing your credit score is important if you want to receive lower interest rates. It will also help you earn access to the best travel rewards credit cards and other best credit cards, as well as the best terms on other types of loans. Simply put, if your score is in the good-to-excellent range, lenders trust that you will repay your debts on time and will be more inclined to do business with you by offering you access to the best products and the best rates.

Types Of Credit Scores Available

In the world of consumer credit, there are several different credit scores that may be used by creditors to evaluate the risk of a new borrower.

Regardless of the type used, information like an individuals account payment history, number of accounts open and used, credit utilization percentage, and any negative credit issues are all included in the calculation of ones credit score.

An in-depth algorithm is applied to these details to derive a three-digit number ranging from 300 to 850, in most cases. The higher the credit score, the more sound a borrower the individual is perceived to be when a new application for credit is submitted.

While Credit Karma boasts its free credit score to anyone who wants it, the company provides access to an individuals VantageScore 3.0, not the FICO Score that the majority of lenders use to evaluate an individual. The VantageScore 3.0 has the same credit score range as FICO and uses some of the same information a FICO Score does, but the way in which the information is used to determine ones credit score is different.

When Credit Karma users see their credit score details on the site or the mobile app, they are viewing their VantageScore 3.0.

In addition to using a different type of credit score than most lenders and financial institutions, Credit Karma also offers access to only two credit scores from two of the credit reporting agencies.

Recommended Reading: How To Remove A Paid Repossession From Your Credit Report

Capital One Is The First Bank In Canada To Create And Offer A Free Credit Monitoring Tool Called Credit Keeper To Its Customers

Toronto, ON Many Canadians are burying their heads in the sand when it comes to their credit, according to a new study conducted by Ipsos on behalf of Capital One Canada, with over half of Canadians admitting that theyve never attempted to obtain their credit score. To help Canadians use their credit wisely, Capital One® is launching Credit Keeper, a credit tracking tool that provides customers with free access to their credit score a first among banks in Canada.

According to the study, Canadians who have obtained a credit score are most likely to acquire it from a banker, mortgage professional or financial services provider . This suggests that many are waiting until they are already applying for credit to assess their creditworthiness, rather than tracking it proactively.

A strong credit score makes many important life milestones, like renting that first apartment or buying that first car or home, a real possibility. We want to help our customers reach those goals, says Shane Holdaway, President, Capital One Canada. We believe that personalized digital tools, like Credit Keeper, will help Canadians on their journey to build a successful financial future.

@CapitalOneCA just launched #CreditKeeper a free credit monitoring tool for its customers

Armed with this information, Capital One offers the following tips to help Canadians use their credit score more effectively:

TransUnion and associated names and logos are trademarks of TransUnion, LLC or an affiliate.

Other Services Credit Karma Offers

Credit Karma will access your credit information from TransUnion and Equifax, two of the three major consumer credit agencies. It will come up with its own independent rating based on VantageScore. You will then receive your current VantageScore rating and the more detailed credit reports behind it.

In addition to this free service, Credit Karma has other related services, including a security monitoring service and alerts for when someone has conducted a credit check on you. This is not unique to Credit Karma: Many of the best credit monitoring services provide similar alerts and services.

When you share your personal information with Credit Karma, you can search for personalized offers for a credit card, a car loan, or a home loan, and your search won’t pop up in your credit report on Credit Karma or anywhere else. A standard section of credit reports is “inquiries,” which lists requests for your report from lenders you’ve applied to for a loan. Credit Karma allows you to limit the number of inquiries you make.

Don’t Miss: Does Sezzle Affect Credit Score

Here Are 10 Ways To Increase Your Credit Score By 100 Points