What Is A Credit Score

A credit score is a number between 300850 that depicts a consumer’s creditworthiness. The higher the score, the better a borrower looks to potential lenders. A credit score is based on : number of open accounts, total levels of debt, and repayment history, and other factors. Lenders use credit scores to evaluate the probability that an individual will repay loans in a timely manner.

Consider Consolidating Your Debts

If you have a number of outstanding debts, it could be to your advantage to take out a debt consolidation loan from a bank or credit union and pay them all off. Then you’ll just have one payment to deal with and, if you’re able to get a lower interest rate on the loan, you’ll be in a position to pay down your debt faster. That can improve your credit utilization ratio and, in turn, your credit score.

A similar tactic is to consolidate multiple credit card balances by paying them off with a balance transfer credit card. Such cards often have a promotional period during which they charge 0% interest on your balance. But beware of balance transfer fees, which can cost you 35% of the amount of your transfer.

Better Chance For Credit Card And Loan Approval

Borrowers with a poor credit history typically avoid applying for a new credit card or loan because they’ve been turned down previously. Having an excellent credit score doesnt guarantee approval, because lenders still consider other factors such as your income and debt. However, a good credit score increases your chances of being approved for new credit. In other words, you can apply for a loan or credit card with confidence.

Recommended Reading: What Is Syncb Ntwk On Credit Report

What Is A Vantagescore

VantageScore was actually developed by the 3 major credit bureaus. The credit scoring system with VantageScore is a lot different than FICO, ranging from 300 850. However, there are still 5 major categories to assess an application Very Poor, Poor, Fair, Good, Excellent. About 60% of US citizens with a credit score have a Fair or better VantageScore rating.

Below is a table with the VantageScore credit rating system ranging from 300 850 . This is distinct from older versions that ranged from 501 to 990. Like FICO, VantageScore is constantly updating its system.

| VantageScore |

|---|

Major Differences Between Vantage Score And Fico

There are too many differences between the VantageScore and FICO scoring methodologies to go into in great detail, but we will run over some of the major differences to see how each one individually calculates credit scores.

While FICO calculates on a total of 5 categories, VantageScore calculates 6. No longer are there differences in the total range model, with VantageScore migrating to FICOs model ranging from 300 850. Earlier versions of VantageScore used a 501 to 990 range. VantageScore also abandoned the letter grades with its third version.

VantageScore is now a lot different than FICO, due to its latest upgrade to VantageScore 4.0. It no longer gives percentages with regard to how heavily weighted each category is. The following are the breakdowns for the most popular credit versions:

You May Like: Synchrony Networks On Credit Report

Is 665 A Good Credit Score For A Car Loan

Best Auto Loan and Credit Card Options. A credit score of 665 is considered a Fair credit. Its perfectly average, and individuals with these scores wont have much trouble securing loans and credit cards. They are likely to be approved for both, and will most often be offered average APR and terms.

What Is A Fair Credit Score Range

Fair credit score = 620- 679: Individuals with scores over 620 are considered less risky and are even more likely to be approved for credit.

In the mid-600s range, consumers become prime borrowers. This means they may qualify for higher loan amounts, higher credit limits, lower down payments and better negotiating power with loan and credit card terms. Only 15-30% of borrowers in this range become delinquent.

Recommended Reading: Does Paypal Credit Report To Credit Bureaus

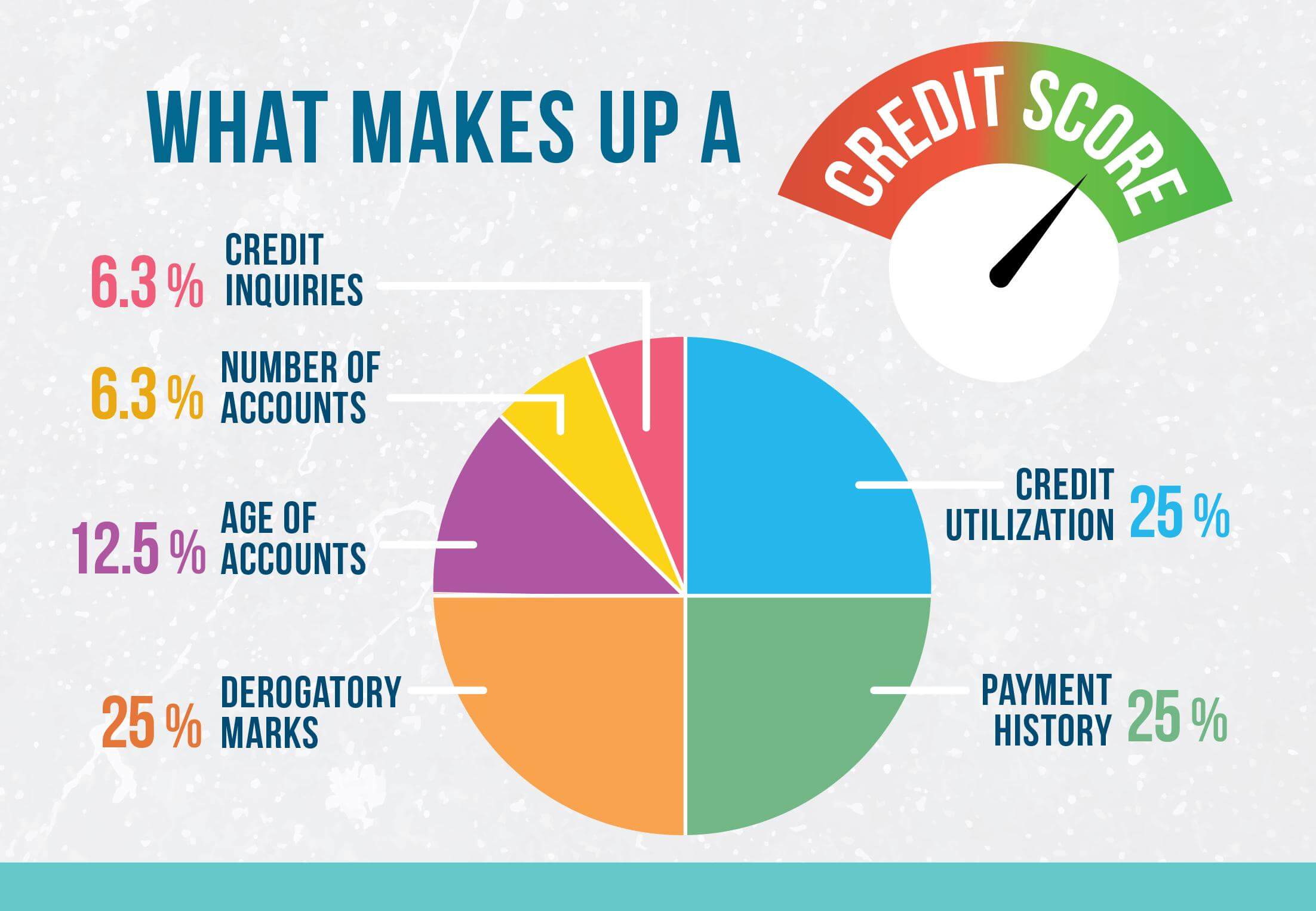

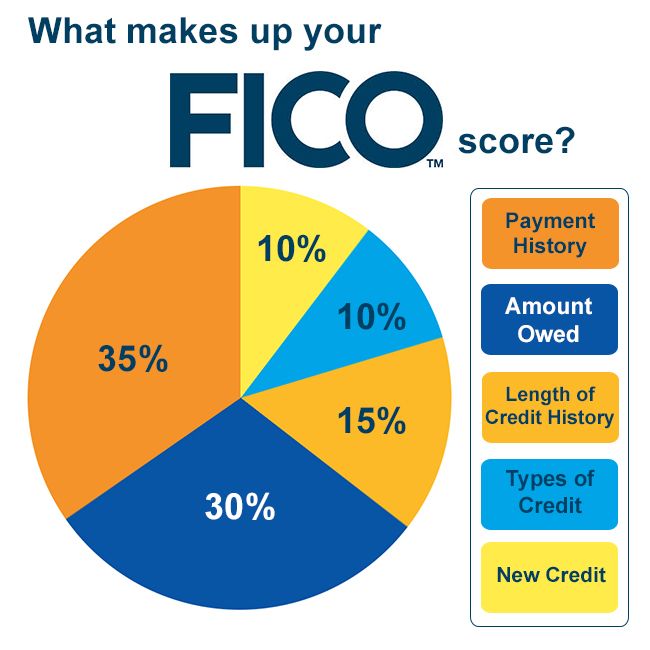

The Fico Credit Scoring Formula

The FICO® Score is made up of five weighted categories of information. In order from most important to least, they are:

- Payment history — Do you pay all of your bills on time? The answer to this question is the single largest factor in your FICO® Score.

- Amounts owed –– How much of your available credit lines are you using? How much do you still owe on installment loans, relative to their original balances? These are some of the items included in this category.

- Length of credit history –– This includes a variety of time-related factors, such as how long ago you opened your oldest account, the ages of your individual credit accounts, and the average age of all of your accounts.

- New credit –– There are two main credit factors in the “new credit” category. First, it includes the new credit accounts you’ve recently opened . Second, it includes credit inquiries — that is, the times you’ve applied for credit — within the past 12 months.

- — The FICO® formula also considers the different types of credit accounts you have. The rationale here is that a consumer who has demonstrated the ability to manage several different account types responsibly has done a better job of demonstrating creditworthiness than one who has only used a single type of credit.

What Is A Poor Credit Score Range

Poor credit score = 550 619: Credit agencies consider consumers with credit delinquencies, account rejections, and little credit history as subprime borrowers due to their high credit risk. Although it is possible to qualify for credit, it is often at very disadvantageous terms you will pay much higher interest rates and penalty fees.

If you find yourself in this range, you should begin to address any specific credit problems you have to try to boost your score before applying for credit. Subprime borrowers typically become delinquent 50% of the time.

Recommended Reading: What Is Syncb Ntwk On Credit Report

Review Your Credit Reports

To improve your credit, it helps to know what might be working in your favor . Thats where checking your credit history comes in.

Pull a copy of your from each of the three major national credit bureaus: Equifax, Experian, and TransUnion. You can do that for free once a year through the official AnnualCreditReport.com website. Then review each report to see whats helping or hurting your score.

Factors that contribute to a higher credit score include a history of on-time payments, low balances on your credit cards, a mix of different credit card and loan accounts, older credit accounts, and minimal inquiries for new credit. Late or missed payments, high credit card balances, collections, and judgments are major credit score detractors.

Check your credit report for errors that could drag down your score and dispute any you spot so they can be corrected or removed from your file.

Why Is My Credit Score Low

Lower credit scores arent always the result of late payments, bankruptcy, or other negative notations on a consumers credit file. Having little to no credit history can also result in a low score.

This can happen even if you had established credit in the past if your credit report shows no activity for a long stretch of time, items may fall off your report. Credit scores must have some type of activity as noted by a creditor within the past six months.If a creditor stops updating an old account that you dont use, it will disappear from your credit report and leave FICO and or VantageScore with too little information to calculate a score.

Similarly, consumers new to credit must be aware that they will have no established credit history for FICO or VantageScore to appraise, resulting in a low score. Despite not making any mistakes, you are still considered a risky borrower because the credit bureaus dont know enough about you.

Also Check: Annual Credit Report Itin

Your Credit Report Contains The Following Information

Personal Information

- Identity verification

Each of your credit accounts will be given a rating that includes a letter and a number.

Letters

| Installment | Accounts that receive an I are installment style accounts that are paid off in predetermined fixed amounts. For example, a car loan. | |

| Open | Accounts that receive an O are open, which means they can be used up to a preset limit. An example of an open credit account is a line of credit. | |

| Revolving | Accounts that receive an R are considered revolving credit because your payments change based on how much of your limit you borrow. A credit card would receive an R. | |

| Mortgage | Depending on the credit bureau you pull your report from, your mortgage may or may not show up. If it does, it will be represented by an M. |

Numbers

| Account is in collections or bankruptcy |

Did you know that bad credit can affect your daily life? Learn more here.

Who Calculates Your Credit Score

Your credit score is calculated by a credit reference agency . There are 3 CRAs in the UK: Equifax, Experian and TransUnion. At ClearScore, we show you your Equifax credit score, which ranges from 0 to 700.

Each CRA is sent information by lenders about the credit you have and how you manage it. Other information, such as public records like the electoral roll and court judgments, are also sent to the CRAs and form part of your credit report.

Also Check: Credit Check Without Ssn

Why Is A Good Credit Score Valuable

Now you know a little about where scores come from. But that doesnât explain why good credit scores are so valuable. Credit scores are often associated with credit card or loan applications, but their influence goes beyond that.

Good scores can affect interest rates, credit limits, housing applications and even job prospects. And they can offer more options, more bargaining power and more financial flexibility.

Pre-Approval, Pre-Qualification and Comparing Offers

For starters, you may be pre-approved or pre-qualified for more credit card offers if you have a good score. That may allow you to compare offers and find the best fit for your situationâwhether youâre looking at mortgages, credit cards or auto loans. But if youâre shopping around, be sure to understand how credit inquiries can affect your credit.

Interest Rates and Credit Limits

If youâre approved for a loan or a credit card, a good credit score could mean higher credit limits, lower interest rates or both. And when youâre paying less in interest, you may have smaller payments and be able to pay off your debt faster. In general, that means that higher credit scores could decrease the cost of borrowing money.

Beyond Credit Cards and Loans

Finally, good credit scores could affect other parts of your life, too:

Why There Are Different Credit Scores

For example, VantageScore creates a tri-bureau scoring model, meaning the same model can evaluate your credit report from any of the three major consumer credit bureaus . The first version was built in 2006. The latest version, VantageScore 4.0, was released in 2017 and developed based on data from 2014 to 2016. It was the first generic credit score to incorporate trended datain other words, how consumers manage their accounts over time.

FICO® is an older company, and it was one of the first to create credit scoring models based on consumer credit reports. It creates different versions of its scoring models to be used with each credit bureau’s data, although recent versions share a common name, such as FICO® Score 8. There are two commonly used types of consumer FICO® Scores:

- Base FICO® Scores: These scores are created for any type of lender to use, as they aim to predict the likelihood that a consumer will fall behind on any type of credit obligation. Base FICO® Scores range from 300 to 850.

- Industry-specific FICO® Scores: FICO® creates auto scores and bankcard scores specifically for auto lenders and card issuers. Industry scores aim to predict the likelihood that a consumer will fall behind on the specific type of account, and the scores range from 250 to 900.

Also Check: What Is Syncb Ntwk On Credit Report

Learn About Credit Score Ranges From Fico And Vantagescore And How They Classify Excellent Good Or Poor Credit Scores

By Allan Halcrow | American Express Freelance Contributor

7 Min Read | January 31, 2020 in

Figuring out what a credit score of 640 means isnt really as tough as cracking the Da Vinci Code. But by the time youve considered the various credit score scales , it can certainly feel that way.

Fortunately, you dont need to be the hero of the Da Vinci Code to make sense of your . Thats because the different scales are more similar than different, and the scales are divided into credit score ranges whose names are simple and easy to remember .

Although cracking the credit code wont help you save the world, knowing the credit score range where your score lands can help you understand how lenders may view you in terms of credit risk. That could help you plan various aspects of your life, including the likely success of credit card, loan and rental applications, and whether you can expect to be offered favorable interest rates. And if you dont like the implications of your credit score range, you can take actions that could change it.

The two most commonly used credit scoring models, FICO and VantageScore, both rank credit scores on a scale from 300 to 850 and divide the scale into five credit score ranges. The ranges differ somewhat between the two models, and also have different names. If youve heard of higher scores, its either based on old information or industry-specific scoring models.

- Superprime

- Subprime

Equifax Credit Score Rangesand Others

What’s A Good Credit Score By Age

Credit scores vary widely by age. Typically, the younger an individual is, the lower their credit score is expected to be. For a college student, having a credit score above 680 can be considered good. However, by the time an individual is in his late 40s, that same score isn’t quite as good when compared to others in their cohort. This is due to the nature of how a credit score is calculated. Things like the average age of credit and diversity of credit accounts matter a great deal. The older one gets, the easier it is to build up those two factors. Generally speaking, the average credit score goes up with age.

A college student, however, may not require a credit score above 780, therefore a good credit score is something that changes with age. A fresh graduate is unlikely seek a mortgage, where a credit score of 640 would mean high interest rates. Therefore, its typically good enough for individuals in that age group to have a score between 640 and 680.

Recent college graduates are ahead of the curve if they have any credit score at all. According to data by the Consumer Financial Protection Bureau, over 30% of those between 20 and 24 years of age have no credit score. These individuals are referred to as “credit invisible”.

Don’t Miss: Does Afterpay Affect Credit

Fico 8 Vs 9 Explained

FICO periodically releases different versions of its scoring model. Right now, we are on FICO version 9. However, this does not mean that all lenders are using the latest model. In fact, most are still working off FICO 8 and will be for some time. Many still use older FICO scores or custom scores depending on the industry. This is because, in some industries, certain credit criteria might be more relevant.

The most common FICO models can vary greatly by industry. Mortgage lenders are still using FICO versions 2, 5, and 4 according to the official MyFICO page. Car lenders often use these FICO versions too. However, the most common version is still FICO 8. The main differences between FICO 8 and FICO 9 are that:

- Third-party collections that have been paid off no longer have a negative impact.

- Medical collections are treated differently than other types of debt. Unpaid medical collections will have less of a negative impact on FICO 9.

- Rental history, when its reported, factors into the score. This may be especially beneficial for people with a limited credit history.

Better Car Insurance Rates

Add auto insurers to the list of companies that will use a bad credit score against you. Insurance companies use information from your credit report and insurance history to develop your insurance risk score, so they often penalize people who have low credit scores with higher insurance premiums. With a good credit score, youll typically pay less for insurance than similar applicants with lower credit scores.

Recommended Reading: What Is Syncb Ntwk On Credit Report

What Is A Good Credit Score For A Mortgage

Your credit score arguably matters more on a mortgage application than with any other type of personal financing. With a mortgage, a good credit score might save you thousands of dollars in interest every year.

For example, say you have a FICO credit score around 640 when you apply for a $350,000 mortgage. FICOs Loan Savings Calculator estimated that in June 2020, your APR would be around 3.957% on a 30-year, fixed-rate loan. Your monthly payment would be $1,662, and youd pay $248,424 in interest over the life of your loan.

Now, imagine you work to improve your FICO Score to 680. With the higher score, you might qualify for an APR of 3.313%. Based on the lower rate, your monthly payment would be $1,535 for the same home. You would pay $202,726 in interest over your 30-year loan term. Because you improved your credit score from fair to good, you would save:

- $127 per month

- $1,524 per year

- $45,698 over the life of the loan

If youre aiming to qualify for a mortgage lenders lowest rates, that generally falls under a FICO Score of 760 or higher. Of course, getting a great mortgage rate requires more than just a brag-worthy credit score. But the three-digit numbers sold alongside your credit reports are a key factor that mortgage lenders consider when you apply for financing.

Read More:How Your Credit Score Affects Your Mortgage Rates