Impact Of Identity Theft On Your Credit Report

Identity theft occurs when someone steals your personal information and uses it to apply for new lines of credit. If these new accounts go into default, they will appear on your credit report and hurt your score.

Cleaning up your credit after identity theft can take anywhere from a day to several months or even years. The longer it takes you to realize someone stole your identity, the more difficult it will be to undo the damage. Monitoring your credit report will help you to stay on top of potential fraudulent charges.

How To Remove Medical Debt Collections From Credit Report

I am going to show you exactly what you need to do to audit your credit and remove a medical debt collection account from your credit report. First, you need to get a copy of your report here You want to go to the bottom of the credit report where it says Collections Accounts. Look over each account and find out if the Negative Account has reported to any of the three major credit bureaus, Equifax, Experian or Transunion.

My first and most important words of advice DO NOT PAY THE DEBT COLLECTOR until you have read the steps below or scheduled a free credit consultation with us! My second words of advice You should never dispute your credit online You can read about that too, but you want to do everything in writing, you dont want to risk making any mistakes.

Can You Dispute A Collection With The Credit Bureaus

You can absolutely dispute a collection if you think its erroneous. Formal disputes must be filed individually with each credit bureau and can usually be done online through each credit bureaus website. You should also dispute the information with the company that provided the information.

can help you dispute errors on your TransUnion® credit report. We can also help you file a dispute with Equifax directly if you see an error on your Equifax® credit report.

You May Like: Who Is Syncb/ppc

Send Letters To The Credit Bureaus

If the debt really is too old to be reported, its time to write to the credit bureau to request its removal. When you dispute an old debt, the bureau will open an investigation and ask the creditor reporting it to verify the debt. If it cant, the debt has to come off your report.

The Fair Credit Reporting Act requires credit bureaus to correct or delete any information that cant be verified or that is incorrect or incomplete, typically within 30 days. Otherwise, they are in violation and you are within your rights to file a lawsuit, as well as file a complaint with the Consumer Financial Protection Bureau.

Make sure to craft a case so strong that the creditor will have to acknowledge that its correct or present tangible evidence to the contrary. Include copies of anything that supports your claim, such as copies of court filings that show the correct date for a judgment or bankruptcy or a letter from your original creditor showing when the account became delinquent.

If a collection agency is reporting an account as a different debt, include any paperwork showing that the two accounts are really the same debt.

Send this letter certified with a return receipt requested so that you can prove when it was sent and that it was received.

Why this is important: If you can prove that the debt is older than legally allowed to show on your credit report, the bureau can remove it.

How To Keep Your Score Moving Upwards

Image Source: http://bit.ly/2kuIQKn

Once Marion got all the collections accounts paid, resolved and removed from his report, his score stalled out in the high 600s.

He learned from several credit score websites including Credit Sesame he would have to attack some of the other factors that affected his credit score.

You can find these on your own , along with actions you can take to improve.

The best news is that after several months of charges and on-time payments, Discover Card raised my limit and returned my security deposit which has improved my credit usage, raising my score even more.

Also Check: Credit Score 766 Means

Have A Professional Remove Collections From Your Credit Report

If this all seems like too much for you to handle, and you are worried about trying to take on a collection agency on your own, theres an entire industry devoted to credit repair that is ready to help you.

A professional credit repair company like Lexington Law could help restore your credit usually within three or four months.

They wont take any action you couldnt take yourself. Since credit repair is all they do, itll work faster and more efficiently.

You would need to budget some money for the monthly payments, which average about $100 depending on the plan you choose.

Theres also a one-time set-up fee for most .

But if you want to get your personal finances back on track without spending your free time on the phone or writing letters, you should consider this kind of service provider.

Debt collections come in many forms.

Whether its an unpaid medical bill, a cell phone bill, or even an $18 library book you never returned, unpaid debt can lead to negative information on your credit report.

It looks especially bad when the negative item comes from a collection agency.

Collections accounts tell other creditors you let an old debt go three or maybe even six months without paying.

When you apply for new credit, lenders know your old lenders lost money on your accounts.

So a collection account will have a negative impact on your ability to apply for new credit whether its a mortgage, a major credit card, or a personal loan.

Dispute When Collectors Sell

Collection accounts often change hands. Debts are assigned and sold to other collectors, so theres a strong possibility the collection agency listed on your credit report isnt the agency that’s currently collecting on the debt. When this happens, you can have the older collection removed by disputing it with the credit bureaus. If the debt collector fails to respond to the dispute, the credit bureau should remove the account since it has not been verified.

You May Like: How Do I Unlock My Experian Credit Report

Should You Hire A Credit Repair Company

Trying to repair your credit on your own can be challenging and time-consuming. It often involves piles of paperwork, letters and phone calls. Thats what makes credit repair companies who promise to repair your credit for a fee so appealing. But keep in mind, a credit repair company cant do anything that you can’t do on your own.

Unfortunately, are somewhat common. If you do decide to outsource the work to a credit repair company, the FTC recommends avoiding companies that:

- Insist you pay them before they do any work on your behalf

- Tell you not to contact the credit reporting companies directly

- Tell you to dispute accurate information on your credit report

- Tell you to provide false information on applications for credit cards or loans

- Dont explain your legal rights when telling you what they can do for you

The Medical Debt Collector Is Reporting On My Credit

If the Medical Debt Collector is reporting negative information on your credit , write down the name of the Debt Collector and the name of the original creditor or medical center. Write down the original balance and the current balance . Go to the part of the report that says inquiries. If you see any Inquiries from any Debt Collectors, write it down. All this information is important and will be used to help get this account deleted from your credit report. *When we work with clients, we collect this same information for our Fair Credit Reporting Act Attorney to review. He finds all the violations and forces the Debt Collector to remove the account and pay a settlement to YOU!

Read Also: Does Speedy Cash Report To Credit Bureaus

There Is No Medical Collection On My Credit Report

You dont see any Medical Debt Collection on the report? Good. But, we dont stop there. Have you been receiving Phone Calls from any of those pesky debt collectors? How about letters? Yes? Great! Here is what you do. Save ALL voicemails and letters. Take screenshots from your cell phone or pictures of your caller ID each time they call. Do they have an automated system calling you? Great! Write that down too, its a MAJOR violation.

Gather as much information as possible, we can use this evidence against them to and negotiate with the collector to remove the account from your Credit Report. Debt Collectors have to follow specific laws and procedures for every phone call they make and letter they send. Debt Collectors usually dont follow the rules. Did you know, its illegal for a Debtor to call you at work, on a cell phone, after 8pm, or on Sundays!!?? The list goes on. They have to recite a paragraph before they are allowed to speak to you. So, like I said, hold onto all evidence! You might not think its evidence, but it is.

Remove Collection Account Without Hurting Your Credit Score

Categories

Your credit score is your key to loans and low-interest rates. If your score is too low, youll end up paying more for a loan than you need to or even be denied credit altogether. Your credit score is determined by a combination of factors, including how often you pay your bills on time, how much credit you have at your disposal, how much of that credit you are currently using, and how many recent inquiries there have been about your credit history.

A single incident, like an errant collections account, can do damage to your score without you even being aware of it. Unfortunately, this happens all too often as it is very easy to simply ignore or forget about issues with your credit. Perhaps you closed a credit card account that still had a couple of charges pending or maybe you had a medical procedure that wasnt covered under your health plan and are unable to pay for it. Collection accounts are a reality for a lot of individuals. What matters is how you deal with them, and thats what sets the responsible consumers apart from the others.

Don’t Miss: When Does Opensky Report To Credit

Is It Legal For A Debt Collector To Harass You

No! According to the Fair Debt Collection Practices Act, a debt collector may not engage in any conduct the natural consequence of which is to harass, oppress, or abuse any person in connection with the collection of a debt.

If youve been receiving threats or repeated, annoying phone calls, we recommend consulting with a legal professional before proceeding with a debt payment plan. You can also report any problems you have with a debt collector to your state Attorney Generals office, the Federal Trade Commission and the Consumer Financial Protection Bureau. If your state has debt collection laws that differ from the Fair Debt Collection Practices Act, your Attorney Generals office can let you know exactly how they differ.

Hire A Credit Repair Service

A reputable company like may be a viable solution if your report is riddled with inaccuracies that further complicate the repair process. can help you with the following items:

- Cleaning up credit report errors

- Disputing inaccurate negative entries

- Handling creditor negotiations

If you decide to hire a credit repair service, know that laws govern how they operate and what they can do. The establishes the following regulations governing credit repair services:

- They cannot provide false or misleading information concerning a persons credit status and identification

- They must provide a detailed description of the service

- They cannot receive payment for the performance of any service until said service has been entirely performed

- There must be a written contract detailing the services to be performed, the time frame during which these services will be performed, and the total cost for those services

- They cannot promise to remove accurate information from a credit report before the term set by law

- The consumer will have three days in which to review the contract and cancel without penalty

You May Like: Does Paypal Report To Credit Bureaus

How Long Do Late Payments Stay On Your Credit Report

Late payments remain on your credit report for seven years. However, contrary to popular belief, you do NOT have to wait up to seven years before being able to get a mortgage, car loan, or any other type of credit again.

Your credit score will steadily rise as time goes on. Even better is that there are several ways to get the late payment permanently deleted.

Keep reading to find out how you can get a late payment removed from your credit reports.

Do Medical Bills Appear On Credit Reports

Medical bills usually only show up on your credit reports if theyre sent to collections.

As long as you pay your doctors bill or hospital bill on time, it shouldnt be reported to the credit bureaus. But if you miss the due date, and youre significantly late, the medical office might turn your debt over to a collections agency.

Experian, one of the three major consumer credit bureaus, notes that while each healthcare provider has its own practices, its typical for providers to wait 90 days before sending medical debt to collections. Some might even wait 180 days.

Regardless of when your unpaid bills are turned over to a collections agency, the three major consumer credit bureaus give you a six-month grace period. That means unpaid medical bills wont show up in your credit history until youre at least 180 days late. So, theoretically, even after your past-due medical bills are sent to collections, with the 180-day rule you might be able to pay them before they show up on your credit reports.

Don’t Miss: Does Paypal Credit Report To Credit Bureaus

When Negative Information Comes Off Your Credit Reports

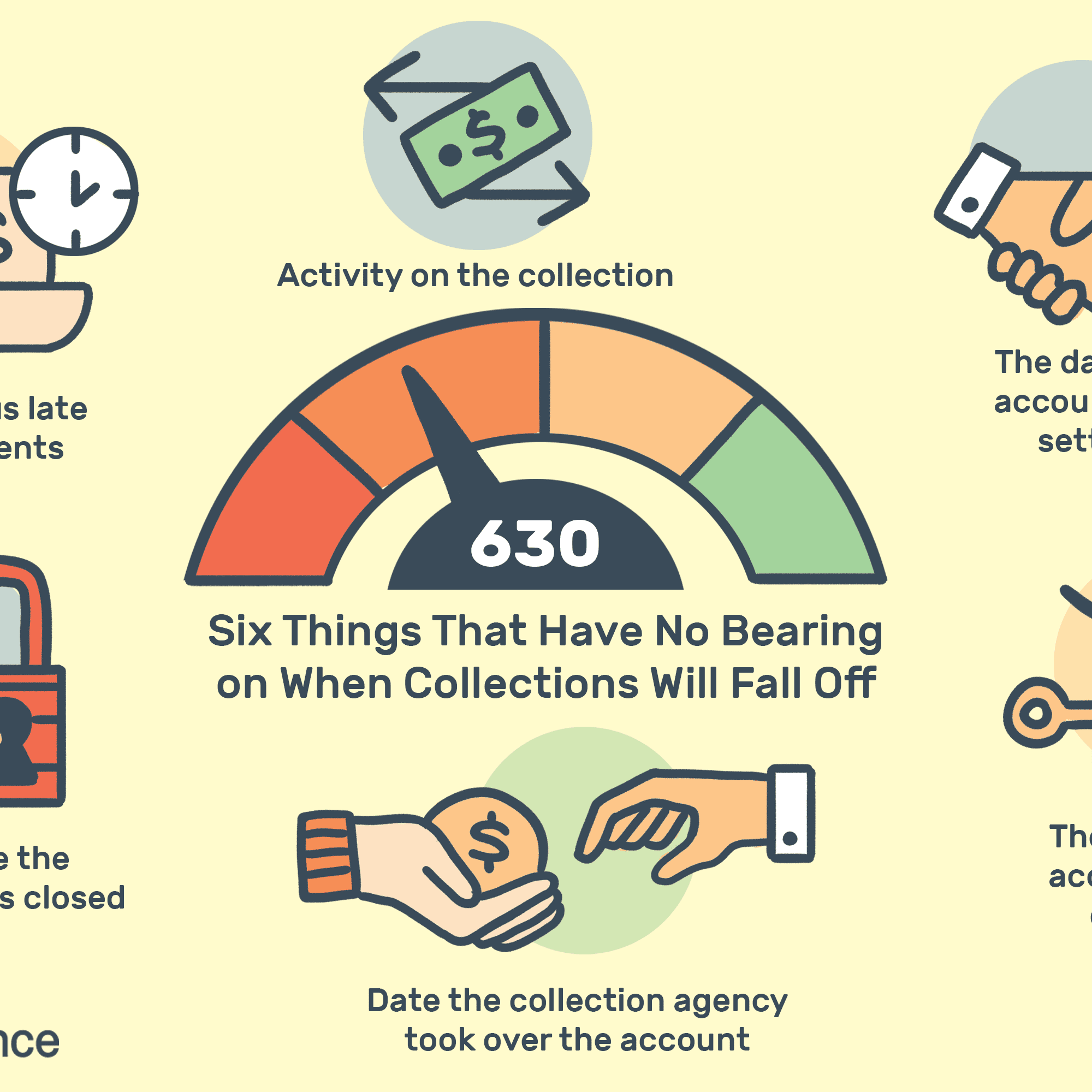

Delinquent accounts may be reported for seven years after the date of the last scheduled payment before the account became delinquent. Accounts sent to collection , accounts charged off, or any other similar action may be reported from the date of the last activity on the account for up to seven years plus 180 days after the delinquency that led to the collection activity or charge-off.

What Is a Tradeline?

Negative Credit Report Entries That Impact Your Score The Most

Accurate items will stay on the credit report for a determined period. Fortunately, their impact will also diminish over time, even if they are still listed on the report. For example, a collection from a few years ago will bear less weight than a recently-reported collection. If no new negative items are added to the report, your credit score can still slowly improve.

Read Also: Syncb/ppc Credit Card

How Many Days Late Before It Is Reported To The Credit Bureau

Others may wait until you close your account to report them. Once you are 90 days late or more, it affects your credit even more.

At this point, it can be turned into a charge-off if the creditor decides to sell the outstanding balance to a collection agency. However, even if you are already 90-plus days late on a payment, its still a good idea to pay to avoid additional harm in the form of a charge-off, collection, or repossession.

No matter how much you owe, delinquent accounts have the same effect. To the credit reporting agencies, a late payment of $50 is just as bad as one of $5,000. Knowing this, if you have to choose which bills to pay first, it may be wise to pay the less expensive ones first.

Confirm The Age Of Sold

One point that confuses even the experts: No matter how many times a debt is sold , the date that counts for the seven-year credit report clock is the date of delinquency with the original creditor.

If a collection agency bought your 10-year-old retail card debt and has started putting it on your credit report with a different date, thats a no-no.

Why this is important: Again, its the original date of when the debt was incurred that determines when it falls off your credit report. You want that to be as accurate as possible.

Who this affects most: Those with older debts are more likely to have their debts sold to a collection agency.

Don’t Miss: Syncb Amazon Credit Inquiry

This Man Removed 12 Collections Accounts On His Own And His Credit Score Improved By 169 Points

Editors Note: This is the personal story of one consumer . You should know that:

- Debt settlement sometimes causes a tax liability. The IRS considers forgiven debt taxable income. Depending on the type and amount of debt forgiven, and whether and how it is reported to the IRS, you could be liable for additional federal taxes.

- The credit bureaus are under no obligation to remove an account from your credit report before it legally ages off, including paid collection accounts, and in fact may refuse to remove a collection account from your file even if the creditor agrees to request removal. Paid collection accounts do not hurt your score in the newest FICO® scoring model.

If youve heard you have to wait seven years for a collection account to fall off your credit report, take notes while reading this heroic story about a guy who conquered 12 collections and emerged victoriously with a dramatically higher credit score after a very short amount of time.

While that may seem far-fetched, Credit Sesame member Larry Marion, owner of Rogue Wave Media in Chicago, Ill., learned that its doable by anyone.