Find Out What People Businesses And Entities Can Get Your Credit Report

By , Attorney

There are quite a few businesses and entities, beyond the usual credit card issuers and other lenders, who are allowed to order your credit report.

The federal Fair Credit Reporting Act and state credit reporting laws restrict who can access your credit report and how it can be used. According to the FRCA, the following people and entities can request your credit report:

These people and businesses can review your report when you apply for credit or to monitor your credit once they have given you a loan or credit. There are some restrictions. For example, for a new transaction, you must have made an offer or otherwise initiated a credit transaction before the creditor can look at your report.

Mortgage lenders. If you’re seeking to borrow $150,000 or more, mortgage lenders can see some informationin particular, older informationthat wouldn’t be provided to other creditors.

Landlords. Landlords might get a report from a specialty consumer reporting agency that tracks rental histories, including evictions.

Utility companies. However, there are often state rules that prevent utility companies from denying you service in many circumstances, even if you have bad credit. To learn about programs and laws that can help you avoid utility disconnections, see this article on preventing a utility shut-off.

Car insurance companies. These companies often use credit information to help determine how much to charge when offering a new policy.

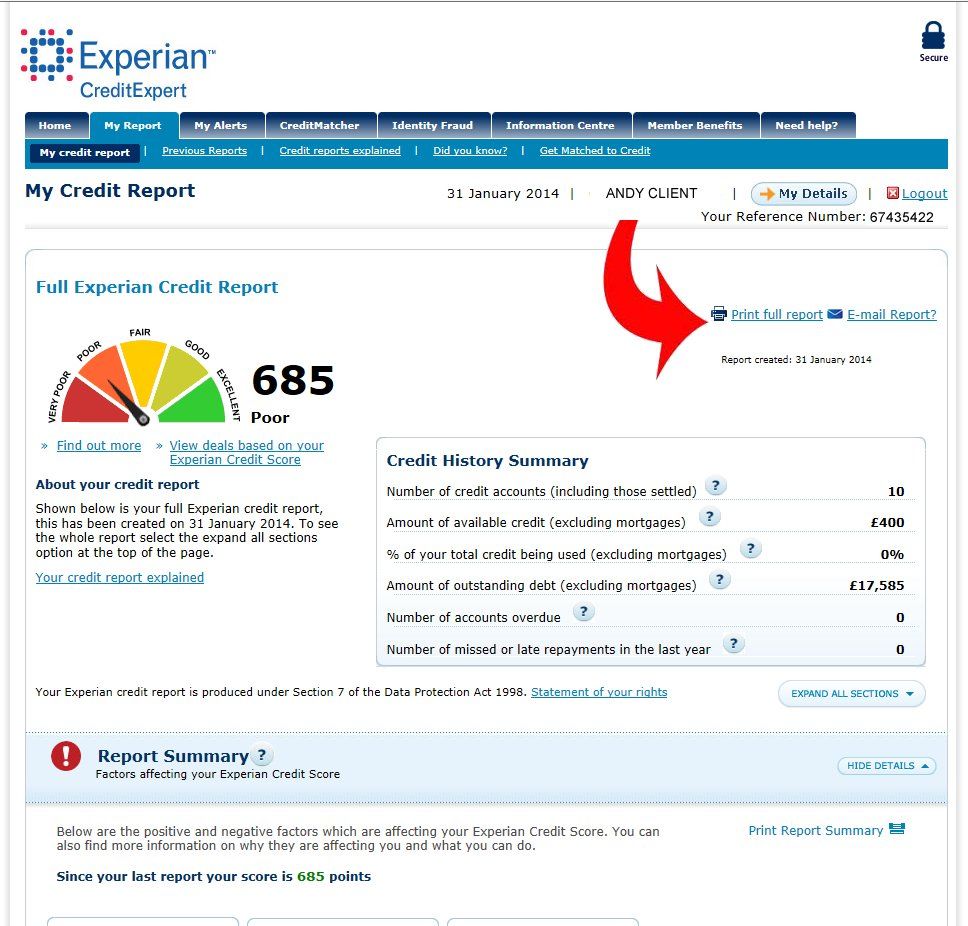

How Do I Check My Credit Score

CIBC clients can check their credit score using the CIBC Free Credit Score Service in the CIBC Mobile Banking® App.

You can also contact one of Canada’s credit bureaus to receive a copy of your credit report by mail, free of charge. For a fee, you can view your credit report online.

For more information, contact one of the credit bureaus directly at:

- Equifax Canada: ;www.equifax.ca

I Can See My Account Listed On The Equifax Credit Report But It Doesnt Seem Like Its In A Deferred Status Now What

Don’t Miss: How To Get Credit Report Without Social Security Number

Request Your Free Medical History Report

You have the right to get one free copy of your medical history report, also known as your MIB consumer file, each year. You can request a copy for:

- Yourself

- Someone else, as a legal guardian

- Someone else, as an agent under power of attorney

You can request a medical history report online from MIB or by phone at 1-866-692-6901.

Not everyone has a medical history report. Even if you currently have an insurance plan, you won’t have a report if:

- You haven’t applied for insurance within the last seven years

- Your insurance policy is through a group or employer policy

- The insurance company isnt a member of MIB

- You didnt give an insurer permission to submit your medical reports to MIB

Contact The Credit Bureaus

Both Equifax Canada and TransUnion Canada have forms for correcting errors and updating information. Fill out the form to correct errors:

Before the credit bureau can change the information on your credit report, it will need to investigate your claim. It will check your claim with the lender that reported the information.

If the lender agrees there is an error, the credit bureau will update your credit report.

If the lender confirms that the information is correct, the credit bureau will leave your report unchanged.

In some provinces, the credit bureau is required to send a revised copy of your credit report to anyone who recently requested it.

Also Check: Zzounds Financing Review

Add A Consumer Statement

If the credit bureau confirms the information is accurate but you’re still not satisfied, submit a brief statement to your credit report explaining your position. It’s free to add a consumer statement to your credit report. TransUnion lets you add a statement of up to 100 words, or 200 words in Saskatchewan. Equifax lets you add a statement of up to 400 characters to your credit report.

Lenders and others who review your credit report may consider your consumer statement when they make their decisions.

How Do Credit Bureaus Collect Their Information

Credit bureaus rely on creditors and lenders for the information they need, not every single creditor reports to both credit bureaus if they report to them at all, which can cause a discrepancy between your reports from Equifax and TransUnion. Part of the data that is sent to credit bureaus from creditors is your accounts status and payment history, both of these factors contribute to your credit score.

How long does information stay on your credit report? Find out here.

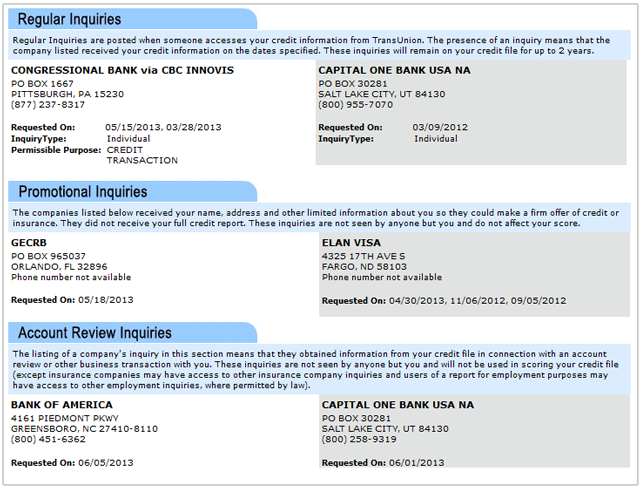

Other information that credit bureaus collect is your personal information, such as your legal name and address, credit account information, inquiry statistics, public records, and collections information. Lenders are interested in how youve handled debt in the past, although, they also consider additional details which is why credit bureaus gather extensive data.

You May Like: Innovis Consumer Assistance Letter

How Does Information Get On My Credit Report And Is It Updated On A Regular Basis

When you have an account with a lender, theyll typically submit account updates to at least one of the three major credit reporting agencies TransUnion, Equifax and Experian. Since lenders dont always report to all three agencies, the information on your credit reports may vary.

Its also important to note that lenders report at different times of the month, so you might see slight differences in your reports, and therefore your credit scores, at any given time.

What Information Do I Have To Give

To keep your account and information secure, the credit bureaus have a process to verify your identity. Be prepared to give your name, address, Social Security number, and date of birth. If youve moved in the last two years, you may have to give your previous address. Theyll ask you some questions that only you would know, like the amount of your monthly mortgage payment. You must answer these questions for each credit bureau, even if youre asking for your credit reports from each credit bureau at the same time. Each credit bureau may ask you for different information because the information each has in your file may come from different sources.

Read Also: How To Get Credit Report Without Social Security Number

What Do Employers See When Checking Your Credit

“They see largely what a lender sees, except for your credit score,” Ulzheimer says.

Since a lot of the credit report data that lenders and employers see is the same, employers have access to a comprehensive background report that includes, in addition to your credit history, your past employment, insurance and legal activity.

Though prospective employers don’t see your credit score in a credit check, they do see your open lines of credit , outstanding balances, auto or student loans, foreclosures, late or missed payments, any bankruptcies and collection accounts.

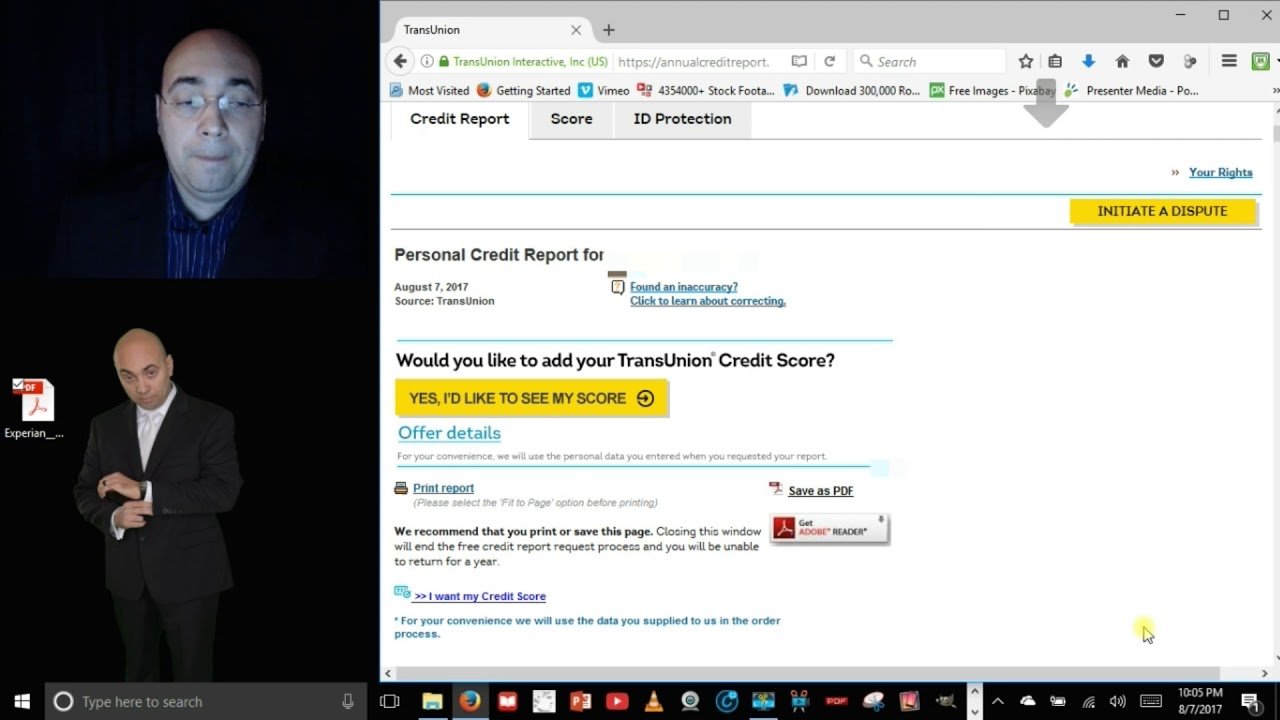

When Will My Report Arrive

Depending on how you ordered it, you can get it right away or within 15 days.

- Online at AnnualCreditReport.com youll get access immediately.

- using the Annual Credit Report Request Form; itll be processed and mailed to you within 15 days of receipt of your request.

It may take longer to get your report if the credit bureau needs more information to verify your identity.

Read Also: Is 524 A Good Credit Score

What Should I Do When I Get My Credit Report

Your credit report has a lot of information. Check to see if the information is correct. Is it your name and address?; Do you recognize the accounts listed?

If there is wrong information in your report, try to fix it. You can write to the credit reporting company. Ask them to change the information that is wrong. You might need to send proof that the information is wrong for example, a copy of a bill that shows the correct information. The credit reporting company must check it out and write back to you.;

Who Looks At Your Credit Report

When you apply for credit, youll usually be expected to give your permission to the credit provider to check your credit report.

The term credit provider doesnt only include banks and credit card companies. It also includes mail-order companies and, for example, providers of mobile phone services if you have a phone contract .

Employers and landlords can also check your credit report. However, theyll usually only see public record information such as:

- electoral register information

- County Court Judgements .

Don’t Miss: Aargon Agency Settlement

Want To Feel More In Control Of Your Finances

Our free and flexible Couch to Financial Fitness plan will help you build confidence to manage your money.

Step by step we can help you cut your spending, develop core saving muscles, and create better habits for the future.

In the UK, companies called credit reference agencies compile information on how well you manage credit and make your payments.

The three main CRAs are:

How To Review Your Credit Reports

To check your reports for errors or possible signs of identity theft, look especially at three areas.

You can view sample credit reports, with the different sections explained, on the Web sites of the three credit bureaus: experian.com, transunion.com, equifax.com/home/en_us.

Don’t Miss: Does Paypal Credit Report To Credit Bureaus

How Do You Check Your Credit Report

On AnnualCreditReport.com you are entitled to a free annual credit report from each of the three credit reporting agencies. These agencies include Equifax, Experian, and TransUnion.

Due to the COVID-19 pandemic, many people are experiencing financial hardships. To remain in control of your finances, you can get free credit reports every week through April 2022.

Request all three reports at once or one at a time. Learn about other situations when you can request a free credit report.;

Request Your Free Credit Report:;

By Mail: Complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request Service

PO Box 105281

Atlanta, GA 30348-5281

If Your Request for a Free Credit Report is Denied:;

Contact the CRA directly to try to resolve the issue. The CRA should tell you the reason they denied your request and explain what to do next. Often, you will only need to provide information that was missing or incorrect on your application for a free credit report.

If you can’t resolve your dispute with the CRA, contact the Consumer Financial Protection Bureau .

Have Other Questions About Your Credit Report

The myFICO Blog has a wealth of information regarding credit reports and scores you can access. You can also learn how to improve your credit score, how to be a responsible credit card holder, and more right here on our blog.

This information is presented for educational purposes only. It is not intended as, nor should it be construed to be, legal, financial or other professional advice. Please consult with your attorney or financial advisor to discuss any legal or financial issues involved with credit decisions.

Read Also: How To Get Credit Report Without Social Security Number

Get Your Credit Score And Report For Free

If you’ve ever applied for credit or a loan, there will be a credit report about you.

You have a right to get a copy of your credit report for free every 3 months. It’s worth getting a copy at least once a year.

Your credit report also includes a credit rating. This is the ‘band’ your credit score sits in .

Usually, you can access your report online within a day or two. Or you could have to wait up to 10 days to get your report by email or mail.

Contact these credit reporting agencies for your free credit report:

Since different agencies can hold different information, you may have a credit report with more than one agency.

Some credit reporting agencies may provide your credit score for free check with them directly.

Alternatively, you can get your credit score for free from an online credit score provider, such as , Finder or Canstar. This usually only takes a few minutes.

Typically, you agree to their privacy policy when you sign up, which lets them use your personal information for marketing. You can opt out of this after you sign up.

Avoid any provider that asks you to pay or give them your credit card details.

How Do You Lock Your Credit At Each Bureau

Unlike a credit freeze, which you can add and remove from your account as needed, a credit lock requires you to enroll in a program. To make a credit lock most effective, enroll in the programs at all three of the major consumer credit bureaus Equifax, Experian and TransUnion.

Locking your credit costs nothing at Equifax and TransUnion if you enroll in their separate locking programs, but if you choose to use their joint program that locks both at once and also includes theres a fee. Theres no free option from Experian, but its credit lock program also comes with additional features like credit monitoring that may make the cost worth it to you.

To enroll in a credit locking program, youll fill out an online form that requires personal information like your name, address and Social Security number, and then youll answer some identity-verification questions.

Heres how each bureaus credit locking program works and how to enroll.

Recommended Reading: Cbcinnovis On My Credit Report

Does An Employer Credit Check Hurt Your Credit Score

Your credit score won’t be affected by a potential employer conducting a credit check on you.

“An employment inquiry is treated like a soft inquiry,” Ulzheimer says. “Not visible to other parties and not considered in credit scoring systems.”

According to the 2018 HR.com report, employers typically assess applicants based on their long-term credit history four to seven years overall; unlike lenders. That means if there is a big discrepancy from a few years ago, an employer may still ask you about it even if your most recent credit history is healthy.

Do I Have To Give Them My Permission First

Anytime you apply for an account, such as a credit card, loan, apartment or utility service, your application itself grants permission for the business you are applying with to access your credit report as part of their approval process. Your express permission is not required in every instance.

When applying for a home or car loan, for example, a financing professional at the business you’re working with may send your application to several different lenders in an attempt to find you the lowest rate and best terms. Each of these lenders will appear on your credit report as a separate inquiry, but you don’t need to give specific permission to each one.

And, as long as they occurred within a certain time period most credit scoring models will count these inquiries as oneminimizing the damage they’ll do to your credit.

Lenders you already do business with can also access your credit reports periodically without your express permission as part of their account review or account monitoring process, but their inquiries have no impact on credit scores.

In most cases, a notice that your credit history will be accessed usually is provided with credit applications, often indicating that by signing the application you are giving the lender permission to access your credit history.

In fact, the only time explicit, written permission is required is when your credit is checked for employment purposes.

Also Check: Does Paypal Working Capital Report To Credit Bureaus

What Lenders Look At On Your Credit Report

What do lenders consider when they look at your ? It’s a simple question with a complicated answer, as there are no universal standards by which every lender judges potential borrowers.

Of course, there are some items that will decrease your odds of approval just about everywhere. Looking at what makes up your FICO;score is a good place to start. FICO scores range between 300 and 850, with anything 650 or above considered a good . If your score is below 620, you will probably find it difficult to borrow money at favorable interest rates.