Dealing With Credit Scores Can Be Challenging Because:

-

It often takes at least a year or two to establish or improve your business credit history or personal credit history

-

You can influence and improve your credit scores with effort, but you cannot directly change them since they are given to you by external rating agencies

-

Internal record keeping and monitoring small business credit scores can be time consuming

What Affects Your Business Credit Score

Just like personal credit scores, there are various factors which determine a business credit score. This score is generated by credit reporting agencies and is calculated using a number of parameters like the companys payment history.

These details typically consist of public financial data and information supplied by the company, its lenders, and other vendors. Some example variables considered in a business credit score include the company size, its level of credit utilization, any current outstanding debts, and the length of the companys credit history.

You can help improve your business credit score by providing accurate and up-to-date financial information. Its a good idea to routinely check your business credit report in order to identify any errors or inaccuracies. You should notify the relevant credit bureau if you spot anything that needs correcting.

Canadian Business Credit Score And Report

Join millions of Canadians who have already trusted Loans Canada

Most consumers in Canada are aware that they have a personal credit score and report. But did you know that business owners in Canada have a business credit score and report as well? If you are a business owner in Canada, its important for you to be aware of, and understand how your business credit can affect the success and growth of your company.

If youre an Indigenous business owner or entrepreneur, be sure to read this.

You May Like: What If My Credit Score Changes Before Closing

Business Credit Score In Action

What if Company A was considering taking on Company B as a client and wanted to know the likelihood that Company B would pay its invoices in full and on time? No business wants to do hours and hours of work for a client, then not get paid. Company A could check Company Bs business credit score first, then agree to do business only if Company Bs credit score showed that it had a strong history of paying its suppliers. Company A could even purchase a subscription service to monitor Company Bs credit score on an ongoing basis. If the score dropped significantly, Company A could lower its risk by discontinuing business with Company B or requiring payment in advance.

Similarly, Company C, a wholesale supplier, might want to check the business credit score of Company D, a manufacturer, before shipping out a truckload of goods with an invoice granting Company D 30 days to pay. If Company D has a high credit score, this arrangement would seem low-risk, but if it has a low credit score, Company C may want to ask for payment up front, before shipping any goods.

Three Key Reasons To Check Your Business Credit Score

The use of the traditional business credit scores is so commonplace that many people dont stop to question how effectively they identify a companys true credit risk. While traditional business credit reports contain valuable information, they suffer from several shortcomings. Heres how a Tillful Score can help:

Know what lenders look for: While every lender is a little different, our credit model can help you determine whether you will qualify for a credit product before you apply.

Know what is behind your number: We share the top factors that impact your score. You can focus your efforts where it counts and tape immediate steps to improve your credit profile.

Build strong credit and financial health: With our alternative credit scoring resource, you get unfettered access to your credit score any time, along with email notifications when your score changes.

Also Check: Does Paypal Working Capital Report To Credit Bureaus

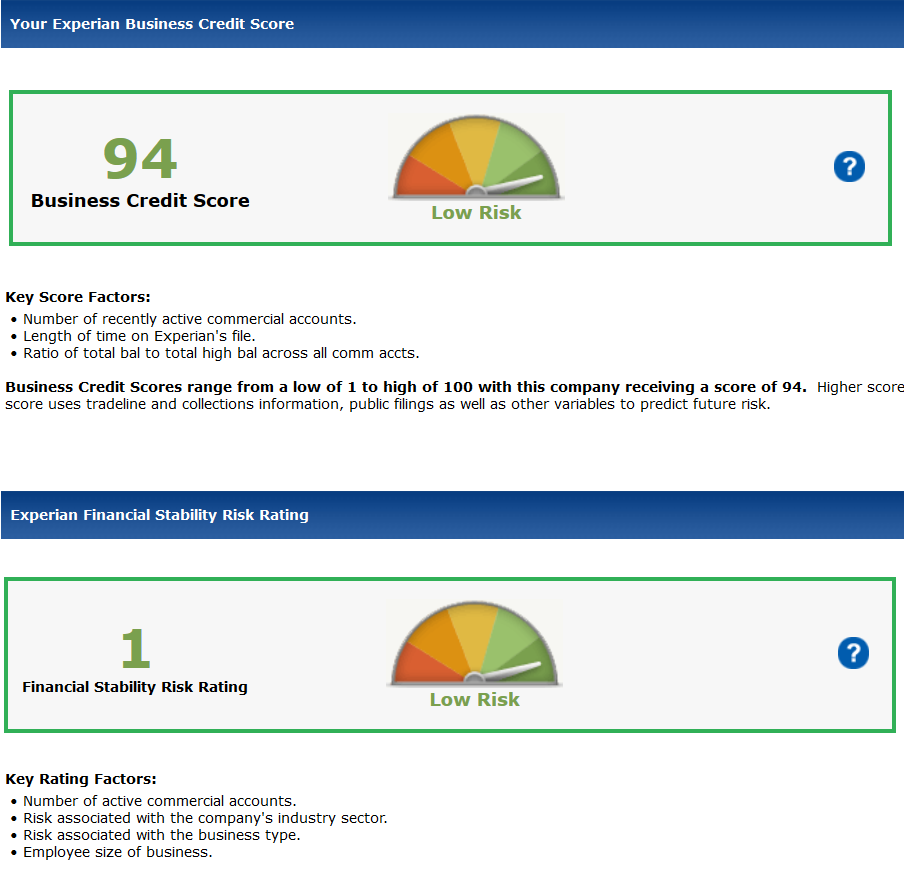

What Is An Experian Business Credit Score

The Experian business credit score calculates the risk of a business making payments in a delinquent manner or defaulting on them altogether. It is measured on a scale of 1 to 100, with a higher score representing a lower risk level. Banks and other lenders typically use this score.

Experian uses over 800 variables to determine this score. It collects data on both the business and its owner through legal filings, credit obligations with suppliers and lenders, and general business background information from independent sources. Those sources can include credit card companies and marketing databases.

Unlike some other credit reporting agencies, no self-reported business information is required to determine the Experian credit score. Instead, the credit bureau gathers all the relevant information itself to determine the business risk level based on its credit, public records and demographic data.

Is A Business Credit Score Necessary

Whether youre starting up or already running a business, you might have so much on your plate that establishing business credit may be low on your list of priorities and we cant blame you. We know youre swamped.

For many entrepreneurs, business credit isnt even on their radar until something happens, such as getting denied for insurance or small-business loans, says Gerri Detweiler, education director at Nav, a company that helps business owners track and manage their business credit.

They arent checking their business credit reports, so they dont know if they are accurate, and they arent monitoring them for negative events or identity theft, she explains.

But establishing business credit early on comes with a number of advantages.

- Good credit scores can enable you to take out business loans at lower rates, or qualify for lower insurance premiums.

- Establishing business credit can also enable you to take out business loans without signing a personal guarantee to be liable for any debts your business is unable to repay.

- Good business credit also makes your business look good. Creditors are not the only ones who might be interested in your business credit scores. Investors, insurance companies and potential business partners may also request to see your reports.

You May Like: Credit Score To Be Approved For Care Credit

What Happens To Your Credit When You Stop Being An Authorized User

Your credit will benefit by having an account on your credit report for several years because the age of your credit history is also a substantial credit reporting factor.

There may come a time when you will want to break free. In that case, apply for your own credit card or loan while that well-managed account still appears on your reports and works in your credit favor.

After you are removed or you remove yourself from the account, not only will you not have access to the credit card, but the issuer will no longer report that account to your credit files.

The age of your credit history may be shortened once youre removed from the account, which will take 30 to 45 days to appear on your reports. Two other credit scoring factors affected when you are no longer an authorized user are the types of credit in use, which is also a credit scoring consideration, and your if you have other credit cards with high balances and this card has no or a very low balance.

How To Dispute Errors On Your Business Credit Reports

As with your personal credit scores, its important to check your business credit scores regularly, as the credit bureaus can make mistakes or have incorrect information on your reports.

Your business could get mixed up with that of another, which could mean negative information from another business is mixed with yours, Detweiler says. Or information such as UCC filings could be affecting your business credit and you dont know it.

Contacting the credit bureaus directly is the best way to resolve this type of discrepancy. If youre able to prove that their information is incorrect, they will adjust the reports accordingly.

Also Check: Remove Repo From Credit

Dun & Bradstreet Business Credit Scores

Dun & Bradstreet measures a companys risk using a Paydex score, ranging from zero to 100. This number is based on payment data reported either to the bureau or to data-gathering companies that partner with the bureau. It, along with a “commercial credit score” and a “financial stress score,” helps lenders decide whether to extend credit to you and how much. Insurance companies also can use the score to set your premiums, and it can help landlords determine whether to take you on as a business tenant, according to Dun & Bradstreet.

To have a Paydex number, you have to file for a DUNS number through Dun & Bradstreets website, which is free, and the bureau must have records of your payments with at least four vendors.

To increase your Paydex score, Dun & Bradstreet recommends repaying debts on time or ahead of schedule, and encouraging suppliers and vendors to report positive payment history.

D& B credit reports

In a D& B credit report, youll see both your commercial credit score and financial stress score.

The commercial credit score predicts the likelihood of a delinquent payment on bills within the next year. The score ranges from 101 to 670, with a lower score representing a higher probability of a delinquency.

Heres what a Dun & Bradstreet business credit report looks like.

Reporting Agencies: Who Are They And How Do They Track Your Business Credit Score

Nearly all small business lending institutions rely on Dun & Bradstreet PAYDEX® scores as at least one of the tools they use to decide whether or not to grant credit. Your D& B PAYDEX® score is based on how quickly your business pays its bills, and collects lots of additional information beyond payment data.

Here is a link to a sample Dun & BradstreetBusiness Information Reportshowing PAYDEX®, D& B Rating, Composite Credit Appraisal and D& B Viability Rating. Dun & Bradstreet compiles a tremendous amount of information about every small business that has been issued a D-U-N-S® Number. They collect this information from public records, personal telephone interviews with the business itself, and with other companies who conduct business with the company being rated.

A Dun & Bradstreet report provides the following information in detail:

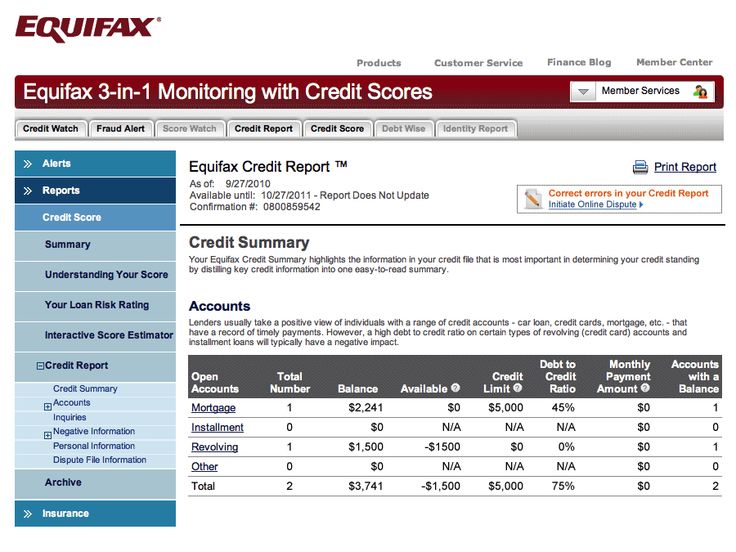

Lenders also use information from Equifax and Experian to make lending decisions. In these cases they are basing their decisions on composite scores from different sources.

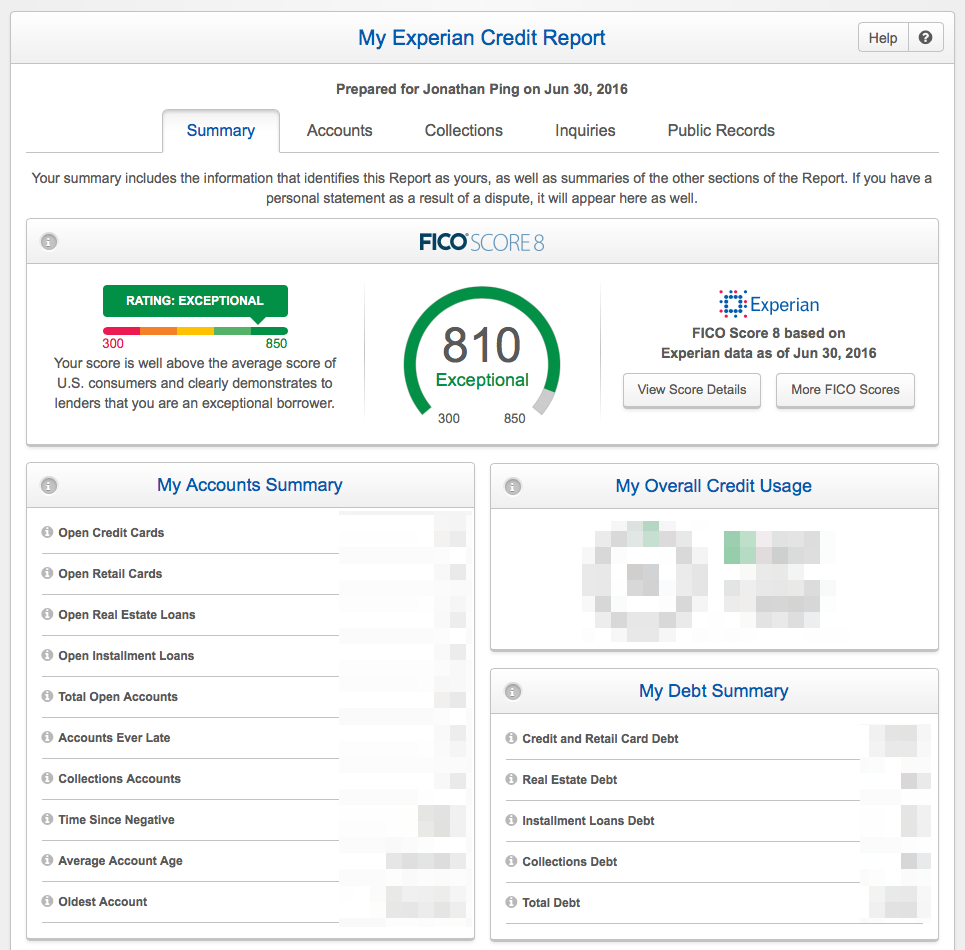

Although not nearly as extensive as D& B PAYDEX®, ExperiansIntelliscore PlusSM compiles a collection of both business and personal statistics to predict whether or not a business will default within the next 12 months. Once again, businesses do not want to be in the red zone when being considered for small business financing.

Read Also: Verizon Credit Collections

The Experian Business Credit Score Rating Scale Is As Follows

-

10076: Low risk of delinquent or defaulted payment

-

7551: Low to medium risk of delinquent or defaulted payments

-

5026: Medium risk of delinquent or defaulted payments

-

2511: Medium to high risk of delinquent or defaulted payments

-

101: High risk of delinquent or defaulted payments

An Experian business score of 76 or higher is generally considered to be good.

Dun & Bradstreet Paydex Score

The D& BPAYDEX Score ranges from 0 to 100, and a score of 80 is typically considered good.

On-time or early payments will have a positive impact on your score, while late payments will have a negative impact. Payments that are 31 to 90 days late will have a greater impact than payments that are 15 to 30 days late.

Use the graphic below to better understand the PAYDEX Score ranges.

To get a D& B PAYDEX Score, youll have to first sign up for a D-U-N-S Number on its website, allowing your suppliers and vendors to report your payment history to D& B. If they dont report your activity, you wont be able to build a PAYDEX credit score.

Recommended Reading: Does Klarna Improve Your Credit Score

Explore Borrowing Options Available From Pnc

Whether the flexibility of a Line of Credit will help you best prepare for the changing needs of your business, or you’re looking for a Term Loan to provide a specific amount of credit to purchase assets or meet specific financing need, PNC has a variety of borrowing options to meet your needs.

PNC is a registered mark of The PNC Financial Services Group, Inc.

How Do I Check My Business Credit Score

June 29, 2021 byGuest

Both businesses and individual consumers have credit scores that reflect how theyve historically used credit. Lenders and others use these scores to help determine creditworthiness and make decisions based on what they see. Business credit scores are based on different information than personal credit scores and use a different scoring system.

You May Like: Syncb Qvc

International Company Credit Scores And Reports Made Easy

Get instant access to credit reports and scores on companies in over 160 countries.

With Creditsafe, you can quickly and confidently verify any customer or supplier in the world, ensuring they are financially stable and trustworthy before entering into any business agreement.

Our database of more than 365 million international company credit reports is the largest globally, giving you exceptional coverage on business credit information about your existing and future customers and suppliers, wherever they are in the world.

All major credit insurers endorse our international company credit scores and limits to give you peace of mind when extending credit to your domestic and international customers.

Increasing Your Credit Score For An Existing Business

If youve been in a business for a few years and just recently found out that your business credit scores are low, you can take some steps to rectify this as well.

1. Check Your Credit Report

You cant fix bad credit without knowing what is on your credit report. You should purchase a copy of your businesss credit report from all three credit reporting agencies .

Review the information carefully and dispute any mistakes you see. It is not uncommon for credit reports to have some errors.

It can also help to submit any missing or outdated information. This can be done by contacting the individual agencies.

2. Make Early Payments

On-time payments are good, but early payments are even better.

Whatever you do, dont make late payments as they will reflect poorly on your scores and make it look like you are in financial distress.

3. Request Trade References

References can help. Ask a business associate to submit information to D& B about your financial status with them. This will increase your D& B PAYDEX score.

Considering a small business loan? Check out these guides:

Working Capital Loans | Inventory Loans | Grants vs. Loans

Just as your personal credit score can affect your personal financial stability, a business credit score reveals much about how well your business manages its money.

Keep in mind that there are some other factors a lender might take into consideration when deciding whether or not to extend you a loan:

- Net worth

Recommended Reading: 775 Credit Score Mortgage Rate

Whats A Business Credit Score

If youre familiar with personal credit scores, then youll recognize business credit scores as a similar concept.

As a quick refresh, your personal credit score is a three-digit number that helps lenders decide whether to offer you credit, and on what terms.

The way they see it, the higher your credit scores are, the higher your likelihood to pay off debt on time. This comes into play when applying for credit cards or loans, and is determined using information from your personal credit reports.

A business credit score performs the same function for your business as a personal score does for your own finances. Lenders and creditors look to minimize risk when giving out loans, so they look for information on whether a business is likely to repay the loan.

Business credit reporting agencies collect information on your businesss financial history and can use it to put together an assessment of your risk level for lenders this serves as your business credit score.

The higher your score, the likelier you appear to lenders to be able to repay your debts. And that means it might be easier for you to get approved for loans and qualify for lower insurance premiums.

How Private/public Are Business Credit Scores And Fico Scores

While personal credit scores are kept private for legal reasons, business credit scores and FICO scores are considered a matter of public record and are easily accessed by banks, auto dealers, realtors, suppliers and customers. Bad credit reports follow your business wherever you go and can definitely work against you and your ability to conduct business.

Don’t Miss: Paypal Credit Bureau

Can I Get A Late Payment Removed From My Credit Report

If you have a long history of on-time payments with your credit card company and you typically maintain a reasonably low balance, there is a chance you can get a reprieve. Under those circumstances, some creditors would certainly consider reversing the late fee if you ask. Reversing a late payment on your credit report may not be as easy, but it is worth trying. Here are three approaches you can take:

Also Check: Minimum Score For Care Credit

Where Can You Check Your Small Business Credit Scores For Free

Both personal and business credit scores are available from a number of online sources. However, you may have to pay for them. With personal credit scores, its a legal requirement for the credit bureaus to provide you with a copy of your credit report for free. However, there is no such requirement for business credit scores.

You can do an online search for free business credit report, but you may encounter some scams. There are some websites out there that will promise you a free report in order to get your personal information. Make sure that you only share your information with a reputable website or company. We recommend that you contact each of the rating agencies and Dun & Bradstreet directly. You can obtain a copy of your D& B report for free.

You May Like: Does Renting A Storage Unit Build Credit