Top Credit Card Recommendations For Canadians With Good Credit

Dont miss out on the benefits of having a good credit score. Credit cards with generous rewards or competitive perks will only be available to those with the best credit. So if your score is 650 or higher, consider upgrading to one of these premium cards or using our credit card filters to see what other cards you can get with good credit or excellent credit.

MBNA Rewards Mastercard

How To Improve Your 784 Credit Score

Knowing how to improve your credit score is a big deal. You want to ensure that your credit is the best out there so that you do not have a problem applying and being granted loans and lines of credit.

Here are some tips to help you maintain or even grow your 784 credit score a bit more than it currently is:

- Always make sure that youre making all of your monthly payments on time, every time.

- You should always pay off your debt as quickly as you can to ensure that you have a boost in your credit.

- Keep your credit utilization to 30% of the available credit that you have overall. This will ensure that you have the best credit utilization and that you are not using too much all at once.

- Dont move the debt around that you have, pay it off and it will move quicker and benefit the score even more.

- Dont keep opening up new accounts every month since this can negatively impact the score and having hard checks done can also bring the score down.

- Never open up new accounts just to increase the amount of available credit, always just use the ones you have.

- Dont own too many credit cards all at once, or other loans since this can become overwhelming and actually harm your credit more than do it any good.

- Keep a comfortable income coming in and budget for expenses going out so that your credit score can benefit from bills being paid.

How To Get A Good Credit Score

Good credit habits, practiced consistently, will build your score. Heres what you need to do:

-

Pay bills on time. This is important because payment history has the largest impact of all the factors in your score. A missed or late payment can do tremendous damage to a credit score and it can stay on your credit report for up to 7 years.

-

Try to keep your credit card balances well below your credit limits aim for, and lower is better. High utilization dings your score, but the damage will fade when you’re able to reduce your balances and the lower utilization shows up on your credit reports. You also may be able to lower utilization by getting a higher credit limit or becoming an authorized user on a lightly used card with a large limit.

-

Keep credit accounts open unless there is a compelling reason, such as high fees or poor service, to close them. Keeping older accounts open helps your average age of accounts, which has a small influence on your score. Also, closing an account cuts into your overall credit limit, driving up your credit utilization.

-

Avoid making several credit applications in a short time frame. Credit checks for the purpose of credit decisions can cause a small, temporary dip in your score, and several in a short time can add up.

-

Monitor your credit reports and dispute information you believe is incorrect or too old to be included .

Don’t Miss: What Is Syncb Ntwk On Credit Report

More Bargaining Power On Interest Rates

Are you aware of the fact that the interest rates vary for different loans at different banks? Some people end up getting a better deal than others. A higher CIBIL score enables you to bargain with banks for a better rate or deal. You can easily compare the offers from lenders and authoritatively negotiate as creditworthy customers are assets for any financial institution.

You Need A Mortgage Loan

You definitely dont need a mortgage loan to have good credit. However, if you want to max out your credit score, having a mortgage loan with good payment history is a must.

Since a mortgage loan is usually a relatively large loan and more difficult to get than other installment loans such as an auto loan, a mortgage shows creditors you have been responsible enough with your credit to get the mortgage in the first place.

Fair Isaac Corporation, which provides the FICO score, recommends you have a mix of different types of credit accounts. So along with credit cards and installment loans, a mortgage loan is the last piece of the pie to round off your credit mix.

I also want to note I didnt start seeing my credit score go up because of the mortgage loan until about a year later, so it definitely takes some time.

You obviously shouldnt take out a mortgage loan just to get a perfect credit score. But a mortgage loan is normally considered to be good debt, in that interest rates are relatively low and youre financing something that usually appreciates in value.

If you dont already have a mortgage, be sure to fix up your credit report before applying for a mortgage assuming youre ready for homeownership.

Read Also: Does Paypal Credit Report To Credit Bureaus

What Is A Good Vantagescore

FICO’s competitor, VantageScore produces a similar score using the same credit report data from the three bureaus.

A good VantageScore lies between 661 and 780, which the company calls a “prime” credit tier. VantageScores above 780 are considered “superprime” while those between 601 and 660 are “near prime.” VantageScores below 600 are considered “subprime.”

The average VantageScore 3.0 in July 2021 was 693.

Great Credit: The Door Opener

Having a high credit score can open many more doors in your financial world compared to having a low score. A good to excellent credit score proves that youve got a healthy track record of making timely bill payments and adequately managing your credit.

Consumers who have great credit scores are more attractive to lenders and credit card providers who will usually offer these borrowers prime lending terms. These can include lower interest rates, more flexibility with repayment schedules, and the opportunity to sign up for credit cards with great rewards.

to discover more surprising perks of having a good credit score.

Also Check: How To Get Credit Report With Itin Number

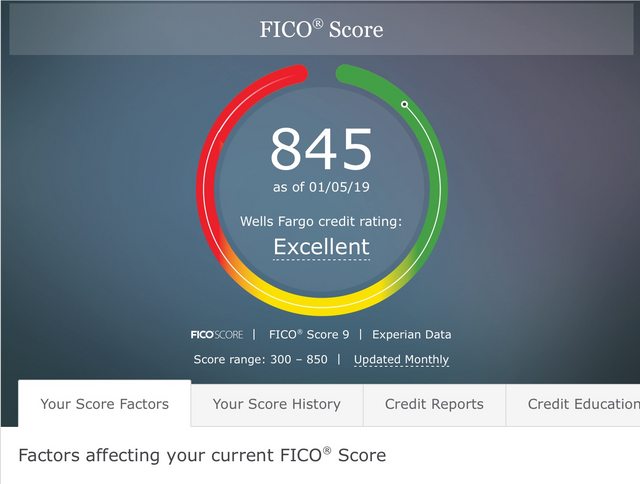

How Does A 784 Credit Score Rate

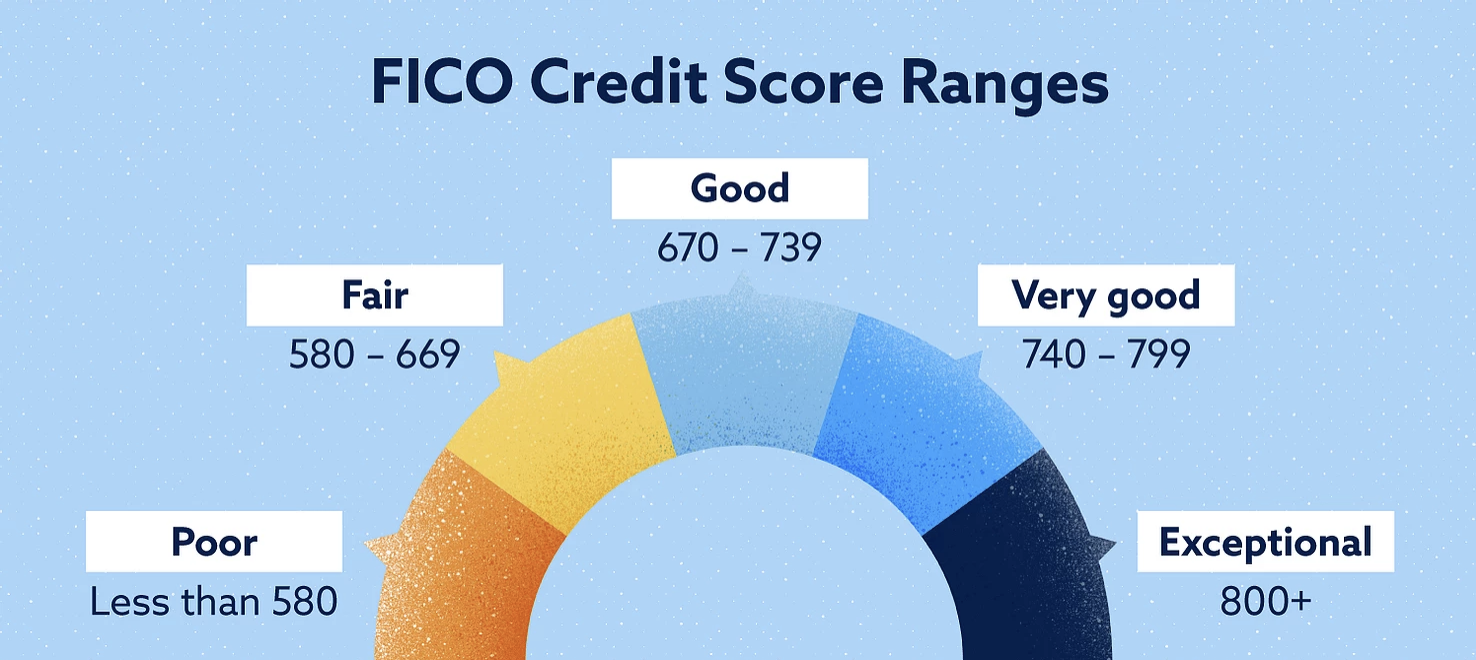

Most authentic credit scoring models like FICO and VantageScore use credit score range from 300-850. Even though the range seems broad but let me tell you that there are different categories within this range that starts from Very Poor to Excellent. If your score is near to the higher limit then it indicates the lower credit risk as well, likewise the lower credit score point to higher credit risk.

To help you in better understanding the ranges and the relative categories they fall in are explained below:

- Excellent Credit: 750 850 < < <

- Good Credit: 700 749

- Very Poor: 549 & Below

How To Read Your Credit Report

Your credit report contains both personal information and financial information. Your credit report illustrates who you are as a borrower, both the good and the bad. Checking it allows you to keep an eye on your accounts, make sure there are no errors, and even potentially prevent the damaging effects of fraud. Your credit report is the report card of your financial life and understanding how to read it can help you take control of your finances and be prepared for any of your future credit needs.

Don’t Miss: Credit Inquiry Removal In 24 Hour

Canadian Credit Ratings And What They Mean

Lenders and creditors typically use a credit score to determine youre likelihood of making payments on time. Its important to note that your is only one of the factors that lenders will evaluate when approving you for new credit.

- Excellent Individuals with a rate of 780 or over may enjoy the best interest rates on the market. They also will typically always be approved for a loan.

- Very Good This is considered near perfect and individuals with a rate in this range may still enjoy some of the best rates available.

- Good An individual who has a credit score that falls within this range has good credit and will typically have little to no trouble getting approved for the new credit.

- Average While this is still a good range, individuals with this score may receive slightly higher interest rates than those with higher scores. According to Equifax, at the end of 2012, the average national credit score was 696.

- Poor Scores in this range indicate that the individual is high risk. It may be difficult to obtain loans and if approved, they will be offered higher interest rates.

- Very Poor Scores in this range are rarely approved for anything, but credit can be repaired.

- Terrible Individuals whose credit scores are less than 500 may not get approved for new credit and should seek credit improvement help.

Loans Canada Lookout

What An 800+ Credit Score Can Mean

The advantages of having an 800+ credit score are huge. Ilene Davis, a certified financial planner with an 800+ credit score, says she did a calculation on the mortgage payments for a $300,000 home loan for various FICO scores.

If the difference between payments for borrowers with the highest and lowest credit scores were invested at 6% a year, at the end of a 30-year mortgage the borrower with the highest credit score would have accumulated around $750,000. Thats a chunk of money worth improving your credit score for.

Feeling overwhelmed or like you are drowning in credit card debt? ACCCs Debt Management Plan may be your answer!

Our Debt Management Plan will help you consolidate your unsecured debt into one monthly payment and restructures your payments to make it more affordable.

A Debt Management Plan:

- Is designed to fit your budget

- Will reduce your interest rate on most credit card accounts

- Will reduce or eliminate the penalty fees

Recommended Reading: Is 626 A Good Credit Score

Credit Score: Personal Loan Options

With a score this high, you wont face any problems securing a loan. Your personal loan interest rates for credit score 784 and above should range from 13% to 15% on average, but lower rates are definitely available. Shopping around will be in your best interest, because youll qualify for nearly every loan. However, be sure to do your shopping in a brief period of time so your credit score doesnt take a dip.

The Average American Credit Score

The average FICO score in the United States is 706. But this varies based on a variety of factors. Most peoples’ . Some states have higher or lower average credit scores, too. For example, Minnesotans on average have the highest FICO credit scores in the nation at 733.

As of this report, 55% of Americans have a FICO score of 740 or higher. This has historically been the case, but the decade of steady economic growth since the Great Recession has caused Americans’ credit profiles to improve significantly. Credit scores are higher when fewer consumers have serious delinquencies weighing down their scores. The state of the economy can influence whether or not people are financially able to avoid credit score pitfalls from year to year.

Recommended Reading: Klarna And Credit Score

A Lesser Premium For Insurance

Insurance is another financial instrument that rides mainly on trust and credibility, whether it is life cover, medical insurance, or others. Your repayment history, claims history, and general handling of debts and dues â all these are tracked carefully by the insurance companies. This helps them determine if you can enjoy a lower premium compared to others policyholders with a low credit score.

What Is The Highest Credit Score

For most situations, 850 is the best FICO score possible. It’s extremely difficult to reach a perfect credit score, though. Only 20% of Americans have a credit score of 800 or higher. Even if you’re one of the people with the best credit score in the country, you might not reach 850.

Wondering how to get a 850 credit score? Here are some ways to improve your credit score — and move closer to the highest credit score you can get:

- Paying off your credit card balance every month

- Correcting errors on your

- Keeping an old credit card open, even if you don’t use it often

- Paying your bills on-time

- Requesting an increase to your credit limit

If you reach a FICO credit score of 800 or higher, you should congratulate yourself. Raising your credit score takes hard work, dedication, and patience. Even if you don’t have perfect credit, an excellent credit score is something to be proud of.

Don’t Miss: How Do I Get A Repo Off My Credit

Key Things That You Must Know About Credit Score

If you are new to the concept of credit or CIBIL score, you may have several questions about how it works, what impacts credit score, etc. Here are some of the additional aspects you must know about credit score.

1. You can check your credit score and get a credit report for free

Most credit bureaus and third-party websites provide credit scores for free. You can sign up with them and check your credit score for free at any time. It is good to check your credit score frequently to keep a close watch on your credit health. While checking your credit report, you can look for any errors and get them resolved by raising a dispute with the credit bureaus.

2. Not everyone has a credit score

A credit score is available only after an individual takes some form of credit from banks, NBFCs or online lenders. This can include credit card, personal loan, home loan, two-wheeler loans, loan against property, gold loan, car loan, etc. If you have never borrowed before, you would not have any credit score.

3. Factors that Make your Credit Score

If you are wondering how a credit score is calculated, you must know that it is based on factors such as your repayment history, credit utilisation ratio, credit age, credit mix and number of hard enquiries, etc. You will have a good credit score if you have a good combination of all of these factors.

4. It takes time to build an excellent credit score

5. Poor credit score can be improved

6. Checking your own credit score doesnt hurt it

Keep Paying Your Bills On Time

Your payment history is one of the biggest factors TransUnion and Equifax evaluate when they calculate your score. If youve got good credit, you probably already make prompt payments on all your bills. Ensure youre always on time by setting up automatic payments and using phone or calendar reminders.

Also Check: When Does Open Sky Report To Credit Bureau

Take Advantage Of Score

The number of accounts and average age of your accounts are both important factors in your credit score, which can leave those with a limited credit history at a disadvantage.

Experian Boost and UltraFICO are programs that allow consumers to boost a thin credit profile with other financial information.

After opting into Experian Boost, you can connect your online banking data and allow the credit bureau to add telecommunications and utility payment histories to your report. UltraFICO allows you to give permission for your banking data, like checking and savings accounts, to be considered alongside your report when calculating your score.

Your Fico Score: Just One Piece Of The Puzzle

Id like to conclude this post by offering a little perspective. You may want a perfect credit score, and if you do I suggest you go for it.

But theres more to your personal finance life than perfect credit. Different lenders consider criteria other than your credit history when you apply for a loan or a credit card.

Your debt-to-income ratio, for example, could disqualify you for some of the best credit cards and loan options. This ratio measures how well youre able to pay your current bills with the income youre bringing in.

Your employment history could matter to some lenders, too. Just like with the length of credit history, a longer employment history works in your favor.

If you work to create the most stable personal finance life possible, your FICO score will fall into place, and youll stay at the top of the credit score range.

You May Like: Syncb Ppc Address

Fico Credit Score Ranges

Heres how to find out exactly where your credit score falls in the range of FICO scores.

- Excellent Credit : With an excellent credit score of 780 or higher you will get the best rates available.

- Very Good Credit : In this range you shouldnt have any problems getting good rates.

- Good Credit : This is a good credit range to be in, but you wont get the very best rates on loans or credit cards.

- Average Credit : Your score could use some improvements, but you should still be able to get decent rates. You can still qualify for most FHA mortgage loans, for example.

- Poor Credit : A credit score in this range means youre higher risk and might have trouble finding decent rates. Youll also get turned down on some credit applications. You could still get some USDA and VA loans if you qualify for those programs.

- Very Poor Credit : Anything less than 580 means that youre very high risk for borrowing. Youll get turned down for almost all credit applications. If you do get approved, the interest rates will be staggering. Dont worry though, this can be fixed!