Percent Of Adults Who Check Their Score Monthly

Data regarding how many adults check or dont check their scores will vary from study to study due to the nature of the sample population. Research offered by CreditCardInsider.com found that only 21 percent of their respondents check their credit score on a monthly basis9.

This low number can be supported by data in other studies, such as a LendingTree survey that found only 33 percent of adults checked their score within the past year in 202010.

What To Do With An 800 Credit Score

Once youve earned your 800 credit score, continue the same good credit habits that got you there. People with exceptional credit scores never miss a payment, so stay on top of your credit card and loan payments by setting up mobile alerts or signing up for autopay. People with very high credit scores also keep their credit utilization as low as possible, so try to pay off every credit card statement balance in full before your grace period expires.

Is there anything you shouldnt do once you earn an 800 credit score? Dont assume you can get away with letting things slide a little just because youve put in the work to earn near-perfect credit. Even a single missed payment could drop you out of the exceptional score rangeand it might be hard to earn your way back up to 800.

That said, as long as you are maintaining responsible credit habits you shouldnt worry too much about day-to-day credit score fluctuations. If you apply for a new credit card and generate a hard credit inquiry, for example, your credit score might drop below 800 by a few pointsbut it will probably bounce back fairly quickly, especially when you factor in your new line of credit. Likewise, you might see your credit score dip below 800 after you make a large purchase, only to rise again after you pay it off.

Vantagescore Vs Fico Credit Score Calculation Methods

VantageScore and FICO take the same factors into account to produce your score, but they weigh them slightly differently . Here are just a couple of the differences between FICO and VantageScore: 4

- VantageScore groups the length of your credit history and your credit mix into one category called Depth of Credit.

- In addition to your credit utilization , VantageScore also looks at your current balances and your remaining available credit .

The tables below show how the models weigh your financial decisions to produce your score:

| 688 |

Recommended Reading: Does Affirm Hurt Your Credit

Dont Apply For Every Credit Card

Too many credit inquiries in a short period of time can hurt your credit score. This can be difficult to avoid during Christmas when it seems that every department store is offering you a discount for signing up for its credit card.

Applying for new credit card accounts can account for 10% of your credit score, which isnt a huge number, but it can be enough to push you into the 800+ credit score club.

Holly Wolf, who with her husband has a credit score in the 800 range and is a chief marketing officer at Conestoga Bank, says she doesnt open a lot of credit cards and often closes cards she may have opened to get a store discount.

Honestly, this isnt a lifestyle to which most folks aspire, Wolf says. They need to have a nice car a big house and all the accouterments of prosperity over having a high credit score. Living debt-free or with as little debt as possible has enabled us to save for retirement, get the best rates on loans, and be prepared for unexpected expenses when they arise.

Andrea Has An 800 Credit Score And Loves It

We spoke to Credit Sesame member, Andrea after she worked with Credit Sesame to increase her credit score to 800. Here she explains how she did it.

Member Since: 4/16/2017

| What benefits have you seen from having an 800 credit score? |

|---|

| I was able to get a lower interest rate on my credit cards which allowed me to save money and therefore decrease the overall credit utilization which then improved my credit even more. I also was able to save up money from having a better interest rate so that I could take a two-week long trip with my family. I closed the newest card that I had and that was the final step to getting over 800, when I did that I treated myself to the car of my dreams. With such great credit, the interest on the used car loan was great and now I am driving everywhere in it. |

| Would you say its worth it to try to improve your credit score to 800? |

| Yes, it may have taken some time, and I had to learn how to do some things, but boy was it worth it. The trip that I took with my family and friends was so worth it. I also got to buy the car that I have wanted since I was young because of my hard work. |

| Are you actively trying to improve your credit score ? |

| Not anymore, I took the trip that I had been dreaming about for so long, and I just bought the car of my dreams last month because of my great credit score. Am I going to just let it fall? No, but I am not going to actively work on it like I over the last year. |

Don’t Miss: Opensky Payment Due Date

Is That High Score Worth The Effort

The good news is that many lenders consider 760 the cutoff for excellent credit. With a credit score above that number, you’ll receive most of the same benefits as someone with an 800 credit score. You’ll just have to work a little harder and wait a little longer if you also want the bragging rights.

Is A Perfect Credit Score Necessary

Being part of the 800 Credit Score Club has its perks, but it is not necessary to be successful financially by any means, as many get by without being a member. It is especially not worth the exclusive status if you take on more debt that you cant pay off. Instead, it is best to strive towards better credit that is realistic for you.

Rating of 4/5 based on 25 votes.

You May Like: Does Uplift Do A Hard Credit Check

Explore Your Refinancing Options

Now may be a good time to refinance your car loan or your mortgage. Doing so can save you money in the long term and potentially help your credit by making it easier to keep on top of future payments.

Although it is possible to refinance when you have bad credit, youll reap much greater rewards with an 800 credit score. For example, youll get better interest rates, which will save you money and may allow you to pay off the loan quicker.

Fair Credit Score: 580 To 669

Borrowers with credit scores ranging from 580 to 669 are thought to be in the fair category. They may have some dings on their credit history, but there are no major delinquencies. They are still likely to be extended credit by lenders but not at very competitive rates. Even if their options are limited, borrows in need of financing can still find solid options for personal loans.

Also Check: Remove Student Loans From Credit Report

The Best Credit Cards For Excellent Credit

With excellent credit, you could be eligible for some of the best credit card offers.

This might include premium rewards cards that come with more-valuable rewards and top-notch perks like travel credits, free hotel nights, airport lounge access, complimentary upgrades and elite status. Keep in mind that these cards also tend to carry expensive annual fees and higher interest rates if you carry a balance. So youll have to weigh the benefits against the costs to see if its worth it for your wallet.

On the other hand, if youre paying down credit card debt, you also might see offers for the best balance transfer cards that come with longer 0% intro APR periods and higher credit limits.

Explore on Credit Karma to see whats available.

Review Your Credit Reports

If your credit score isn’t what you would like, it’s possible it’s not your fault. Your credit report may contain inaccurate information, which could be harming your credit score. It can be beneficial to review your credit reports regularly for incorrect information and dispute the errors with the lender who reported the information to the credit bureaus, or to the credit bureaus where the inaccuracy exists.

You can request a free credit report from Experian, TransUnion and Equifax once a week through December 31, 2022, at AnnualCreditReport.com. You can also request your free credit score and report from Experian online.

Recommended Reading: How Long Does A Car Repo Stay On Your Credit

How Do You Keep An 800 Credit Score

Credit scores change because of things you can control, like applying for a new credit card, which could impact your credit portfolio, just as can, too.

But credit scores can also be affected by things you dont have control over, like fraud. A good way to watch out for fraud or keep errors off of your credit reports is through credit monitoring:

Youre entitled to receive a free from each of the credit bureaus – Equifax, TransUnion, and Experian – once every 12 months. Credit monitoring is also a good personal finance habit to do no matter what.

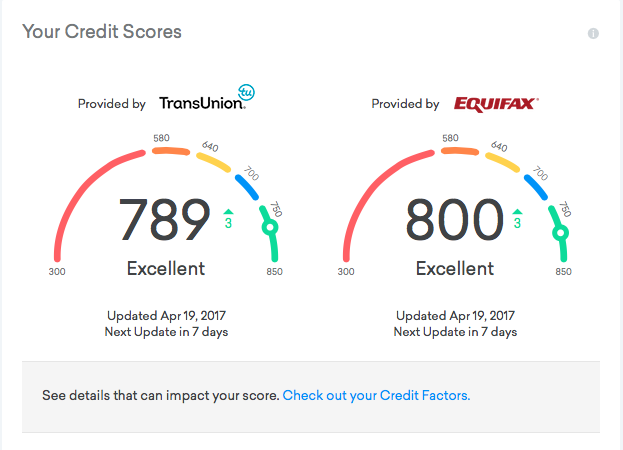

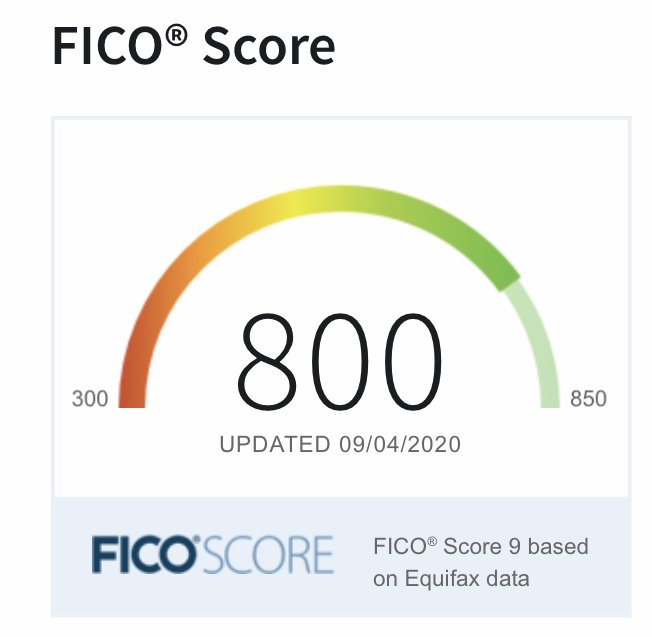

Exceptional Credit Scores: 800 To 850

850 is a perfect credit score, but it is, of course, a difficult one to achieve. Luckily, any score between 800 and 850 is considered excellent. So, if youve got an 804 credit score, you fall well within the lines of exceptional.

There are many advantages of having an exceptional credit score. Apart from finding it easier to borrow from lenders, youre also likely to get excellent interest rates on loans.

An excellent credit score is not so hard to achieve. The easiest way is to ensure you make all your payments on time. Making payments on time is the biggest factor when it comes to credit scores.

You should also aim to borrow less frequently and pay in full whenever possible. To keep your score in the exceptional range, try not to open too many credit accounts. The more credit accounts you have, the more you borrow, and the lesser your credit score is likely to be.

Also Check: How To Get An Eviction Off Your Credit

Monitor Your Credit Score

Make sure to check your credit score regularly. Many popular provide you with an updated credit score every week, along with an analysis of why your score might have changed. Learn what is likely to raise your score and what is likely to lower it, and avoid anything that might bring your credit score down.

What Life Is Like With An 800 Credit Score

In addition to bragging rights, having and maintaining an 800+ credit score could come with some additional benefits: youre considered to have an excellent credit score. As such, lenders are more likely to approve a loan or credit account, as well as offer you lower interest rates.

Its possible that you also could receive a higher credit limit as a result of your excellent credit score, and qualify for top rewards credit cards that let you earn cash back and/or miles on your purchases. And with more credit card options, youll also have more options when it comes to cards annual fees .

This article is for informational purposes only and is not a substitute for individualized professional advice. Articles on this site were commissioned and approved by Marcus by Goldman Sachs®, but may not reflect the institutional opinions of The Goldman Sachs Group, Inc., Goldman Sachs Bank USA or any of their affiliates, subsidiaries or divisions.

Recommended Reading: Credit Score To Be Approved For Care Credit

How Do You Get An 850 Credit Score

If you are determined to improve your credit to reach that perfect score for bragging rights, you may have a long journey ahead. There are just a few . If you manage them all well, you can get the best possible 850 credit score.

Start by keeping your revolving credit balances low and consider trying to raise your . These are accounts like credit cards and lines of credit. Some experts a reasonable is when you keep the balance below 20% or 30% of your total available balances. In reality, however, the best balance to get the highest credit score is $0.

At the same time, you should never, under any circumstances, make late payments. You can use automatic recurring payments or sign up for payment reminders to help make sure you dont miss a due date. Just one late payment will keep you from a perfect credit score for at least seven years.

You will also need a large mix of accounts to join the 800+ credit score club. The Self Credit Builder Account counts as one credit line if you are a customer. Perfect credit requires a mix of both revolving credit and installment loans. Installment loans are loans with a fixed payment like student loans, a personal loan, a car loan or a mortgage.

Signing up for new credit can harm your score in multiple ways, and just an application or two in the last two years may keep an otherwise perfect score in the 780-849 range. New stay on your credit report for two years.

You May Like: How Accurate Is Creditwise Credit Score

Keep Your Credit Score In Tip

Should you stress if your credit score doesn’t hit the 800 range? Absolutely not. Many borrowers can get loans and adequate interest rates when in the lower credit ranges.

However, you may want to consider boosting your credit if you fall into the “poor” or “fair” categories to make sure you get the absolute best credit offers possible when you want to buy a car, buy a home or utilize credit in other ways.

Also Check: Does Seventh Avenue Report To Credit Bureaus

What Is An Excellent Credit Score Range

Excellent credit score = 740 850: Anything in the mid 700s and higher is considered excellent credit and will be greeted by easy credit approvals and the very best interest rates.Consumers with excellent credit scores have a delinquency rate of approximately 2%.

In this high-end of credit scoring, extra points dont improve your loan terms much. Most lenders would consider a credit score of 760 the same as 800. However, having a higher score can serve as a buffer if negative occurrences in your report. For example, if you max out a credit card , the resulting damage wont push you down into a lower tier.

Recommended Reading: How To Get Credit Report Without Social Security Number

What A Good Credit Score Can Get You

Having good credit matters because it determines whether you can borrow money and how much you’ll pay in interest to do so.

Among the things a good credit score can help you get:

-

An unsecured credit card with a decent interest rate, or even a balance-transfer card.

-

A desirable car loan or lease.

-

A mortgage with a favorable interest rate.

-

The ability to open new credit to cover expenses in a crisis if you don’t have an emergency fund or it runs out.

A good credit score helps in other ways: In many states, people with higher credit scores pay less for car insurance. In addition, some landlords use credit scores to screen tenants.

So having a good credit score is helpful whether you plan to apply for credit or not.

If your credit score is below about 700, prepare for questions about negative items on your credit record when shopping for a car. People with major blemishes on their credit are routinely approved for car loans, but you may not qualify for a low rate. Read about what rates to expect with your score.

You dont need flawless credit to get a mortgage. In some cases, credit scores can be in the 500s. But credit scores estimate the risk that you wont repay as agreed, so lenders do reward higher scores with lower interest rates. Read about your mortgage options by credit score tier.

Landlords or property managers generally aren’t looking for immaculate scores, they are interested in your credit record. Learn more about what landlords really look for in a credit check.

Read Also: Is 524 Credit Score Bad

Very Good Credit Score: 740 To 799

A credit score between 740 and 799 indicates a consumer is generally financially responsible when it comes to money and credit management. Most of their payments, including loans, credit cards, utilities, and rental payments, are made on time. are relatively low compared with their credit account limits.

How Good Is An 800 Credit Score

Lenders tend to evaluate , and a credit score between 800 and 850 falls in the excellent range. People who achieve such a high score have generally shown they pay back borrowed money on time and dont miss payments

Here are just a few advantages to having an 800+ credit score:

- You have a better chance at getting approved for a home loan

- You may qualify for a low mortgage rate

- You have more power to negotiate your interest rate and closing costs

Learn More: What Is a Mortgage Rate and How Do They Work?

Don’t Miss: Raising Credit Score By 50 Points