What Are Fha Credit Score Requirements In 2021

The Federal Housing Administration, or FHA, requires a credit score of at least 500 to buy a home with an FHA loan. A minimum of 580 is needed to make the minimum down payment of 3.5%. However, many lenders require a score of 620 to 640 to qualify.

Thanks to a new FHA policy, lenders appear to have started reducing their FHA minimum credit score requirements starting in 2017, opening homeownership to thousands more home buyers.

FHA loans have helped untold thousands of home shoppers complete their purchases despite low-to-average credit scores. You no longer need to wait to have excellent credit before you buy a home.

Now FHA has implemented a policy that may open the floodgates of new home buyers rushing into the market.

Analysts predict the change could allow 100,000 additional families per year to buy a home with an FHA loan.

Since its inception in 1934, the FHA loan program has enabled more than 40 million families to buy or refinance property. Its extreme popularity is a direct result of its flexibility. The program was built from the ground up to promote homeownership among a portion of the population that would not otherwise qualify.

When Can Lower Credit Score Borrowers Apply For Fha

The new policy has been rolled out for a few years , so your chosen lender may have changed its internal policy already. But some are slower to adopt new regulations.

Typically, theres a step-down effect across the lending landscape. One lender will slightly loosen guidelines, followed by others until a majority function similarly. If the new standards work, lenders loosen a bit more.

Lower credit home shoppers should get multiple quotes and call around to multiple lenders. One lender might be an early adopter of new policies, while another waits to see results from everyone else.

Despite when lenders adopt FHAs new policy, there is strong reason to believe that they will. Thousands of renters who have been locked out of homeownership due to an imperfect credit history could finally qualify.

Want to know if you qualify now? Contact an FHA lender now who will guide you through the qualification process.

What Is A Good Credit Score For Getting A Home Loan

To qualify, youll need at least the minimum credit score to buy a house, which ranges from about 500 680, depending on the mortgage program. But a higher credit score can boost your chances of qualifying for a mortgage because it shows the lender youre likely to repay your loan on time.

During the application process, lenders commonly check the borrowers FICO® credit score, which grades consumers on a scale of 300 850, with 850 being the highest score possible. The best credit score to buy a house is 760 or higher. According to FICO® data, borrowers with a credit score in this range tend to get the best interest rates on a home loan.

You May Like: Is Opensky Reliable

What Does My Credit Score Need To Be For A Mortgage

The minimum credit score required to get a mortgage varies by loan type:

| Type of Loan | |

| 700-740 | 10-20% |

*With a credit score between 500-579 you may still qualify for an FHA loan if you can put at least 10% down.

If youre a first-time home buyer, you may be surprised you could get approved for a mortgage loan with a credit score below 600.

But the score you see in a credit monitoring app, or in your credit card statement, wont be the score your lender sees when it pulls your credit.

The score your lender sees will likely be lower. So if your credit is borderline, youll want to understand how lenders evaluate your credit score and credit history before moving forward with a loan application.

Your Credit Report Should Reflect A Good Diversity Of Credit Products

When youre successfully managing a credit card, a line of credit and a loan, potential mortgage lenders are going to see someone who will be capable of handling one more payment every month. If all you have is one credit card, even if youve managed it well and kept it in good standing, your credit report is not going to look as good as it could. Lenders may still wonder what sort of risk you pose as a borrower – will you be able to handle multiple credit products or is one your limit? There is no way of them knowing. If you have poor credit, there are still ways to go about diversifying your credit products. Look into secured cards, secured lines of credit and credit building programs. for more info on those.

Read Also: Does Opensky Report To Credit Bureaus

Consider A Rapid Rescore

Credit report changes can take time to go through the system. That means improved scores might not show up in time for a mortgage application. In this case, you might want to get a so-called rapid rescore through your lender.

A rapid rescore allows a mortgage lender to submit proof to a credit agency that an applicant has made recent changes or updates to their account that are not yet reflected on their credit report, according to Experian. Borrowers cannot request their own rapid rescore the service is only offered to lenders. A rapid rescore isnt free, either, but the fee for adjusting your credit during your mortgage application could be offset by your lower interest rate.

The Credit Scores And Other Qualifications Of Actual Mortgage Borrowers

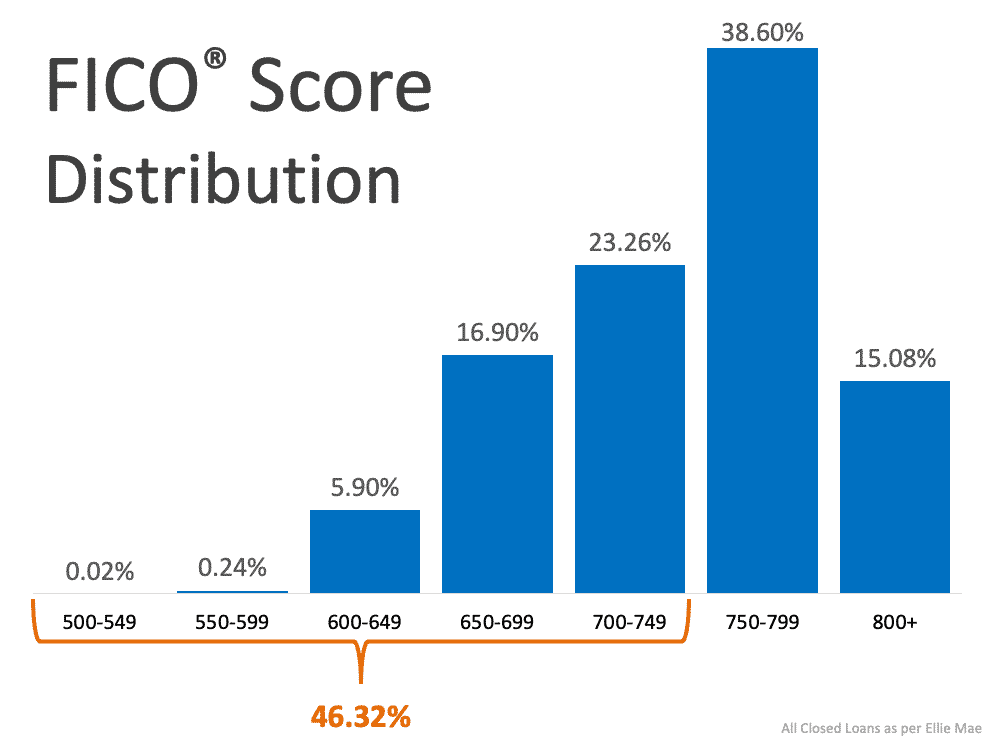

Most mortgage borrowers have significantly higher credit scores than their particular loan program requires. As of September 2020, the average homebuyer who obtained a conventional purchase mortgage had a FICO® Score of 759, according to Ellie Mae — a score largely considered to be great credit.

What’s more, the average buyer put 19% down and had an overall debt-to-income ratio of 35%. This is more money down than a conventional loan requires, and is also a significantly lower DTI.

Even for an FHA loan, the average credit score for a mortgage was a 684 FICO® Score. That’s generally considered to be good credit, and significantly above the minimum requirement. The average FHA borrower only put 4% down and had a relatively high 43% DTI. This makes sense, as FHA loans are typically used by borrowers with little cash to put down.

Read Also: 8773922016

How A Credit Score Is Calculated

Its impossible to know exactly how much your credit score will change based on the actions you take. Credit bureaus and lenders dont share the actual formulas they use to calculate credit scores.

Factors that may affect your credit score include:

- how long youve had credit

- how long each credit has been in your report

- if you carry a balance on your credit cards

- if you regularly miss payments

- the amount of your outstanding debts

- being close to, at or above your credit limit

- the number of recent credit applications

- the type of credit youre using

- if your debts have been sent to a collection agency

- any record of insolvency or bankruptcy

Lenders set their own guidelines on the minimum credit score you need for them to lend you money.

If you have a good credit score, you may be able to negotiate lower interest rates. However, when you order your credit score, it may be different from the score produced for a lender. This is because a lender may give more weight to certain information when calculating your credit score.

What Is A Good Credit Score In Canada For A Mortgage

Many young Canadians dream about purchasing a home. Apart from the down payment and closing costs, it is essential to find an affordable mortgage option. A good credit score allows you to access the best mortgage options at low-interest rates. Are you worried about finding a mortgage with a bad credit score? We will discuss the mortgage options available to borrowers with a bad credit score.

Read Also: How To Remove Repossession From Credit Report

How Your Credit Score Affects Your Mortgage Eligibility

When it comes to getting a mortgage, your credit score is incredibly important. It determines:

- What loan options you qualify for

- Your interest rate

- Your loan amount and home price range

- Your monthly payment throughout the life of the loan

For example, having a credit score of excellent versus poor could save you over $200 per month on a $200,000 mortgage.

And if your credit score is on the lower end, a few points could make the difference in your ability to buy a house at all.

So, it makes sense to check and monitor your credit scores regularly especially before getting a mortgage or other big loan.

The challenge, however, is that theres conflicting information when it comes to credit scores.

There are three different credit agencies and two credit scoring models. As a result, your credit score can vary a lot depending on whos looking and where they find it.

What Changes Your Credit Score

These 5 factors provide a glimpse into your financial habits and history, and help lenders assess your financial health. Home buyers with lower credit scores are typically assigned a higher interest rate.

Recommended Reading: How To Add Utility Bills To Your Credit Report

How Hard Is It To Buy A House

There are some minimum score requirements that banks use in order to determine if the applicant is financially able to take on a large mortgage. To understand how firm these requirements are, its helpful to have a basic understanding of how the mortgage industry works.

Some lenders arent interested in keeping your mortgage. There are two reasons why your lender may sell your loan to another lender to free up capital and/or to make money. Lenders who need to free up capital, do so in order to provide loans to other consumers. The other reason is when a lender sells a mortgage they can make money in interest, origination fees, and even selling it for a commission. Your loan being sold is not necessarily a bad thing, but it is something that you, the mortgagee should be aware of. Everyone has different standards for acceptance after all, they dont want bad mortgages. This is where minimum score requirements come into place.

Heres a quick look at the minimum credit score requirements for the various types of mortgages.

Minimum Credit Score Requirements for Mortgages Types

| Mortgage Types | |

|---|---|

| 580 and a 3.5% deposit | |

| FHA 203K Loan | |

| VA | 620+ |

Of course, these are just the minimum requirements and dont necessarily mean automatic approval. Lets take a closer look at how many people were denied a mortgage, by credit score range, to give you a better idea of how difficult it can be to qualify for a home loan:

Mortgage Denial Rates

| 93% | 91% |

The main benefits include:

Other Types Of Mortgages

Several of the best mortgage lenders for first-time homebuyers offer lower down payments and more flexible credit requirements. In addition to conventional and FHA mortgages, the credit score for a mortgage can be lower with the following types of mortgage loans:

VA Loans:VA Loans are available to certain current and former members of the U.S. Armed Forces. There is no formal minimum credit score for a home loan, but most lenders want to see a FICO® Score of at least 620 to originate a VA loan.

USDA Loans: A USDA loan is a type of financing available for borrowers with low-to-moderate income buying homes in certain rural areas. While there isn’t a set-in-stone credit requirement, most USDA lenders want to see a score of at least 640.

Read Also: Is A 500 Credit Score Bad

How Can My Fico Scores Affect My Mortgage Interest Rate

When a loan officer gets your mortgage application, they may use a pricing grid to figure out how your credit scores affect your interest rate, says Yves-Marc Courtines, a chartered financial analyst with Boundless Advice. Generally, higher scores can mean a lower interest rate, and vice versa.

From there, a mortgage loan officer will likely look at the rest of your loan application to decide whether your base interest rate needs any adjustments. For example, if youre making a smaller down payment, you may be given a higher interest rate, says Courtines.

A banks pricing grid may change on a daily basis depending on market conditions. However, heres an example of what you might expect your base interest rate to be, based on your credit score, on a $216,000, 30-year, fixed-rate mortgage.

| FICO® score range |

|---|

Source: myFICO, November 2020.

How Mark Got A Mortgage With A Good Credit Score

Member Since: 2/15/2017

| We interviewed Mark on July 31, 2018. He earns $55,500 a year, is 41 years old and lives in Indianapolis, Ind. Hes married with one child and is currently working as a graphic designer. |

|---|

| What is your credit score? |

| My credit score is 699. Ive been monitoring it for the last seven years. Ive increased it by about 50 points within that span of time. I made a few poor choices when I first got my credit cards. I used them to visit Europe after I graduated from college. I had no way to pay back what I borrowed. The interest accumulated and I had to close those credit cards which made my credit score take a nosedive. |

| Did you have any trouble qualifying for a mortgage loan? |

| I dont know whether shopping around and talking to lenders is classified as trouble or not. It certainly was a lengthy process. Weve been saving for years for a down payment on a house and had 20 percent of what we needed to buy our home. |

| Which mortgage loan did you choose, and why? |

| We chose a Federal Housing Administration insured loan which saved us nearly $160 a month in insurance. We needed a mortgage that would be approved with my low credit score and one that wouldnt pile on the insurance fees and high interest rates. Our mortgage lender explained that an FHA mortgage would suit us best as first-time buyers. |

Don’t Miss: How To Report Death To Credit Bureaus

It’s Not Just About Your Credit Score For A Mortgage

Your credit score for a home loan is certainly an important factor, but it is just one piece of the puzzle. In addition to your FICO® Score, your mortgage lender will consider:

- Your down payment: The minimum down payment for a conventional loan is 3% for first-time buyers. But higher down payments can increase your approval chances and also lower your interest rate. Plus, if your down payment is less than 20%, you’ll likely have to pay for PMI.

- Your income: Lenders want to know that you earn enough money to justify the loan. Generally speaking, lenders want to see that your new housing payment will make up less than 28% of your pre-tax income and that your total debts will be less than 45% of your income.

- Your assets: If you have substantial money in savings, lots of investments, or other assets, it can help bolster your mortgage application. In fact, lenders generally require that you have a certain number of mortgage payments in reserve.

- Your employment history: Not only does your lender want to see enough income to justify the loan, but it also wants to know that your income is likely to continue for the foreseeable future. As a general rule, lenders want to see at least two years of steady employment in the same industry, with no significant gaps.

- A total DTI ratio of 36% or less, and a down payment of at least 25% of the purchase price.

- A DTI of 45% or less, a down payment of at least 25%, and two months’ worth of mortgage payments in reserve.

What Credit Score Do I Need For A Mortgage In 2021

For many people the first time they will ever look at their credit rating is when they start looking to buy a house hopefully a few months ahead of time, but often only after having been rejected for a mortgage.

The mortgage market is complicated enough as it is, but on top of figuring mortgage types, loan to value and repayments you also have to look at your own credit worthiness and try to guess whether you will even be able to get a mortgage.

Don’t Miss: Does Paypal Report To Credit Bureaus

Using Credit For Home

Buying a house involves more than simply making payments on your mortgage. The simple truth is that when you own a home, you’re going to have house-related expenses. However, it’s not always possible to drop large amounts of cash on big-ticket items like new appliances, home repairs, or maintenance.

- Use a low-interest credit card: one convenient way to pay for immediate, unexpected, or emergency home costs is with a credit card. Consider getting a low-interest card that you set aside for this purpose while you build an emergency fund. Remember to apply for the card < em> after< /em> closing on your house, though, so you don’t impact your credit. This gives you the option to fund an unexpected housing cost immediately. Use a credit card for things like an emergency furnace repair or an appliance service call.

- Use a line of credit: another option for larger home expenses or repairs is a line of credit. A line of credit works like a credit card in that you can borrow up to a limit. You only pay interest on what you borrow, and then make monthly payments to pay it back. Line of credit rates are often lower than credit card interest rates, and a strong credit score could reduce your rate even further.