If I Have A Low Credit Score Do I Need A Large Income To Get A Mortgage

When a mortgage lender is deciding whether you meet their criteria for a loan, they will look at the factors that affect affordability. Your income certainly impacts your ability to repay your mortgage and having a sufficient income is important.

Lenders will look at the amount you earn against your outgoings which may include debt repayments, bills, car insurance or other travel expenses. If your current income could comfortably cover your current outgoings as well as your new mortgage repayments and any associated costs, a lender may decide to approve you.

Having a lower income that may not stretch to cover the above, may cause concern for some lenders, especially if you already have a low credit score. Your broker can take the time to listen to what you need from mortgage and can calculate the most affordable and viable route.

Ways To Buy A House With Bad Credit

While its not going to be as easy or affordable for a consumer with bad credit to purchase a house as a consumer with good credit, it is still possible to get a mortgage. Here are a few steps you can take toward securing a high-risk mortgage.

Be Patient

Although taking the time to rebuild your credit will always work in your favor when youre searching for a mortgage, being patient is especially important for those who have had a consumer proposal or gone bankrupt. Most conventional lenders are probably not going to even consider approving you for a minimum of two years after your case was discharged. So, its best to take that time to improve your finances and get your credit score back up.

Find Stable Employment

If you have good credit and a suitable income, even if youre self-employed or a commission based worker, prime lenders will still approve you for a mortgage. However, if you have bad credit, gone through a consumer proposal or bankruptcy, an unstable employment history will only add to a lenders opinion that youre a risky investment. For that reason, its best to find a stable source of confirmable income, especially if you one day hope to work with a prime lender.

Look Into Subprime and Private Lenders

Save For a Larger Down Payment

Improve Your Credit Score

For more information about Canadian interest rates, read this.

Even With The Credit Score For A Mortgage Are You Ready To Buy That Home

Sometimes, its just not the right time to buy a home. This is a step that cant really be reversed. Youre locking yourself into many, many years of monthly payments you will have to make or destroy your credit and lose your home. Even if you lose your job, hurt yourself, or go through other life-altering traumas, you will still on the hook for the monthly payments on your mortgage.

The new rules and obstacles in our way to home-ownership are there for a reason: to protect us from defaulting on our mortgage. But none of these new rules and regulations can protect your credit score if you jump into something so huge without considering everything. An organized, prepared home-buyer is far more likely to reach the end of their mortgage still a homeowner and with a great credit score. The keys to responsible home buying are patience and preparation. With enough patience and preparation, you wont be held back by anything.

Before you leap into this, head over heels, youve got to make sure youre ready. Do you have a backup plan? Do you have an emergency fund, should something bad happen? Taking the time before leaping into home-ownership, to make sure you have something to fall back on, will give you security and protect your investments while making sure your credit score does not suffer.

Recommended Reading: What Bank Is Syncb Ppc

Low Credit Score Costs

On a 30-year fixed-rate mortgage for $150,000, having a credit score of 620 to 639 could cost you tens of thousands of dollars more over 30 years compared to having a credit score of 760 or higher. Check out the table below to see how much more youd pay.

| FICO score |

|---|

|

$123,706 |

Still, 4.5% is, historically speaking, a great interest rate. Theres hardly been a more affordable time to get a mortgage if you have bad credit.

What Mortgage Lenders Look For When Approving A Home Loan

When you apply to get pre-approved, your lenders will review your credit history and consider your current credit outlook. This includes looking at:

- How on-time have you been with your payments and obligations?

- What does your current debt load look like, and how is spread out?

- How much experience do you have managing credit?

- Have you been recently trying to acquire access to new sources of credit?

- Do you let items go into collection?

- Have you previously filed for bankruptcy?

Lenders ask these questions to get comfortable about you. Your financial health isnt the only consideration lenders make, but how you manage your bills tells a large part of your story.

Lenders also look for specific credit events known as derogatory items, like bankruptcy or delinquent accounts.

Derogatory items dont disqualify a mortgage approval. Generally, its only required that theyre historical events and not current ones. For example, you can get approved for a mortgage if youve declared bankruptcy in the past, or if youve lost a home due to foreclosure.

Lenders know that life is unexpected and bad things happen. Whats important is whats happened in the time since the derogatory event occurred.

Also Check: Does Carmax Check Credit

Find A Bad Credit Mortgage Lender

You need a minimum credit score for mortgage approval in Canada from a big bank, and that number is 600. If you have a credit score below 600, most of Canadas big banks will not approve you for a mortgage loan.

If you dont meet the banks threshold for the minimum credit score for mortgage approval, youll have to look for a B lender or subprime lender. These financial institutions, including trust companies, work almost exclusively with people that do not have ideal credit scores. If youve gone through a bankruptcy or consumer proposal within the last two years, you may even need to work with a private mortgage lender. If youre working with a mortgage broker, they should be able to put you in touch with a lender they know will work with you.

| Description |

*The exact cut-offs will vary by lender

**Other factors will also influence your mortgage rate

If you work with a B lender for your poor credit mortgage, youll most likely pay some extra fees that you would normally avoid with an A lender. First, your B lender may charge a loan processing fee of up to 1% of the mortgages value. Second, if you choose to find your lender through a poor credit mortgage broker, they may also charge you a fee, usually around 1%. This fee is levied because lenders dont typically compensate mortgage brokers for bad credit mortgage clients, so the cost is passed along to you. 2% may not sound like much, but it amounts to $10,000 on a $500,000 mortgage.

Finding The Best Mortgage For You

Now that you know what credit score you need to get the best mortgage rates and how to improve your score, you should be well on your way to getting the best mortgage rate. But how do you find the best mortgage for you?

There are a few different routes you can take when looking for a mortgage. You can go to your big bank and choose from the options they make available. You can also opt for a mortgage broker. A mortgage broker is a licensed professional that will compare mortgages on your behalf from a variety of lenders to help you find the best rates available to you.

A mortgage broker can save you time and effort because they have access to many different lenders, including the major banks, credit unions, alternative lenders, and private lenders. They can compare lenders and look for the most competitive mortgage rates without being obligated to pick from any singular lender.

Also Check: Is 524 A Good Credit Score

What Credit Score Do Mortgage Lenders Use

As explained above, the most commonly used mortgage credit scores are the FICO credit scores that you have with the UKs main three credit reference agencies: TransUnion, Experian, and Equifax.

Mortgage lenders will normally look at your credit score from each of the CRAs when you apply for a mortgage. If a borrower has three different scores according to each scoring system, then they will use the middle credit rating to assess your application.

But, if two credit agencies agree on your credit score, the mortgage lender will just use that credit rating in their assessment.

Dont Shut Bank Card Accounts

You might need been tempted to shut an account in the event you dont use it a lot or it comes with a excessive annual payment. However you may preserve the account energetic by connecting the cardboard to a small recurring invoice and establishing cost reminders.

Tip: Moreover, your card issuer would possibly be capable of downgrade the account to a card with decrease charges. Simply be sure to ask about modifications to your perks and rewards, and ensure the issuer will report the brand new card to the credit score bureaus as the identical account.

Recommended Reading: What Credit Bureau Does Usaa Use

What Is Considered A Bad Or Bad Credit Score

The exact meaning of a bad credit score depends on who you ask, but in general a score less than 580 can be considered bad or bad. People with bad credit have much higher borrowing costs and are often only eligible for very risky loans with higher interest rates.

While it may still be possible to improve your credit score, it will take some effort, financial discipline and a little help.

When Are Credit Scores Too Low To Qualify For A Mortgage

Theres no credit score threshold that will definitely disqualify you from getting a mortgage, but the lower your score, the harder it will be to find a lender to underwrite your loan. Lenders generally view applicants with poor credit as more likely to default, which means the lender is less likely to get its money back plus interest. Each lender evaluates loan applications differently, though, and some will make loans to borrowers with low credit scores, while others will simply pass.

You May Like: How To Get Car Repossession Off Credit Report

What Else Do Mortgage Lenders Consider

Your credit score is a key factor in determining whether you qualify for a mortgage. But its not the only one lenders consider.

Income: Lenders will also look at your income. They want to make sure you make enough money each month to afford your payments.

Debt-To-Income Ratio: Lenders also look at your monthly debts. Lenders vary, but they generally want your total monthly debts, including your estimated new mortgage payment, to consume no more than 43% of your gross monthly income. If your debt-to-income ratio is higher, you might struggle to qualify for a mortgage.

Down Payment: The bigger your down payment, the more likely it is that youll qualify for a mortgage with a lower interest rate. Thats because lenders think you are less likely to stop making your payments if youve already invested a significant amount of your money into your loan. A higher down payment, then, makes your loan less risky for lenders.

Savings: Lenders want to make sure that you have funds available to make your mortgage payment if your income should unexpectedly dry up. Because of this, most will want to see that you have enough money saved to cover at least two months of mortgage payments.

Employment History: Lenders vary, but they usually like to see that youve worked at the same job, or at least in the same industry, for at least 2 years. They believe youre less likely to lose that job, and that stream of income, if youve built up a longer work history.

Take Advantage Of Credit

The UltraFICO and Experian Boost programs track the movement of cash in your bank account, and in many cases your score can go up based on this data.

According to Experian, 61 percent of the Boost programs participants saw their scores go up, with the average bump being 13 points. Fair Isaac published similar statistics, reporting that seven out of 10 consumers in the U.S. with good financial habits have an UltraFICO score higher than their traditional FICO score.

Many banks also offer credit monitoring for their customers, which can be a good idea to utilize in tandem. Having a handle on what goes into your score can help you improve it.

You May Like: Does Klarna Affect Your Credit Score

Can I Get A Mortgage If My Credit Score Is Low

When we talk about minimum credit scores required to get approved for a mortgage, were talking about conventional lenders, such as big banks. These traditional lenders are usually quite stringent about their mortgage approval requirements, including the credit scores needed for mortgage approval.

There are options for bad credit borrowers who are looking for a mortgage to finance a home purchase. Credit unions, trust companies, and subprime lenders are potential sources for mortgages for borrowers who cant qualify with their banks because of their sub-par credit scores. These sources often deal with people who may be viewed as risky to conventional lenders.

Have you considered a bridge loan to help purchase the home of your dreams?

It should be noted that if you do plan to apply for a mortgage with one of these lenders with a bad credit score, you will likely pay a higher interest rate than you would if you had a higher credit score and applied with a conventional lender.

Thats why its best to consider taking the time to improve your credit score before applying for a mortgage. That way youll have an easier time getting approved for a home loan and clinch a lower rate, which will make your mortgage less expensive.

Loans Canada Lookout

What Information Do Credit Reference Agencies Have

-

The Electoral Roll. This shows how long you’ve been registered to vote at your given address

-

Public records. This shows any county court judgments, bankruptcies, IVAs, Debt Relief Orders and Administration Orders.

-

Account information. This shows the financial status of your existing accounts, how much you’ve borrowed and whether or not you’ve paid on time

-

Home repossessions. This shows if you’ve information This is information from members of the Council of Mortgage Lenders about homes that have been repossessed

-

Associated financial partners. This shows all of the people who you are financially connected to. For example, you could have a joint bank account

-

Previous searches. This shows companies and organisations who you have looked at in the last 12 months. For example, if you made an application for credit in the last 12 months, it would show here.

Read Also: Does Paypal Report To Credit Bureau

Turn Out To Be A Certified Consumer

With this selection, a reliable buddy or relative provides you to their bank card account. You get your individual copy of the bank card and might make purchases with it, however youre not required to make funds. The account exercise can be mirrored in your credit score experiences together with the first account holders.

An account in good standing will positively influence your credit score, however the reverse is true too. Any late funds or excessive balances might negatively have an effect on your credit score.

Can I Purchase A Home With A 600 Credit Score Rating

A 600 credit score rating is excessive sufficient to get a house mortgage. In reality, there are a number of mortgage packages designed particularly to assist folks with decrease credit score scores. Nevertheless, youll want to satisfy different lending necessities too. As an illustration, the lender will test your debt-to-income ratio , confirm employment, and go over your credit score historical past. You might need to make a down cost as effectively.

A decrease credit score rating additionally means youll have increased borrowing prices as a result of theres extra threat for the lender. These prices often come within the type of mortgage insurance coverage premiums and better rates of interest.

Also Check: Usaa Credit Score

Do I Need A Credit Score To Get A Mortgage

Most mortgage lenders will want you to have a credit score before theyll be willing to offer you a mortgage. But there are specialist mortgage lenders who will consider you with a very low or even no credit score. Theres a few reasons you might not have a credit score, for example, if youve never taken out any kind of credit like a utility bill in your name, or maybe youre still living at home with parents so havent yet had a chance to build a credit profile.

Generally, itll be specialist lenders wholl be willing to consider your mortgage application if you dont have a credit score yet. To find a specialist lender, youll need a specialist mortgage broker. Get matched to your perfect mortgage broker, go to our homepage and click Get started.

Basics Of Credit Scores

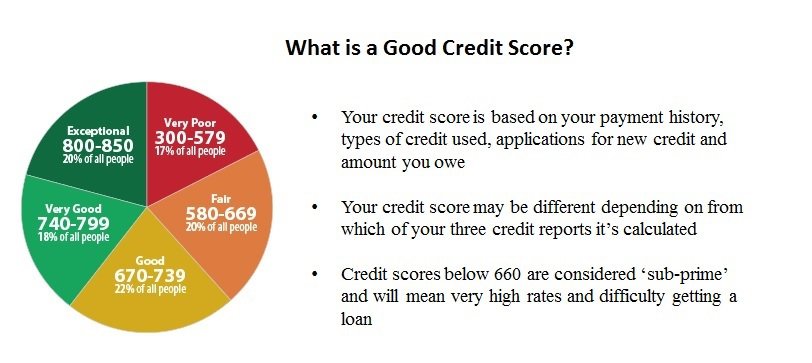

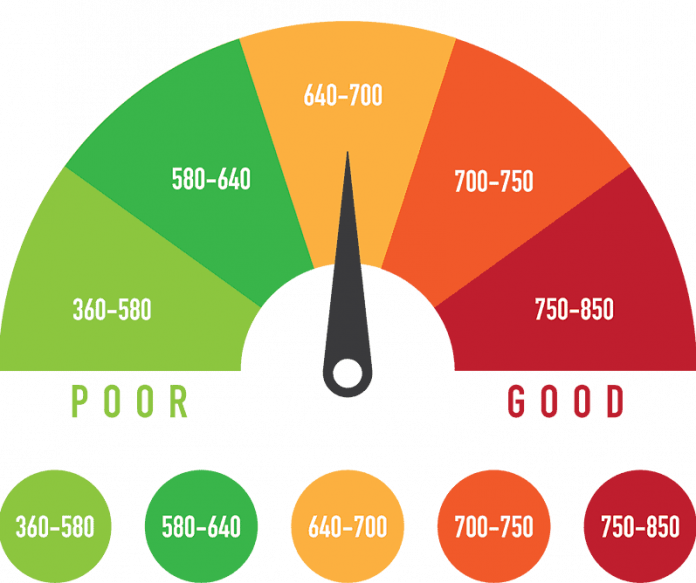

Typically ranging between 300 and 850, your credit score is determined by factors such as how many accounts you have, how old your accounts are, your payment history, your credit mix and overall debt. Although credit bureaus and financial data analysis sources categorize credit scores differently, Experian puts credit scores below 580 in the “very poor” category and scores between 580 and 669 in the “fair” category. At the higher end, a score in the “good” category ranges between 670 and 739, while a score 740 or higher would be “very good” or “excellent.”

Having a score of 600 puts you in the “fair” category at best based on these guidelines. This means lenders see you as a bigger credit risk than people who have good credit, and this can make it harder for you to get loans as well as receive favorable terms. If you’ve recently made late payments or had accounts sent to collections, this makes lenders more reluctant to lend to you.

Also Check: How To Remove Old Addresses From Credit Report