Be Current With Your Current Accounts

One of the best ways to improve your credit score is to make sure that you pay your current bills on time. That includes your monthly utility bills and cell phone payments. If you have overdue bills, update your payments and make sure you settle them on-time from then on. It can take about two months or more before you see improvements in your credit score, depending on how bad your credit record is.

You should also pay collections accounts, although it wont improve your score right away. They would appear as paid or settled in your record and will be viewed more favorably by creditors compared to unpaid ones. It will show lenders that youre financially responsible when you pay severely past due debts.

What Is A Fair Credit Score Range

Fair credit score = 620- 679: Individuals with scores over 620 are considered less risky and are even more likely to be approved for credit.

In the mid-600s range, consumers become prime borrowers. This means they may qualify for higher loan amounts, higher credit limits, lower down payments and better negotiating power with loan and credit card terms. Only 15-30% of borrowers in this range become delinquent.

Will My Credit Score Increase Due To Other Reasons As Well

It generally will. Your credit score is determined by a variety of factors, but the one that is relevant to paying or settling collections and charge offs is your outstanding balances.

FICO generates 30% of your credit score by accessing your outstanding balances.

When you payoff or settle collections and charge offs, you eliminate the balances, thus impacting your score in that manner as well.

You May Like: Comenity Bank Pulls What Credit Bureau

Bankruptcy Information Can Be Wrong

You may want to hire a credit repair attorney if your record shows inaccurate financial or bankruptcy information. They can speak with credit reporting agencies, credit card companies, or credit card issuers if you are having personal finance trouble. An attorney can also step in if a company does not discharge your debt correctly or you fall into a credit counseling scam.

Remember: A bankruptcy discharge legally stops creditors from harassing you. You have rights if a company is not following the process or respecting your bankruptcy filing.

Note: Payment History May Not Be Updated During Your Filing

Although your credit report will list your accounts and show the included in bankruptcy status while you file, payment history typically wont get reported. Typically, data furnishers will not report payments to the , whether you make the payments on time or not.

This may be frustrating, particularly for debts that may be current, such as a mortgage. However, lenders avoid reporting payment history to avoid discharge violations with the court.

Also Check: How Long Repossession Stay On Credit Report

Getting Positive Markers On Your Credit File

In addition to cleaning out the bad stuff from your credit history, you want to get new, positive credit marks after you are discharged. First make sure you are on the electoral roll, that your address etc are correct on your record, that your bankruptcy discharge is shown and start the clean-up process above. This may take several months to complete if you have to go to the ICO.

Then you have two options.

Get a bad credit card

You can apply for a bad credit card such as Vanquis, Aqua or Luma. Vanquis is owned by Provident, Luma is owned by Capital One if you have had debts to either of these firms included in your bankruptcy, I suggest you apply a different one to maximise your chance of being accepted.

If you are refused, double-check your credit file really is clean with all three credit reference agencies and wait six months or so, then apply to a different card.

This sort of credit card is dangerous. They are aimed at people with very bad credit and they charge a very high rate of interest. This doesnt matter if you use the card every month and repay it in full every month, so you never pay interest.

Your credit rating will not improve faster if you leave a balance on this card and pay interest. The best thing for your credit rating is to repay it in full each month.

If you find your balance is creeping up because you are not clearing it in full, stop spending on the card until it is cleared and have a re-think about budgeting.

Start saving with LOQBOX

Difficulties You May Face Before A Bankruptcy Falls Off Your Credit Report

Before a bakruptcy is removed from your credit report, you may face the following problems:

- Unsecured credit card applications will not be approved

- Loan applications will not be approved

- Payment of higher interest rates

- Payment of higher insurance premiums

- More difficult time finding a job

- More difficult time getting approved to rent an apartment

- Difficulty taking out a loan to buy a home

Recommended Reading: Does Affirm Hurt Your Credit

Apply For A New Line Of Credit

Adding a new line of credit can demonstrate that you can responsibly make on-time payments. In turn, itll help your credit score. However, when you apply for new lines of credit, the lender will do a hard pull on your credit. Every time you apply for new credit, your prospective lender accesses your credit report, says April Parks-Lewis, director of education and corporate communications at Consolidated Credit. Those inquiries can drag down your credit score.

As too many hard inquiries will ding your credit score, try to apply for credit lines you know you can qualify for. You can also apply to get prequalified, which results in a soft pull of your credit. When youre trying to build your credit after bankruptcy, here are some types of credit for you to consider:

Why this matters: A new line of credit can help you build your creditworthiness.

How to get started: Choose one of the options from above that fits your situation best and work on keeping that line of credit in good condition.

Get Your Bankruptcy Removed Professionally

In some cases, we recommend speaking with a Credit Repair professional to analyze your credit report. It’s so much less stress, hassle, and time to let professionals identify the reasons for your score drop.If you’re looking for a reputable company to increase your credit score, we recommend Credit Glory. Call them on or setup a consultation with them. They also happen to have incredible customer service.Credit Glory is a credit repair company that helps everyday Americans remove inaccurate, incomplete, unverifiable, unauthorized, or fraudulent negative items from their credit report. Their primary goal is empowering consumers with the opportunity and knowledge to reach their financial dreams in 2020 and beyond.

Read Also: 779 Fico Score

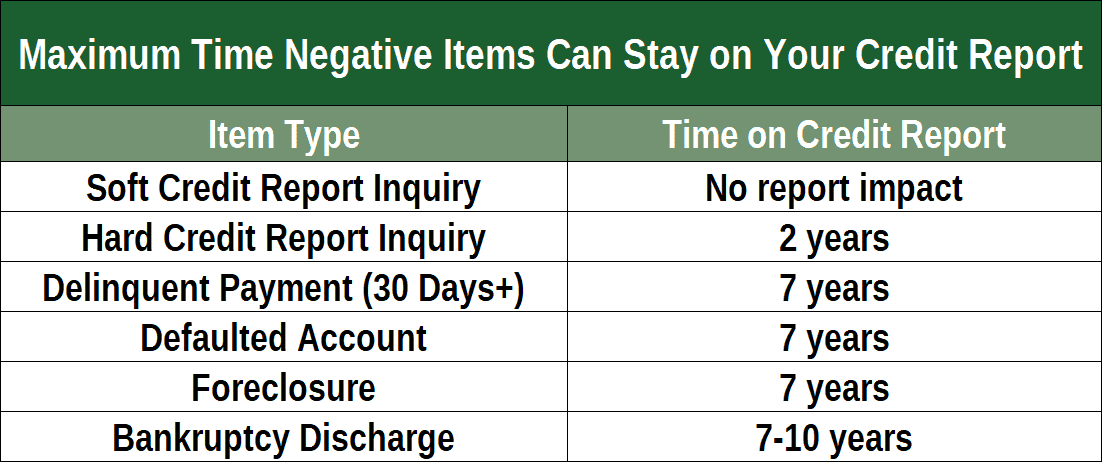

The Different Types Of Defaults On Your Credit Report

Default typically happens when you miss multiple payments on a debt. Usually, after several attempts to contact you and work out a solution, your creditor will determine that you’re defaulting on payment. Your account will then be transferred to a collections department or sold to a collections agency.

The timeframe and consequences can vary, but here’s an overview of common types of default:

Keep Your Credit Utilization Ratio Low

Another key credit score factor is your it accounts for 30% of your FICO Score. Your credit utilization ratio measures how much of your credit you use versus how much you have available. For example, if your available credit is $10,000 and you use $2,000, your credit ratio is 20% .

Although its often recommended that you keep your ratio below 30%, you may be able to rebuild your credit faster by keeping it closer to 0%.

Read Also: Bankruptcy Preparer

Read Also: How To Get A Repo Off Credit Report

Bottom Line: Bankruptcy And Credit

I have personally seen the impact of the bankruptcy petition on some debtors five to seven years later and most are doing fine, says Arnold Hernandez, an attorney in Tustin, Calif., who handles bankruptcy cases. Bankruptcy is not forever.

Tips To Help Rebuild Your Credit After Bankruptcy

If youve already felt the wrath of bankruptcy, chances are youre not feeling too optimistic about your future credit score. However, the good news is filing for bankruptcy wont haunt you forever, and the odds of rebuilding your credit are definitely in your favor.

Of course, having the bankruptcy removed from your credit report is the easiest way to get your credit back on track in the shortest period possible. You can also take the following actions to boost your score:

Recommended Reading: How Long Do Repos Stay On Credit

How Long Until Bankruptcy Falls Off Your Credit Report

Talk to different bankruptcy attorneys and credit professionals, and youre sure to get just as many answers about the length of time the bankruptcy stays on your credit report before it is removed.

According to Experian, the credit reporting agency:

The bankruptcy record from the court is deleted either seven years or 10 years from the filing date of the bankruptcy depending on the chapter you declared.

Chapter 13 bankruptcy is deleted seven years from the filing date because it requires at least a partial repayment of the debts you owe. Chapter 7 bankruptcy is deleted 10 years from the filing date because none of the debt is repaid.

Individual accounts included in bankruptcy often are deleted from your credit history before the bankruptcy public record. Usually, a person declaring bankruptcy already is having serious difficulty paying their debts. Accounts are often seriously delinquent before the bankruptcy.

All delinquent accounts are deleted seven years from the original delinquency date, which is the date the account first became delinquent and was never again current. Declaring bankruptcy does not alter the original delinquency or extend the time the account remains on the credit report.

If the account was delinquent before being included in the bankruptcy, it will probably be deleted before the bankruptcy public record because the original delinquency date is typically earlier than the bankruptcy filing date.

Check In Detail What Your Credit Records Show

There are three different Credit Reference Agencies in Britain.

To do a thorough job of cleaning up your credit records, you need to look at all three of them as many lenders only report to one CRA. If you only check one, you may miss a problem which is only showing on a different CRA.

Get the Statutory reports from each of the three CRAs, there is no charge for this, see How to check all your credit records for free.

Even if you can get other reports for free, the Statutory Reports are best:

- they are simple

- they can easily be downloaded

- they are real-time so you get a current picture of your credit record.

You May Like: Syncbppc

How Long Does A Chapter 13 Bankruptcy Stay On Your Credit Report

A Chapter 13 bankruptcy stays on your credit reports for up to seven years. Unlike Chapter 7 Bankruptcy, filing for Chapter 13 bankruptcy involves creating a three- to five-year repayment plan for some or all of your debts. After you complete the repayment plan, debts included in the plan are discharged.

If some of your discharged debts were delinquent before filing for this type of bankruptcy, it would fall off your credit report seven years from the date of delinquency. All other discharged debts will fall off of your report at the same time your Chapter 13 bankruptcy falls off.

How Much Will Credit Score Increase After Bankruptcy Falls Off

Your credit score will increase by 50 to 150 points after a bankruptcy is removed from your credit report. The removal of bankruptcy can dramatically increase your credit score because bankruptcy is the most negative item that can appear on your credit report. The amount of points your credit score will increase depends on other items you have on your credit report.

If you have other negative items bringing down your credit score, you might not see a huge increase. But if nothing else is affecting your credit score, the removal of bankruptcy will likely result in a huge increase in your credit score.

If, after filing for bankruptcy, you open new accounts, make all of your payments on time, you should see a substantial increase in your credit score once the bankruptcy is removed from your credit report.

Many people have reported that their credit score has increased by 50 to 150 points after the bankruptcy fell of their credit report. That said, some saw a 50 point increase, others saw a 91 point increase, and others experienced a 150 point increase. So, your point increase will vary depending on the information in your credit report.

If, after filing for bankruptcy, you opened new credit cards, racked up a lot of new debt, and missed payments on your account, you will be hurting your credit score and the removal of a bankruptcy would have little to no impact on your credit score because the new derogatory information will drag your credit score down.

You May Like: 672 Credit Score Auto Loan

What If I Need A Loan Or Credit Card Immediately After Bankruptcy

Luckily, most mortgage companies provide FHA loans for scores of 560-600. Traditional financing options often require a score of 600 or higher.

There are options for buying high-cost necessities after filing bankruptcy claims. Secured credit cards and loans exist for those facing bankruptcy. You can look into credit builder loans or other financing options specially built for people after bankruptcy.

How Credit Scores Work

First, lets take a look at how your credit score is calculated in the first place. You have credit scores from each of the three major credit bureaus: TransUnion, Equifax, and Experian. These bureaus track all of your credit activity. That includes the use of your credit cards and whether you pay them in full, your student loans, mortgages, auto loans, and more. Each item the bureaus track is factored into your credit score, which ranges from 280 to 850.

The exact mechanism by which the bureaus arrive at an individuals credit score is proprietary they keep it secret so that, in theory, no one can game the system. However, FICO recently released some data about how much certain common events will affect your credit score, called damage points.

Your score affects your access to all sorts of things. It will show up when you want to get a credit card or a loan, for example. If you want to rent an apartment or get a cell phone plan, theyll check your credit. Some employers may even check your score when you apply for a job.

You May Like: How To Dispute A Repossession

How Does Bankruptcy Help Improve My Credit Score

You may be wondering how filing for bankruptcy can increase your credit score if you have a credit score that is less than 600. There are a few reasons. First, wiping your slate clean makes creditors realize that youâre more likely to pay them back. Just think of two different people, John and Sam. John is $40,000 in debt and owes three hospitals, four credit card companies, and five friends money. Sam, on the other hand, just filed for bankruptcy so he does not owe anybody.

Who are you more likely to give a loan to because you think theyâll pay you back? If you give a loan to Sam, you are going to be the 13th creditor that he owes. If you give a loan to John, you are going to be the only creditor that he owes. Of course, you are more likely to give the loan to John, even if he just filed for bankruptcy. The takeaway is that lenders look at your credit score to determine how risky you are as a borrower and how likely they are to lend you money.

Review Your Credit Reports For Any Errors

Start by reviewing your credit reports and looking for ANY errors regarding your bankruptcy.

By law, youre entitled to a free copy of your credit report once every 12 months, and you can request your free report by visiting www.annualcreditreport.com.

Once you have your credit report, check it over for accuracy.

You want to look for any type of error: a misspelling of your name, an incorrect address, the wrong account number, the wrong date, etc.

Basically, any type of technicality that you can use in order to bring on a dispute.

You May Like: Which Credit Score Is Correct

Don’t Miss: Usaa Credit Card Approval Score

Ask To Become An Authorized User

Getting someone to co-sign on a loan may be a tall order, but building your credit as an authorized user on someone elses credit card is often more feasible. Being an authorized user involves having a card in your name thats attached to another borrowers account, not your own. Youll be able to use the card for purchases without having to qualify for the account on your own meritsbut you wont be able to modify the account.

Credit card payments will show up on your credit report, so if these payments are made on time and the credit utilization rate stays low, your score will improve over time. Just make sure the credit card company reports authorized user payments to the three main credit bureaus so you have the greatest chance of increasing your score. While this isnt as impactful as other methods of increasing a credit score, it can still be helpful as part of a larger strategy.

How Much Will My Credit Improve Once My Bankruptcy Falls Off

Bankruptcies fall off personal credit reports after 10 years, after which time a damaged credit score can begin to improve. There’s no way to determine exactly how much your credit score will improve after bankruptcy, because it depends entirely on the decisions you make after the 10-year period. By actively working to improve your credit score, it’s possible to raise it out of the “high-risk” category and eventually into the 700’s or higher, to a maximum score of 850. Rebuilding a credit score requires patience and consistent financial responsibility.

Also Check: Which Bureau Does Care Credit Pull