The Scoring Model Used In Mortgage Applications

While the FICO® 8 model is the most widely used scoring model for general lending decisions, banks use the following FICO scores when you apply for a mortgage:

- FICO® Score 2

- FICO® Score 5

- FICO® Score 4

As you can see, each of the three main credit bureaus use a slightly different version of the industry-specific FICO Score. That’s because FICO tweaks and tailors its scoring model to best predict the creditworthiness for different industries and bureaus. You’re still evaluated on the same core factors , but the categories are weighed a little bit differently.

It makes sense: Borrowing and paying off a mortgage arguably requires a different mindset than keeping track of and using a credit card responsibly.

The FICO 8 model is known for being more critical of high balances on revolving credit lines. Since revolving credit is less of a factor when it comes to mortgages, the FICO 2, 4 and 5 models, which put less emphasis on , have proven to be reliable when evaluating good candidates for a mortgage.

Which Credit Bureaus Banks Check

When you apply for a credit card, the issuer contacts a credit bureau to purchase a copy of your credit report. Included in your report are the five categories mentioned above.

Youll notice one credit-report category, which counts for 10% of your score, is called new credit. If you have too many credit applications opened within a short period of time, it may affect your credit score negatively.

Imagine the following scenario: Youve filled out several applications for new credit in the last 12 months. These applications show up on your credit reports as hard inquiries and could potentially damage your credit scores.

You then decide to apply for another new credit card. In addition to your score potentially taking a hit, you might experience another dilemma. The bank processing your application might be concerned about why youre applying for so much new credit in a short period of time. As a result, theres a chance you could be turned down for a credit card even if your credit score is in good shape.

Knowing which credit reporting agency card issuers use to pull reports might help you avoid this problem. By understanding this concept, you can time your applications in such a way that you improve your approval odds for the credit cards you want.

Unfortunately, credit card companies dont openly reveal which credit bureau they favor. However, there are online resources that gather customer feedback to gauge which issuer uses which credit bureau.

How Your Experian Credit Score Is Calculated

Your Experian credit score, and your credit report, is calculated based on five major factors. These factors contribute to a different percentage of your final Experian score. They include:

|

Factors |

||

|

Payment History |

Timely repayments on your credit cards and loans help your score and missed payments and defaults harm your score. |

|

|

Your account balances, the amount of money you owe, and how much of your credit limit you have used impact your credit score. |

||

|

Length of Credit History |

The average age of your credit accounts has an impact on your credit score. The older the credit accounts, the higher is your creditworthiness. |

|

|

New Credit |

New loan applications impact your credit score. A high number of new applications can harm your credit score. |

|

|

The types of credit accounts you have impact your credit score. A good mix of secured and unsecured loans is good for your credit score. |

Don’t Miss: What Is A Credit Score Definition

What To Do If Theres An Error On Your Credit Report

If you find an error on your credit report, youll need to report and dispute that error with each individual bureau since each bureau collects and utilizes different information. Each bureau has their own process for disputing. Youll need to go to their individual sites to find details on how to fix an error on your credit report.

One of the reasons its so important to check your credit report regularly is that it can often take months to properly fix an error on your credit report. For more details on common credit report mistakes and how to dispute credit report errors, visit the FICO website.

Indias Cut In Credit Rating

Indias credit rating has moved one step closer to junk after Moodys Investors Service had downgraded the country to a low investment grade level and had also surprised the economists.

Moodys had reduced the long-term foreign-currency credit rating to Baa3 from Baa2, and this implies that it can get cut further. This action brings it in par with the BBB- assessment from Fitch Ratings Ltd and S& P Global Ratings. The economy is now facing a huge contraction in over four decades.

4 June 2020

Recommended Reading: Speedy Cash Collection Agency

Also Check: How Often Does Capital One Report To Credit Bureaus

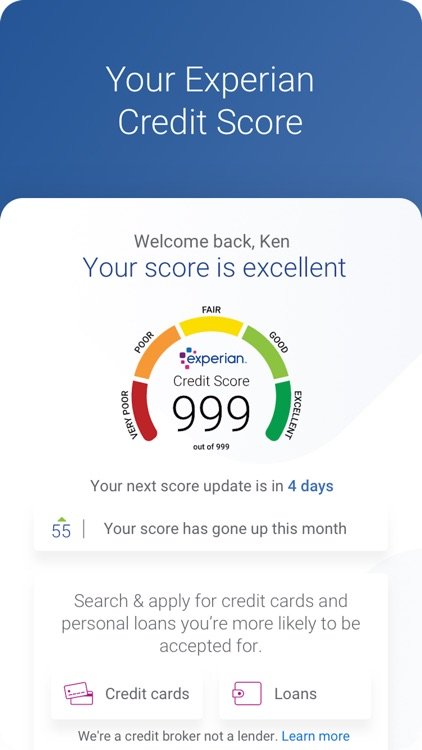

How Can You Get Your Experian Credit Scores

If youd still like to access your Experian credit score, you can find it for free in several places.

Experians free CreditWorks Basic service updates your credit score every 30 days. Experian also operates freecreditscore.com, another place where you get your free Experian FICO score once a month.

Some banks and credit card issuers, like Discover, also offer complimentary Experian-based FICO® credit scores.

And if youre willing to pay, Experian and FICO both offer premium services through which you can access your credit scores on a more regular basis. These services offer other benefits, too, such as access to your credit reports and credit- and identity-theft monitoring and support. But we believe strongly that you should never have to pay to access your credit scores or credit reports.

Is Equifax Or Experian Better

The better option between Experian vs Equifax in Australia depends on your needs. Both of these agencies provide comprehensive credit reporting solutions. If needed, you can ask the credit provider which credit rating agencyâs report they consider when evaluating loan applications so that you can look at the appropriate one.

However, remember that lenders also have their own credit scoring models based on an applicantâs credit history. Therefore, the same credit score from Equifax and Experian may be interpreted differently by the lenders.

Recommended Reading: Which Credit Score Is Used For Auto Loans

How Do Credit Bureau Companies Collect My Information

Okay, we admit it all sounds a bit creepy. Big Brothers always watching, right? Well, yes, but it might comfort you to know how credit bureaus collect and share your information.

Credit bureaus mainly collect information from credit institutions with which you already have a relationship, such as:

- Banks

- Student loan providers

- Auto loan providers

Credit bureaus do not have access to these accounts instead, the credit institutions share the information with the credit bureaus. Typically, credit bureaus store data on your balances, available credit, payment history, and the number of open and closed accounts you have. Collection agencies and debt collectors may also report to the credit bureaus if you have any delinquent activity.

The rest of the information credit bureaus collect comes from public court records. They access these records in search of any possible bankruptcies, tax liens, repossessions, and foreclosures.

Remove Negative Financial Links

You should check your credit file for financial links that you dont recognise. Some financial links can reduce your credit file as this might mean your credit score is going down due to someone elses bad credit behaviour.

Any financial links which seem out of the blue can be removed from your credit file. Financial links can be generated by just sharing apartments with someone else, getting a loan with someone else etc. You should ask the credit bureaus to correct this.As you remove these negative financial links your credit score should improve.

Don’t Miss: How To Fix A Bad Credit Score

How To Improve My Experian Credit Score

While improving your credit takes time, it does pay off since you get a higher credit score which increases your chances of getting your home loan application approved.

Here are ways to improve your credit score:

- Make consistent and timely repayments on your mortgage, loans and credit cards.

- Even if you have missed a payment, Experian allows a 14 days grace period. So if you pay within the 14 days, it will not show up as default.

- Do not consistently have consecutive missed payments for your loans or bills.

- Try to avoid getting more negative listings like defaults, court judgements, etc. on your credit file.

- Always stay updated with your credit file and check it regularly to ensure that new information is reflected on your credit file.

- If there is an incorrect listing, rectify them immediately by contacting Experian or the credit provider who has listed the wrong information.

- Reduce your credit card limits as lenders might view a higher limit as having more debt or ongoing payments. Thus, increasing risk to them.

- Try to limit your credit card applications.

- Seek assistance from a financial counsellor if youre facing financial hardship and cannot keep up with payments. Getting help from them will not affect your credit score.

Does American Express Use Experian

When you apply for an American Express credit card, the company will almost always check your credit report with Experian. In some very rare cases, American Express will check with a different credit bureau. Remember that all three credit bureaus get their information from the same place: your financial life.

Read Also: Is 672 A Good Credit Score

How Can I Get My Credit Report Ready For A Mortgage

Your Experian credit score is a reflection of how you are as a borrower.

You should focus on building your credit, and avoid putting any more credit enquiries at least six months before you apply for a home loan.

Here are some tips you can follow to get your Experian credit report ready before you apply for a home loan:

This Brings Us To: What Factors Affect Credit Score In Australia

What makes your score better or worse is a combination of factors:

Understanding these 9 factors are important to maintaining the health of your credit score. So, our recommendation is: always make sure to be in control of your credit, not let it control you. After all, being able to know that you can utilise your credit to qualify for any item that is within your means is a great thing to have in your financial arsenal.

Read Also: How Does A Charge Off Affect Your Credit Report

Why Do My Credit Scores Differ Across The Credit Bureaus

Credit scores are a tool commonly used by lenders and other service providers to help assess the risk that their applicants and existing customers won’t fulfill the terms of their loans or contracts. , which are calculated by credit scoring models using the information in your credit reports, are available from a variety of sources, including each of the three national consumer credit bureaus . There are many different credit scoring models available on the market, so your score can vary between lenders depending on which model they choose. It can also vary depending on which credit bureau the information was taken from because of differences in the information being reported to each of your credit reports.

Other Ways To Build Credit

No matter how well Experian Boost works for you, it isn’t a complete solution for building credit or credit repair. You’re not going to go from having no credit score to having an excellent credit score just from paying your utility bills on time.

The best way to build your credit history is to use credit responsibly over time. This includes paying your credit cards and loans on time every month. You should also focus on keeping your low .

You need credit to build credit, though. If you’re struggling to get started, there are a few methods you can use.

You May Like: How Long Does It Take To Improve Your Credit Score

Experian Vs Transunion: Whats The Difference

- Banks Editorial Team

When youre checking your credit report or credit score, you may hear about different credit bureaus, including TransUnion and Experian. What are the similarities and differences between these credit reporting agencies, and does it matter which one you use to check your information?

Recommended Reading: Carmax For Bad Credit

Does Experian Boost Have Any Downsides

There have been some reports of consumer scores going down after using Experian Boost, yet these accounts dont seem to be associated with the tool itself. Everhart and Felice-Steele confirmed that Experian Boost only reports positive payments to credit reports, so the addition of new bills will ultimately improve ones credit score or be neutral.

Ulzheimer says that if someone uses Experian Boost and their credit score drops, its due to other credit factors. For example, they may have closed a credit card in the same timeframe, resulting in a sudden increase in their .

He points out that users also have the power to instantly add and remove bills through Experian Boost, so you can shut it off and have the tradelines removed any time you want.

However, Ulzheimer notes that theres an intermediary company involved with Experian Boost called Finicity. Finicity goes into your bank account and grabs all the information that is converted to a tradeline for Boost.

That is what goes on your credit report, Ulzheimer says. Ultimately, this means you have to be comfortable letting Finicity get into your bank accounts and see all your information.

Users should also know that, while incredibly useful in some cases, Experian Boost has some serious limitations.

Read Also: What Credit Score Do Most Lenders Use

Understanding The Scoring Models

FICO and VantageScore arent the only scoring models on the market. Lenders use a multitude of scoring methods to determine your creditworthiness and make decisions about whether or not to give you credit. Despite the numerous options, FICO scores and VantageScores are likely the only scores youll ever see yourself.

Heres what FICO uses to determine your credit score:

- Payment history. Whether or not you pay your bills in a timely manner is critical, as this factor makes up around 35% of your score.

- . How much of your open credit you have usedwhich is called credit utilizationaccounts for 30% of your score. Keeping your utilization below 30% can help you keep your credits core healthy.

- Length of credit. The average age of your creditand how long youve had your oldest accountis a factor. Credit age accounts for around 15% of your score.

- Types of credit. Your credit mix, which refers to having multiple types of accounts, makes up around 10% of your score.

- Recent inquiries. How many entities have hit your credit history with a hard inquiry for the purpose of evaluating you for credit is a factor for your score. It accounts for about 10% of your credit score.

VantageScore uses the same factors, but weighs them a little differently. Your VantageScore 4.0 will be most influenced by your credit usage, followed by your credit mix. Payment history is only moderately influential, while credit age and recent inquiries are less influential.

What Is The Difference Between Vantagescore & Fico

The VantageScore was developed by the major credit reporting agencies and uses a combined set of consumer credit files from the three agencies to come up with a single formula. The scores for the most recent iteration of this scoring model, the VantageScore 3.0, ranges from 300 to 850, with a higher score indicating lower risk.

FICO was developed by Fair Isaac Corporation and bases its credit scoring models on credit reports obtained separately from each of the three reporting agencies. FICO then builds scores based on each specific agencys data. While the score range is the same for FICO and VantageScore 3.0, there isnt just one FICO score.

Also Check: Does Speedy Cash Report To Credit Bureaus

Don’t Miss: How Long Can A Negative Stay On Credit Report

What Is A Good Fico Score

FICO® creates different types of consumer credit scores. There are base FICO® Scores that the company makes for lenders in multiple industries to use, as well as industry-specific credit scores for credit card issuers and auto lenders.

The base FICO® Scores range from 300 to 850, and FICO defines the good range as 670 to 739. FICO®s industry-specific credit scores have a different range250 to 900. However, the middle categories have the same groupings and a good industry-specific FICO® Score is still 670 to 739.

You May Like: How Long Does A Repossession Stay On Your Credit Report