What To Remember When You Are Rate Shopping

If you need a loan, do your rate shopping within a focused period such as 30 days. FICO Scores distinguish between a search for a single loan and a search for many new credit lines, in part by the length of time over which the inquiries occur.

When you look for new credit, only apply for and open new credit accounts as needed. And before you apply, its good practice to review your credit report and FICO Scores to know where you stand. Viewing our own information will not affect your FICO Scores.

As a general rule, it is OK to apply for credit when needed. Be mindful of this information so you can start the credit-seeking process with more confidence.

Estimate your FICO Score range

Answer 10 easy questions to get a free estimate of your FICO Score range

You May Like:

Check Your Credit Reports For Updates

It may take some time for your credit reports to be updated. Creditors can take up to 45 days to send a credit bureau new information, according to TransUnion. If the information isnt updated after 45 days, contact the credit bureaus or data furnisher again to see why inaccurate information is still being reported.

If Youve Spotted An Error On One Of Your Credit Reports You Should Take Immediate Steps To Correct The Inaccuracy

Around 25% of U.S. consumers found errors that could affect their credit scores in one of their credit reports, according to a 2012 study by the Federal Trade Commission. The same study reported that one in five consumers had an error that a credit bureau corrected after the consumer disputed the mistake on at least one report.

An error on your credit reports could lead to lower credit scores and impact your ability to open a new credit account or get a loan. Here are steps you can take to ask the credit bureaus to remove incorrect derogatory marks from your credit.

You May Like: 524 Credit Score Good Or Bad

Negative Credit Report Entries That Impact Your Score The Most

Most accurate negative items stay in your file for around seven years. Fortunately, their impact diminishes as time goes by, even if they are still listed on the report.

For example, a collection from a few years ago will carry less weight than a recent one especially if there arent any new negative items in your history. Improving your debt management after receiving a derogatory mark can show lenders you’re unlikely to repeat the issue and help increase your score.

These are the most common items that can lower your credit score:

Multiple hard inquiries

Multiple hard credit checks over a short amount of time are a red flag for lenders, as it tells them that you are applying for credit too often and, potentially, being denied.

However, there are some exceptions to this. For example, if youre looking to buy a home and want to compare interest rates between several lenders, you can. FICO and VantageScore, the two most commonly used credit scoring models, give consumers a window of around 14 to 45 to compare rates this is known as rate shopping. All credit inquiries done between this period of time will show up on your file as one item.

Delinquency

Foreclosure

Foreclosure can also cause a credit score to drop substantially. According to FICO, a score can drop up to 100 points from a foreclosure, depending on the consumers starting score. Foreclosures stay on your record for seven years.

Charge-offs

Repossessions

Judgments

Collections

Gather Materials & Documents To Dispute Errors

Before you submit your dispute, you should gather the personal information and documents the credit bureau or creditor may need to investigate your claim.

When you open a dispute, you may be asked for the following personal information:

- A copy of your drivers license or government-issued ID

- SSN

- Your current address and addresses for the past two years

In addition, you may be asked for the following documentation to support your dispute:

- Federal Trade Commission Identity Theft Report or a police report if an account has been added as a result of identity theft

- Billing statements

- Canceled check or money order stub showing a bill has been paid

Don’t Miss: Does Usaa Report Authorized Users

How To File A Dispute

If you believe information in your Experian credit report is inaccurate, you can file a dispute with Experian in the following ways:

- Online: The Experian Dispute Center allows you to submit disputes anytime, day or night, from your smartphone or computer. This is the quickest and easiest way to dispute your credit report.

- Phone: To submit a dispute by phone, call the number displayed on your Experian credit report or 888-EXPERIAN to speak with an agent. To request mail delivery of a hard-copy credit report, call 866-200-6020.

- Postal mail: You can also file a dispute without a credit report by writing to Experian at P.O. Box 4500, Allen, TX 75013. Be sure to include all of your personal information so that Experian can access your report.

After you’ve submitted a dispute, Experian will contact the data furnisher and ask them to check their records and verify the information. Depending on their response, one of three things typically happens:

- Incorrect information is corrected.

What Is A Credit Dispute

A credit dispute is an inquiry sent to a credit bureau about an error on your credit report. If you regularly check your from all three major , you’re likely on the lookout for inaccurate information. If you do find a mistakeespecially one thats hurting your credit scoreyou can send a credit dispute to the credit bureaus.

You can submit your dispute as a letter, over the phone or online.

Also Check: Leasingdesk Screening Reviews

What Happens After You Dispute Information On Your Credit Report

Tip

If you suspect that the error on your report is a result of identity theft, visit IdentityTheft.gov, the federal governments one-stop resource to help you report and recover from identity theft.

If the furnisher corrects your information after your dispute, it must notify all of the credit reporting companies it sent the inaccurate information to, so they can update their reports with the correct information.

If the furnisher determines that the information is accurate and does not update or remove the information, you can request the credit reporting company to include a statement explaining the dispute in your credit file. This statement will be included in future reports and provided to whoever requests your credit report.

Is The Credit Reference Agency To Blame If There Is An Error

The three credit reference agencies, Experian, Callcredit and Equifax provide lenders with your credit report if you apply for a product with them.

This gives them plenty of power of your ability to get a mobile phone contract, credit card, mortgage and much more.

As a result, having an error free credit report is absolutely important, as any mistakes could damage your credit score.

Read Also: Can A Closed Collection Account Be Reopened

Wait Up To 45 Days For The Credit Bureau Or Furnisher To Investigate And Respond

The credit bureau generally has 30 days after receiving your dispute to investigate and verify information with the furnisher. The credit bureau must also report the results back to you within five days of completing its investigation.

If you dispute the error with the information furnisher, that company must also report the results of its investigation to you. It also typically has 30 days to investigate. But if the furnisher stands by the accuracy of the information it reported, it wont update or remove the error.

One more thing to note is that either the credit bureau or the furnisher may decide that your dispute is frivolous. This generally happens when youve submitted incorrect or incomplete information on the dispute, but can also occur if youve tried to contest the same item multiple times without any new information or if youve attempted to claim that everything on your credit report is incorrect without proof.

If the bureau decides that your dispute is frivolous, it doesnt need to investigate it further as long as it communicates that to you within five days, along with the reasoning for deeming the dispute frivolous. If your original dispute was labeled frivolous, you can try to resubmit a dispute with updated materials.

How Debt Settlements Work

As you know, your is a snapshot of your financial past and present. It displays the history of each of your accounts and loans, including the original terms of the loan agreement, the size of your outstanding balance compared with your credit limit, and whether payments were timely or skipped. Each late payment is recorded.

You can negotiate a debt settlement arrangement directly with your lender or seek the help of a debt settlement company. Through either route, you make an agreement to pay back just a portion of the outstanding debt. If the lender agrees, your debt is reported to the as “paid-settled.”

While this is better for your report than a charge-offit may even have a slightly positive impact if it erases severe delinquencyit does not bear the same meaning as a rating that indicates that the debt was “paid as agreed.”

The best-case scenario is to negotiate with your creditor ahead of time to have the account reported as “paid in full” . This does not hurt your credit score as much.

Also Check: Synchrony Bank Ntwk

If Your Credit Reports Contain Errors Or Outdated Information Heres How To Dispute Those Items With The Credit Reporting Bureaus

By Amy Loftsgordon, Attorney

A “credit report” is a detailed record of how you’ve managed your credit over time. Credit reporting agencies, like Equifax, Experian, and TransUnion, collect data from creditors, lenders, and public records to produce the reports. The agencies then sell the reports to current and prospective creditors, and anyone else with a legitimate business need for the information. For example, lenders use credit reportsor the that results from the data in itto help them decide whether to grant you credit and, if so, under what terms. The better your credit report, the more likely your credit request will be granted, and the lower your interest rate will be. Many landlords, employers, and insurance companies will also consider your credit history when making a decision.

So, your credit report is either a valuable asset or a liability, depending on its contents. The Fair Credit Reporting Act requires credit reporting agencies to adopt reasonable procedures for gathering, maintaining, and distributing information. It also sets accuracy standards for creditors that provide data to agencies. Even with these safeguards, credit reports often have errors and inaccuracies.

In this article, you’ll learn:

How Do Zip Pay And Afterpay Work

Essentially, you can purchase goods or services and receive them instantly, then pay the account off over four fortnightly instalments. IFPPs dont charge sign-up fees, and there are no interest charges .

As soon as the transaction goes through, your contract with the retailer is complete Lieu explains they are paid in full by Afterpay or Zip Pay at the time of the transaction, and your payment contract is now entirely between you and your IFPP.

Zip Pay offers three different credit limits: $350, $500 and $1,000, while Afterpay has a limit of $500 for debit card purchases and an account opened with a credit card will be assessed based on your limit and credit history.

To apply, you can log onto their website and fill out an online form. Youll need to allow them to look at your Paypal, social media or bank account to verify your identity to make sure you are who you say you are. Subject to approval, sign-up takes only seconds, after which you can complete your purchase and pay for it later.

Some online stores will allow you to sign up on the spot and then at the checkout, you can select Zip Pay or Afterpay for payment method and answer a few quick questions. Once youve been approved, you can continue to use your account anywhere that accepts the payment platforms.

Read Also: Does Capital One Report Authorized Users To Credit Bureaus

How Much Will Credit Inquiries Affect My Score

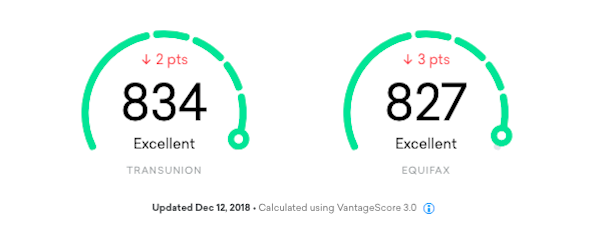

The impact from applying for credit will vary from person to person based on their unique credit histories. In general, credit inquiries have a small impact on your FICO Scores. For most people, one additional credit inquiry will take less than five points off their FICO Scores.

For perspective, the full range for FICO Scores is 300-850. Inquiries can have a greater impact if you have few accounts or a short credit history. Large numbers of inquiries also mean greater risk. Statistically, people with six inquiries or more on their credit reports can be up to eight times more likely to declare bankruptcy than people with no inquiries on their reports. While inquiries often can play a part in assessing risk, they play a minor part are only 10% of what makes up a FICO Score. Much more important factors for your scores are how timely you pay your bills and your overall debt burden as indicated on your credit report.

You May Like: How To Get Credit Report Without Ssn

Mistake #1: Paying Debt Collectors

It may sound counterintuitive, but paying a debt collector can cause unforeseen damage. If, for example, you have old debt that has outlived the statute of limitations, making a payment on that debt could update the debt. If you are unsure about the validity or status of the debt, its important not to pay until and unless the debt collector proves the debt is legit and current. Its important to remember that debt collectors are experts at trying to frighten you into paying up. Dont pay based on anything verbal. Written communication is the only acceptable form of communication.

Also Check: Does Titlemax Report To Credit Bureau

You Still Need To Keep Your Bnpl Spending Under Control

They arent called buy now, pay never platforms. Theyre called buy now, pay later for a reason, and that later part always comes due unless you want to attract late fees or have your account suspended. According to an ASIC review, more than half of BNPL users admitted to spending more than they otherwise would, and one in six have become overdrawn, delayed other bill payments, or borrowed money as a result of over-commitment through BNPL platforms.

Typically if an individual is using a BNPL product for micro-purchases say under $200 this would likely be an early warning sign that an individual may be suffering from potential cash flow pressure strains, Mr Jamieson said.

The other aspect is with the BNPL products initially it does provide an artificial boost short term with your cash flow.

However, as these micro-purchases build on top of each other, mid to longer-term we find that the cash flow position is likely to start to deteriorate and suffer over the burden of these payments as time goes on if they are not managed properly.

Can I Cancel A Dispute With Equifax

You may not have the option to call for disputes that show up on your Equifax report, as some sources say you’ll need to write a letter requesting the dispute be removed. If you’d still like to give customer service a try, some reports suggest asking for the Executive Consumer Service department may be successful.

You May Like: Aargon Agency Complaints

Fixing Errors In A Credit Report

Anyone who denies you credit, housing, insurance, or a job because of a credit report must give you the name, address, and telephone number of the credit reporting agency that provided the report. Under the Fair Credit Reporting Act , you have the right to request a free report within 60 days if a company denies you credit based on the report.

You can get your credit report fixed if it contains inaccurate or incomplete information:

- Contact both the credit reporting agency and the company that provided the information to the CRA.

- Tell the CRA, in writing, what information you believe is inaccurate. Keep a copy of all correspondence.

Some companies may promise to repair or fix your credit for an upfront fee–but there is no way to remove negative information in your credit report if it is accurate.

Review The Claim Results

Reporting agencies and lenders usually take around 30 days to investigate disputes. Once they make a decision, they must notify you within five days of completing their review. The notice will inform you if the disputed item was found to be inaccurate or not.

If the disputed information was, in fact, inaccurate, the bureau must update or delete the item. They should include a free copy of your file if the dispute results in a change.

If the bureau or lender considers the disputed information isn’t a mistake, you can file an additional claim. Review your initial claim for any errors and correct those. If possible, you should include additional documents to support your request as this can help the bureau evaluate any data it might have missed the first time around.

Read Also: Get Repo Off Your Credit Report

How To Remove Negative Items From Your Credit Report

First, it’s important to know your rights when it comes to the information in your credit history.

Under the Fair Credit Reporting Act , credit bureaus and lenders must ensure that the information they report is accurate and truthful.

This means that, if you find mistakes in your , you have the legal right to dispute them. And, if the information disputed is found to be incomplete or erroneous, the bureaus are obligated to remove it from your record.

Some common credit report errors include payments wrongly labeled as late or closed accounts still listed as open. It’s also possible for your report to include information from someone else, possibly someone with a similar name, Social Security number, or identifying information.

Bear in mind that correct information cannot be removed from your credit report. So, if your score is being dragged down by accurate negative information, youll need to repair your credit over time by ensuring you make payments on time and decrease your overall amount of debt.

Here are some tips to help you repair your credit history: