How Do Collection Reports Impact Your Credit Score

While a collection report usually causes serious damage to your credit score, how much it impacts it depends on which credit scoring model you use to calculate your score. It also depends on whether the collection account is paid or unpaid. For example, FICO Score 9the latest version of the FICO credit scoring modeldoesnt report paid collection accounts.

Earlier versions of this credit scoring model, however, do include paid collection accounts. If a lender uses an earlier model to assess the likelihood you can repay a loan, its likely that it will see a lower credit score if you have a paid collection account listed on your credit reports.

Ask The Collection Agency To Validate The Debt

If you cant find inaccuracies on your credit reports, write to the collection agency and ask it to validate your debt.

Under section 809 of The Fair Debt Collection Practices Act, collection agencies are required to validate debts they are attempting to collect, if you request that they do so.

The main issue here is that you have only 30 days to make the request after the collection agency first contacts you.

If they are unable to validate the debt, you can ask them to remove it from your credit report.

Q How Do I Add A Potential Fraud Alert To My Credit File

A.If you think you may be a victim of fraud but there has been no reported misuse of your credit or no confirmed misuse of your personal information, you can place a Potential Fraud Alert on your credit file. If, for example, you’ve lost a purse or wallet, placing a Potential Fraud Alert will tell potential lenders that you may be a victim of fraud and provide them with your contact phone number.

- A Potential Fraud Alert can be placed on your credit file.

- An alert can also be placed on your Social Insurance Number .

- A Potential Fraud Alert on your credit file will remain in place for 6 years unless you request to have the alert removed earlier.

- An alert on your Social Insurance Number will remain in place for at least 1 year.

- If fraudulent misuse of your personal or credit information is confirmed, please contact us by phone or in writing to add a Confirmed Fraud Alert to your credit file.

There are three ways you can add a Potential Fraud Alert to your credit file:

- Online: to visit our self-service website. To promote our online Potential Fraud Alert service, sign-up is free for a limited time.

- Over the telephone: call 1-800-663-9980 and select option 3 to use our Interactive Voice Response system to place your alert. Please note that SIN protection is not available through the IVR.

- In writing: Click Here for additional information.

Also Check: Syncb/zulily Credit Card

Hold Onto Your Oldest Credit Cards

Tera:

And Ilan, what if youve reviewed your credit file and your credit score is lower than youd like, what now? What steps do people need to take that want to higher their credit score, or want a higher credit score?

Ilan Kibel:

So, its basically, as weve been saying, its being diligent on your credit and making sure youre managing it properly. Youre paying your cards off. There are things that will affect the credit score. Some people look and say, I got too many credit cards. Im going to go and close credit cards. So those things are actually going to impact you if youll end up closing your oldest credit card, as Mike said earlier. And we were discussing earlier is credit history is important. And most probably one of the highest factors in calculating your credit score.

Dispute After 7 Years

According to the Fair Credit Reporting Act , past-due accounts can only remain on your credit report for seven years from the first date of delinquency. Sneaky collectors often try to re-age a debt, making it look like the account became delinquent later than it did. This re-aging keeps the debt on your credit report longer.

If the seven-year reporting period is up , dispute the debt from your credit report. Any proof you have regarding the first date of delinquency will strengthen your dispute.

Recommended Reading: Can I Buy Appliances With Affirm

Ways To Remove Negative Items From Your Credit Report

Your credit report almost always has a huge influence on the financial aspect of your life and if your credit report is full of negative items like closed credit accounts, overdue bills, repossessions, and foreclosures, you may have some serious issues in your financial life. If you have a bad credit score, your eligibility for car loans, apartment rentals, and even job opportunities can be seriously damaged.

But the good news is, theres hope! Even if you have bad credit, there are some basic steps that you can take to remove negative items from your credit report, and start your journey towards better financial health.

In this article, Ride Time will take a look at the 5 most common ways that you can get negative items removed from your credit report, so that you can start rebuilding your credit today!

Q What Is A Credit Scorea A Credit Score Is A Statistically Derived Prediction Of An Individuals Credit Risk At A Particular Point In Time Credit Risk Is Typically Defined As The Likelihood Of An Individual Becoming Seriously Delinquent Within A 12

*Quebec Residents:

In order to comply with the Quebec Credit Assessment Agents Act effective February 1, 2021, consumers who reside in the province of Quebec are entitled to see their credit score and score factors on their consumer disclosure. Therefore all consumer disclosures issued to Quebec residents have a score and score factors integrated as part of the consumer disclosure.It is important to regularly review your own credit score to understand how you may be viewed by lenders and other businesses when submitting applications for credit products and services. Get UNLIMITED access to your Credit Score with TransUnion Credit Monitoring.

A credit score is:

Q. Once my credit report is updated, how long before my score is updated?A. Credit scores are calculated when requested by a lender based on the most current information available on your credit file.

You May Like: 641 Credit Score Credit Card

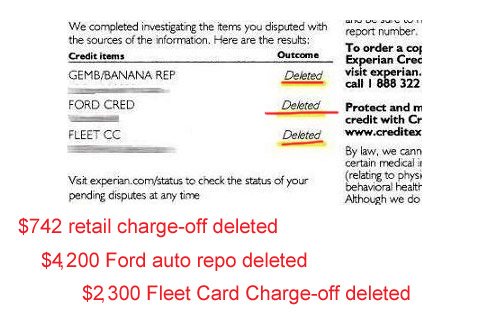

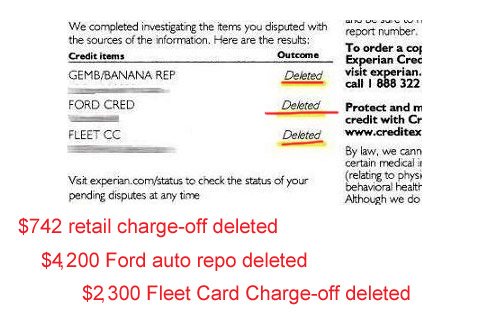

How To Remove Collections From Your Credit Report Without Paying

Here is an actual letter sent by one of the credit reporting agencies of collections that they deleted from a credit report:

Removing collections from your credit report can raise your credit score significantly. Its often the case that there are errors on collections accounts.

So its important to get a copy of your free credit report from each of the three major credit bureaus at AnnualCreditReport.com and check them thoroughly. It is not uncommon for records to be mixed up because they get passed back and forth so often among debt buyers.

Your collection accounts may not have the right amount, the right date, or include any number of other mistakes that creditors dont bother to fix. You may also have instances of late payments appearing that werent actually late.

Debt collectors dont care about what they do to your credit. They only care about what it takes to get you to pay up, and they are hoping that you dont realize that the law is on your side!

How Long Does It Take Before A Bill Goes To Collections

There’s no set time period for creditors to send your debt to collections. Once you miss a payment, you’re considered delinquent, but most creditors will make several attempts to contact you and work with you to bring your account back into good standing before they send you to collections. The more you can communicate with your creditors, the better your chances are of keeping collections off your credit report.

Also Check: How Often Does Capital One Report To The Credit Bureaus

Dispute If It’s Not Your Collection

If it’s not your debt, you’re not required to pay it, and collectors aren’t allowed to list it on your credit report. Dispute the error with the credit bureau. Report the collections account and ask to have it removed from your credit report. Provide copies of any evidence you have proving the debt doesn’t belong to you.

Even if the debt belongs to you, that doesn’t mean the collector is legally able to collect from you. If the debt collector first contacted you within the past 30 days, you can request debt validation. This process requires the collector to provide proof that you owe the debt. If the collector cant validate the debtor they do not respond to your requestthe debt has to be removed from your credit report.

Rehabilitate Your Canada Student Loan

If your loan is in collection, Contact the CRA to:

- see if you qualify to have your federal student loan brought up to date

- make payments equal to 2 regular monthly payments and choose one of the following options:

- pay off all outstanding interest on your loan, or

- add all unpaid interest to the balance of your loan

Once you make your payments, contact the NSLSC. You should receive a new repayment schedule within 1 month.

Read Also: Aargon Collection Agency Bbb

Negotiate A Pay For Delete Settlement

If you still havent settled the debt, you can use this to your advantage. You can send your creditor a letter asking them to remove the account and in exchange, youll pay the account in full.

Before requesting a pay for delete agreement, you should be sure that you have the funds to pay the debt in full or this opportunity will be wasted even if they agree. And if Capital One does agree to a delete for pay arrangement, make sure you get this down in writing.

Further Resources And Help

The best defense against collection services is to know your rights! And while there are general rules that collection agencies across Canada must abide by, they do vary slightly province to province. If you would like to learn more about specific rules around debt collections for your province or territory, check out the Office of Consumer Affairs .

If you have questions or concerns regarding the actions undertaken by a collection agency, you can also contact your provincial or territorial consumer affairs office directly. For a full list, check out the Canadian Consumer Handbook.

If your debt has you feeling overwhelmed and you want to stop collection calls, book a free debt counselling session with Credit Canada and one of our certified, non-profit can give you all your best options for how to deal with debt collectors when you cant pay .

At Credit Canada, weve been helping people learn how to manage debt for over 50 years, and we can make the phone calls stop. Contact us today at to learn more.

Leave a Comment

Budget Planner + Expense Tracker

Easy money management is possible with our all-in-one budgeting template. Take the first step towards achieving your money goals by downloading this easy-to-use tool!

Don’t Miss: What Credit Report Does Chase Pull

Q How Do I Add A Fraud Alert To My Credit Report

A. Please contact the Fraud Victim Assistance Department:For English speakers in all provinces except Quebec, please contact us between the hours of 8:00 a.m.-8:00 p.m. ET at 1-800-663-9980For French speakers in all provinces and English speakers in Quebec, please contact us during the hours of 8:30 a.m.-5:00 p.m. ET at the following phone numbers: 1-877-713-3393.The statement advices that creditors viewing your report contact you before making a decision to extend credit based on the information in your credit report. The protective statement is applied to your credit file and remains for 6 years, however if any time you wish to have the statement removed, we require a written request with two pieces of acceptable identification to do so.

How A Credit Bureau Reporting Collection Agency Can Help Businesses Collect Debt In Canada

For collection agencies that report debtor accounts to the Credit Bureaus of Canada, collections can be considerably easier. Once an individuals or a businesss credit report indicates that a collection agency has been assigned to collect on it, there is a substantial negative impact on its credit score.

In many cases, a debtor will want to avoid this impact by paying the debt before the report is initiated, as failure to do so can make it impossible to obtain a mortgage, line of credit, auto loan or other financing.

Once the debt is reported to a credit bureau, the barrier to obtaining credit will persist until the collection agency reports the debt to the credit bureau as paid. Still, even after the paid-up collection is reported to the credit bureau, in Canada it generally takes six years before the individual or businesss credit score impact is fully restored. That being said, a paid debt looks much better to any lender than an unpaid one, and it is important to any debtor that the account is paid promptly so the restoration period can begin. Check out this article about .

Recommended Reading: Navy Federal Auto Loan Reviews

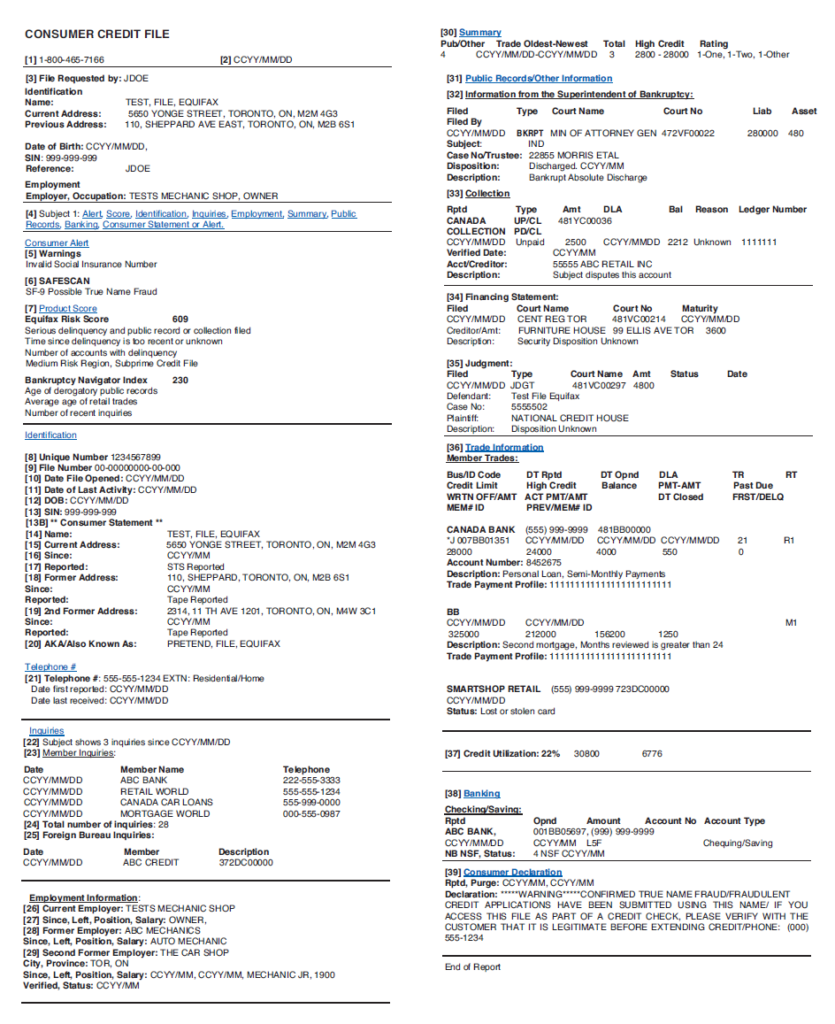

Why Check Your Credit Report

Your credit report is a record of how well you manage credit. Errors on your credit report can give lenders the wrong impression. If there’s an error on your credit report, a lender may turn you down for credit cards or loans, or charge you a higher interest rate. You may also not be able to rent a house or apartment or get a job.

Errors can also be a sign that someone is trying to steal your identity. They may be trying to open credit cards, mortgages or other loans under your name.

Take a close look at your credit report at least once a year to see if there are any errors.

Paying Your Debt Once It Has Been Transferred To A Collection Agency

If the debt is yours and the amount is correct, paying the full amount you owe will resolve the issue.

When repaying your debt:

- always get a receipt for any payment you make

- only deal with the debt collector who contacted you to make payments

- dont contact the creditor that lent you money, as this might create confusion

If its not possible for you to pay the full amount:

- explain why to the debt collector

- offer an alternate method of repayment, such as monthly payments

- follow up in writing

- include a first payment to show your commitment to paying back the debt, if possible

Also Check: Cbna Thd Credit Inquiry

When To Dispute With The Creditor

If the credit bureau has done its investigation and has verified with the creditor that the account was within the credit reporting time limit, you should now dispute with the lender that listed the negative information. Your dispute letter will look very much the same. State that your credit report shows an inaccurate delinquency date for the account. Give the true date of delinquency if you have it. You may be able to get the delinquency date from an old billing statement, past due notice, or previous credit report if you saved any of these.

Just like credit bureaus, the business is required to investigate and respond to your dispute within 30 days and have the credit bureau remove the account from your credit report.

Will Paying Off A Collection Improve Your Credit Score

Actually, this is a common misconception. The fact is, paying off a collection account will not improve your FICO score. Collection agencies and debt settlement companies will tell you the opposite because they want your money. When you pay off a derogatory account, the balance will be reported as paid, but your credit score will not increase.

The number of collection accounts you have, regardless of the amount owed, counts against your credit rating the same. The older these accounts get, the less impact they will have on your score, but paid or unpaid, it doesnt matter.

The only way you can increase your credit score is by having the collection completely removed from your credit report.

You May Like: Procedural Request Letter To The Credit Bureaus

What A Debt Repayment Agent Or Agency Cannot Do

A debt repayment agent or agency cannot:

- charge any fee for an NSF cheque unless the agency has disclosed in writing prior to the submission of the cheque that a fee will be charged

- make any arrangement with you to accept a sum of money that is less than the amount of the balance due to a creditor as a final settlement without the consent of the creditor

- give any false or misleading information including references to the police, law firm, credit history, court proceedings, lien or garnishment

- lend you money to pay your debts

- offer to pay or give you any other form of compensation for entering into a debt repayment agreement

- collect any fee for referring or helping you get an extension of credit from a lender, creditor or service provider

- fail to provide a receipt for all cash transactions or payments made in person or at your request

- discuss your debt or the existence of your debt with any person except you, a guarantor of the debt, your representative or the creditor of the debt

- make a claim for breach of contract if you cancel the repayment agreement

More information is available in the Bill Collection and Debt Repayment tipsheet.

Q Does Adding A Fraud Warning Prevent Information From Updating To My Credit File

A. A fraud flag does not prevent changes from being made to your file without your authorization. In Ontario, the legislation mandates that financial institutions upon receipt of a fraud warning, take reasonable steps to identify the consumer that they are entering into specific transactions with. These reasonable steps may include contacting the consumer by phone or other steps, as determined by each financial institution. If you wish to monitor changes to your credit file, we recommend a visit to our website at www.transunion.ca for more information about our Credit Monitoring product. Please note that there is a fee for enrolling in this service.

You May Like: Does Affirm Show Up On Credit Karma