My Student Loans Were Just Paid In Full Will This Improve My Credit Score

-SLQ

Dear SLQ,Paying off your student loans is a great accomplishment. Once your lender notifies the credit bureaus that the loans are paid in full, you will see them updated to reflect that on your credit reports. How this change will impact your credit scores can depend on several factors, such as your account history prior to paying off the loans and your overall credit situation. If your account is in default when paid off, you may see an increase in scores, but its also possible to see a small dip in scores after paying off a loan. This is especially true if there are no other active installment loans in your credit history. However, this dip is usually temporary.

Collection Agencies Dont Always Play By The Rules

Collection agencies can sometimes be pushy, and some may even violate the Fair Debt Collection Practices Act, which prohibits debt collectors from using abusive or deceptive practices in an attempt to collect from you.

If you suspect youre being harassed or treated unfairly, its important to know your legal rights. We recommend consulting with a legal professional as a matter of course, but you can start by checking out our guide to your debt collection rights.

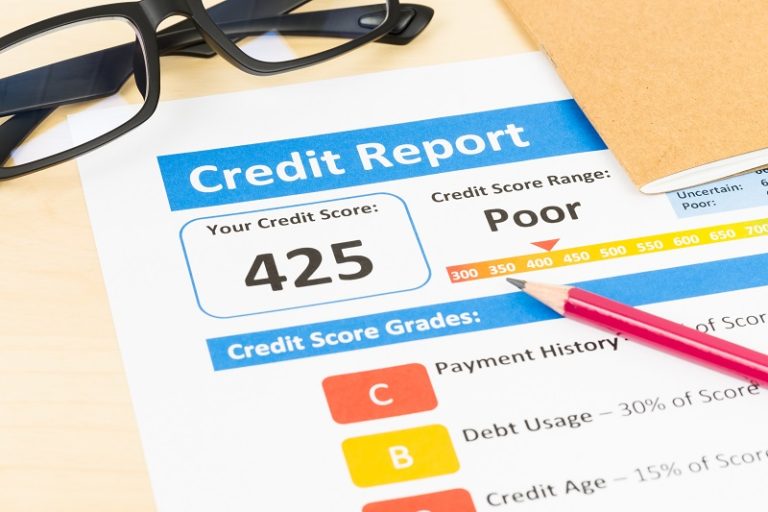

How Long Does Information Stay On Your Credit Report

The length of time that information stays on your credit report depends on the type of information. Here’s a brief list of items and how long they will stay on a credit report.

- Inquiries remain two years from the date of the inquiry. However, the impact of inquiries on credit scores diminishes rapidly. The impact to scores starts to fade after a few months. While the inquiries will still show in the report, FICO® excludes inquiries from the score calculation after 12 months.

- Late payments remain seven years from the original delinquency date of the debt.

- Collection accounts remain for seven years from the original delinquency date of the original account. They are treated as a continuation of the original debt.

- Bankruptcy can remain on your credit report for up to 10 years, depending on the chapter filed.

The Fair Credit Reporting Act specifies how long information can remain on a credit report. You can find a more comprehensive list of timeframes and explanations of them by learning more about when negative information is removed from a credit report. You can also learn about how long some of the most common types of information remain on your credit report.

Check out the scope to hear answers to all the questions asked:

Do you have questions about credit?

How to Unfreeze Your Credit Report

Resources

Get the Free Experian app:

Experian’s Diversity, Equity and Inclusion:

Also Check: Can You Have A Credit Score Of 0

Lawsuit Or Judgment: Seven Years

Both paid and unpaid civil judgments used to remain on your credit report for seven years from the filing date in most cases. By April 2018, however, all three major credit agencies, Equifax, Experian, and TransUnion, had removed all civil judgments from credit reports.

Limit the damage: Check your credit report to make sure the public records section does not contain information about civil judgments, and if it does appear, ask to have it removed. Also, be sure to protect your assets.

How Many Points Will A Hard Inquiry Cost You

According to FICO, one new inquiry will generally lower a credit score by less than five points. As that inquiry grows older, the impact on your score should be less until it no longer counts at all. Of course, the real credit scoring process is a bit more complicated when you break it down.

Hard credit inquiries dont count toward your credit score calculation nearly as much as other factors. With FICO scoring models, for example, credit inquiries influence 10% of your credit score. By comparison, your payment history is worth 35% of your FICO Score. Hard inquiries matter even less under VantageScore credit scoring models. VantageScore calculates just 5% of your score based on hard inquiries.

Individual credit inquiries dont have a specific point value across the board. For example, you cant say that a new hard inquiry will lower your credit score five points. Thats not how credit scoring works.

Instead, a credit scoring model considers the total number of inquiries that appear on your credit report along with the age of those inquiries. The rest of your credit information matters too. A new hard inquiry might have a bigger score impact for people with little credit history versus those with older, more established credit reports.

Also Check: How Many Years Collection On Credit Report

If You Want To Get Out Of Debt Entirely

Repayment

When student loans default, the full amount owed becomes due immediately. If you can afford that, you can pay off your loans and be done with your debt. Of course, that wont be possible for most borrowers. You may be able to negotiate a student loan settlement for less than you owe, but dont expect big savings.

Dont take on a personal loan to pay your student loans even if theyre in default. Personal loans typically carry higher interest rates than student loans. Explore other remedies that wont put you in more debt.

You can discharge defaulted student loans via bankruptcy, but federal student loans are trickier to get rid of through this process than other debts. Private student loans may be easier to discharge in bankruptcy.

Make sure bankruptcy is right for you because it has a long-term effect on your finances. If you go this route, look for a bankruptcy attorney who specializes in student loans.

Fraud Alert: Unauthorized Hard Inquiries Mean Trouble

But if you dont recognize the credit pull, someone could be applying for new credit on your behalf, using your personal information, without your knowledge.

If you didnt initiate the credit check, write a letter to the lender who checked your credit. Insist that it removes the unauthorized inquiries from your credit report with all three credit reporting agencies right away.

Make sure you submit this request in writing, and send the dispute letter via registered mail to make sure it arrives.

Meanwhile, youll also want to dig deeper to search for proof of identity theft. If youve been a victim of this kind of fraud, call the police, notify the credit bureaus, and start changing passwords on your bank account and other sensitive accounts.

Don’t Miss: Does Checking Credit Score Affect Credit Rating

There Are More Important Factors To Your Score

Its smart and prudent to limit how often you allow others to access your credit reports, but if you want to earn and maintain solid credit scores, there are more important factors you should pay attention to as well.

For example, your payment history is worth 35% of the points in your credit scores. Which is why its always in your best interest to make sure you pay all of your credit obligations on time.

Your is another major factor that influences your credit scores. Maintaining lower credit card balances will lower your credit card utilization ratio and, by extension, help you improve your credit scores.

Finally, its important to keep an eye on your credit reports from all three of the credit reporting bureaus. You should check them often and review them for errors. If you find mistakes, be sure to dispute them with the appropriate credit bureau so your credit score will not be penalized as a result of incorrect information.

Check Your Credit Reports For Free

The first step is to get your credit reports from each of the three credit bureausEquifax, Experian and TransUnion. Often, the same information is recorded on all three, but not always, and thats why its important to check all three.

You can typically pull your credit reports for free once per year on AnnualCreditReport.com. However, due to Covid-19, you can order free weekly credit reports until April 20, 2022.

Don’t Miss: What Credit Score Does Credit Karma Use

How Long Does Credit Information Stay On Your Credit Report

Join millions of Canadians who have already trusted Loans Canada

In Canada, there are two , which means you probably have two credit reports. If you have two credit reports, they will likely be different as some lenders and creditors report to only one bureau, while others report to both.

What To Do If You Dont Recognize An Inquiry On Your Credit Report

Did you know that an estimated 1-in-5 Americans have an error on their credit report that makes them appear riskier to lenders than they actually are?

Its now more important than ever to review your credit report on an annual basis to check for potential discrepancies.

According to Credit sesame Number of inquiries comprises of 10% of your credit score.

But why does this happen? Isnt FICO looking out for us?

The reality is, our credit reporting system is huge. And because of its size, it tends to be less accurate than it could be. The result is what was just mentioned above: millions upon millions of consumers end up with discrepancies on their credit report which should have never been placed there in the first place.

And the worst part is, this can affect your ability to get approved for a loan without you even knowing it .

Jeanne Kelly, a credit expert at Jeannekelly.net, suggests checking your credit at least 3 months before big purchases to give yourself enough time to fix these discrepancies.

So, start first by getting your free credit report.

Once youve done this, skim through to the section called credit inquiries and look it over. Is there anything there you dont notice? Something you for a fact shouldnt be there?

If you do notice something on your credit report that wasnt authorized by you, you have two main options:

Recommended Reading: How To Remove Capital One Charge Off From Credit Report

Why Dont Hard Inquiries Stay On Your Credit Report For More Than 2 Years

The reason hard inquiries dont stay on your credit history for very long is that they mainly predict your financial behavior in the short term. They dont necessarily suggest anything about your long-term borrowing habits.

The way the credit bureaus see it, applying for new credit might be a sign that youre financially struggling . However, the longer you manage your new account responsibly, the less likely this is to be the case, so it doesnt make sense to penalize you for hard inquiries for a long time.

What Is The Difference Between A Hard And Soft Inquiry

When you review your credit reports after applying for a loan, credit card or other form of credit, you’ll likely see the hard inquiry it caused, but you also may see other inquiries, called soft inquiries.

Soft inquiries are often the result of you checking your own credit report, a preapproved offer of credit, or a periodic account review by a company you already do business withbut those aren’t the only events that can cause them. They differ from hard inquiries because they don’t generally reflect an application you’ve submitted for credit, and could even be the result of something like the IRS verifying your identity for your tax refund, for instance. Soft inquiries do not affect your credit scores.

Don’t Miss: How To Gain Credit Score

Why Its Important To Remove Inaccurate Hard Inquiries

If you spot a hard credit inquiry on your credit report and its legitimate , theres nothing you can do to remove it besides wait. It wont impact your score after 12 months and will fall off your credit report after two years.

However, if you spot a hard credit inquiry you dont recognize, its vital to remove it. There are a few reasons for this. First, it means that youre being unfairly penalized for that error, even if it only has a small impact. Second, it could be a sign of fraud, so its important to investigate it further and to get it removed.

Avoid Unnecessary Applications Prior To Applying For Home Or Auto Loan

While a single hard inquiry on your credit report can cause a small, short-term decline in your credit score, it shouldn’t have a major negative impact, especially if you have good credit. Having several hard inquiries for different types of credit in a short time, however, could cause a more significant dip in scores and cause lenders to worry that you are having financial difficulty or that you could become overextended.

If you’re seeking a loan for a big purchase like a home or a car, first get a copy of your and review it. Avoid applying for new credit until you apply for your mortgage or auto loan. And consider signing up for free credit monitoringit will help you stay on top of your credit situation and can also help alert you to signs of fraud or identity theft, including unauthorized hard inquiries.

Recommended Reading: What Affects My Credit Score

Hard Inquiries And Your Credit Score

Hard credit pulls are listed on your credit report. Each pull affects the new inquiries part of your score calculation. So how damaging are they?

The impact of a single inquiry typically isnt that serious. Each new inquiry can shave 2 to 5 off your score.

If you apply for one new credit card or line of credit each year, you may not see a noticeable difference in your score. Generally, your score will rebound within 6 to 12 months.

Multiple inquiries, on the other hand, can wreak havoc with your score, especially if theyre grouped close together.

If you apply for four or five credit cards all at once, you could lose 20 points or more off your score. That could push you out of good credit range and into fair, or even poor, credit territory.

Even if your score doesnt suffer dramatically, you still want to avoid going overboard with credit applications. It sends the signal to lenders that youre desperate, which could lead to denials if you come off as more of a credit risk.

Tip: Theres an exception to the inquiry rule if youre shopping around for a mortgage, car loan, or private student loan. Generally, if the inquiries are within a 14- to 30-day time frame, theyre treated as a single inquiry for scoring purposes.

How Long Does Information Stay On My Equifax Credit Report

Reading time: 3 minutes

Highlights:

-

Most types of negative information generally remain on your Equifax credit report for 6 years

-

Closed accounts that were paid as agreed remain on your Equifax credit report for up to 10 years after they were reported as closed by the lender

-

Hard inquiries may remain on your Equifax credit report for 3 years

When it comes to credit reports, one of the most frequently asked questions is: How long does information stay on my Equifax credit report? The answer is that it depends on the type of information and whether its considered positive or negative.

Generally speaking, negative information such as late or missed payments, accounts that have been sent to collection agencies, or a bankruptcy stays on credit reports for approximately six years. Here is a breakdown of some the different types of negative information and how long you can expect the information to be on your Equifax credit report:

Here are some examples of “positive” information and how long it stays on your Equifax credit report:

- Active accounts paid as agreed. Active credit accounts that are paid as agreed remain on your Equifax credit report as long as the account is open and the lender is reporting it.

- Closed accounts paid as agreed. If the last status of the account is reported by the lender as paid as agreed, the account would stay on your Equifax credit report for up to 10 years from the date it was reported by the lender as closed to Equifax.

Read Also: How To See Your Credit Report

Keep An Eye On Your Credit Inquiries

Remember: Checking your own credit scores is an example of a soft inquiry. And soft inquiries donât impact your credit scores.

Hard inquiries, on the other hand, happen when a lender checks your credit report after you apply for credit. And since hard inquiries do affect your scores, youâll want to control how many âhardâ hits your credit takes.

Monitoring your credit can help you keep an eye on where you stand.

Learn more about Capital Oneâs response to COVID-19 and resources available to customers. For information about COVID-19, head over to the Centers for Disease Control and Prevention.

Government and private relief efforts vary by location and may have changed since this article was published. Consult a financial adviser or the relevant government agencies and private lenders for the most current information.

We hope you found this helpful. Our content is not intended to provide legal, investment or financial advice or to indicate that a particular Capital One product or service is available or right for you. For specific advice about your unique circumstances, consider talking with a qualified professional.

The CreditWise Simulator provides an estimate of your score change and does not guarantee how your score may change.

Consent And Credit Checks

In general, you need to give permission, or your consent, for a business or individual to use your credit report.

In the following provinces a business or individual only needs to tell you that they are checking your credit report:

- Prince Edward Island

- Saskatchewan

Other provinces require written consent to check your credit report. When you sign an application for credit, you allow the lender to access your credit report. Your consent generally lets the lender use your credit report when you first apply for credit. They can also access your credit at any time afterward while your account is open.

In many cases, your consent also lets the lender share information about you with the credit bureaus. This is only the case if the lender approves your application.

Some provincial laws allow government representatives to see parts of your credit report without your consent. This includes judges and police.

Don’t Miss: How To Know My Credit Score