Errors To Look For On Your Transunion Credit Report

According to a study by the FTC, 1 in 5 credit reports contains errors. So, theres a good chance your credit report may include incorrect information. A few issues to be on the lookout for that could be dragging your credit down:

- Accounts you dont recognize

- Incorrect account names and numbers

- Incorrect loan or credit limits

- Issues with payment history

- Unauthorized credit inquiries

- Negative accounts that have hit the 7-year credit reporting timeline mark and should no longer be there

Wait Up To 45 Days For The Credit Bureau Or Furnisher To Investigate And Respond

The credit bureau generally has 30 days after receiving your dispute to investigate and verify information with the furnisher. The credit bureau must also report the results back to you within five days of completing its investigation.

If you dispute the error with the information furnisher, that company must also report the results of its investigation to you. It also typically has 30 days to investigate. But if the furnisher stands by the accuracy of the information it reported, it wont update or remove the error.

One more thing to note is that either the credit bureau or the furnisher may decide that your dispute is frivolous. This generally happens when youve submitted incorrect or incomplete information on the dispute, but can also occur if youve tried to contest the same item multiple times without any new information or if youve attempted to claim that everything on your credit report is incorrect without proof.

If the bureau decides that your dispute is frivolous, it doesnt need to investigate it further as long as it communicates that to you within five days, along with the reasoning for deeming the dispute frivolous. If your original dispute was labeled frivolous, you can try to resubmit a dispute with updated materials.

Start By Reviewing Your Credit Report

To get started, you’ll need to review your to catch any errors. There are three main credit bureaus, each with its own report: Experian, Equifax and Transunion. You’ll need to obtain a credit report from all three, since they all collect information in their own way.

Though the credit bureaus can charge you for a credit report, federal law allows you to obtain your credit reports for free once a year on annualcreditreport.com. Even better, temporary changes to the federal law allow you to obtain up to six free credit reports per year through 2026 by visiting the Equifax website. And all three credit bureaus continue to provide free weekly reports as the pandemic stretches on.

To access your reports, make sure you have your Social Security number ready and follow the steps described on the website. You’ll be able to view or download them directly from the site so you can read them over carefully for errors.

You May Like: Does Qvc Easy Pay Report To Credit Bureaus

Are Credit Report Errors Common

People commonly assume the information on their credit reports is entirely accurate. And if you dont look at your own personal credit report, its impossible to know whats listed there.

According to a study by the Federal Trade Commission , 20% of consumers have an error on one or more of their credit reports. Of these errors, 5% could impact their ability to get credit or a loan or change the loan terms.

Not only do creditors and credit bureaus make mistakes, but its also possible that you have been a victim of identity theft without even knowing it. Thats why its important to review your credit reports regularly.

See also:Best Identity Theft Protection Services for 2022

By law, you are entitled to one free credit report from each of the three major credit bureaus once a year. There are numerous credit bureaus, but Equifax, Experian, and TransUnion are the most recognized and utilized.

Each credit reporting company is independent of the others and may include different information. Creditors arent obligated to report any information to the credit bureaus. Instead, they choose which ones they provide information to.

Wait Up To 45 Days For The Results

After you dispute credit reporting errors with a credit bureau, it typically has 30 days to investigate your claim. It must notify you of the results five days after completing the investigation. However, it can take up to 45 days under the following circumstances:

- Youve submitted a dispute after receiving a free credit report from AnnualCreditReport.com

- During the 30-day investigation window, you submit new materials and documents

Also Check: How To Report A Death To Credit Bureaus

Choosing To Challenge Online Or By Phone

Going through the credit bureaus online dispute system is convenient and fast. Credit bureaus may even encourage you to challenge credit errors online. However, its best to do everything on paper so that you have a written record.

Although you can attach evidence to your online dispute, your best bet is to have a paper trail. This means:

- Mailing a detailed letter via certified mail

- Attaching evidence proving the mistake

- Making copies for your records

Check Your Credit Reports For Updates

It may take some time for your credit reports to be updated. Creditors can take up to 45 days to send a credit bureau new information, according to TransUnion. If the information isnt updated after 45 days, contact the credit bureaus or data furnisher again to see why inaccurate information is still being reported.

Read Also: Does Marriage Affect Credit

Can I Dispute A Credit Card Charge I Willingly Paid For

The short answer is yes, in some circumstances, you can dispute credit card charges you willingly made and paid for. This is in accordance with the Fair Credit Billing Act, which affords consumers some protections regarding their credit purchases. Whether its a billing error or you werent given your goods or services as promised, credit card disputes give people an avenue for recovering their money from purchases.

Determine If You Should Contact The Furnisher As Well

The CFPB also recommends that you contact the company that provided the information to the credit bureau. Companies that provide information to credit bureaus are also known as furnishers. Examples of furnishers include banks and credit card issuers. If the furnishers address is listed on your credit report, send your dispute to that address or contact the company for the correct address.

You can try going directly to the furnisher and asking them to correct their reporting mistake before contacting the credit bureau, says Kevin Haney, a credit bureau expert at Growing Family Benefits. That might save a step, since all the bureau can do in its investigation is communicate to the company that the consumer says its wrong, he says.

But if the error is an identity-related mistake made by a credit bureau, go to the bureau first.

Those are the most likely to get corrected, because the bureau owns the problem so it doesnt have to reach out to anyone, Haney says.

In this case, you should also check with the other major credit bureaus to make sure the identity-related error isnt on their reports as well.

Read Also: How To Fix Delinquency On Credit Report

How Can I Remove Late Payments From My Credit Report

Late payments can stay on your credit reports for up to seven years. If you believe a late payment is being reported in error, you can dispute the information with Experian. You can also contact the original creditor directly to voice your concern and ask them to investigate. If they determine they reported the late payment by mistake, they can contact the credit reporting companies to have it removed.

Review The Claim Results

Reporting agencies and lenders usually take around 30 days to investigate disputes. Once they make a decision, they must notify you within five days of completing their review. The notice will inform you if the disputed item was found to be inaccurate or not.

If the disputed information was, in fact, inaccurate, the bureau must update or delete the item. They should include a free copy of your file if the dispute results in a change.

If the bureau or lender considers the disputed information isn’t a mistake, you can file an additional claim. Review your initial claim for any errors and correct those. If possible, you should include additional documents to support your request as this can help the bureau evaluate any data it might have missed the first time around.

Read Also: How To Get Repossession Off Credit

Gather Materials To Dispute Errors

Your goal is to make it as easy and quick as possible for investigators to confirm that your complaint is valid. Depending on the error, the things you gather to support your case could include:

-

Copies of credit card statements or loan documents

-

Copies of bank statements

-

Copies of birth or death certificates, or a divorce decree

-

If you’ve reported identity theft, include a copy of your FTC complaint or police report.

Dispute Credit Report Inaccuracies:

You may write to the credit reporting agencies with the information you have highlighted with a request for correction/deletion depending on your specific dispute. Mailing your letters certified or return receipt is recommended. Sample disputes letters can be found on page 113 of credit.orgs ebook, Consumer Guide to Good Credit, available for in English and Spanish. You may also dispute some items online at www.annualcreditreport.com.

You May Like: Does Capital On Tap Report To Credit Bureaus

Figure Out Whats Inaccurate

Your credit report should be an accurate reflection of your information and story.

If you see an account you dont know about, inaccuracies on accounts you know youve paid in full or old accounts that shouldnt be on your report anymore, you can dispute those items. Some inaccuracies could be mistakes. For example, perhaps an account of a relative with a similar name, but with junior or senior, is showing on your report. Others could be more nefarious, like identity theft. No matter the inaccuracy, its important that your report is a true reflection of your credit history.

Personal information can and should be updated as well. Its important for lenders to have access to your current information. Updating your phone number or employer and deleting an old address can be done online. If you need to update your name, date of birth, Social Security number or address youll need to send us supporting documents by mail.

Not everything related to your credit report can be disputed. For example, you cant dispute your . Your score is calculated based on some of the information in your report. If your score changed and youre not sure why, you should review your credit report carefully to understand.

What You Shouldnt Dispute

Disputing a credit card charge must be done responsibly. When you file a dispute, if it is approved, the retailer not only loses the sale but incurs an additional cost called a chargeback fee, which can range from $20 to $100. Doing this on purpose to try to score a freebie or because you regret a purchase is considered friendly fraud.

With that in mind, here are some of examples of when you should not dispute a charge:

If a friend or family member made the purchase. Say your kid decides to make purchases on their tablet or places a one-click order on your without your permission. Although you can work with the merchant directly to try to cancel the order or issue a return or refund , you cant dispute the charge because it was technically your fault for not protecting your account.

If you didnt contact the merchant about the issue first. You place a catering order and pay with your credit card, but when the food arrives, theres an item missing and the sandwiches are all wrong. Your first recourse always should be to call the caterer and let them know about the error. If they fail to take action, you can go ahead and file a disputebut you need to give the vendor a chance to make it right first.

If you are disputing a fraudulent charge, call your creditor to report it right away. That way, they can open an investigation, but also freeze your account as soon as possible to prevent further such charges.

Also Check: Credit Score To Qualify For Care Credit

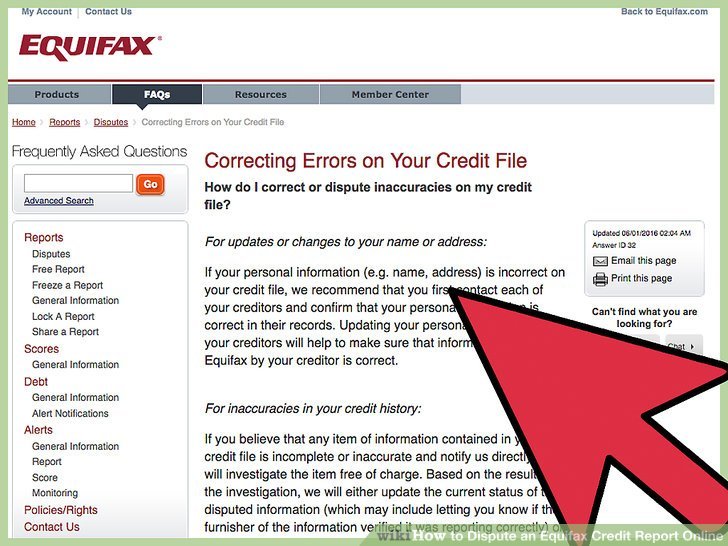

Fixing Errors In A Credit Report

Anyone who denies you credit, housing, insurance, or a job because of a credit report must give you the name, address, and telephone number of the credit reporting agency that provided the report. Under the Fair Credit Reporting Act , you have the right to request a free report within 60 days if a company denies you credit based on the report.

You can get your credit report fixed if it contains inaccurate or incomplete information:

- Contact both the credit reporting agency and the company that provided the information to the CRA.

- Tell the CRA, in writing, what information you believe is inaccurate. Keep a copy of all correspondence.

Some companies may promise to repair or fix your credit for an upfront fee–but there is no way to remove negative information in your credit report if it is accurate.

Some Words Of Advice: How To Dispute Credit Report And Win

Wondering does disputing credit work? Unfortunately, its not always that simplebut there are certainly some things you can do to increase your odds. If you do file disputes with the credit bureaus, you should think about how to word your letter. Im not sure Id go so far as to tell them you want accurate information removed. Id simply ask that they verify whats already being reported.

After you file your dispute, the credit bureaus will contact the furnishing party, normally a lender or a collection agency. These parties are formally referred to as data furnishers or furnishers for short.

Its their responsibility to investigate your claim and get back to the credit bureaus, normally within 30 days, but there are some scenarios when it can take 45 days.

If they confirm the accuracy of the credit reporting, then youll likely have to live with it until the credit bureaus have to remove the item, which normally takes 7 years for the bad stuff.

Don’t Miss: Speedy Cash Open 24 Hours

Checking Your Nationwide Specialty Credit Reports

Several nationwide specialty credit reporting agencies also exist. These agencies keep records on particular types of transactions, like tenant histories, insurance claims, medical records or payments, employment histories, and check writing histories. These agencies must give you a free report every twelve months if you request it. To get a specialty credit report, you’ll have to contact each agency individually.

How to Stop Getting Prescreened Credit Card and Insurance Offers

Under the FCRA, credit reporting agencies are allowed to include your name on lists that creditors and insurers use to make offers to you, even though you didn’t initiate the process. ). The FCRA also provides you the right to opt out of receiving these offers , which prevents the agencies from providing yourcredit file informationfor these offers. ). You can opt out for five years or permanently.

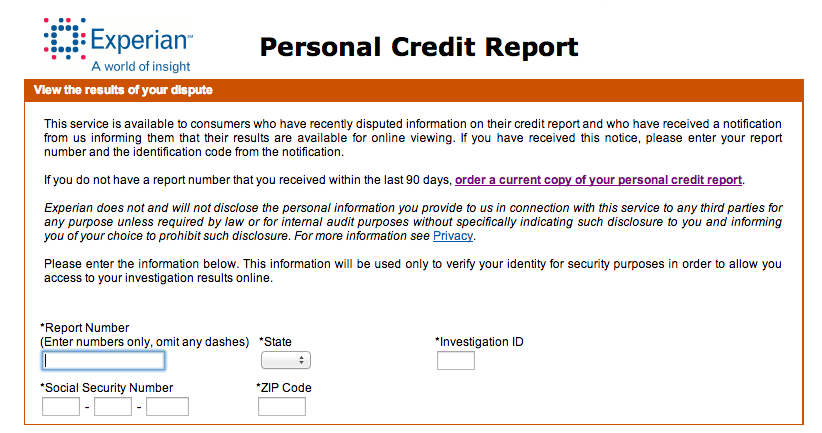

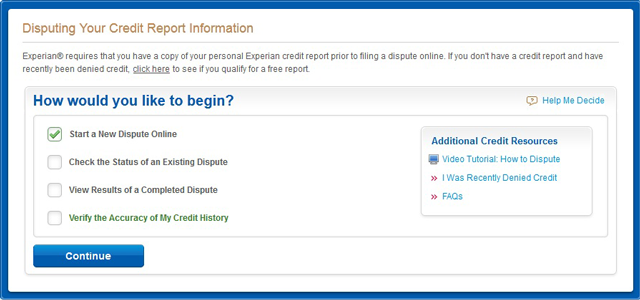

Contact The Credit Reporting Agency

Once youve spotted and confirmed the inaccuracy, you can start a dispute request with the credit reporting agency. TransUnion offers a free online credit dispute service that is the quickest and easiest way to get started. We also have an extensive online FAQ section there to answer your dispute-related questions.

To get started with your dispute online, click Start Dispute and set up an account if you dont already have one. This way you can log in later to check your dispute status or view your investigation results. If youve requested an online dispute, freeze, or fraud alert before with TransUnion, you should already have a username and password you can use. If youve forgotten your username or password, the login page will provide steps to recover your account information.

Once your account is set up and youve logged in, select New Investigation and choose the item you want to dispute. Remember, if you need to dispute multiple items, you should select each item before submitting your request.

After making your selections, youll have the option to upload relevant supporting documents. Examples include court or lender documents that provide specific evidence to prove your claims. Currently, we dont support document uploads for updates to personal information like your Social Security number, date of birth, name or address. If you need to update this type of personal information, please use our phone or mail dispute services.

Don’t Miss: Navy Auto Loans

Why Did My Credit Score Change

Scores can change when information is added or removed from your credit report, like when you apply for credit or miss a payment. Continuing to make on-time payments and keeping balances low may result in a positive impact to your score. While it may seem like closing an account or canceling a credit card could help raise your score, it may temporarily drop when you lose that information on your report. Healthy habits like those you probably used to pay off your debt will continue to help you improve your credit health over time.

What Documents Do I Need To Submit

When you file a dispute, you’ll need to provide some documentation. What you will need to provide depends on what information you are disputing. Here are some examples of the types of documents we may need copies of during our investigation:

Personal information

- One piece of government-issued ID confirming your name, date of birth, and/or address

- Birth certificate

- Document confirming the name and address on the ID

Account information

- Current bank statements with account information

- Letters from a creditor supporting your claim

- Proof that an account was created through or impacted by identity theft

Other information

- Bankruptcy discharge or other court documents

- Release letters from lenders, collection agencies or satisfaction of judgment

Don’t Miss: Usaa Authorized User