What Does A Low Credit Score Mean

A low credit score doesnt mean youll never be able to borrow. Some places might still lend you money, although at a higher interest rate. This is one of the ways youll find your credit score really matters: the better your score, the less you pay on interest.

In other words, a good credit score helps you save money.

What Is The Best Score

Every consumers financial history is unique. There is no magic number that would apply across the board, so you may not need to raise your credit score by 200 points. The top category unlocks the best interest rates and conditions, but reaching it may be impossible or unnecessary depending on your situation and the requirements of the lenders.

In FICO, 800 is when the best terms become available. Lenders do not even price their products within the category. It does not matter if you have 800, 820, or 850 you still reap maximized benefits. However, even 670 may still be good. This figure is much easier to reach by following the personal finance advice on brooksconkle.com.

What Information Credit Scores Do Not Consider

FICO® and VantageScore do not consider the following information when calculating credit scores:

- Your race, color, religion, national origin, sex or marital status.

- Your age.

- Your salary, occupation, title, employer, date employed or employment history.

- Where you live.

- Soft inquiries. Soft inquiries are usually initiated by others, like companies making promotional offers of credit or your lender conducting periodic reviews of your existing credit accounts. Soft inquiries also occur when you check your own credit report or when you use from companies like Experian. These inquiries do not impact your credit scores.

You May Like: Paypal Credit Minimum Score

A Good Credit Score Is In The Eye Of The Beholder

Although the FICO and VantageScore charts above display a general idea of how lenders may interpret different credit score ranges, lenders and other companies can, and often do, differ in their opinions of creditworthiness.

For example, just because youre considered to have a good credit score to an auto dealer doesnt mean a mortgage lender would consider that same score to be a good credit risk. Each lender has their own criteria for credit scoring as well as their own thresholds for a good score vs. a bad score.

How Are Credit Scores Determined

A credit score is a number that indicates your perceived creditworthiness in the eyes of credit rating companies, banks and other financial institutions. If you have a history of paying your bills on time and only using a small percentage of your available credit, you should have a high score. If youve missed bills, filed for bankruptcy, defaulted on loans or dealt with collections, then your score will likely be lower.

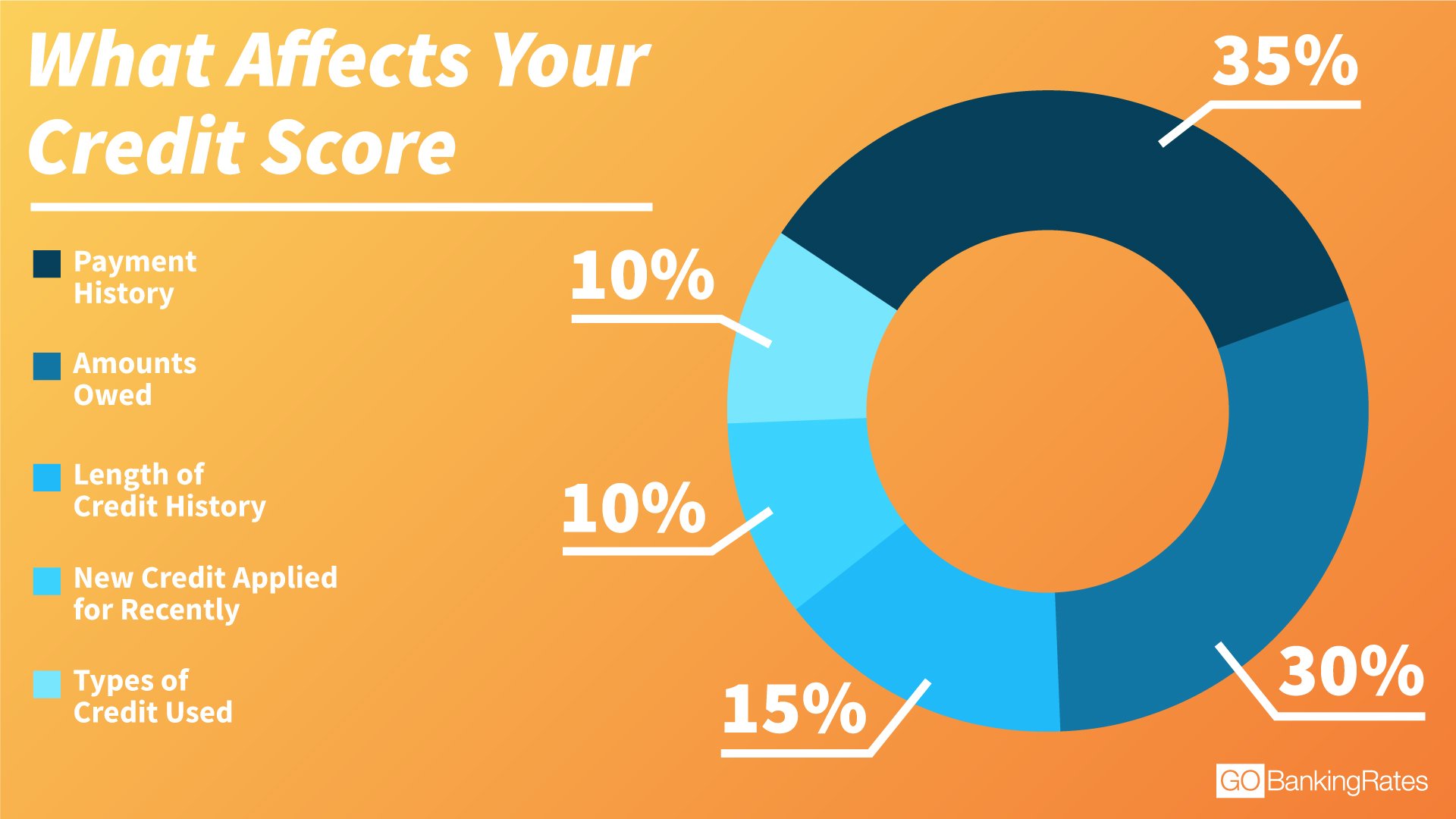

Heres a deeper breakdown of what goes into the creation of your credit score:

- Payment history: 35% of your score

- 30% of your score

- 15% of your score

- New credit applications: 10% of your score

- 10% of your score

The most well-known provider of credit scores is the Fair Isaac Corporation, or FICO. However, each of the three credit bureaus has its own take on your score. This is known as a VantageScore, and it is a modified version of your FICO score thats based on both the credit bureaus scoring models and their own information on your credit history.

There are also different FICO credit scores for bank cards, auto loans and more. Thats why a single person can have several credit scores. Different bureaus may treat credit events or authorized user accounts differently, so you may have excellent credit according to your Transunion credit score, but still be in the good range with your Equifax score.

Read Also: 1?800?859?6412

What Is A Good Credit Score

Reading time: 3 minutes

-

Different lenders have different criteria when it comes to granting credit

Its an age-old question we receive, and to answer it requires that we start with the basics: What is a credit score, anyway?

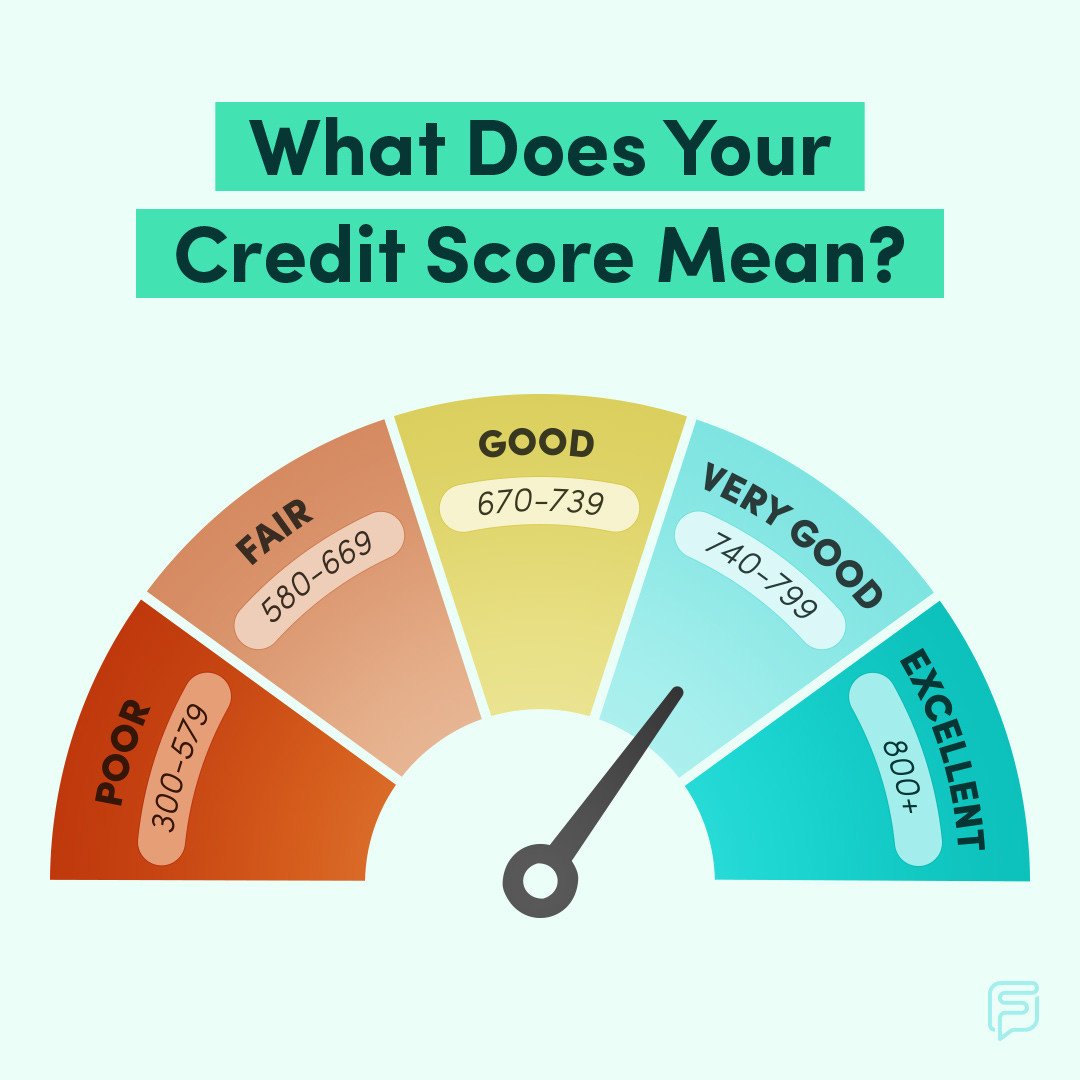

Generally speaking, a credit score is a three-digit number ranging from 300 to 850. Credit scores are calculated using information in your credit report, including your payment history the amount of debt you have and the length of your credit history.

There are many different scoring models, and some use other data in calculating credit scores. Credit scores are used by potential lenders and creditors, such as banks, credit card companies or car dealerships, as one factor when deciding whether to offer you credit, like a loan or credit card. Its one factor among many to help them determine how likely you are to pay back money they lend.

It’s important to remember that everyone’s financial and credit situation is different, and there’s no “magic number” that may guarantee better loan rates and terms.

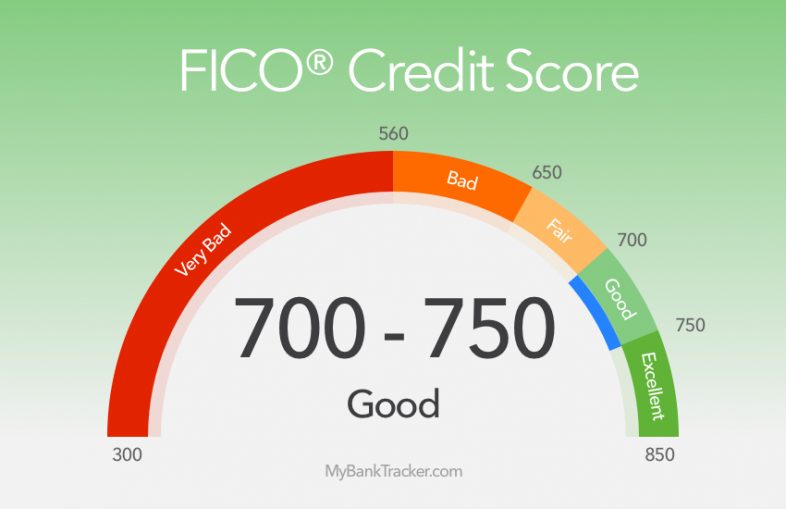

Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair 670 to 739 are considered good 740 to 799 are considered very good and 800 and up are considered excellent. Higher credit scores mean you have demonstrated responsible credit behavior in the past, which may make potential lenders and creditors more confident when evaluating a request for credit.

What Factors Impact Your Credit Score?

Reasons Why Outstanding Debt Spells Bad News For Your Credit Score:

1. It maximises your credit utilisation ratio:

- A good credit utilisation ratio is 30% or lower.

- A high ratio means you are using too much credit and can, as a result, reduce your credit score

2. It makes repayment of future loans difficult:

- If you have outstanding debts, it means that you could already be paying high EMIs.

- Borrowing more loans in the future with outstanding debts can create a major repayment burden and even cause bankruptcy.

Read Also: What Is Syncb Ntwk On Credit Report

What Is A Bad Credit Score

Credit score ranges vary based on the credit scoring model used and the credit bureau that pulls the score. Below, you can check which credit score range you fall into, using estimates from Experian. Take note that the lenders use varies, though 90% pull your FICO score.

FICO Score

- Excellent: 781 to 850

Factors That Can Affect A Credit Score

There are 5 main factors that can affect the calculation of a credit score. If youre interested in improving your credit these are the areas that you should focus on.

History of Payments

This is determined by the payments you have made to lenders or creditors. This ultimately reflects on how frequently you pay your loans or bills on time. Anyone looking to improve their credit scores should always make their payments on time, without fail.

Debt/ Credit Utilization

This shows the amount of outstanding debt a consumer has compared to the amount of available credit they have. For example, if you have a total credit limit of $5,000 and consistently carry a high balance, your credit score may be negatively affected. To help improve your credit scores, pay down your debt and make sure you need your balance to lower than 35% of your available credit.

This factor is straightforward, the longer a credit account has been open, the better it is for your credit scores. If youre considering cancelling a credit card, make sure you cancel a new one and keep the older ones open.

New Inquiries

Every time a potential lender or creditor pulls your credit, your credit score may take a small and temporary hit. If you apply for a lot of new credit within a short period of time, your credit score may drop and other creditors will be able to see that youve recently applied for a lot of credit which they may consider to be a red flag.

Diversity

Loans Canada Lookout

You May Like: How To Get Inquiries Off Your Credit

Monitor Your Credit Report And Score

Checking your credit score right before you apply for a new loan or credit card can help you understand your chances of qualifying for favorable termsbut checking it further ahead of time gives you the chance to improve your score, and possibly save hundreds or thousands of dollars in interest. Experian offers free credit monitoring for your Experian report, which in addition to a free score and report, includes alerts if there’s a suspicious change in your report.

Keeping track of your score can help you take measures to improve it so you’ll increase your odds of qualifying for a loan, credit card, apartment or insurance policyall while improving your financial health.

What Is A Bad Credit Score Range

Bad credit score = 300 549: It is generally accepted that credit scores below 550 are going to result in a rejection of credit every time. If your score has fallen into this range, improving your score is going to take some work.

Filing for bankruptcy can bring a score down to this level. Statistically, borrowers with scores this low are delinquent approximately 75% of the time. But if you continue to make your payments on time, your score should improve. There are certain types of loans, like home loans, that are hard to get with a score in this range, but there are still options for getting a mortgage with bad credit.

Don’t Miss: Does Paypal Credit Report To Bureaus

What Is The Average Credit Score In Canada

While credit scores in Canada range from 300 – 900, the average is around 650, according to TransUnion, though it varies from province to province. Once you’ve reached a credit score of 650 or higher, you’ll be able to qualify for more financial products. A credit score below 650 is going to make it hard to qualify for new credit, and anything you are approved for will likely come with very high-interest rates.

Do you know your credit score? You can use Borrowell to get your credit score in Canada for free. With Borrowell, you’ll get weekly credit score updates, see exactly what’s impacting your credit score, and get personalized tips on how to improve your score. You can also find your free credit score here.

Check out this infographic that shows the average credit scores in Canada:

How To Get Excellent Credit: 5 Expert Tips

1. Always pay on time. Always.

Payment history heavily influences your credit score. In fact, it is the most influential factor for FICO and VantageScore.1 To stay on top of your payments, set up a calendar reminder or enroll in automatic payments. The on-time payment goal applies to all your bills, including utilities, rent and cell phone service.

What if you were late on a payment a few years ago? While late or missed payments can stay on your credit report for seven years, the impact on your credit score decreases over time. Most negative items have little impact on your score after two years2 so be patient, keep making timely payments, and youll soon be on your way to an excellent credit score.

2. Optimize your credit utilization ratio.

is another key piece of your credit score puzzle. Credit utilization measures the balances you owe on your credit cards relative to your cards credit limits. Its calculated on an overall basis .

The general rule of thumb with credit utilization is to stay below 30%.3 This applies to each individual card and your total credit utilization ratio. Strategies for improving your credit utilization ratio focus on reducing the numerator and managing the denominator .

Try one of these techniques to improve your credit utilization ratio:

3. Regularly monitor your credit scores for inaccuracies.

4. Be strategic about taking on new debt and closing accounts.

5. Consider your credit mix.

You May Like: How To Get Credit Report With Itin Number

Why Your Credit Score Matters

There are real benefits to staying on top of your credit score.

Thats because a strong credit score can translate into real perks, like access to a wider range of products and services including loans, credit cards and mortgages. You could also enjoy better interest rates and more generous credit limits. Meanwhile, if your credit score isnt quite where you want it to be, knowing the score is the first step to improving it.

Either way, it pays to know your credit score. Its your financial footprint the way companies decide how financially reliable you are. A higher credit score means lenders see you as lower risk.

What Fico Score Do You Need To Get A Mortgage

A credit rating of 580 is generally considered the minimum acceptable rating for a home loan. At this level, the borrower must qualify for a revolving loan from the Federal Housing Administration. However, you must have a minimum credit rating of 620 to qualify for this type of mortgage.

622 Credit ScoreIs 622 a good credit score?The FICO score ranges from 300 to 850, with an average US credit score of 723.According to Fair Isaac, with a credit score of 700, you are in the low category , which means it depends on other factors such as: B payments, you get the best interest rates. Can be found . A score between 690 and 600 is considered a moderate credit score and many people say that when you are between 650-680 you are high. This mean

Also Check: Credit Inquiries Fall Off

What A Fair Credit Score Means For You:

Borrowers within the “fair” credit score may push interest rates higher for their lines of credit. Borrowers in this range may incur higher charges associated with a loan or line of credit. It may be difficult to obtain a 30-year mortgage at the lower end of this range and you may expect higher interest rates. Auto loan APRs may have higher rates and credit cards may have lower limits and higher APRs.

What Does It Mean If Your Credit Score Is High

Lenders tend to look at your credit score when you apply for credit, such as a credit card. Theyâre looking for someone who will be able to meet the repayments – someone who is low risk.

A higher credit score means your credit report contains information that shows youâre low risk, so youâre more likely to appeal to lenders. For example, if your report shows that you always pay your bills on time, youâll be considered a reliable borrower.

If you have a high credit score, your application is more likely to be accepted. Youâre also more likely to be offered the best interest rates and higher credit limits.

Check your eligibility: See what offers you’re eligible for with your credit score.

Don’t Miss: Is 570 A Good Credit Score

What Is A Good Credit Limit For A Credit Card

Good credit requires a utilization rate of 30% or less, and better yet, 10%. To reach 10% with a combined credit line of $8,000, your balance must be between $800 and $2,400.

Credit to buy a houseWhat is a good credit score to buy a house? These are the credit requirements for the most popular mortgages: Typically: 620 FHA: 500 to 580 VA: Usually low to medium USDA 600, depending on the lender: Usually around 580, depending on the lender.Do I need a good credit score to buy a house?In general, a good credit rating for buying a home is 620 or higher. With a of at least 6

What Exactly Is A Credit Score

A credit score is a three-digit number used by lenders to determine whether you qualify for credit, such as a loan or credit card.

Your credit score is based on your credit report, which is a record of your credit history and how youâve managed your finances in the past. This allows lenders to assess your level of risk when you apply for credit.

Recommended Reading: Does Les Schwab Report To Credit

What Is The Average Credit Score In Canada By Age

Categories

A good credit score is a valuable tool for anyone trying to navigate their financial life. True, making a decent income and saving money are also healthy practices, but a solid credit score is one of the key factors that can put you in the position to get approved for loans and other types of credit products. You can use those products to pay for your childrens education, get married, even buy a car or a house. While everyones financial goals are different, one thing is certain. Its important to learn about your own credit score so you can always keep it in the best shape possible.

It can be tough to predict what your own will look like in the years to come. You could experience debt issues, job loss, or get your finances back on track, no one can predict the future. While its never a good idea to compare your finances to someone elses, it can be beneficial to understand where your credit score should be during different times in your life as well as how that can affect the overall health of your credit.

Factors That Affect Credit Scores

So, you can see credit-scoring models and credit reports are two big factors that determine your credit score. But if you donât know what information from your credit report is being used, itâs not much help.

Here are a few factors the CFPB says âmake up a typical credit scoreâ:

- Payment history: How well youâve done making payments on time.

- Debt: How much current unpaid debt you have across all your accounts.

- A ratio that reflects how much of your available credit youâre using compared with how much you have available. is usually expressed as a percentage.

- Loans: How many loans and what kinds they are, such as revolving credit accounts and installment loans. Sometimes this is called your credit mix.

- How long youâve had your accounts open. But remember, what qualifies as your oldest line of credit depends on whatâs being shown in your credit reports.

- New credit applications: How many times youâve applied recently for new credit. The effect on your scores might be minor, but a lot of new hard credit inquiries could still give a negative impression to lenders.

How Does FICO View Those Credit Factors?

FICO is pretty specific about what it views as the most important credit factors: Payment history makes up about 35% of its scoring. About 30% is based on the total debt. The other primary factors are credit history , credit mix and new credit .

How Does VantageScore View Those Credit Factors?

Read Also: How To Remove A Repossession From Credit Report