Your Credit Card Provider

Many credit card providers also offer cardholders the ability to check their credit scores for free. Oftentimes, these tools include access to view your score history and see what led to recent changes. Some providers also let customers forecast how their scores would react to variables like on-time payments, credit limit increases and taking out a mortgage.

Keep in mind, however, that most providers require cardholders to opt in to this service, so make sure you sign up if you want to access your score.

Heres a look at popular credit card providers with credit score tools.

Free Credit Scoring Website

One of the best ways to check your credit score for free is by visiting a free credit scoring website. These websites typically offer access to your credit report, score and/or credit monitoring and are updated anywhere from weekly to monthly. Theres no fee to sign up for basic credit score updates. However, some websites offer more advanced services for a monthly fee.

How Do I Establish A Good Credit Rating

The easiest way to establish a good credit rating is to pay your bills on time. If you don’t have a credit card, apply for one, and use it responsibly. If you make your minimum payments, you can develop a good credit history. This will have a positive impact on your ability to borrow in the future.

To find out more about establishing credit, talk to a CIBC advisor.

Also Check: Tri Merge Credit

Benefits Of Checking Your Credit Score Regularly

The benefit of checking your credit scare regularly is that you need to know your score if you plan on buying a house, a car or even applying for a credit card or a short term loan.A regular score check affords a lot of benefits, including:

Ensure Your Credit Information is Accurate

Your score reflects the information on your credit report. Check your score regularly to ensure your financial record is current and accurate. If the score is lower than expected, there could be errors in your file. In this case, dispute the issue with the relevant credit bureau.

Rebuild and/or Maintain a Good Credit

Know Your Financial Health

Ignoring your score is just as detrimental as ignoring your physical health. Whether good or bad, it’s important to know where you stand financially. This will push you to take steps to improve your financial position and get out of debt.

Respond to Crucial Issues Quickly

Checking your score frequently informs you of changes to your credit report as soon as possible. For example, if your score falls suddenly, you can easily trace the cause and quickly take the necessary actions to recover your lost points. If you take too long to check your score, you may not be able to narrow down the cause and may have a difficult time recovering.

Is It Safe To Check My Credit Score For Free

Checking your free credit scores on Credit Karma wont affect your credit, and any attempts to monitor your credit with Credit Karma will not appear on your credit reports.

If you want to learn more about how Credit Karma collects and uses your data, take a look at our privacy policy.

You can also read Credit Karmas security practices to learn more about Credit Karmas commitment to securing your data and personal information as if it were our own.

Ready to help your credit go the distance? Log in or create an account to get started.

Don’t Miss: Creditwise Simulator

It Can Affect Your Finances

Financial institutions look at your credit report and credit score to decide if they will lend you money. They also use them to determine how much interest they will charge you to borrow money.

If you have no credit history or a poor credit history, it could be harder for you to get a credit card, loan or mortgage. It could even affect your ability to rent a house or apartment or get hired for a job.

If you have good credit history, you may be able to get a lower interest rate on loans. This can save you a lot of money over time.

How To Check Your Credit Scores

There are a few ways to check your credit scores:

Don’t Miss: Syncb/ppc Credit Inquiry

If The Information On A Credit Reference File Is Wrong

If you think any of the information held on your credit reference file is wrong, you can write to the credit reference agencies and ask for it to be changed. But you can’t ask for something to be changed just because you don’t want lenders to see it.

You can also add extra information about your situation. For example, you can add information if you have had a past debt but have now paid it off. This is called a notice of correction. This might help you if you apply for credit in the future.

Monitor Your Credit Score Monthly

Many organizations offer credit monitoring services which is great if youre concerned about fraud/identity theft or simply want to improve your credit score quickly. While credit monitoring will identify fraud, you wont be able to stop it from happening.

Monitoring also comes at an additional cost. Equifax and TransUnion offer credit monitoring for around $20 per month. Make sure you consider the pros and cons before signing up, as credit monitoring doesnt come cheap. You still get your free report from each credit bureau which will help you stay on top of your credit history, and if needed, you can always pay for instant online access. Ultimately, the choice is yours.

You May Like: Does Affirm Show On Credit Report

Why Is A Good Cibil Score Required

The CIBIL score is the most important determinant of loan approval. There are several reasons why individuals from all walks of life borrow money from the bank. You might come across the need for an education loan if youre a student, a housing loan if you intend on buying a house, and so on and so forth. Maintaining a high CIBIL score can ensure that your loan is quickly APPROVED and help you get the LOWEST INTEREST RATE possible.

Another reason to maintain or increase your CIBIL score is to attain a HIGH CREDIT LIMIT. If youve been consistently paying your dues on time, banks will offer to increase your credit limit as youre a low-risk individual. Banks will also approve higher loan amounts from individuals with a high CIBIL score.

Who Can See And Use Your Credit Report

Those allowed to see your credit report include:

- banks, credit unions and other financial institutions

- offer you a promotion

- offer you a credit increase

A lender or other organization may ask to check your credit or pull your report”. When they do so, they are asking to access your credit report at the credit bureau. This results in an inquiry in your credit report.

Lenders may be concerned if there are too many credit checks, or inquiries in your credit report.

It can seem like you’re:

- urgently seeking credit

- trying to live beyond your means

You May Like: Can A Public Record Be Removed From Credit Report

Who Can Request A Copy

- lenders and creditors

- insurance companies

- landlords

- potential employers

If a person denies you credit or increases a charge or fee and if you request it within 60 days you must be told:

- the nature and the source of the information

- the name and address of the consumer reporting agency reporting the information

How Do You Apply For Your Schufa Score

Once a year, youre entitled to a free Schufa report. To get yours, just fill out the form on their website and provide copies of your passport and registration certificate . You can also order your credit report by calling the Schufa customer service.

It may take a few weeks for you to receive your report. So, what do you do if you need a credit report immediately? Via the ImmobilienScout24 portal, you can get one quickly. You can also request it on-site at participating Postbank and Volksbank branches. For this service, youll be charged a one-time fee of 29.95. Remember to have your account details such as IBAN and BIC with you, since its not possible to pay in cash. Alternatively, you can use the paid service offered on the Schufa website itself. All your credit data is, of course, protected by the European General Data Protection Regulation , so you can rest assured that it wont be shared illicitly.

Getting your Schufa is an essential step in managing your personal finance in Germany, and it can be easy to both know your score and keep it high as long as you take care of your bills.

Also Check: Remove Eviction From Credit

Basics Of Credit Reports And Scores

Your are statements of your . And there are three major bureaus that compile credit reports: Equifax®, Experian® and TransUnion®. Each credit bureau compiles its own credit reports, so your credit reports may be slightly different.

Your are based on the information in those credit reports. Generally speaking, the higher the score, the better. FICO® and VantageScore® provide some of the most commonly used scores. But keep in mind that you have many different credit scores that different lenders use.

As the Consumer Financial Protection Bureau explains, âYour score can differ depending on which credit reporting agency provided the information, the scoring model, the type of loan product, and even the day when it was calculated.â

Why Is Credit Important?

Your because it gives lendersâand othersâa general idea of how financially responsible you are. And many companies use your credit to predict your future financial behaviors.

So the better your credit, the better your chances of qualifying for things like credit cards, loans, mortgages and other credit products. And the better your rates might be.

What Doesn’t Impact Your Credit Score

There are many common misconceptions about what does affect your credit score. “Consumers sometimes focus on things that simply don’t matter to their scores. The most common is information about your wealth,” says Ulzheimer.

“Income, balances in retirement accounts, equity in your home, net worth … anything that defines how much money you have or how much you’re worth are not considered by your credit scores.”

Other factors that don’t affect your credit score include race, religion, nationality, gender, marital status, age, political affiliation, education, occupation, job title, employer, employment history, where you live or your total assets.

Learn more: Can employers see your credit score? How to prepare for what they actually see when they run a credit check

Read Also: Credit Score 779

Top Sources For Free Credit Scores

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

How Does Credit Score Rating Work

At Equifax, we use proprietary algorithms to assess the data found in the report and then give you a credit score rating. Many factors go into producing your credit report however, by making sure your current loan payments are made on time and your loan conditions are met, your credit score can improve over time. Most lenders will have a credit score range that they will approve for loans,and the higher your credit rating, the better your chances of having an application approved.

Having an average may limit your chances of obtaining a loan with some banks and other financial institutions, as they are looking for applicants who have a low-risk credit score. In most situations, the higher your credit score rating, the better your chances of being offered a low-interest-rate loan with the lender of your choice. Banks that deal with mortgages and home loans will target and offer loans to applicants with the best credit score.

You May Like: Minimum Credit Score For Affirm

What Is A Cibil Score

The Reserve Bank of India has authorised CIBIL, which is an acronym for Credit Information Bureau Limited, as a credit agency. The agency is responsible for generating CIBIL scores and reports for individuals based on their credit information. Individual CIBIL scores take into account 6 months of financial data of an individual before scoring them. The score is in three digits and usually lies between 300-900. The closer the score to 900, the better it is. 300 is the minimum score, and you should try maintaining your CIBIL score to at least 750 points, which will benefit you when taking loans as companies provide lower interest rates to such individuals. Paying your Credit Card bills on time and optimizing the credit utilisation ratio are some points you should factor in to maintain a high CIBIL score.

How To Check Your Credit Report

- Check your Experian credit report through their partner website, MoneySavingExperts Credit Club

- Check your Equifax credit report through their partner website, ClearScore

- Check your TransUnion credit report through their partner website,

Its often worth getting a copy of your credit report from all three main CRAs if you havent applied for it before or if you havent checked it for some time.

Thats because they might have different information from different credit providers, although there is quite a lot of overlap between them.

If youd prefer a paper copy of your credit report, you can contact the credit scoring agencies direct:

Find out more about how to get a written copy of your credit report from the Information Commissioner’s Office

Read Also: Serious Delinquency Credit Report

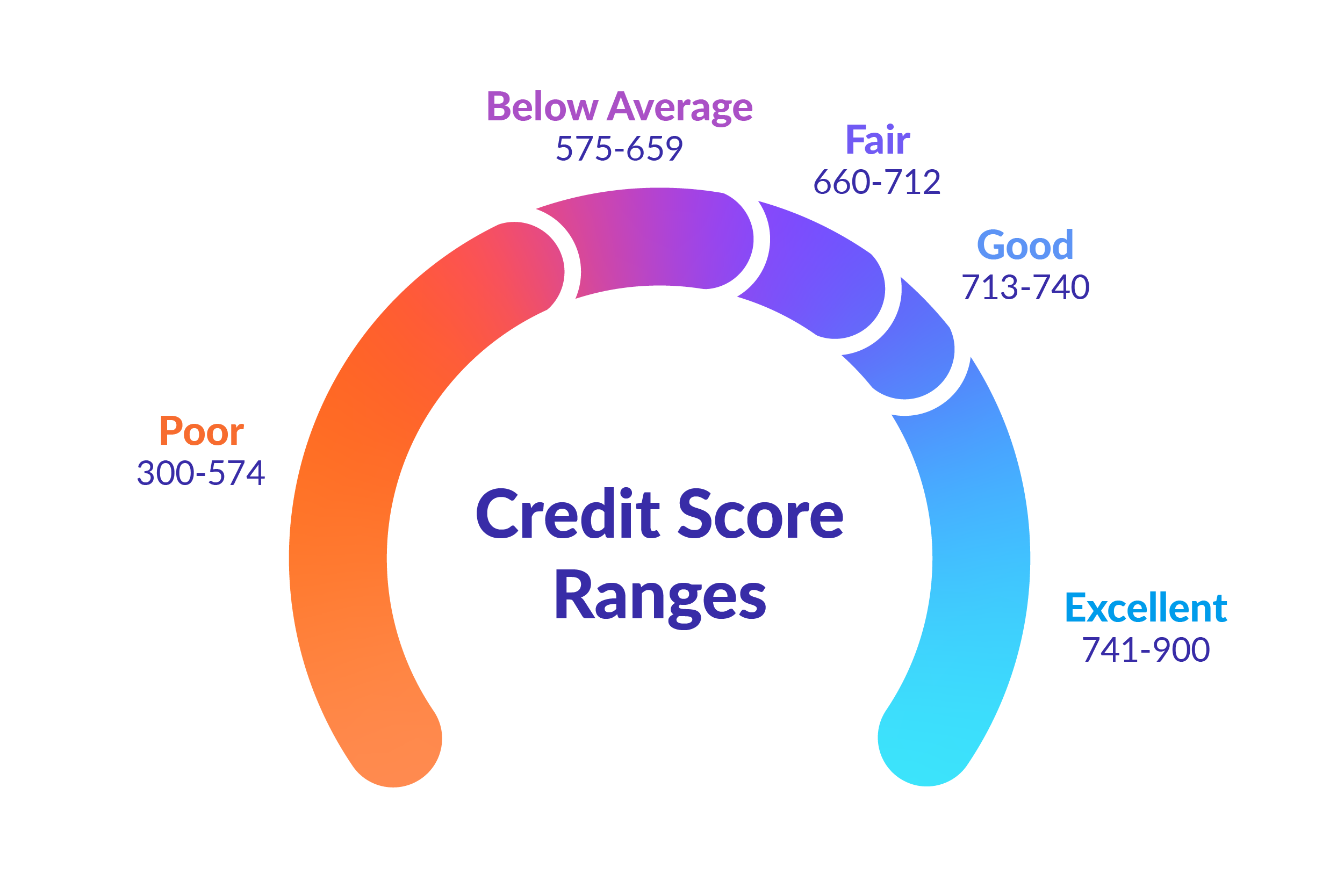

Overview Of Credit Score

Your credit score is a numerical expression that tells lenders whether you are likely to default on a loan: your creditworthiness. A high score shows that you would be a low-risk borrower and ideal for a low-interest rate offer.Your score is generated from your credit report, which is a health summary of your financial history.Keep in mind that credit bureaus use different types of scoring models to calculate your score. This means that you may have different results from other bureaus.There is no specific number that guarantees you better loan terms and interest rates. Nonetheless, credit scores from 740 to 799 are above average, while those 800 and above are considered excellent.These numbers mean the individual has demonstrated responsible credit behaviour, making potential lenders and creditors confident to process their request for quick cash.Scores from 670 to 739 are considered good, and those from 580 to 669 are fair. Generally, lenders see people with 670 and above as lower-risk borrowers and those from 580 to 669 as subprime borrowers.These individuals may find it difficult to qualify for favourable loan terms. People with a score of below 580 may find it even more difficult to be eligible for a loan or to get credit.Note that direct lenders have different criteria when assessing loan applications. Some factors they consider include employment status, source of income and location. Therefore, they may accept varying scores depending on the criteria.

Types Of Credit Scores: Fico Vs Vantagescore

There are two main credit scoring models: FICO and VantageScore. However, lenders have a clear preference for FICO its model is used in over 90% of U.S. lending decisions.

FICO and VantageScore credit scores have some similarities: In both, scores range from 300 to 850 and payment history is the most influential factor in determining your score. But they differ in exactly how they weight and rank several other factors.

Read Also: 1?800?859?6412

How To Check Your Credit Score With Equifax

To check your score on Equifax, you’ll also have to purchase it using the following steps:Step 1: Create myEquifax AccountVisit the TransUnion credit check portal and sign up for an account with them.Step 2: Request Your Credit Report and ScoreFrom your account, request your report and score, choose how you want to receive it , and then pay the fee.Note that TransUnion offers a subscription credit monitoring service. You can use this to check your TransUnion credit score online for $4.95 (for the first month, and following the monthly fee is $19.95.How to Get a Free TransUnion Credit ReportOnce a year, you are eligible for a free copy of your financial credit history via mail from TransUnion. If you want to receive your report faster online, you will have to pay for it. That said, the TransUnion free credit report doesn’t contain your score.

A Hard Inquiry Vs A Soft Inquiry

Every time anyone runs a credit check, it will create a single inquiry. All hard inquiries and soft inquiries show up on your credit report. But not all inquiries hold the same weight in a credit check, and not all of them will negatively impact your credit score.

A soft inquiry will appear on your credit report when someone runs a credit check for reasons unrelated to a direct application for credit. Soft inquiries can result from a lender or credit card issuer checking your credit report for pre-approval on lending services. Checking your own credit report will appear as a soft inquiry as well.

Soft inquiries dont affect your credit score and do not qualify as a risk factor when lenders check your credit report. Hard inquiries have the most significant impact on your credit score as they only occur with legitimate credit card applications. A hard inquiry affects your credit score, whether your credit card application is approved or denied.

Also Check: Stoneberry Credit Karma