How To Improve A 816 Credit Score

Work on removing all negative accounts such as collections, charge-offs, medical bills, bankruptcies, et al.

Remove as many excess hard inquiries as you can. Get your revolving utilization as low as you can . Ensure you have a good credit mix of installment loans and revolving accounts.

Last but not least, make sure you have at least two revolving accounts older than 2 years

We recommend taking a look at Credit Glory. Give them a call

It’s generally much faster if you worked with Credit Glory, and they happen to have incredible customer service.

How To Improve Your 816 Credit Score

A FICO® Score of 816 is well above the average credit score of 711. It’s nearly as good as credit scores can get, but you still may be able to improve it a bit.

More importantly, your score is on the low end of the Exceptional range and fairly close to the Very Good credit score range . A Very Good score is hardly cause for alarm, but staying in the Exceptional range can mean better chances of approval on the very best credit offers.

Among consumers with FICO® credit scores of 816, the average utilization rate is 11.5%.

The best way to determine how to improve your credit score is to check your FICO® Score. Along with your score, you’ll receive a report that uses specific information in your credit report that indicates why your score isn’t even higher.

What Does An 816 Credit Score Mean

A credit score of 816 means that your credit reports show that you always pay your bills on time. It indicates to lenders that youre a very low-risk borrower. An 816 credit score is in the highest score bracket in both of the two major credit scoring models in the US , and its well above the national average.

An 816 credit score is very far from the lowest credit score of 300, and its very close to the highest credit score of 850. Your score is good enough to get the best terms on loans and lines of credit from the vast majority of lenders.

To put your score of 816 into context, heres how it compares with the average for various generations:

You May Like: Comenity Bank Late Payment Forgiveness

Credit Score Car Loan Options

You can get approved for a car loan with almost any credit score, but having a score in the exceptional credit range will guarantee you much better interest rates.

Someone with a super prime credit score of 720 or higher can expect to get an average interest rate of 3.65 percent on a new car and 4.29 percent on a used car. In comparison, people with a deep subprime score of 579 or less typically get 14.39 percent on a new vehicle and 20.45 percent on a used car.

Do A Loan And Insurance Checkup

When I first started tracking my score I discovered I had a negative item a late payment from a store credit card of all things, says Philip Taylor, blogger from PT Money.

As a result, he ended up just shy of the score he needed to get the best mortgage interest rate when he bought his first home. I made it a mission to improve my score by the time I purchased a second home, says Taylor. He spent the next few years being meticulous about his credit, and he did indeed qualify for that better rate the second time around.

From home mortgages to auto loans to student loans, a great credit score can also put you in a prime position to refinance for a better interest rate, says Foguth. Look at the largest interest rates youre paying, and renegotiate those.

Refinancing almost always requires strong credit in order to get approved, and the better it is, the more likely youll score the lowest rate possible.

Likewise, Griffin recommends checking in with your auto and home insurance companies and comparing quotes from other insurers. Credit scores have been developed for the insurance industry, and they use that information to help them set rates when you first become a customer, he says. Sometimes switching over once your credit has improved can pay off.

Tip:When refinancing or changing insurance providers, be sure to consider all of the other factors and fine print to make sure youre actually upgrading to a better deal.

You May Like: Does Aarons Help Build Credit

What Does Not Count Towards Your 616 Credit Score

There are many things that people assume go into their 616 credit scores but that actually dont. Examples include how much money you earn, your age, your marital status, your child support payments , how much money you have donated to charity, where you work or live, or your employment history.

None of these things or anything like them do anything at all to your credit score, so instead, focus on the five primary factors that we outlined and discussed above.

Now that you know what counts towards your overall credit score and what does not, you should know exactly what you need to pinpoint in order to enhance your score. For example, maybe one reason your credit score is low is because youve opened several new accounts of credit.

Regardless, its important at this stage for you to positively identify what it exactly is that is lowering your credit rating. Once you have identified what that is, you can start to formulate a plan.

Measuring Your Credit Score

Measuring your credit score is something that has to be done. Every specific credit bureau has a different way of measuring the score. Some measure to 850 while others will measure to 830 and so on. Each one is different and while one might record one default on their records, another might not and so on.

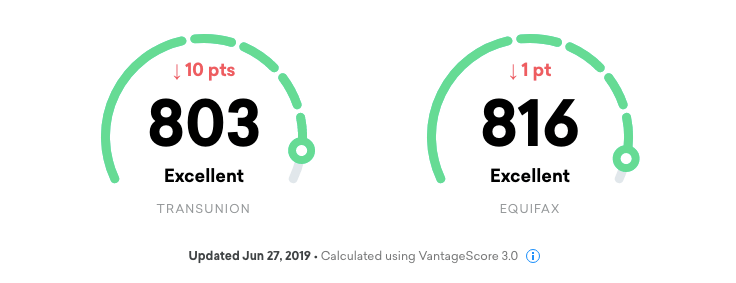

With the three major credit reporting agencies: TransUnion FICO, Equifax and Experian, you can be sure that you have all of the information you need. Youre allowed to have a free print out of your credit score every year from each of these three bureaus. If youre ever curious about what is on your report or ways that you can find out what you can do to fix your report, printing a copy and reading it is the best way to find out more about it, as well as report anything that shouldnt be on the report.

Don’t Miss: Does Care Credit Build Your Credit

Percent Of Adults Who Never Check Their Scores

One study conducted by Javelin Strategy & Research and sponsored by TransUnion revealed that 54 percent of adults never check their credit scores8.

Checking your credit score is a crucial aspect of reaching your financial goals and correcting any mistakes in your credit report.

Whether you regularly use a credit card or are paying back loans like student loans, always check your score on a regular basis, whether its through a third-party application or using an established credit reporting company like Experian.

One Email A Day Could Help You Save Thousands

Tips and tricks from the experts delivered straight to your inbox that could help you save thousands of dollars. Sign up now for free access to our Personal Finance Boot Camp.

By submitting your email address, you consent to us sending you money tips along with products and services that we think might interest you. You can unsubscribe at any time. Please read our Privacy Statement and Terms & Conditions.

You May Like: Does Seventh Avenue Report To Credit Bureaus

Your Credit Score Can Fluctuate

You may see some short-term movement in your credit score. This happens as information is added or falls off your report, which can happen frequently. Our latestConsumer Pulse revealed one-third of consumers monitor their credit at least weekly. Its encouraging to see people take an active approach to managing their credit health. But when it comes to your credit score, theres no need to obsess over minor, day-to-day changes. Nor is it necessary to achieve a perfect score. Trying to stay within a certain credit range is a smart, less stressful way to monitor your score.

Also, your credit score may not be the only thing a lender looks at when making a lending decision. For example, if you apply for a mortgage, lenders may also verify your income, personal assets and employment history. Because lenders look at multiple factors, its important to strive for overall financial wellness in addition to any credit score goal you may have. Building an emergency savings account and creating a plan to pay down debt, if you have any, will help you be more financially secure and can reflect positively in your credit health.

Ask Your Current Creditor For Better Terms

If you have a revolving credit account with a good payment history, then consider contacting your creditor and asking for better terms, such as a higher credit limit or lower interest rate. Highlight your strong payment history and loyalty as a customer. Some creditors are willing to make accommodations to keep you from looking elsewhere for a better deal.

In addition to helping your finances, this can help improve your credit score. For example, getting an increase in your credit limit will automatically reduce your credit utilization rate, as long as you dont start spending more.

Don’t Miss: Minimum Credit Score For Affirm

Is A Perfect Credit Score Necessary

Being part of the 800 Credit Score Club has its perks, but it is not necessary to be successful financially by any means, as many get by without being a member. It is especially not worth the exclusive status if you take on more debt that you cant pay off. Instead, it is best to strive towards better credit that is realistic for you.

Rating of 4/5 based on 25 votes.

Things You Can Do To Improve Your Credit Score Of 816

A score of 816 and above means that you have an excellent credit rating. It should not stop you from maintaining or improving it. You should not get too comfortable and take things for granted to a point where you forget your financial obligations. Doing this means that your credit rating my end up being damaged.

You May Like: Does Aarons Do A Credit Check

An 815 Credit Score Is Often Considered Very Good Or Even Excellent

With excellent credit, your credit scores become more of a bridge and less of a roadblock a high score can help you qualify for premium rewards credit cards, auto loans and mortgages with the best terms.

Having excellent credit scores doesnt guarantee approval, but it certainly helps. Thats because your excellent scores make you more attractive to lenders, who may see it as an indicator that you pose less of a risk. And the more they trust you to repay the money you borrow, the less they need to hedge their bets with things like down payments, security deposits and low credit limits.

Of course, your arent the only factor lenders look at. They also consider details like your employment status and income.

Its also important to keep in mind that you might have dozens of different credit scores. And it may not be clear which score a particular lender looks at, or how high that score needs to be in order to grant you approval at the best terms.

But in general, your excellent credit scores will impress them.

Take a look at how your credit scores stack up against the scores of people from different generations.

| Percentage of generation with 750850 credit scores |

|---|

| Generation |

Ranges identified based on 2021 Credit Karma data.

Getting Mortgages With 816 Credit Score

816 FICO credit score qualifies you for the best mortgage terms available, which can mean saving up to 1% on your mortgage interest overall. Over the course of your loan, this means thousands of dollars in savings. Interest rates should hover around 4%. While improving your credit wont make much of a difference at this point, you can decrease your interest rates further in a variety of ways, such as making your home environmentally friendly or making a larger down payment.

Considering these things, your credit score is one of the most important numbers in your life. It can affect every action you take, from the house you live in to the car you drive. Taking steps to improve your 816 credit score is the best way to save money and make your life easier down the road. Theres no excuse to not improve your credit score!

How is a 816 credit score calculated?

The three major credit bureaus rely on five types of information to calculate your credit score. They collect this information from a variety of sources, and compile it to give you an overall score. The score is comprised of 35% payment history, 30% amount owed, 15% credit history, 10% new credit, and 10% credit diversity.

You May Like: How To Notify Credit Bureaus Of Death

Monitor And Manage Your Exceptional Credit Score

A FICO® Score of 816 is an accomplishment built up over time. It takes discipline and consistency to build up an Exceptional credit score. Additional care and attention can help you keep hang on to it.

Whether instinctively or on purpose, you’re doing a remarkable job navigating the factors that determine credit scores:

Utilization rate on revolving credit. Utilization, or usage rate, is a measure of how close you are to maxing out credit card accounts. You can calculate it for each of your credit card accounts by dividing the outstanding balance by the card’s borrowing limit, and then multiplying by 100 to get a percentage. You can also figure your total utilization rate by dividing the sum of all your card balances by the sum of all their spending limits .

| Balance | |

|---|---|

| $20,000 | 26% |

If you keep your utilization rates at or below 30% on all accounts in total and on each individual accountmost experts agree you’ll avoid lowering your credit scores. Letting utilization creep higher will depress your score, and approaching 100% can seriously drive down your credit score. Utilization rate is responsible for nearly one-third of your credit score.

Time is on your side. Length of credit history is responsible for as much as 15% of your credit score.If all other score influences hold constant, a longer credit history will yield a higher credit score than a shorter one.

What Counts Towards Your 816 Credit Score

In essence, your credit score tells you whether you have a responsible credit management and a history showing that you have been financially stable. So what factors contribute to showing that you are fiscally responsible and stable?

The first and most critical factor will be your overall payment history. This is simply whether you have paid all of your bills on time. There are also a variety of aspects of your payment history that your credit rating will include, including how late you were on your payments , how many bills you paid and how many you did not, if any of your accounts have gone into collections and if you have a history of foreclosures, bankruptcies, and debt settlements.

The second biggest factor that counts towards your credit score is the total amount of money that you owe. Again, there is a variety of aspects of this that goes into your 816 credit score. One such example is the amount of your allotted credit that you have used up. Heres a piece of advice: the less you owe on the credit, the better your credit score will be.

Another aspect of your amounts owed is how much money you owe on each of your loans, including your credit cards, your car payments, and your mortgage payment. The best way to have a positive credit rating here is to have a variety of credits and loans and to manage each of them in a very responsible manner.

Recommended Reading: Does Zebit Report To The Credit Bureau

How Are Credit Scores Calculated

The weight of each of the five categories are 30% of amount owned, 10% is for the new credit, 15% accounts for the length of credit history, 10% is the credit mix and the last 35% accounts for the person’s payment history.

The FICO score takes into consideration positive as well as negative aspects of the credit report. The percentage or the weight of any of the categories mentioned above may differ from a person to another depending upon the information available in the credit report.

The FICO score takes all of the information from your credit report. However, the banks or any other lending institution might look at your income, type of credit and employment history when you apply for a loan or mortgage.

Once a certain lender asks for a client’s credit report, they can also ask for the Fico score. Other sources say that your Fico score will include 35% of your payment history, 30% of your credit utilization, and 15% as to how long have you been borrowing.

Keeping Your Credit Card Balance Low

The very act of having credit cards will impact your credit rating. Regardless of whether its positive or negative, it has an impact.

But something else that you want to ensure you do is keep the balance on your credit card low. The balance on your credit cards can influence over one third of your total credit score. The higher your balance is, the lower your score will be.

What you want your credit card history to show is that you have been reducing your balance on an active basis by making your minimum monthly payments on time and using your credit cards responsibly.

A good rule to follow is for your balance on your credit card to be 35% of the total limit on that card. So if you have a limit of $1,000 on your card, you want your balance to be $350 at the very highest. This holds true regardless of whether you have one credit card or multiple cards. In the long run, this will not only prevent your overall credit score from dropping, but it could also cause it to increase.

The reason why this is so important is because most lenders these days want you to stay as far away from the limit as possible in order to have the best credit scores. In fact, most experts would recommend that you never use more than fifty percent of your total available credit. If you use any more than that, or if you max out your limit, your overall credit score will drop.

Recommended Reading: Check My Rental History Free