Negotiate A Lower Interest Rate

A lower rate can help you pay off your balance faster, because more of your payment can be applied to your principal balance than interest. Lower balances can mean a lower credit utilization ratio . Learn more about how to negotiate a lower interest rate.

Never Miss A Repayment

Showing that you can repay on time and stay within the credit limit you’ve been given will help convince lenders you’re a responsible borrower.

Inform your lenders as soon as possible if your debts are proving too difficult to handle. Its better to seek their help than to repeatedly miss loan or credit card repayments with no explanation.

If you are late with a payment or miss one, it will show up on your report within a month. One late payment on a credit card or loan can dent your score by as much as 130 points, according to Experian.

A missed payment will show on your report for six years, although its effect will lessen. If youve missed only one payment, your score could start to recover after around six months and should be fully recovered after a year.

Increase The Length Of Your Credit History

The longer you have a credit account open and in use, the better it is for your score. Your credit score may be lower if you have credit accounts that are relatively new.

If you transfer an older account to a new account, the new account is considered new credit.

For example, some credit card offers come with a low introductory interest rate for balance transfers. This means you can transfer your current balance to this new product. The new product is considered new credit.

Consider keeping an older account open even if you don’t need it. Use it from time to time to keep it active. Make sure there is no fee if the account is open but you don’t use it. Check your credit agreement to find out if there is a fee.

You May Like: A Credit Report Is Particularly Sensitive Information Because

End Financial Associations With Ex

Living with or being married to someone who has a bad credit rating won’t affect yours, but taking out a joint financial product with them will.

Opening a joint current account, for example, will create a ‘financial association’ between you and the other account holder.

Lenders may look at their credit report as well as yours when assessing your application, as their circumstances could affect your ability to make repayments.

If you have ever jointly held a financial product with someone you no longer have a relationship with, ask all three credit reference agencies to break this link so that your ex-partner’s financial situation doesn’t have an impact on any credit applications you may make in the future.

Breaking a financial link with an ex-partner or disassociating could boost your score within a month.

Use A Secured Credit Card

Another way to build or rebuild your credit is with a secured credit card. This type of card is backed by a cash deposit you pay it upfront and the deposit amount is usually the same as your credit limit. You use it like a normal credit card, and your on-time payments help build your credit.

Impact: Varies. This is likeliest to help someone new to credit with accounts or someone with dented credit wanting a way to add more positive credit history and dilute past missteps.

Time commitment: Medium. Look for a secured card that reports your credit activity to all three major credit bureaus. You may also consider looking into alternative credit cards that don’t require a security deposit.

How fast it could work: Several months. The goal here is not just having another card, although that can help your score a bit by improving your depth of credit. Rather, your aim is to build a record of keeping balances low and paying on time.

Read Also: What Credit Report Does Rooms To Go Pull

Things You Can Do To Improve Your Credit Score

A low credit score makes life much more complicated than it should be. Your FICO number helps determine whether you get a mortgage, credit cards, and, sometimes, a job. A low credit score also means you will pay higher interest rates and insurance premiums. Sadly, a low score negatively affects many aspects of your life. Fortunately, you can “fix” your score, just not overnight. It takes good planning and a concentrated effort, but it can happen. You can start today by taking some simple steps.

Break Free From Past Financial Partners

Remove financial associations on your credit file between you and anyone whose poor credit rating could be hurting yours. If you dont let all three credit reference agencies know that youre no longer financially connected to that person, their debts could affect your rating. On the flip side, being linked to a responsible borrower with a positive financial history can make you look good.

Don’t Miss: Does Checking Your Credit Score Affect Your Credit Rating

Sign Up For Free Credit Monitoring

Whether its with Credit Karma or someone else, keeping a close eye on your credit is essential. Signing up for credit monitoring can help alert you to important changes in your credit, so that you can check for suspicious activity. Fraudulent activity can weigh down what could be an otherwise good credit score, so its important to dispute any details you identify as inaccurate. If the credit bureau rules in your favor, the fraudulent activity will be removed from your credit report, which can help raise your credit scores.

How Long Does Improving Your Credit Score Take

There is no set minimum, maximum, or average number of points by which your credit score improves every month, and there is no set number of points that each action will gain. How long it takes to boost your credit depends on the specifics for why your credit score is low. If the major negatives on your credit score are credit utilization, and then you pay off your balances, your score can improve drastically in a single month. If your credit is low because of multiple collections and poor payment history, then it will take several months of on-time payments to see any positive movement in your score.

Don’t Miss: Does Running Credit Check Lower Score

Things You Can Do Over Time To Raise Your Credit Rating

Five things you can do over time:

Improving your credit rating wont happen overnight, so be prepared to make longer-term changes to your finances.

First, do all you can to reduce your outstanding debt. This will signal to the credit rating agencies that youre tackling any issues and working to improve your credit worthiness.

If you can, stay in one address for a long period. This shows stability on your part, which is something that lenders like to see. The more stable your life appears on paper, the higher your credit rating is likely to be.

Its an obvious point, but it cant be overstated: keep on top of bills, payments and contracts. Jot down debit dates in your calendar to make sure theres enough money to pay the bills and you dont go overdrawn or default on your payment.

There are specific credit cards designed to help you improve your credit rating. Using one responsibly over a long period can boost your reputation with credit reference agencies.

The trick to using one successfully is staying within your credit limit and making at least the minimum payment each month. If you dont make at least the minimum repayments on time and stick to the limit all the time, it could in fact worsen your credit score the exact opposite of your goal. Read more about Barclaycards .

Get Credit For Paying Rent And Bills

Reporting services for rent can put the fact that you pay your rent on time on your credit report. Not every scoring model takes rent payments into account. For example, VantageScores does, but FICO 8 does not. Still, if a potential creditor looks at your credit report, rent records will be there, and a long history of paying rent on time can only help.

Experian Boost can also help, though not as much. You link your bank accounts to the free Boost service, which then checks for payments to streaming services, phone bills, and utility bills. You decide which payments you want Experian to add to your credit report. If a creditor pulls your FICO 8 using Experian data, you can use that extra payment history to your advantage.

Some services offer an instant lookback of the last two years of rent payments, while Boost works right away. Without that, it might take a few months to show that you pay on time.

Don’t Miss: How To Remove Names From Credit Report

Avoid New Credit Card Applications

As long as you’re in credit repair mode, avoid making any new applications for credit. When do apply for new credit, the lender will often perform a “hard inquiry,” which is a review of your credit that shows up on your credit report and impacts your credit score.

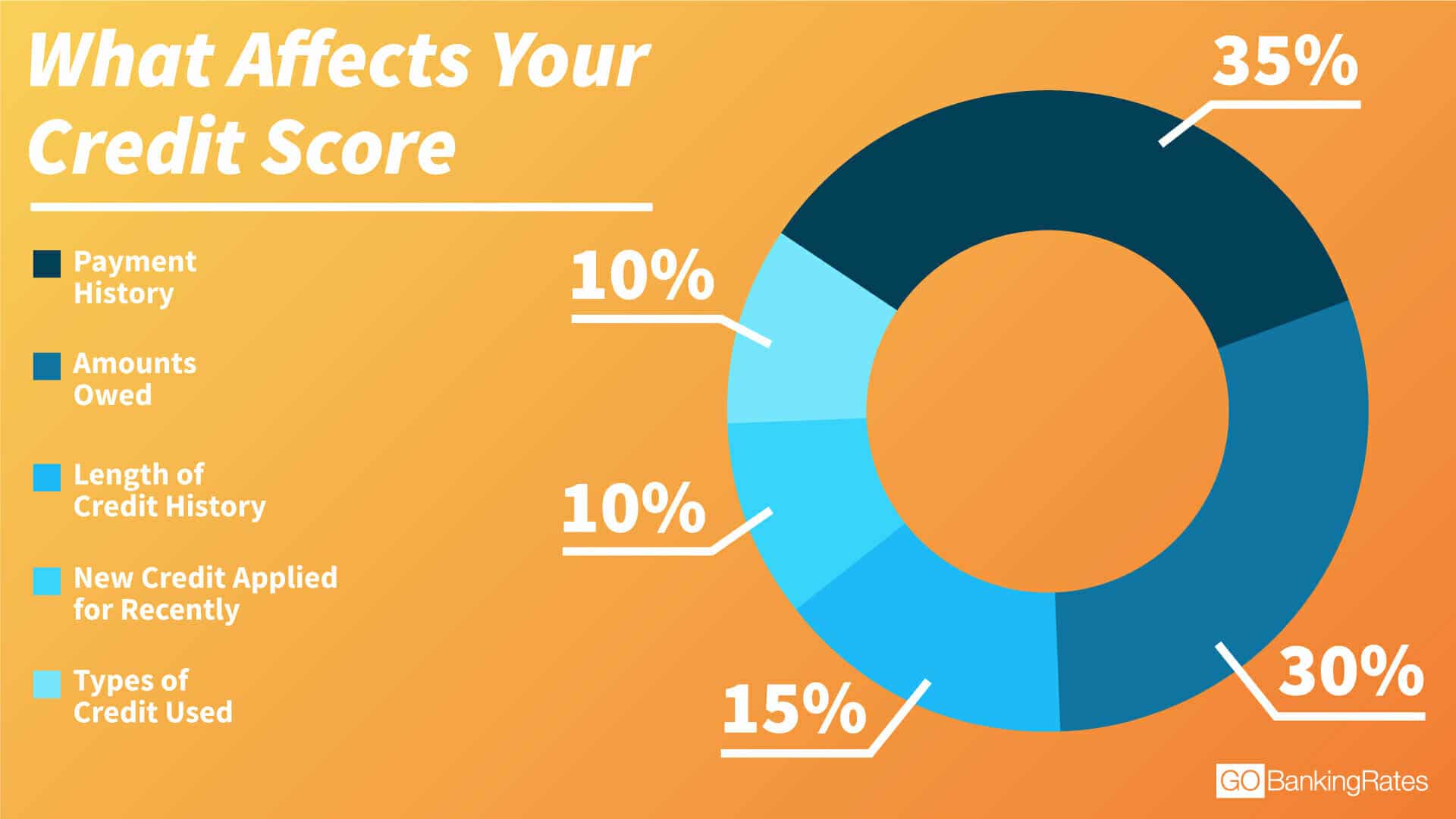

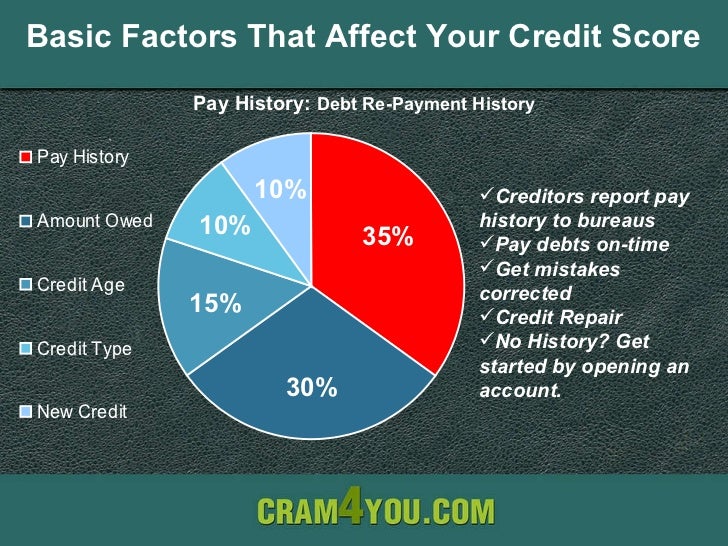

How many credit accounts you recently opened and the number of hard inquiries you incurred both reflect your level of risk as a borrower, so they make up 10% of your credit score. Opening many accounts over a relatively short period can be a red flag to lenders that a borrower is in dire financial straits, so it can further decrease your score. In contrast, having few or no recently opened accounts indicates financial stability, which can boost your credit score.

S To Improve Your Credit Score Right Now

Leslie CookKristen Bahler11 min read

Taking good care of your credit score is an important part of your financial life.

Interest rates on all kinds of products from personal and student loans to mortgages and have increased significantly since January, making it more costly for people to borrow money. When you apply for a new line of credit, a high credit score can help you qualify for a low interest rate. Good credit also makes it easier to refinance your debt, which can lower your monthly payments and free up money for other purposes.

Improving a credit score takes time, however. So if your score needs some work, the sooner you start working on it the better off you’ll be. Here’s how to start.

You May Like: How Long Do Credit Card Inquiries Stay On Your Report

When Would I Use A Credit Repair Company

You might consider using a credit repair company if you need help fixing numerous errors on your credit report and you dont want to spend the time doing it yourself. You can resolve credit reporting errors on your own. However, the process can be time-consuming, especially if there are lots of errors. Credit repair companies can ease the burden by doing this work for you.

If you only need to resolve one or two simple credit reporting errors , youll save money by working directly with your creditor to fix the problem. However, if you have lots of errors , then a credit repair company may be a good option. This is because the credit repair company will do all the work needed to fix your credit report.

Keep in mind that credit repair companies can only be used to resolve credit reporting errors. If an item is not on your credit report erroneously, then credit repair is not for you. Rather, a good place to start is with a . Your credit counselor will help you develop a plan to repair your credit and inform you about other debt relief options .

Check Your Credit Reportson A Regular Basis To Track Your Progress

No matter where you turn for your credit check-in your bank, or one of the major consumer credit bureaus its important to keep an eye on your credit. And if you find any mistakes or inaccuracies, we can help you file a dispute. If your dispute is approved by the credit bureaus, you may see the error corrected as soon as within 30 days, which can help raise your credit scores.

Also Check: How Long Does Irs Tax Lien Stay On Credit Report

Consider Experian Boost Or Ultrafico

When you have no credit history, adding extra accounts can boost your score. You have two options that could help you: Experian Boost and UltraFICO:

- Experian Boost evaluates your utility, streaming and other accounts and adds on-time payments from these accounts to your Experian credit report. If a lender or card company uses another credit bureau, they wont see any of your Experian Boost accounts.

- UltraFICO is a program from FICO that adds information about your bank account balances, cash flow and bank transactions. However, not every lender uses or accepts the UltraFICO score.

Is There A Quick Fix To Repairing Credit

Unfortunately, there’s no way to improve your credit overnight. In some cases, may advertise fast results, but they can’t do anything about your credit score that you can’t do for yourself.

In general, it’s best to develop good credit habits and use them to build your credit history. Go over your credit report and the credit score factors above to plan out the steps you can take to improve your credit score now and in the future.

Read Also: Does Medical Debt Affect Your Credit Score

Limit How Often You Apply For New Accounts

While you may need to open accounts to build your credit file, you generally want to limit how often you submit credit applications. Each application can lead to a hard inquiry, which may hurt your scores a little, but inquiries can add up and have a compounding effect on your credit scores. Opening a new account will also decrease your average age of accounts, and that could also hurt your scores.

Inquiries and the average age of your accounts are minor scoring factors, but you still want to be cautious about how many applications you submit. One exception is when you’re rate shopping for certain types of loans, such as an auto loan or mortgage. Credit scoring models recognize that rate shopping isn’t risky behavior and may ignore some inquiries if they occur within the span of a couple of weeks.

How Can I Raise My Credit Scores By 100 Points

If you have poor credit and are looking to increase your scores by 100 points, you will need to put in the work. This wont happened overnight and depending on your credit profile it could take several months. But, dont be discouraged, it is still an attainable goal.

Practicing the healthy credit habits weve outlined in this article is the best way to improve your credit. If a company or service promises that they can guarantee your credit will improve by 100 points, they are likely lying. All credit scores react differently, keep that in mind during your credit improvement journey.

You May Like: How To Build Credit Score Fast

Pay Everything On Time

Your payment history is the most important factor for rebuilding your credit. Even if a payment isn’t regularly listed on your credit report, it can eventually wind up there if you fall behind on payments.

Avoid falling behind on any accounts, even small ones like library fines, school lunches, and medical bills. More businesses are using collection agencies to follow up on their unpaid customer accounts. If one of your accounts goes to collections, it gets reported to the credit bureaus and damages the progress you’ve made.

Keep Your Credit Utilization Rate Low

Weigh your balances relative to your credit limit to ensure youre not using too much available credit, a practice that can indicate risk.

Ulzheimer recommends trying to maintain a utilization rate of 10%. The higher that ratio, the fewer points youre going to earn in that category and your scores are absolutely going to suffer, he says. In fact, people who have the highest average FICO scores have a utilization of 7%.

The date your credit card provider reports to the credit bureaus may also impact your utilization rate.

Ulzheimer points out that FICOs scoring systems dont differentiate between those who pay in full each month and those who carry a balance. Your utilization rate at the time your issuer reports is what’s used for your score. VantageScore, though, does consider whether you pay in full or carry your balance month to month.

If you struggle with high balances and mounting interest payments on your cards, consider consolidating with a 0% introductory rate balance transfer credit card, but make sure you know when the rate will increase and by how much.

Don’t Miss: Does Creditwise Affect Your Credit Score

How To Repair Your Credit And Improve Your Fico Scores

You can improve your FICO Scores by first fixing errors in your credit history and then following these guidelines to maintain a consistent and good credit history. Repairing bad credit or building credit for the first time takes patience and discipline. There is no quick way to fix a credit score. In fact, quick-fix efforts are the most likely to backfire, so beware of any advice that claims to improve your credit score fast.

The best advice for rebuilding credit is to manage it responsibly over time. If you haven’t done that, then you’ll need to repair your credit history before you see your credit score improve. The following steps will help you with that.