Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners.

How To Get A 750+ Credit Score

If you want to know how to improve your credit score, look no further than the Credit Analysis section of your free WalletHub account. Youll find grades for each component of your credit score, along with an explanation of where you stand and tips to improve. Getting your credit score to 700 is kind of like making the honor roll in school. You need mainly As and Bs to pull it off.

For example, heres a common credit scorecard for someone with a 750 credit score:

- Payment History: A = 100% on-time payments

- A = 1% – 10%

- Debt Load: A = < 0.28 debt-to-income ratio

- Account Age: B = Average account is less than 9 years old

- Account Diversity: A = 4+ account types or 21+ total accounts

- Hard Credit Inquiries: A = Fewer than 3 in past 24 months

- Collections Accounts & Public Records: A = 0 collections accounts and public records

You dont need to match this scorecard exactly to build a credit score of 700 or even higher. Different profiles can get the job done. For example, you might have an A in Credit Utilization but a B, or even a C, in Account Age. Its the complete picture that matters.

Was this article helpful?

Related Scores

How We Came Up With This List

We started by isolating the cards known to be available to those in the 600 to 649 credit score range. From there, we considered the features that would make it most valuable to people in that credit score range, based on different credit factors.

Those factors include:

- The issuer reports to all three major credit bureaus TransUnion, Experian and Equifax giving you an opportunity raise your credit score with all three

- Secured or unsecured credit cards secured may be necessary for those at the lower end of the fair credit score range

- Low or no annual fee

- Offering the ability to increase your credit line as your payment history warrants.

- Card features, like rewards and other benefits, if offered

Also Check: Does Pre Approval Hurt Credit Score

Life With A 610 Credit Score

Unless your low credit score is a mistake caused by major errors on your credit report, you might remain in the fair range for at least the next few months.

Until your score improves, avoid taking out any unnecessary loans to ensure that you wont sabotage your progress by accumulating debt that you cant pay off.

Factors That Can Affect A Credit Score

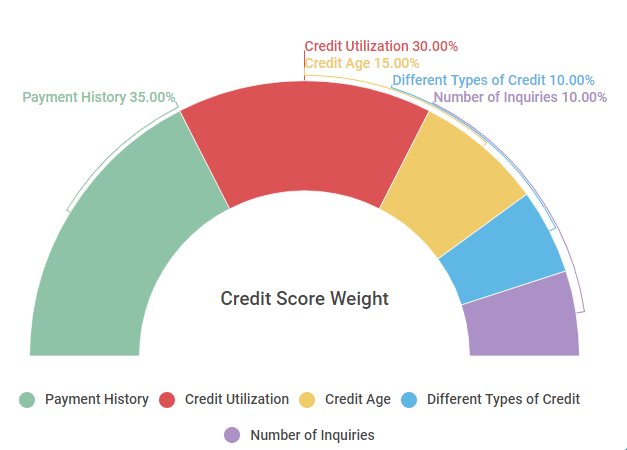

There are 5 main factors that can affect the calculation of a credit score. If youre interested in improving your credit these are the areas that you should focus on.

History of Payments

This is determined by the payments you have made to lenders or creditors. This ultimately reflects on how frequently you pay your loans or bills on time. Anyone looking to improve their credit scores should always make their payments on time, without fail.

Debt/ Credit Utilization

This shows the amount of outstanding debt a consumer has compared to the amount of available credit they have. For example, if you have a total credit limit of $5,000 and consistently carry a high balance, your credit score may be negatively affected. To help improve your credit scores, pay down your debt and make sure you need your balance to lower than 35% of your available credit.

This factor is straightforward, the longer a credit account has been open, the better it is for your credit scores. If youre considering cancelling a credit card, make sure you cancel a new one and keep the older ones open.

New Inquiries

Every time a potential lender or creditor pulls your credit, your credit score may take a small and temporary hit. If you apply for a lot of new credit within a short period of time, your credit score may drop and other creditors will be able to see that youve recently applied for a lot of credit which they may consider to be a red flag.

Diversity

Loans Canada Lookout

Don’t Miss: Is Paypal Credit Reported To The Credit Bureaus

Avoid A Card With An Annual Fee If You Can

If a card has a particularly large annual fee, in combination with a low credit limit, it will effectively reduce that credit limit. It will also increase the likelihood youll be carrying a balance and making interest payments.

Some of the cards weve included on our list do have annual fees, though all are below $100. Its best to avoid these if you can, but if not, just be aware that it will raise the cost of improving your credit score.

How To Maintain A Good Credit Score

Practicing healthy credit habits can help keep your score in a good range. Its smart to keep your balances as low as possible. Your credit utilization, which is how much of your available credit limit youre using, is a major factor in credit score calculations. Popular advice is to keep your utilization rate below 30%. But the lower the better its smart to leave some breathing room should an unexpected expense come up.

Because your payment history is another important credit score factor, youre likely to achieve and maintain a good credit score by not missing payments. Automate payments when you can because with multiple services, subscriptions and accounts, it can be easy to let one accidentally slip.

Aim to only apply for credit when needed. Of course, theres no need to avoid credit altogether. For many people, lifes major purchases may require loans or other credit, and a good credit score lays the groundwork for your credit goals. But because new credit may result in hard inquiries on your report its smart to limit credit applications.

Some people like to take advantage of rewards credit cards that are geared toward those with good credit scores. Just make sure youre mindful in your approach and not overspending and over-applying for the sake of some cash back or travel points.

You May Like: Zebit Reviews Bbb

What Kind Of Interest Rate Can I Get With A 610 Credit Score

599 credit score credit cards available A 610 credit score offers an interest rate between 1.99 per cent and 5.82 per cent annually. There is a 5 percent growth rate. Compared to an average credit card interest rate of 13, someone with excellent credit can obtain a credit card interest rate of 13 percent. Five percent is the percent of growth.

How To Choose A Credit Card For Fair Credit

The best way to use a credit card for fair credit is to make a small amount of monthly purchases and pay your charges in full each month.

The interest rates on these cards may be higher than on credit cards designed for consumers with good credit, so youll want to avoid using them to pay off purchases over time.

As your credit improves, youll be better qualified to apply for a card with a lower rate or higher rewards in the future.

Look for cards that offer lower annual fees or some rewards that can offset an annual fee.

Also Check: Transunion Account Locked

Total Length Of Credit History

A good credit score is amassed over a period of yearsthe longer, the better. The credit bureaus like to see a track record of you managing your payments they also factor in things like average age of all accounts. A slim credit history is not ideal, but as long as your financial habits are healthy, its not a huge impediment. But nothing happens overnight. In the meantime, demonstrate to lenders your growing financial maturity by not having too many debts and paying off the ones you do have in a consistent, timely fashion.

Credit Score Mortgage Lenders

Getting A Mortgage with a 610 Credit Score

A credit score of 610 should give you a solid chance in finding a mortgage based upon todays lending guidelines. Your credit score is a major factor in not only whether you can find a loan, but also what your rate will be. Your credit score also opens and closes various loan program options. It can also close a few doors if your credit score is too low.

If you have a credit score of 610 you will have the ability to not only find a conventional loan but also VA, FHA, USDA and bank statement loans for self employed borrowers. We have developed relationships with some of the best lenders over the past 15 years. Getting a mortgage approval with a 610 credit score could not be easier. Let us help you to find the right program with the lowest rate possible.

Below are some loan options for individuals with a 610 credit score:

FHA Loan Requirements With a 610 Credit Score

- FHA mortgage loans require both taxes and insurance to be escrowed.

- They require you to have a mortgage insurance premium

- You must have a sustained history of employment

- 3.5% down payment required

Conventional Loan Requirements With a 610 Credit Score

- Fully document income and assets

- Minimum of 5% down payment depending upon credit score

- PMI required if less than 20% down

- All property types permitted

- Minimum of a 2 year work history required

- Recent bankruptcies or foreclosures typically not accepted

VA Loan Requirements With a 610 Credit Score

Read Also: Does Affirm Report To The Credit Bureau

Only Use The Credit You Really Need

Just because you have three credit cards, that doesnt mean its wise for you to max them out every month, even if youre making the monthly payments on time. The credit bureaus frown on individuals using too much of their available credit although they do like to see a diversity of credit accountsmortgages, auto loans, credit cards, installment accountsmanaged responsibly. Solution: Go easy on the credit. Make a determined effort to not use more than 10% of your total available credit. Your credit score will thank you.

Why Is Credit Important In The Uk

Having good credit history is important if you want to get approved for:

- Access to utility services

- Much more

Some employers may even ask to run a credit check on you before offering you employment, however they need your permission to do this.

The point is, having credit history in the UK is important. But no need to worry if you just moved here from overseas and need to get started. It can be a slow process, but if you manage things correctly, you can and will succeed.

Recommended Reading: What Credit Report Does Chase Pull

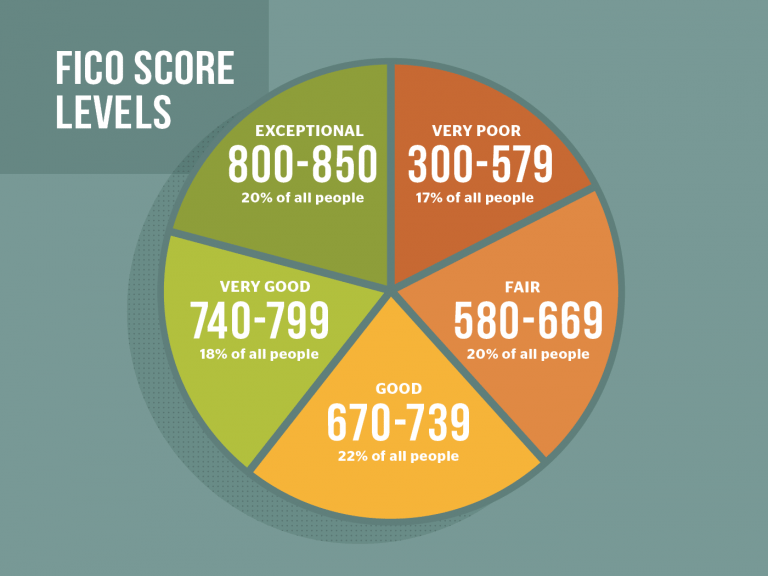

What Is An Excellent Credit Score Range

Excellent credit score = 740 850: Anything in the mid 700s and higher is considered excellent credit and will be greeted by easy credit approvals and the very best interest rates.Consumers with excellent credit scores have a delinquency rate of approximately 2%.

In this high-end of credit scoring, extra points dont improve your loan terms much. Most lenders would consider a credit score of 760 the same as 800. However, having a higher score can serve as a buffer if negative occurrences in your report. For example, if you max out a credit card , the resulting damage wont push you down into a lower tier.

Whats Considered A Good Credit Score

If youre trying to build or maintain healthy credit, knowing whats considered a good score can be helpful. A good credit score can help you get approved and lock in better rates for loans and other credit.

Higher is generally better, but its hard to say specifically what a good score is. Whats considered a good score can differ by lender and the type of credit youre applying for. The score you see when you obtain credit monitoring or buy a credit score along with your credit report may not be the score that the lender is using. There are also different scoring models. That said, read on to learn what a good credit score range is when you check your score with TransUnion. Plus, youll find tips on how to maintain healthy credit.

Recommended Reading: Repossession Credit Repair

How To Improve Your Credit Score

The steps you can take to rebuild your credit score fall into two categories:

- Short-term credit fixes: Things you can do right now to improve your score in the short term

- Long-term credit fixes: Things you can do to help your score slowly improve in the long term 5

Ultimately, how long it will take to repair your credit depends on your credit history, your personal finances, and the decisions you make.

Maintaining Your Good Credit Score

Your 690 credit score puts you solidly in the mainstream of American consumer credit profiles, but some additional time and effort can raise your score into the Very Good range or even the Exceptional range . To keep up your progress and avoid losing ground, steer clear of behaviors that can lower your credit score.

Factors that affect your credit score include:

Payment history. Delinquent accounts and late or missed payments can harm your credit score. A history of paying your bills on time will help your credit score. It’s pretty straightforward, and it’s the single biggest influence on your credit score, accounting for as much as 35% of your FICO® Score.

. To determine your credit utilization ratio, add up the balances on your revolving credit accounts and divide the result by your total credit limit. If you owe $4,000 on your credit cards and have a total credit limit of $10,000, for instance, your credit utilization rate is 40%. You probably know your credit score will suffer if you “max out” your credit limit by pushing utilization toward 100%, but you may not know that most experts recommend keeping your utilization ratio below 30% to avoid lowering your credit scores. Credit usage is responsible for about 30% of your FICO® Score.

44% Individuals with a 670 FICO® Score have credit portfolios that include auto loan and 27% have a mortgage loan.

Also Check: Centurylink Collections Agency

What Is A Good Credit Score Range

Good credit score = 680 739: Credit scores around 700 are considered the threshold to good credit. Lenders are comfortable with this FICO score range, and the decision to extend credit is much easier. Borrowers in this range will almost always be approved for a loan and will be offered lower interest rates. If you have a 680 credit score and its moving up, youre definitely on the right track.

According to FICO, the median credit score in the U.S. is in this range, at 723. Borrowers with this good credit score are only delinquent 5% of the time.

Mortgage Rates For Poor Credit

The average credit score needed to buy a house can vary, but it could be more challenging to qualify for a loan if your credit needs work.

You may find that mortgage offers that are available to you come with high interest rates that can cost you a lot of money. Its important to consider the long-term financial impact of an expensive loan, and it may be worth taking some time to build your credit before applying.

But there are some types of mortgages to consider if you dont qualify for a conventional loan. These government-backed loans that are made by private lenders include

- FHA loans

- VA loans

- USDA loans

If you qualify for one of these loan types, you may be able to make a smaller down payment, too.

No matter what your credit is, its important to shop around to understand what competitive rates look like in your area. Compare current mortgage rates on Credit Karma to learn more.

You May Like: When Does Usaa Report To The Credit Bureaus

Credit Score: Good Or Bad

At a glance

610 is a below-average credit score, but its approaching the good range. Its considered fair by every major credit scoring model. Scores in this range are high enough to get some types of credit, but you wont qualify for the best interest rates. Well explain what financing you can get with a score of 610 and what you can do to improve your credit score.

Get all 3 credit reports and FICO score monitoring, or book a FREE 5-minute credit repair consultation.

Fresh advice you can trust

We promise to always deliver the best financial advice that we can. That’s our first priority, and we take it seriously. Our writers and editors follow strict editorial standards and operate independently from our advertisers and affiliates. Learn more about how we make money.

Can I Get A Car / Auto Loan W/ A 610 Credit Score

Trying to qualify for an auto loan with a 610 credit score is expensive. Thereâs too much risk for a car lender without charging very high interest rates.

Even if you could take out an auto loan with a 610 credit score, you probably don’t want to with such high interest.

There is good news though.

This is completely avoidable with a few simple steps to repair your credit.

Your best option at this stage is reaching out to a credit repair company to evaluate your score and see how they can fix it.

Don’t Miss: Syncb/ppc Closed Account