Who Can See Your Credit Reports

In fact, this question is strictly regulated by federal law. As stated in the Fair Credit Reporting Act, theres a list of so-called permissible purposes that allow others to obtain your credit report. Given this, the list of people who can see your credit report includes but is not limited to the following:

- Prospective landlord or property owner

- Collection agencies

- Insurance companies

- Employers

Apart from the above-mentioned categories, your credit report gets accessible to everyone you decide to authorize. This can be your colleague, close friend, or family member. All it takes is written permission from you.

Overcoming A Low Credit Score With Other Attributes

A credit score for renting is a significant criterion you might weigh when you see a rental application. So what can you do if your applicant’s score is on the lower side?

For applicants with a lower score, you may want to request an extra security deposit or require a co-signer with a good credit score who can vouch for them.

What Is A Good Credit Score For Renting A Home

In this article we’ll cover information you’ll need to know about good credit score required to rent a house in Calgary or for that matter in Canada.

Its important to note that most rental property landlords or rental companies engaged in property management in Canada require renters income and credit worthiness. They will check potential tenant’s credit score and credit history before proceeding with rental lease signing. Let’s understand what is a credit score often noted on the credit reports by Canadian credit bureaus such as Trans Union, Equifax etc.

What is a credit score in Canada?

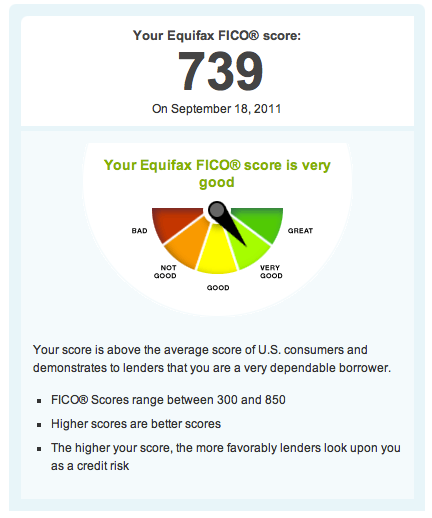

A credit score above 670 is considered good credit score in Canada. Note that credit score in Canada ranges between 300 to 900. Generally credit scores below 580 fall Poor band 580 to 669 fall in Fair band 670 to 739 fall in Good band 740 to 799 fall in Very Good band and 800 and above fall in Excellent band.

* Note that a credit file contains information of ones credit accounts submitted to the credit bureaus, including balances, limit, payment history, etc.

A good credit score, or one above average, is crucial if you are looking to rent a house or seeking credit products. This is because when searching best rental websites for an Apartment rental in Canada potential landlords and property management companies managing rental apartments and condos look for renters with above average credit score along with serene prior rental history to avoid future financial or property damages.

Read Also: Notify Credit Bureaus Of Death

What Credit Score Is Needed To Rent A House

Looking for a new place to live can be exciting and stressful all at the same time. If you are in a situation where you have to move quickly, it can be even more stressful. When you want to rent a house, it is important to know important information such as what credit score is needed.

In general, there is not a set credit score you need to rent a house. Depending on the location and cost of the home, the landlord may have specific criteria they want. Before you start your house rental search, check out this article to find out what credit score is needed to rent a house.

Show Your Progress And Be Honest

The truth is that a bad credit score does not equal bad money management. You might be the most responsible and trustworthy human being, but it does not guarantee you from losing a job or experiencing another form of a financial step back. Some things can get out of your control and ruin your credit history. If something like that happened to you, try acting upfront. Admit your bad credit score even before your landlord asks for it and provide a reasonable explanation of your situation.

Don’t Miss: Syw Mc Cbna

Allow An Automatic Deduction From Your Bank Account

All landlords want to be certain about getting payments in full and on time. To alleviate your landlords concerns, suggest an automatic deduction from your bank account. If you are ready to pay on time , it will make no difference to you. However, it can be a good tactic to increase your chances of renting a property.

What Is Great About Rent

Another advantage of rent-to-own mobile homes is that renting one gives you the benefit of living in your home full-time before committing to a mortgage. In traditional buying situations, you tour the home a few times before ultimately making the purchase, never having the chance to live in it before you buy.

When you rent to own, you can get to know the neighborhood, experience the day-in and day-out of living in the home, and truly get to know the place before buying.

Rent-to-own mobile homes are inexpensive when compared to traditional homes. For example, instead of a $300k price tag, you can own a brand new home for less than $100,000 in most cities. Also, like traditional homes, you can customize your mobile home and configure it exactly how you want it.

Recommended Reading: Bby Cbna Credit Card

Is It Hard To Get Approved For A Mobile Home Loan

Mobile home loans are slightly more difficult to get approved for than traditional home loans, but lenders work with almost all borrowers. Because mobile homes typically decrease, it is harder to qualify for a loan instead of traditional homes that usually increase in value.

In addition, lenders typically look for higher than average credit scores, consistent income, and sufficient down payment. This criterion varies by lender, and some lenders will accept buyers with lower credit scores, income, and down payments.

While it is harder to get approved for mobile home loans than traditional loans, it is not impossible. Those that have trouble qualifying will find renting to own a viable option for obtaining their new home.

What Happens If I Fail A Credit Check For Renting

If you still want the house, find another way to prove you will pay the rent such as offering more cash upfront or providing a letter of reference from a previous landlord. Another alternative is to find a cosigner. You might also try to rent a different house, looking for an individual landlord who will not do a credit check or finding one with a roommate who already has a lease.

Under some FHA programs, you may actually qualify to buy a home when you can’t rent one. If you have a 10 percent down payment, you may be able to obtain an FHA loan with a score as low as 500. If your score is as high as 580, you may qualify with a 3.5 percent down payment.

Recommended Reading: 626 Credit Score Car Loan

Make Your Landlord A Custom Offer

The cold truth is that the rental process is yet another auction. Although landlords are usually clear about the price, tenants are free to make custom offers . Like it or not, but bidding wars exactly what is happening behind the scene of the rental world. But if you have a low credit score, you can actually take advantage of this trend. Choose a rental platform with an option of custom offers, and make your application more attractive by means of extra money.

What Should I Do

If you cannot improve your credit in time, there are some other steps that may allow you to rent a house even with bad or insufficient credit.

You can get a roommate that has good credit, which can balance out your bad credit.

You can also get someone to cosign your lease agreement. This is someone that is guaranteeing that you will pay your monthly rent payments. If you do not make your payments, the cosigner is responsible for making your payments.

You May Like: When Does Capital One Report To Credit Bureaus 2020

Factors That Influence Credit Scores

To use credit scores as part of the tenant screening process, you dont necessarily need to know what factors influence credit scores. Understanding what goes into the score, however, will help you see the bigger picture of what these scores really represent.

Some of these factors will matter more to you as a landlord than others. If a tenant can explain their below-average credit score as a result of factors that dont affect your business, you might be able to work with tenants who may otherwise seem like the wrong fit.

Remember, each credit bureau uses a different formula to determine credit score, so each factor considered will likewise vary.

Applying Rent To The Principal

Youll pay rent throughout the lease term. The question is whether a portion of each payment is applied to the eventual purchase price. As an example, if you pay $1,200 in rent each month for three years, and 25% of that is credited toward the purchase, youll earn a $10,800 rent credit . Typically, the rent is slightly higher than the going rate for the area to make up for the rent credit you receive. But be sure you know what you’re getting for paying that premium.

In some contracts, all or some of the option money you must pay can be applied to the eventual purchase price at closing.

Recommended Reading: Usaa Credit Repair

What Do Landlords Look For On A Credit Check

A landlord uses your credit report to find evidence that you can and will pay the rent on time. Your credit score is only one indicator of your creditworthiness. Your landlord will assess the following aspects of your credit report in context with the rest of your application.

Landlords know that credit reports are only part of the story. A landlord may be able to overlook bad marks on your credit report if your application has many other positive aspects, such as a positive reference from a previous landlord.

Maintaining Good Credit Throughout The Homebuying Process

Check your credit sooner rather than later. That way, if you find any credit issues on your report, you’ll have time to take care of them and boost your credit score before a mortgage lender reviews your credit.

Applying for a mortgage preapproval, finding a home, getting the final mortgage approval, and then pulling off the final house closing often takes between six weeks and three months, but prepare for it to take longer. During this time, it’s important to maintain good credit so nothing throws a wrench into your final mortgage approval.

To prevent any credit issues that could result in less favourable mortgage terms, prevent a final approval, or damage your credit, remember to do the following.

- Avoid completing multiple mortgage applications with different lenders in a short time frame. This may flag you as a credit seeker and lower your credit score.

- Hold off on applying for other credit, such as a car loan or a loan for household appliances, that could increase your total monthly debt payments.

- Make all existing credit payments, including car loans, car leases, student loans, credit cards, and credit lines on time and in full.

Don’t Miss: Does Paypal Credit Report To Credit Bureaus

Where Do You Get A Credit Score

There is a fair amount of brands that provide credit score services, but Experian, FICO, and TransUnion are chief among them. However, with platforms like Rentberry, you should not worry about getting a credit score at all. Due to our partnership with Microbilt , your credit report will be generated automatically and delivered to your prospective landlord together with your application.

Why Do Landlords Credit Check Tenants

A landlord credit checks tenants for several reasons.

The main motivation for landlords to check your credit is to make sure that you will meet your responsibility to pay the cash you owe them on time. Landlords want to avoid issues with tenants missing payments, falling into debts, and needing to be evicted.

If you stop paying your rent, it can take a landlord a long time to carry out an eviction process. Evictions require a written notice as well as a court order called a possession order, so it can cost the landlord or property agents a lot of time and money.

Landlords therefore use your credit report to try and avoid a situation like this with their renters. If your credit information shows that you have:

- Had county court judgements in the past

- Had an IVA

- Experienced bankruptcy or insolvency

Then they may feel concern that you will run into similar debt in the future and not be able to make rent.

However, remember that your background information is just used as a guideline. There is no minimum rating required to rent property in the UK.

So, the decisions are up to the individual landlord and poor scores may not always be deal breakers. As a result, there are many discrepancies and at times you will hear different stories from renters.

They may simply ask for a larger security deposit in advance, for proof of employment and job income from your employers, or get you to name a person you know as a guarantor .

Read Also: How To Get Car Repossession Off Credit Report

How Do Landlords Use Credit Scores

Landlords, however, are not lenders in the traditional sense. How are you going to use the credit score of prospective tenants to run your rental business?

Landlords use credit scores for the same base reason as lenders: to determine how likely a tenant is to pay their rent in a timely manner. By reviewing a prospective tenants credit report, you can get an idea about how they have handled payments in the past on loans, credit cards, and other things.

Do You Need A Credit Score To Rent A Property

Your credit score is an important number that is used to indicate your financial wellbeing, stability and trustworthiness. It is a way for people like lenders or landlords to understand whether or not it is risky to get into a financial relationship with you, based on your financial history.

When youre looking to rent a property, your landlord checks your credit history to get a sense of your capability to pay rent. They will look at your history of repaying or not repaying debts or other financial obligations. A landlord uses this as a benchmark to understand the likelihood of you paying your rent on time, or not.

The higher your credit score, the better, if your score falls for some reason, the chances of the property manager accepting your rental application fails with it. Your credit score will make a difference in whether you get to live in your dream home or maybe have to settle for something else.

Read Also: How To Remove Public Records From Credit Report

Better Screening Better Tenants

What is a good credit score for tenants looking to rent your properties?

With the information you learned today about credit scores and why a credit score can be a good way to screen tenants, you should have a better idea of what to look for.

Remember, credit score can show you:

- How risky it might be to rent to a tenant

- If they have a record of keeping up with payments on time

- If they have many financial obligations right now

Knowing these three things can help you feel more confident in your decision to deny or accept a prospective tenant. Remember, tenant screening is a process you should put some time and effort into. Ensuring you get the right tenants into your property will help hold your bottom line as you find success in the rental industry.

What To Do If Your Score Isnt Ideal:

Since somewhere around 650 appears to be the bare minimum score many landlords want to see, many millennials will just barely eek past that requirement. Most millennials have fair credit, with the average score of younger millennials being 652, according to Experian. Older millennials have an average score of 665.

So, what are tenants to do if their credit scores dont wow their landlords?

Dont get too discouraged, says Scalzo. Oftentimes, the landlord or rental company will work with you and ask for more upfront rent, additional references, or a larger deposit.

Also, your credit score isnt the only thing landlords are looking at when theyre determining your financial responsibility. Even if you have a credit score in the high 600s, some seemingly small issues can cause extra hurdles, explains Ilan Sionit, a real estate agent with Douglas Elliman in Brooklyn, New York. For example, late payments, maxed out credit cards, and any judgements can be red flags for landlords, Sionit explains.

So if youve got a lower-than-desired credit score or some of these smaller credit issues, expect a landlord to ask for first and last months rental payments and a security deposit, Sionit says. Bigger issues may require six months of upfront payments or a cosigner with strong credit.

Related: Everything You Need to Know About Getting a Guarantor

Housing judgments, of course, are huge red flags for landlords.

Also Check: Transunion Account Locked

How Credit Scores Are Created

You already know about the factors used to create a credit score:

- Payment history

- Recent credit changes

There are different credit scoring models used to take all of these factors and morph them into a single, three-digit credit score. Depending on what type of lender is checking the credit score, the best scoring model may vary.

It is normal for an individuals score to vary between credit bureaus because each scoring model puts the weight on something different. This is why some types of scoring models are better than others for loans, while credit card companies may prefer a different model.