Remove Medical Collections That Violate Hippa The Easy Way

Disputing negative items on your credit report is hard work! It takes a lot of time, effort, organization, and follow up. The good news? Our team of credit repair professionals are here to simplify everything! Let your dedicated credit repair expert relieve you of the stress, hassle, and time needed to fight your inaccuracies and boost your credit score

Call us at or set up a consultation to get started, today!

Medical Collection Mysteriously Disappeared From Credit Report

Heres the deal, Im in the process of rebuilding my credit and working with collection agencies to resolve negative information on my credit report. I pulled my free report in April and noticed a medical collection that hadnt been paid. I sent the CA a VOD letter, to which they responded. I then sent them a PFD letter, to which they rejected. So far Im batting “zero” right? Then I pulled my report yesterday following a dispute I filed when I got my free report and noticed the medical collection account has mysteriously disappeared! The account is only 2 years old so I know it didnt fall off because of the SOL. Also, I never disputed the account with the credit bureaus. Any ideas on how/why this happened? Has anyone ever heard of something like this? Im not sure if I should be jumping for joy or worried. I don’t want to make any phone calls to the CA or OC and trigger something that should be left alone. Any insight would be great!

BTW, after the collection dropped off I also noticed my score increased by 44 pts.

Do Medical Bills Hurt Your Credit

According to the Consumer Financial Protection Bureau, 52% of all types of debts in collection are medical bills. The amount of medical debt in collections in June 2020 was about $140 billion and affected 17.8% of Americans. Currently, 50% of Americans report having unpaid medical bills, not necessarily in collections.

Unpaid doctor or hospital bills typically dont automatically hurt your credit score. But debt collections can potentially affect your credit score. A low credit score may make it more expensive to borrow money or more likely that a loan application could be denied.

Its possible for a medical collection to affect your credit scores differently than other types of collections, according to CreditKarma. Some scoring models give less weight to outstanding medical debts than they do other collections, such as credit card debt. And some, but not all, credit-scoring models will disregard unpaid medical bills if you originally owed less than $100.

The other good news is that the three credit bureaus, Experian, Equifax, and TransUnion, have set a 180-day waiting period from the time the bill is sent to collections before including the medical debt on a credit report. This is intended to make sure theres enough time to solve any disputes with insurers and allow for delays in payment.

Read Also: 611 Credit Score Auto Loan

S To Remove Collection Accounts From Your Credit Report

If youve had collections listed on your credit report, then you know it can drop your FICO score significantly.

In This Article

But how do you remove collection accounts from your credit profile?

This article provides some proven strategies to help you get collections removed from your credit report and increase your credit rating.

What To Do When Medical Bills Hurt Your Credit Report

Anthony Battle is a CERTIFIED FINANCIAL PLANNER professional. He earned the Chartered Financial Consultant® designation for advanced financial planning, the Chartered Life Underwriter® designation for advanced insurance specialization, the Accredited Financial Counselor® for Financial Counseling and both the Retirement Income Certified Professional®, and Certified Retirement Counselor designations for advance retirement planning.

Even with health insurance, you can still end up with medical bills from medical expenses that werent covered by insurance. If you don’t pay medical bills when they are due, they can end up going into collections.

When this happens, they will show up on your and lower your credit score.

Unpaid medical bills can affect your credit report, but that doesnt happen right away. Learn what to do when you receive a medical bill and how to react if medical debt is lowering your credit score.

Recommended Reading: Cbcinnovis Credit Check

Can Medical Debt Be Removed From A Credit Report

Once unpaid medical debt has gone unpaid for 180 days and goes into collection, it generally stays there for seven years even if you settle the debt with the collections agency. At that point, your credit report will update to reflect that youve settled the account.

There is an exception, however, and that is if an insurance company pays the debt that is in collection. If that happens, then the credit bureaus are required to remove the debt from your credit reports.

And if the collection activity was reported in error, you should dispute it to have it removed.

You can dispute it with the credit bureau and well go back to the source if you believe it shouldnt be reported, and if the source agrees we will take it off the credit report, said Griffin.

You may work with the medical provider and they may agree to take it off, although thats going to be the exception. If its an accurate collection account, they are obligated to report that information accurately.

While accurately reported medical debt remains on your report for seven years, it has less impact on your score as time passes and once you pay off collections accounts, they wont likely factor into your score at all.

How To Remove Collections From Your Credit Report Without Paying

Here is an actual letter sent by one of the credit reporting agencies of collections that they deleted from a credit report:

Removing collections from your credit report can raise your credit score significantly. Its often the case that there are errors on collections accounts.

So its important to get a copy of your free credit report from each of the three major credit bureaus at AnnualCreditReport.com and check them thoroughly. It is not uncommon for records to be mixed up because they get passed back and forth so often among debt buyers.

Your collection accounts may not have the right amount, the right date, or include any number of other mistakes that creditors dont bother to fix. You may also have instances of late payments appearing that werent actually late.

Debt collectors dont care about what they do to your credit. They only care about what it takes to get you to pay up, and they are hoping that you dont realize that the law is on your side!

Recommended Reading: Is 775 A Good Credit Score

Knowing The Facts Can Help You Manage Your Credit And Medical Expenses More Proactively

- Print icon

- Resize icon

If you think youre immune to damage from a collection account on your credit report because you pay your bills on time, think again. Medical bills that you dont know about could be hurting your creditand the odds are not in your favor.

In fact, the Consumer Financial Protection Bureau reports that around 31.6% of adults in the U.S. have collections accounts on their credit reports. Thats almost one in three Americans. Medical bills account for over half of all collections with an identifiable creditor. Chances are good that you, too, have a medical bill in collections.

Many times, medical bills hit collections because you didnt even realize you owed anything. Here are four common medical bill myths that can cost you dearly and the truth you need to manage your credit and medical expenses more proactively.

Your insurance wont cover everything

Its a consumers obligation to know what theyre responsible for paying. A lot of people are under the impression that their insurance will cover all medical costs, so they dont owe anything. Due to how a visit or procedure is billed with insurance, this isnt always the case. Its always best to be prepared for the worst to prevent anything from being sent to collections.

Your medical bills can be sent to collections, even if youre paying

Tips for dealing with medical bills

How To Remove Medical Collections Violating Hippa From Your Credit Report

Find out how to remove medical collections that violate HIPPA from your credit report. Also, discover how much easier the dispute process is w/Credit Glory today!

You remove medical collections that violate HIPPA the same way you remove inaccurate items â with a dispute. You can dispute the record on your own, but there’s an easier way. When you partner with an expert you simplify the dispute process.

Recommended Reading: Credit Report With Itin Number

Medical Bills Without Health Insurance

If you have a long relationship with your doctor, try to deal with him or her directly to reduce costs or work out a payment plan. When it comes to hospital costs, have all charges explained by the billing office. Auditing every detail is the best way to protect against honest mistakes or outright fraud. Dont be afraid to challenge unexpected charges.

Medicaid is a federal/state program that helps low-income people and families. If you qualify, take advantage of it. Finally, some states require hospitals to offer discounts to uninsured patients regardless of income. Some hospitals and medical groups have funds set aside for individuals who do not qualify for other types of assistance.

Being Proactive About Medical Bills

Just because you left a doctors office without paying more than a copay doesnt necessarily mean the bill is settled. In addition, the providers billing to your insurance company doesnt automatically mean it will be accurate or even paid.

If you havent received a statement from your medical providers billing office within a few weeks of your appointment or hospital stay, it might be a good idea to call for a billing update. Catching errors early in the billing process may keep medical bills off your credit report.

If you know ahead of time that you wont be able to pay the entire amount owed, contacting the providers billing office and trying to negotiate a payment plan may be a good first step. If you can come to an agreement, its a good idea to get it in writing.

Should a collection agency employee contact you about a bill you think has been paid or should have been paid by insurance, stay calm and ask if you can call back with information that shows theres no open balance.

Recommended Reading: How Long Is A Repo On Your Credit Report

If Youve Already Paid The Debt: Request A Goodwill Deletion

It may be possible to get a paid collection account removed from your credit report by asking for something called a goodwill deletion or goodwill adjustment.

To do this, send a goodwill letter to AvanteUSA explaining the circumstances that led to your delinquency. This is usually only an option if youve already paid the debt in full.

Youll want to include any supporting evidence or documentation you have, including:

- An explanation for why you didnt pay your bill

- Records demonstrating that you usually pay your debts

- Examples of how the negative mark is affecting your life, such as making it difficult for you to take out a mortgage

You can also call AvanteUSA on the phone, although theres a chance that the person you end up speaking to wont have the authority to make changes to your records.

Its important to bear in mind that sending a goodwill letter is a long shot, and the company you speak to is under no obligation to change your report. However, it doesnt cost you anything, so theres no reason not to try.

How Medical Collections Hurt Your Credit Score

First of all, its important to understand how medical collections affect your .

Before 2014, FICO treated unpaid medical collections the same as any other debt.

Back then, medical debt hurt your credit score just as much as unpaid credit card bills.

Since 2014, FICO has changed its scoring system to lessen the impact of medical debt collections on your credit score. This is good news if youre dealing with unpaid medical debt.

But it works both ways: Removing unpaid medical debt will improve your credit score less than removing other accounts such as credit card debt.

If you have multiple types of debt pulling down your score, Id recommend attacking a different kind of debt first.

Still, getting medical debt off your credit history can help you get better interest rates and increase your borrowing power, especially if youre applying for a mortgage soon.

Also Check: What’s The Minimum Credit Score For Care Credit

What Happens If I Dont Pay My Medical Bills

If you dont pay your medical bills, it will remain on your credit report for up to seven years. The collections agency may charge you penalties or late fees for non-payment, which can add to your total and make the debt more difficult to pay off. Plus, the medical facility could take you to court for non-payment, and while you cant be sent to jail, it could be very costly.

How To Deal With Medical Bills On Your Credit Report

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

A serious illness or injury can be disruptive. You need to heal, and you may be overwhelmed for a while as you put your work and family life back together.

Theres a strong chance your finances will be affected, too. If an unpaid medical bill makes its way to your credit reports, your credit scores could suffer for years. .

Here’s how unpaid medical bills affect your credit and how to deal with the fallout if you end up in collections.

Also Check: Itin Credit Report

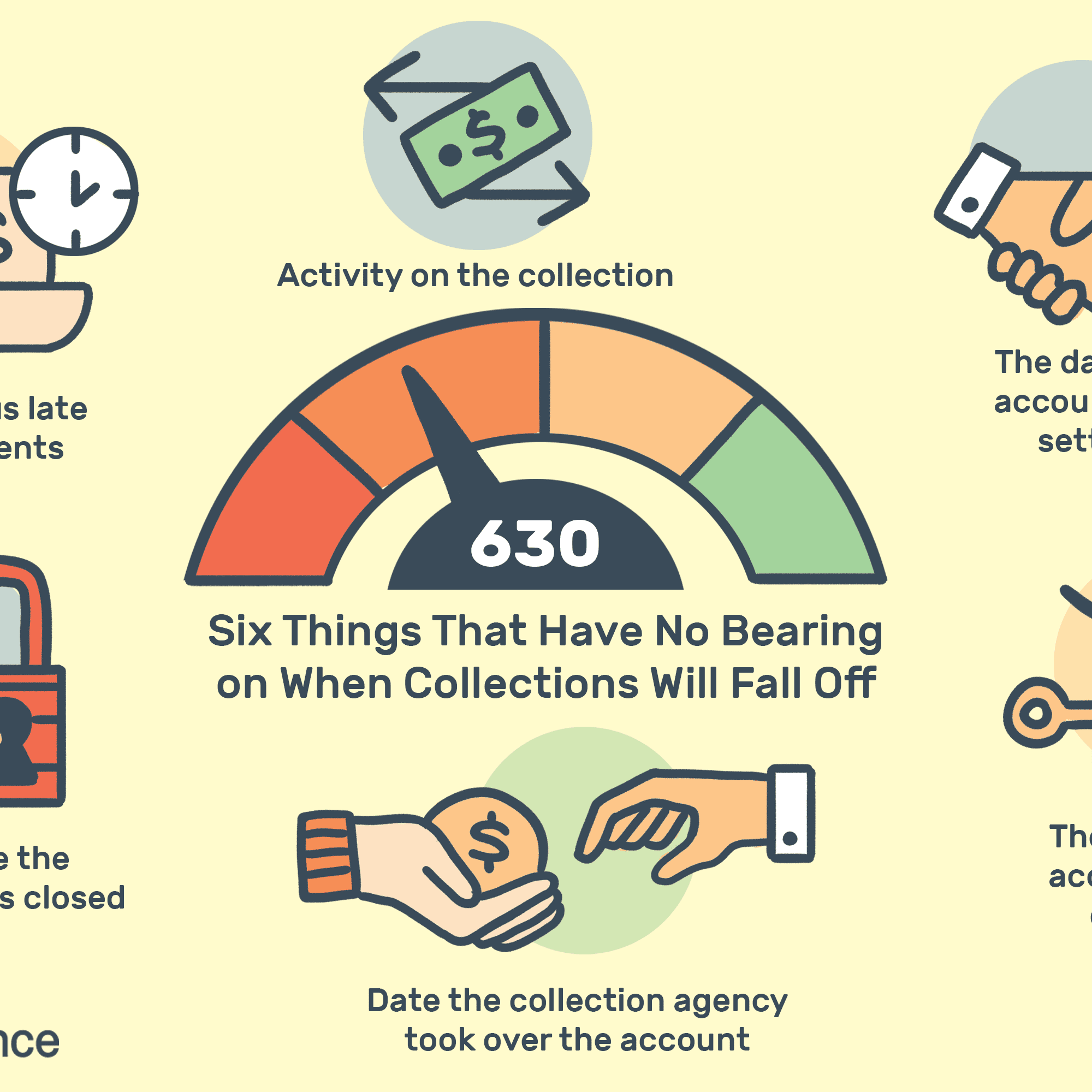

How Long Do Collection Accounts Stay On Your Report

Paid or unpaid collection accounts can legally stay on your credit reports for up to seven years after the original account first became delinquent. Once the collection account reaches the seven-year mark, the credit reporting companies should automatically delete it from your credit reports.

If your collection account doesnt fall off of your credit report after seven years, you can file a dispute with each credit bureau that lists it on your report.

Before You Do Anything Else: Ask Avanteusa To Stop Calling You

Its important to keep a paper trail of all your communications with AvanteUSA, so make sure to only communicate with them in writing. If you ask them to stop calling you and only communicate via letter or email, then theyre legally obligated to do so. 8This should be your first step.

Make sure to date your letters and send them by certified mail. If youre not sure where to start, then check out the sample letters provided by the CFPB.

Also Check: When Does Usaa Report To The Credit Bureaus

Do You Qualify For Medical Debt Forgiveness

Many hospitals and clinics offer some type of medical debt forgiveness program. In fact, Ive used this type of program myself. Shortly after I was newly and unexpectedly divorced, I ended up needing emergency gallbladder removal surgery.

After health insurance covered their portion, I was left with over $5,000 in out-of-pocket expenses. I worked hard to whittle down the expenses, but I wasnt getting very far.

Thats when I learned about medical debt forgiveness. I called the hospital that performed the surgery and asked if they had a medical debt forgiveness program. They did.

There were certain income and other qualifications one had to meet to qualify for the program. As a stay-at-home mom with limited income, I knew I might qualify.

The process of applying for the hospitals debt forgiveness program was a bit tedious. There were forms to fill out and there was information to verify. In fact, I had to try a couple of times to complete the application process properly. But after the board assessed my application, they forgave all $2,000+ that I owed the hospital. What a relief!

If youre struggling with medical debt, call the hospital or clinic you owe money to and see if they have a medical debt forgiveness program. They might not, or you might not qualify, but it sure doesnt hurt to try.

Medical Collections Vs Non

AvanteUSA often collects medical debt. Medical and non-medical collections have some key differences in terms of how the debt is handled by debt collection agencies, the credit bureaus, and the main scoring models.

If you see medical debt on your credit report, there are a few implications you should be aware of:

- Your debt is already several months old: Medical institutions usually wait 60120 days before selling your debt to debt collectors. 5After that, the credit bureaus wait an additional 180 days before adding the collection account to your report to give you time to make arrangements with your insurance company or set up a payment plan. 5

- AvanteUSA probably owns your debt: Medical institutions dont generally report to the credit bureaus. For this reason, the fact that your debt is showing up on your credit report indicates that it was sold to a company that does report to the credit bureaus.

- Medical collections arent as harmful to your credit: In newer credit scoring models developed by FICO and VantageScore , medical collections dont hurt your credit score as much as non-medical collections. 67

You May Like: Unlock Transunion Account