File A Dispute With The Credit Reporting Agency

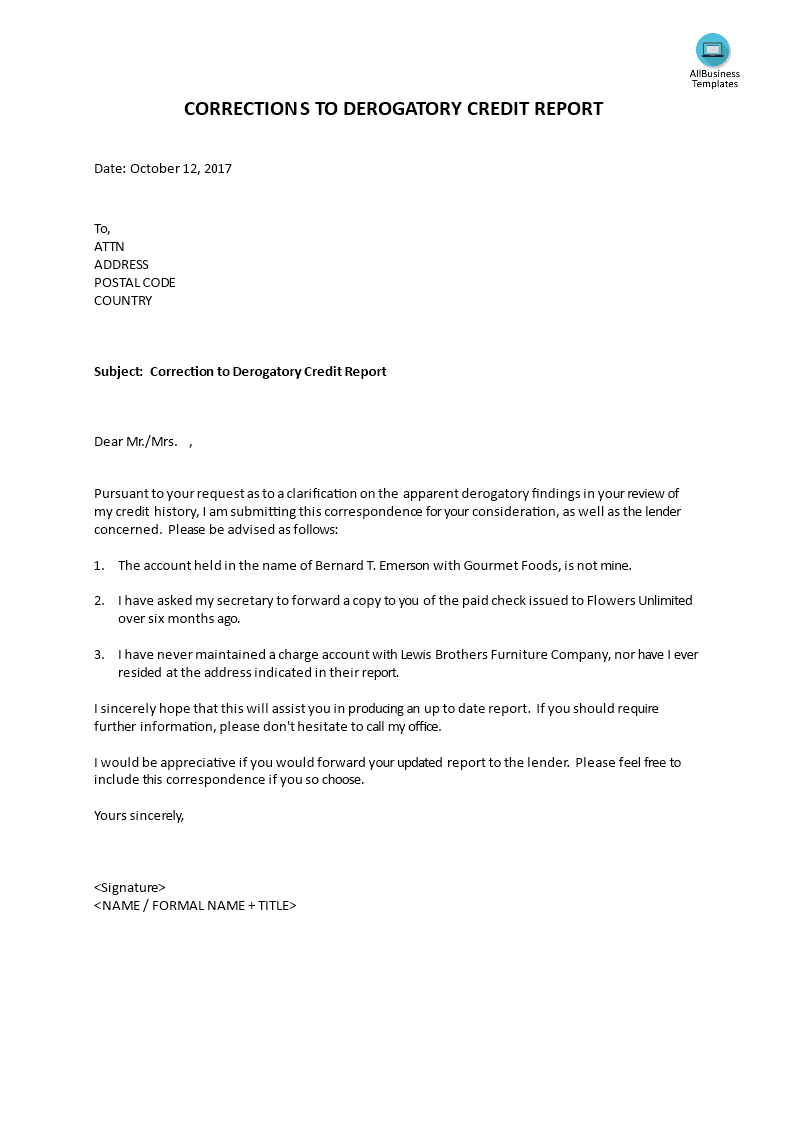

Initiate a claim directly with the credit bureau by writing a dispute letter. The purpose of this letter is to notify them that you believe certain information in your credit file is inaccurate.

The Fair Credit Reporting Act requires creditors to report accurate information about every account. This means they have a legal obligation to review, investigate, and respond to your claim. This process is free and can take up to 30 days to complete.

You can begin a dispute with any one of the credit bureaus through their websites or via mail. The leading credit reporting agencies are Equifax, Transunion, and Experian. Its essential to have documentation and to be precise about the information you are challenging.

Each of the three major credit bureaus has an online section dedicated to walking consumers through the process of disputing a claim online. It would be best to dispute the entry with each credit bureau to make sure the removal is complete across the board. After receiving the initial claim, the credit bureau will contact the source of the erroneous information and dispute it on your behalf.

How to file a dispute letter:

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

Strategy : Pay Off Small Balances On Credit Cards

Did you know that a credit card that has a balance can negatively impact your credit score? It’s true.

Thatâs why if you have small balances on the card, pay them off instead of letting the balances sit there. Also, if you forget about a balance, it could accrue interest that you’ll be on the hook for. This strategy will help prevent that as well.

Also Check: Can You Remove Hard Inquiries Off Your Credit Report

Write A Goodwill Letter

If you did miss a payment but later made the transaction, you can ask your creditor to remove that derogatory mark using a goodwill letter.

Also known as a forgiveness removal letter, itâs a letter you write where you ask for the creditor to remove a negative mark from your credit reports.

Goodwill letters still work today.

You can find out how to write a goodwill letter with templates included right here.

How Can You Get Derogatory Credit Marks Removed

If you find derogatory marks on your credit report, it can feel like those reminders of past mistakes, hardships or failures will never go away. Theyre out there for lenders to see, and they continue to drag your credit score down.

Here are three things to know about getting derogatory credit marks removed from your report:

You May Like: Syncb/bp

Derogatory Mark: Account Charge

If you dont or cannot pay your debt as agreed, your lender may eventually charge the account off. The charge-off will appear on your credit reports for seven years.

What to do: Try to pay off the debt or negotiate a settlement. While this wont get the charge-off removed from your credit reports, it’ll remove the risk that youll be sued over the debt.

Paying Off Derogatory Credit Items

It can be beneficial to pay off derogatory credit items that remain on your credit report. Your credit score may not go up right away after paying off a negative item however, most lenders wont approve a mortgage application if you have unpaid derogatory items on your credit report. Make sure the accounts are valid before sending payment, especially with debt collection accounts.

You May Like: Can You Remove Hard Inquiries Off Your Credit Report

Get Free Credit Reports

Visit annualcreditreport.com to order or download a free credit report from each of the three major credit bureaus.

These reports wont show your credit score, but you can check them for inaccuracies and new credit applications you didnt make all of which affect your credit score.

Federal law gives you the right to one free credit report from each credit bureau each year.

Temporarily, because of the Covid-19 pandemic, you can get one free credit report from each bureau once a week.

This provision is scheduled to expire in April of 2021. After that, youll have access to a free credit report only once a year.

Send Letters To The Credit Bureaus

If the debt really is too old to be reported, its time to write to the credit bureau to request its removal. When you dispute an old debt, the bureau will open an investigation and ask the creditor reporting it to verify the debt. If it cant, the debt has to come off your report.

The Fair Credit Reporting Act requires credit bureaus to correct or delete any information that cant be verified or that is incorrect or incomplete, typically within 30 days. Otherwise, they are in violation and you are within your rights to file a lawsuit, as well as file a complaint with the Consumer Financial Protection Bureau.

Make sure to craft a case so strong that the creditor will have to acknowledge that its correct or present tangible evidence to the contrary. Include copies of anything that supports your claim, such as copies of court filings that show the correct date for a judgment or bankruptcy or a letter from your original creditor showing when the account became delinquent.

If a collection agency is reporting an account as a different debt, include any paperwork showing that the two accounts are really the same debt.

Send this letter certified with a return receipt requested so that you can prove when it was sent and that it was received.

Why this is important: If you can prove that the debt is older than legally allowed to show on your credit report, the bureau can remove it.

Read Also: How To Unlock Your Credit

Check Your Credit Report

The first step to fixing a derogatory mark on your credit report is simply knowing when one exists. Without knowing, you may apply for a loan only to be surprised by your credit score and the loan you qualify for. Thatâs why itâs important to check your credit regularly. The three credit reporting agencies â TransUnion, Equifax, and Experian â provide one free credit report per year.

The sooner you are aware of it, the sooner you can work towards getting it removed.

Submit A Dispute To The Credit Bureau

The Fair Credit Reporting Act is a Federal law that defines the type of information that can be listed on your credit report and for how long . The FCRA says that you have the right to an accurate credit report and because of that provision, you can dispute errors with the credit bureau.

are easiest when made online or via mail. To make a dispute online, you must have recently ordered a copy of your credit report. You can submit a dispute with the credit bureau who provided the credit report.

To dispute via mail, write a letter describing the credit report and submit copies of any proof you have. The credit bureau investigates your dispute with the business that provided the information and removes the entry if they find that is indeed an error.

Also Check: Open Sky Credit Card Payment

How Long Does Information Stay On My Equifax Credit Report

Reading time: 3 minutes

Highlights:

- Most negative information generally stays on credit reports for 7 years

- Bankruptcy stays on your Equifax credit report for 7 to 10 years, depending on the bankruptcy type

- Closed accounts paid as agreed stay on your Equifax credit report for up to 10 years

When it comes to credit reports, one of the most frequently asked questions is: How long does information stay on my Equifax ? The answer is that it depends on the type of information and whether its considered positive or negative.

Generally speaking, negative information such as late or missed payments, accounts that have been sent to collection agencies, accounts not being paid as agreed, or bankruptcies stays on credit reports for approximately seven years. Here is a breakdown of some the different types of negative information and how long you can expect the information to be on your Equifax credit report:

Here are some examples of “positive” information and how long it stays on your Equifax credit report :

- Active accounts paid as agreed. Active credit accounts that are paid as agreed remain on your Equifax credit report as long as the account is open and the lender is reporting it.

- Closed accounts paid as agreed. If the last status of the account is reported by the lender as paid as agreed, the account can stay on your Equifax credit report for up to 10 years from the date it was reported by the lender to Equifax.

Follow Up After The Investigation

Heres what to expect when the investigation is complete:

- The results of the investigation, in writing, from the credit reporting bureau.

- A free copy of your credit report, if the report has changed.

What about parties who have seen your incorrect information? You can ask the credit bureaus to notify them of the corrections, the FTC says. This includes:

- Notifying anyone who received your report in the past six months.

- Sending a corrected copy of your report to anyone who received it in the past two years.

But what if the investigation doesnt resolve your dispute? If the furnisher continues to report the error, you can ask the credit bureaus to include a statement in your credit file that describes your side of the dispute and it will be included in future credit reports. For a fee, you can usually ask the credit bureau to send a copy of the statement to anyone who has recently received a copy of your report.

Also, if you believe you were treated unfairly or a valid error remains on your credit report, you can file a complaint with the Consumer Financial Protection Bureau. The CFPB is required to forward the complaint to the company with which you have an issue. The CFPB usually will provide you with a response within 15 days.

How long can it take for an error to be corrected on your credit report after the dispute is resolved? Credit bureaus have five business days after finishing their investigation to notify you of the results.

Read Also: Aargon Com

Clean Up Any Derogatory Accounts

If you have delinquent accounts that are accurately represented on the credit report, do your best to pay the balances down, or pay them in full if you can. Start with the most recent accounts and work your way back, as the current charges have the greatest impact on your credit score. If youre planning to apply for a loan in the near future, it may actually be best to wait to pay off older debts until after youve received the loan, as this turns them into a current collection. Collection accounts commonly report once the account is created and then never again, so when you pay it off the debt, the account reports current information again. While having a balance paid in full is positive, it’s not so great that an old collection is reporting as a current collection.

Pay Your Bills Regularly And On Time Going Forward

Keep paying your bills on time to boost your credit score. Derogatory marks typically stay on your credit report for seven years. Fortunately, positive information, such as paying bills on time, can affect your credit forever and can even help you repair bad credit. Your credit score increases as your regular, on time payments continue, even if you’ve had derogatory items on your report in the past, such as bankruptcies or judgments.

References

Also Check: Does Speedy Cash Do Credit Checks

What If You Already Have A Mortgage In Process

Your lender may be able to help you correct your credit history within a few days. Only your lender has access to rapid re-score companies. Its not something you can do on your own. But they can fix problems with your credit report very quickly as long as you can prove the items are wrong or fraudulent.

Use a rapid re-score to qualify for a mortgage

Write A Pay For Delete Letter

A pay for delete letter is asking the creditor to remove the negative mark in exchange for paying the balance you owe.

Keep in mind that removing an accurately reported item may be in violation of a creditorâs agreement with credit bureaus, which can be seen as unethical. Because of this, a pay for delete letter may not work.

But if you can get a negative item removed using this method â ensure that you get the agreement in writing before paying â your score will improve.

Read Also: How To Unlock My Experian Credit Report

Derogatory Mark: Missed Payments

If you are at least 30 days late, expect a derogatory mark on your credit report. Missed payments typically stay on your credit reports for 7½ years from the date the account was first reported late. The later the payment goes moving to 60 days late, 90 days late and so on the greater the damage to your credit scores.

What to do: Pay your bill as soon as you can afford to. If youve never or rarely been late before, you might be able to get the creditor to drop the late fee. Call the customer service number, explain your oversight and ask if the fee can be removed. You can also write a goodwill letter. If paying the bill is not an option, call your creditor and let them know about your financial situation to see if you can work out a hardship plan.

The negative effect on your credit scores will fade over time. Try to stay on top of all your payments so positive information in your credit reports dilutes the effect of the missed payment.

Identify Any Credit Report Errors

Review your credit reports periodically for inaccurate or incomplete information. You can get one free credit report from each of the three major credit bureaus Equifax, Experian, and TransUnion once a year at annualcreditreport.com. You can also subscribe, usually at a cost, to a credit monitoring service and review your report monthly.

Some common credit report errors you might spot include:

- Identity mistakes such as an incorrect name, phone number or address.

- A so-called mixed file that contains account information belonging to another consumer. This may occur when you and another consumer have the same or similar names.

- An account incorrectly attributed to you due to identity theft.

- A closed account thats still being reported as open.

- An incorrect reporting of you as an account owner, when you are just an authorized user on an account.

- A remedied delinquency such as a collections account that you paid off yet still shows as unpaid.

- An account thats incorrectly labelled as late or delinquent, which could include outdated information such as a late payment thats over 7 years old or an incorrect date regarding your last payment.

- The same debt listed more than once.

- An account listed more than once with different creditors.

- Incorrect account balances.

- Inaccurate credit limits.

Recommended Reading: Report A Death To Credit Agencies

Dispute Any Credit Reporting Mistakes

The major credit reporting bureaus have dispute submission forms on their websites. You can select an item on your report and mark it disputed, giving a reason for the dispute and attaching any supporting documents. For example, if a creditor has listed an account twice, or if an account is listed as delinquent when it is not delinquent, you should dispute that item. You can also dispute any items that may be on your report if you were a victim of identity theft or credit card fraud, or even small things, such as an incorrect address, name or employer. If you do dispute any items, you should hear back within 30 days follow up if you don’t get a response.

Why Is A Good Credit Score Important

First, letâs do a quick refresh on why credit is important â and why a good credit score can save you money.

At some point, you are going to want to borrow money for a car loan or mortgage.

Because a credit score is an indicator of trust, the better your credit score, the better interest rates you can qualify for, which means youâll be paying less in interest. And overall, saving you money.

Derogatory marks, which lower your score, can hinder this.

Don’t Miss: Amazon Visa Card Credit Score

There Are Other Ways To Improve Your Credit Score

Maybe you have a derogatory mark thats legitimate but dragging your credit score down. If you cant fix the derogatory mark, look for other ways to improve your credit score:

- Work to resolve outstanding debt problems. If you have a debt in collections or are behind on payments, try to quickly resolve those issues by negotiating a settlement or payment plan. The longer the issues go unaddressed, the more severe the derogatory marks will be.

- Make payments on time, every time. Youll build a positive payment history with each month that passes and start to counterbalance negative marks.

- Pay down high credit card balances. One factor that affects your credit score is your credit utilization ratio or how high your credit card or line of credit balance is compared to your credit limit. The lower, the better, so if you make extra payments to lower your balance, it could give your credit score a boost.

- Open a secured credit card. A derogatory mark will lower your credit score and make it harder to qualify for a credit card. However, you could qualify for a secured credit card. You put down a cash deposit on the card and get a tool to build a positive payment history and improve your credit.

Dealing with derogatory credit can be discouraging. It might take time and patience to see progress. But by learning more about your credit score, youre taking steps in the right direction.