The Difference Between Your Credit Score And Credit Report

There are three credit bureaus that produce : Equifax, Experian and TransUnion. When you open a credit card or loan, the lender will report activity to at least one credit bureau, which will then add it to your credit report. Your credit reports show both current and past credit accounts, as well as legal judgments like liens and bankruptcies.

A credit score is a three-digit number that ranges from 300 to 850. The score is determined by an algorithm that takes all the items on your credit report into account. The higher the score, the more responsible you appear as a borrower.

There are two main companies that produce credit scores: FICO and VantageScore. FICO is responsible for 90% of all credit scores used by lenders, but VantageScore is more common with free credit scoring websites. Both companies use similar scoring models to determine your scores, so there should only be a slight discrepancy between a FICO score and a VantageScore.

There are dozens of credit score iterations, and which one is used depends on the type of lender looking at it. For example, the credit score an auto lender sees may be slightly different than the one a mortgage lender sees.

What Are Soft Inquiries

If youre wondering does getting a credit report hurt your score, the answer is no.

Checking your own credit report or score is a type of soft inquiry. Also known as soft pulls or soft pull inquiries, these dont affect your credit score. Other examples of soft inquiries include those made for:

- Pre-qualified credit card offers

- Pre-qualified loan or insurance offers

- Background checks by potential employers

Although pre-qualified or pre-approved offers are soft inquiries, if you accept the offer, it is considered an application. At this point, the inquiry is then regarded as a hard pull.

Whats An Apartment Credit Check

Before we dive in, lets figure out what a credit check is. An apartment credit check reveals your credit history by looking into your bank and credit card account balances. The credit check also shows any outstanding loans or payments. The reason for running the credit check is simple: the better your credit, the more evidence you have that you will pay your monthly rent on time.

Heres what your landlord will ask you for:

- Full legal name

- Current and former addresses from the last two years

- Current and past employment

Also Check: Does Affirm Report To Credit

When Does Checking My Credit Score Lower It

Hard inquiries, also called hard pulls, are the kind that can cost you points. They happen when someone pulls your credit for the purpose of deciding whether to extend credit to you. These hard inquiries should not happen without your knowledge or consent.

You can review your hard inquiries on NerdWallets free credit report summary, which updates weekly. You can also check your free credit reports at AnnualCreditReport.com to see who has looked at it in the past two years. Consumers currently have access to those reports weekly.

A hard inquiry might cost you up to five points according to FICO, the creator of the most widely used scoring formulas. With VantageScore, an increasingly popular credit scoring model, a hard inquiry is likely to cost even more.

In contrast, a soft inquiry or soft pull occurs when you or a creditor looking to preapprove you for a loan or credit card checks your score. A soft inquiry has no effect on your credit score.

So, if you apply for several credit cards close together, you might see a significant drop in your credit scores. Before you begin applying, take time to conduct research on the best credit cards for your specific financial needs, while keeping eligibility requirements in mind.

A hard inquiry stays on your credit report for two years, but any effect on your credit score fades sooner than that.

You Can Shop Around For A Mortgage And It Will Not Hurt Your Credit

Within a 45-day window, multiple credit checks from mortgage lenders are recorded on your credit report as a single inquiry. This is because other creditors realize that you are only going to buy one home. You can shop around and get multiple preapprovals and official Loan Estimates. The impact on your credit is the same no matter how many lenders you consult, as long as the last credit check is within 45 days of the first credit check. Even if a lender needs to check your credit after the 45-day window is over, shopping around is usually still worth it. The impact of an additional inquiry is small, while shopping around for the best deal can save you a lot of money in the long run. Note: the 45-day rule applies only to credit checks from mortgage lenders or brokers’ credit card and other inquiries are processed separately.

Don’t Miss: How To Remove Repossession From Credit Report

Whats A Hard Credit Inquiry

Also known as a hard check, a hard inquiry happens when a lender checks your credit report after you apply for credit.

âWhen you apply for credit, you authorize those lenders to ask or âinquireâ for a copy of your credit report from a credit bureau,â credit-scoring company FICO® explains.

Examples of Hard Credit Inquiries

FICO says that you could trigger a hard inquiry by:

- Applying for a credit card.

- Applying for a loan.

- Applying for a mortgage or to rent an apartment.

- Opening accounts like phone, cable or internet.

Requesting a credit limit increase may also trigger a hard inquiry, but that can depend on the lender’s policies and your specific circumstances.

Hard Vs Soft Inquiries

A credit inquiry shows up whenever your credit report is accessed. That means applying for a loan or a new credit card will generate an inquiry record on your report.

Watch on

Lenders make credit inquiries to check your history of making payments on time and your general credit-worthiness, but theyre not the only ones checking your credit report. Other parties, such as potential landlords, may also use your credit report to get an idea of your financial responsibility.

You May Like: Does Titlemax Report To Credit Bureau

Is There Any Way To Avoid Hard Inquiries While Searching For The Best Loan Or Credit Card Offer

Finding the right lender can get you a more suitable deal, including benefits like flexible repayment plans or competitive interest rates. But this may mean submitting multiple applications, which can affect your credit score quite significantly. Instead, with some careful research, you can identify lenders who offer terms that are suitable for your circumstances without making multiple applications.

Why Does Your Credit Score Go Down When Checked

People often wonder why their credit score goes down after they or a lender checks the information on their report.

The equations that output these scores work like black boxes, and the rules and consequences around hard versus soft inquiries are complex. Therefore, it is easy to be confused.

Be clear on one key point. Running your credit score will never hurt your qualification! The bureaus log a soft inquiry that only you can see.

However, the picture muddies once you begin the process of applying for a new borrowing account. Then, some pulls will impact your score more than others.

Read Also: Does Titlemax Go On Your Credit

So Does Checking Your Credit Score Hurt Your Credit

It depends!

To recap, the most important takeaway here is that checking your credit does not hurt your credit score. There is a difference between hard and soft inquiries hard inquiries happen when you apply for a new line of credit, and a soft inquiry is when you check your own credit. Soft inquiries dont affect your credit score, but hard inquiries can lower your score from just a few points to sometimes many more.

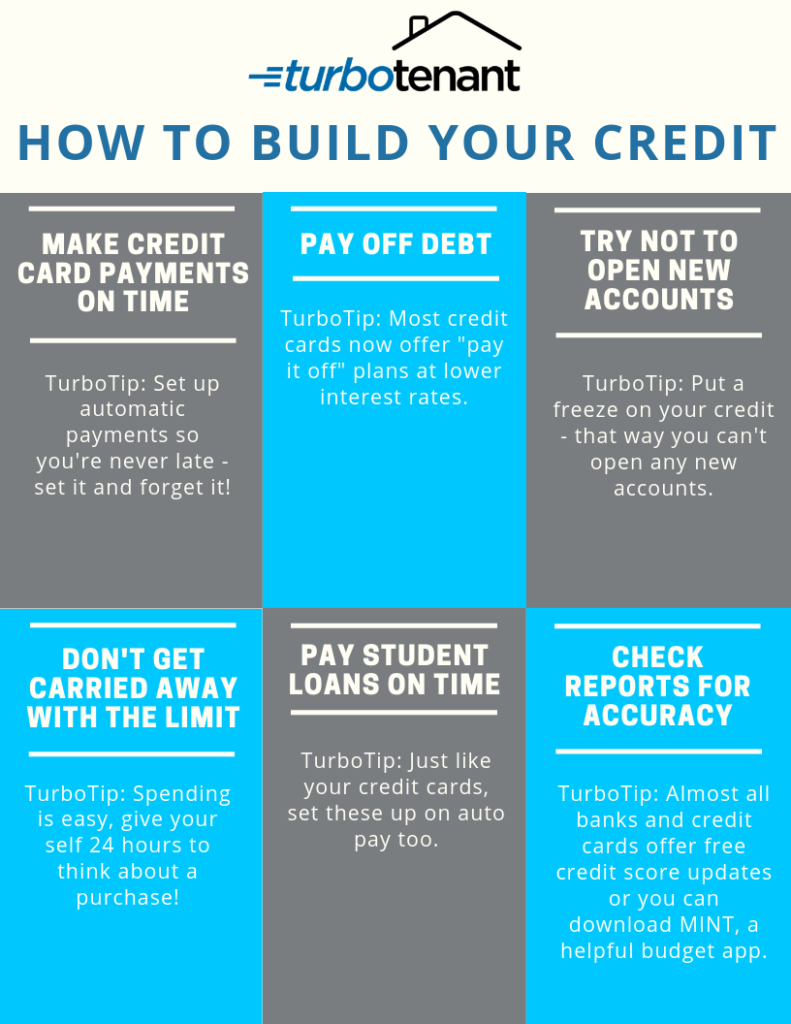

Checking your credit is an important first step to maintaining good credit health. Checking your credit score regularly can be a good indication if something is off in your credit report. Before you apply for a loan for an expensive item, such as a car or a house, its smart for you to be aware of what potential lenders will see when processing your application. Knowing where you stand gives you the chance to shape up your credit, if necessary, before submitting your application.

Does Checking Your Credit Score Hurt Your Credit Not Always

Do you know what your current credit score is? As we mentioned, the first step to any credit-related process is knowing and understanding your credit score. Checking your own credit score is safe, in that it doesnt harm your score, but not all inquiries are the same. The fact that checking your own credit doesnt hurt your score is great news, since research has shown that regularly monitoring your credit can help lead to a higher score.

In other words, not only will checking your credit not hurt your score, it can actually help you improve it. Improvements aside, lets take a closer look at why understanding the process of checking your credit is so important.

You May Like: Comenity Shopping Cart Trick

How Many Hard Inquiries Is Too Many

The effect of a hard inquiry on your credit scores ultimately depends on your overall credit health. In general, adding one or two hard inquiries to your credit reports could lower your scores by a few points, but its unlikely to have a significant impact.

Having a lot of hard inquiries within a short time frame though will likely have a greater impact on your scores. This is because lenders and in effect, credit-scoring models look at multiple credit applications in a short amount of time as a sign of risk. Though there can be exceptions when youre shopping for specific types of loans, like car loans, student loans or mortgages.

Is It Worth Paying For A Credit Score

Sites like MyFICO provide access to your FICO credit score when you sign up for a monthly membership. The monthly fee ranges from $19.95 to $39.95 a month. Unlike free credit score sites that only show one score, youll see the FICO scores used by auto lenders, mortgage lenders and other lenders that use industry-specific scoring models.

Access to those scores is typically not worth the monthly fee because theres usually little difference between credit scores. Dont sign up for a paid service if youre worried about your credit score. Instead, use a free monitoring tool, minimize your credit card use and pay all your bills on time. Those strategies will help you improve your score and qualify for lower interest rates.

You May Like: How To Check Credit Score With Itin Number

Will Checking Your Credit Hurt Credit Scores

Reading time: 2 minutes

Highlights:

-

Checking your credit reports or credit scores will not impact credit scores

-

Regularly checking your credit reports and credit scores is a good way to ensure information is accurate

-

Hard inquiries in response to a credit application do impact credit scores

Many people are afraid to request a copy of their credit reports or check their credit scores out of concern it may negatively impact their credit scores.

Good news: Credit scores aren’t impacted by checking your own credit reports or credit scores. In fact, regularly checking your credit reports and credit scores is an important way to ensure your personal and account information is correct, and may help detect signs of potential identity theft.

Impact of soft and hard inquiries on credit scores

When you request a copy of your credit report or check credit scores, thats known as a soft inquiry. Other types of soft inquiries result from companies that send you promotional credit card offers and existing lending account reviews by companies with whom you have an account. Soft inquiries do not affect credit scores and are not visible to potential lenders that may review your credit reports. They are visible to you and will stay on your credit reports for 12 to 24 months, depending on the type.

The other type of inquiry is a hard inquiry. Those occur after you have applied for a loan or a credit card and the potential lender reviews your credit history.

Getting your credit reports

What About Rate Shopping

You can typically check your interest rate with a lender without a hard credit check through a prequalification process. After you prequalify and choose a lender, thats when it will run a hard credit check.

However, not every lender offers prequalification and you may encounter hard credit checks while rate shopping for some products. For example, if you shop around for mortgage preapprovals, lenders are likely to run a hard credit check from the start.

In these cases, theres still good news. If you do all of your rate shopping for mortgages, student loans or auto loans within a short period of time, itll be recorded as a single hard credit inquiry on your report, even though multiple lenders may have done a hard credit check.

The time period you have to complete your rate shopping varies. FICO has many different credit scoring models that lenders can request. For some of these models, your rate-shopping period is 14 days, while for others, its 45 days. Plan on doing all of your rate shopping within the same two-week period if you can to be on the safe side.

Recommended Reading: 588 Credit Score Car Loan

Question: How Can I Get My Free Credit Report

Answer: The FACT Act makes every consumer eligible for one free copy of your credit report from each of the three national credit reporting agencies every 12 months. Now, TransUnion is pleased to offer you free weekly credit reports online through April 2021 as part of our commitment to supporting all Americans during and after the COVID-19 health crisis. Get your free report now at annualcreditreport.com.

Reviewing your credit reports regularly helps you ensure the information reported is accurate and gives you an opportunity to monitor your account history to combat potential identity theft.

When Does A Credit Check Hurt Your Score

When you check your own credit score, it has no impact because it only counts as a soft inquiry. But when a lender or credit card company pulls your credit score, its a different story.

There are two ways a company can pull your credit information: a soft inquiry and a hard inquiry. A soft inquiry is most often used when a lender wants to preapprove you for a loan or credit card and has no visible impact on your score. Employer credit checks also show up as soft inquiries.

A hard inquiry occurs when youre directly applying for a loan or credit card and will impact your credit score. Landlord credit checks are often considered hard inquiries, too. A hard inquiry will officially stay on your credit report for two years but will only affect your score for one yeartypically between one and five points.

Don’t Miss: Affirm.com Walmart Apply On Your Phone

Who Creates Your Credit Report And Credit Score

There are two main credit bureaus in Canada:

- Equifax

These are private companies that collect, store and share information about how you use credit.

Equifax and TransUnion only collect information from creditors about your financial experiences in Canada.

Some financial institutions may be willing to recognize a credit history outside Canada if you ask them. This may involve extra steps. For example, you may request a copy of your credit report in the other country and meet with your local branch officer.

Sign Up For A Credit Monitoring Service

There are several online that you can get your score from, too. However, the companies offering credit scores this way may require enrollment or payment. Youre more likely to see your VantageScore or an equivalent scoring model this way, which is still useful information, but its not the FICO score used in 90% of lending decisions.

We recommend using this method only if you are interested in the other credit-monitoring services. First, take advantage of what your card or bank accounts offer, and the credit bureau-sponsored tools showing your FICO score.

Regardless of the method you choose, regularly checking your credit score and learning whats on your credit report will benefit your financial health in the long run. And remember, you can check your credit score as often as you like and, doing so wont lower it.

You May Like: What Is The Minimum Credit Score For Care Credit

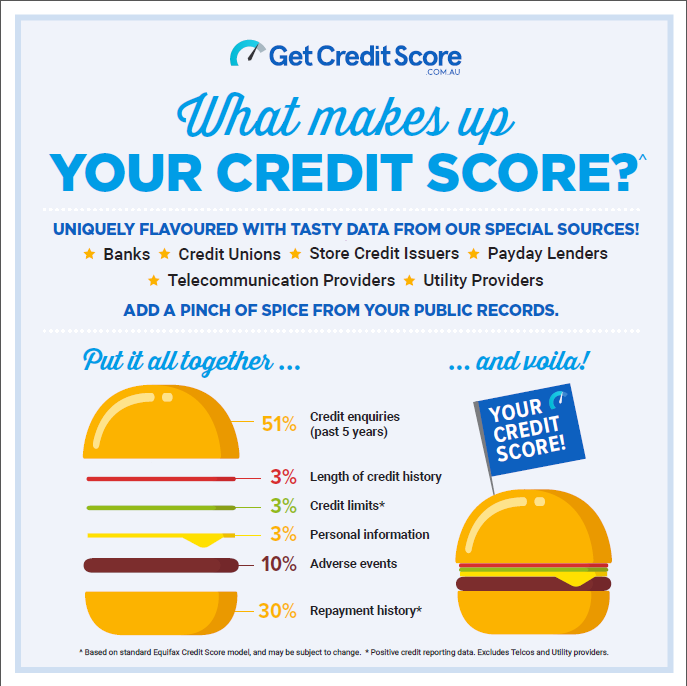

Question: What Impacts My Credit Score The Most

Answer: Payment history is the most important factor in calculating your credit scores because it shows how you’ve managed your finances, including whether you’ve made any late payments. Your credit history is also very important as it demonstrates how long you’ve been managing your accounts, when your last payments were made and any recent charges.

How Many Points Does A Hard Inquiry Affect Your Credit Score

A single hard inquiry will drop your score by no more than five points. Often no points are subtracted. However, multiple hard inquiries can deplete your score by as much as 10 points each time they happen.

People with six or more recent hard inquiries are eight times as likely to file for bankruptcy than those with none. Thats way more inquiries than most of us need to find a good deal on a car loan or credit card.

Realistically, only a narrow group of people has good reason to be cautious about the effect inquiries could have on their FICO score, Watt said.

Heres who might be concerned, according to Watt:

- People who take an unusually long time to shop for a new mortgage or auto loan.

- Consumers who shop around in the same year for several different lines of credit not associated with a mortgage or auto loan.

- People who know before they begin applying for credit presumably from conversations with creditors that their credit score barely qualifies them for their desired credit offering.

You May Like: Does Qvc Do A Credit Check