The Big Three Credit Bureaus

In the U.S. there are several different credit bureaus, but only three that are of major national significance: Equifax, Experian, and TransUnion. This trio dominates the market for collecting, analyzing, and disbursing information about consumers in the credit markets.

In the U.S. there are several different consumer reporting agencies, but only three that are of major national significance: Equifax, Experian, and TransUnion. This trio dominates the market for collecting, analyzing, and disbursing information about consumers in the credit markets.

Credit scores have historically been based on the FICO score associated with the data-analytic company originally known as the Fair Isaac Corporation. While you can still get a FICO score from any of the big three, their calculation methods differ, and Experian uses its own FICO score, also known as Experian/Fair Isaac Risk Model v2.

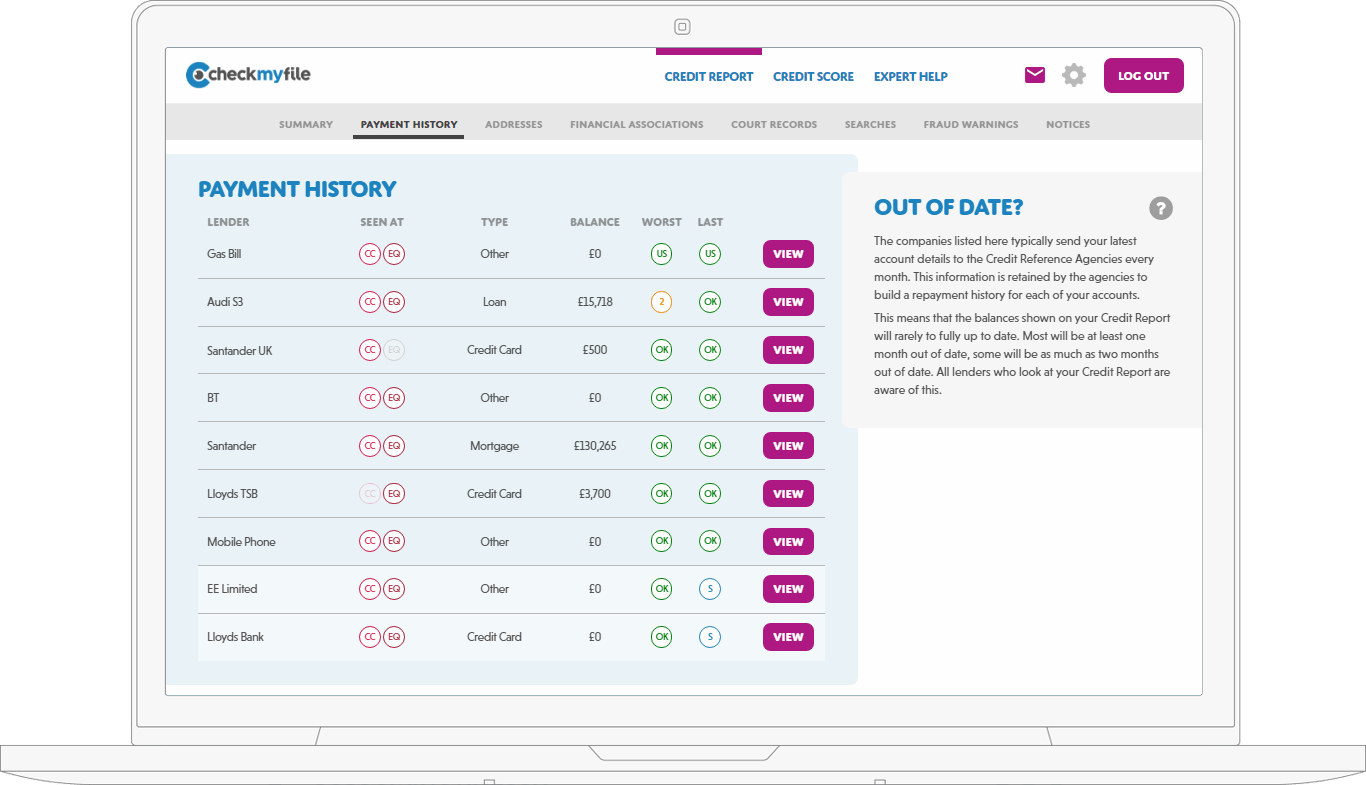

What Is My Credit Report

Think of your credit report as your financial CV. It contains information that helps lenders confirm your identity and decide whether youre a reliable borrower.

This includes details of credit accounts youve held , your current and previous addresses, and any financial connections for example, the name of the person you share a joint account with.

There are likely to be three slightly different versions of your credit report, because lenders dont always share the same information with all three major credit reference agencies – Experian, Equifax and TransUnion .

There Are Few Numbers In Life That Matter As Much To Your Financial Well

Whether youre applying for a credit card or buying a home, these three-digit numbers can go a long way in determining whether a lender will do business with you.

The problem is, there are so many out there. How can you keep track of them all?

And what should you do if your scores differ between credit-reporting agencies ?

First things first: Its perfectly normal for scores to differ slightly between agencies. Its up to lenders to decide which information they report to the major credit agencies and which agencies they report to in the first place. Since your FICO Scores depend on the data listed on your credit reports, you might not see the exact same score from every credit-reporting agency. Of course, there may be other reasons for any discrepancies in your scores more on that later.

The good news? Many agencies look at similar factors when calculating your credit scores. So long as you make payments on time, keep your credit card balances low and dont go wild opening new credit card accounts when you dont need them, you should be in good all-around shape.

Here at Credit Karma, we want to help you develop the healthy financial habits that credit-reporting agencies look for when they crunch your credit scores.

So, listen up .

Read Also: Navy Federal Car Loan Credit Score

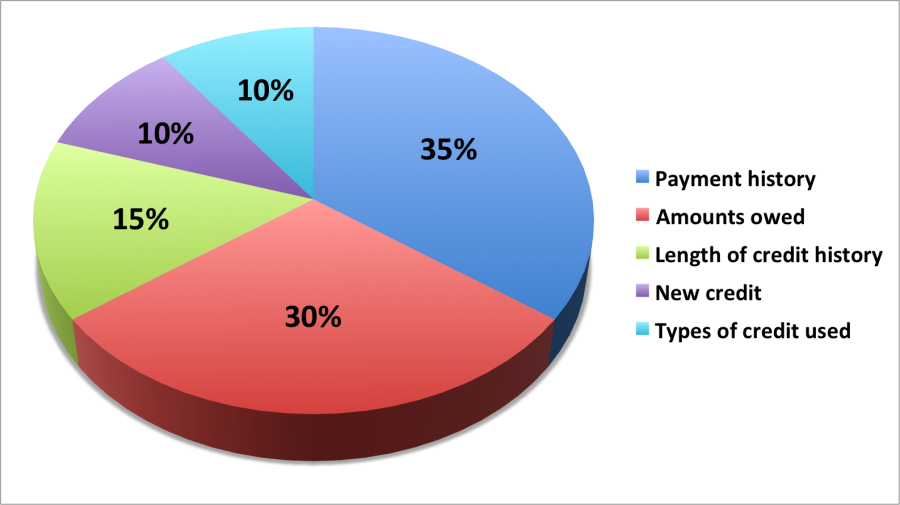

Payment History Is The Most Important Factor Of Your Credit Score

Payment history accounts for 35% of your FICO® Score. Four other factors that go into your credit score calculation make up the remaining 65%.

Keep in mind that there are as many as 28 versions of the FICO® Score, meaning you may have one score that’s used to determine whether your credit card application is approved, another score for a mortgage application and yet another score for an auto loan application. When calculating these various scores, FICO weighs your payment history on your credit accounts most.

Why is payment history more important than the other factors? A lender wants to protect itself from risk. Therefore, it wants to know whether you’ve made timely payments on current and previous credit accounts. According to FICO, research shows payment history is typically the No. 1 predictor of whether you’ll pay your debts on time, thus the heavier emphasis on this factor.

What Is A Credit Scoring Model

Scoring calculations are based on payment record, frequency of payments, amount of debts, credit charge-offs and number of credit cards held. A weight is assigned to each factor considered in the models formula, and a credit score is assigned based on the evaluation.

Scores generally range from 300 to 850 .

Lenders use credit scores to help determine the risk involved in making a loan, the terms of the loan and the interest rate. The higher your score, the better the terms of a loan will be for you. There are different credit score models, which emphasize varying factors.

Read Also: Does Eviction Show On Credit Report

Which Credit Reporting Agencies Banks Use To Pull Your Credit Report And Why It Matters

This post contains references to products from one or more of our advertisers. We may receive compensation when you click on links to those products. Terms apply to the offers listed on this page. For an explanation of our Advertising Policy, visit this page.

Editors note: This post has been updated with the latest information.

One of the most important things to know when you apply for a credit card is which credit bureau each bank uses to pull your credit report. In case you didnt know, there are three major credit bureaus, also called credit reporting agencies, in the United States. When you apply for a new line of credit, banks and credit card companies can pay to access your credit report from Equifax, Experian or TransUnion.

Related: How to check your credit score for free

The CRA used by a card issuer to see your credit report can determine whether your application is approved or denied, especially when you apply for various cards in a short amount of time. If several card issuers pull from the same credit reporting agency, it could affect your chances of being approved.

However, if card issuers go to different credit bureaus to buy your reports, one issuer might not see that youre applying for a new account elsewhere. As a result, your chances of being approved for several cards should increase.

So What Are Credit Scores Then

As weve mentioned previously, a credit score is a three-digit grade credit bureaus give you based on your credit history. Since this grade can determine so many of your lifes big financial decisions – from buying a home to getting the job you want – its important to check your credit history regularly and be aware of whats being taken into account when calculating your score.

Many people arent aware that they dont have just one credit score, just as they dont have one single credit report. FICO, for instance, has over 50 distinct credit score types corresponding to different industries–and there are other, lesser-known and lesser-used scoring models as well .

at least in the two most popular scoring models, FICO and VantageScore usually range from 300 to 850, with 300 considered extremely poor and 850 excellent. The higher the number the more creditworthy youre thought to be. People in the higher end of the scale will not only qualify for most loans and credit cards, but will also be offered the lowest interest rates.

FICO Score

The FICO Score was created by the Fair Isaac Corporation and is considered the most widely used credit score model. In fact, FICO states they are used in more than 90% of lending decisions.

FICO has developed different versions of their score throughout the years. As a result, you have more FICO scores than you probably imagine.

Theres also the FICO Score 3 which is used primarily for credit card lending.

VantageScore

Read Also: Realpage Consumer Report

How Do You Check Your Credit Report

On AnnualCreditReport.com you are entitled to a free annual credit report from each of the three credit reporting agencies. These agencies include Equifax, Experian, and TransUnion.

Due to the COVID-19 pandemic, many people are experiencing financial hardships. To remain in control of your finances, you can get free credit reports every week through April 2022.

Request all three reports at once or one at a time. Learn about other situations when you can request a free credit report.

Request Your Free Credit Report:

By Mail: Complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request Service

PO Box 105281

Atlanta, GA 30348-5281

If Your Request for a Free Credit Report is Denied:

Contact the CRA directly to try to resolve the issue. The CRA should tell you the reason they denied your request and explain what to do next. Often, you will only need to provide information that was missing or incorrect on your application for a free credit report.

If you can’t resolve your dispute with the CRA, contact the Consumer Financial Protection Bureau .

Why Did My Credit Score Drop After Paying Off Debt

The most common reasons credit scores drop after paying off debt are a decrease in the average age of your accounts, a change in the types of credit you have, or an increase in your overall utilization. … In general, the benefits of paying off debt outweigh the downsides of a reduced credit score.

Read Also: Does Paypal Credit Report To Credit Bureaus

Best Free Credit Monitoring Services

See our methodology, terms apply.

Who’s this for? is a free credit monitoring service that doesn’t require you to enter a credit card number to sign up and provides a great range of features.

Plus it’s open to anyone regardless of whether you’re a Capital One cardholder. If you’re a Capital One customer, CreditWise features are integrated into the Capital One mobile app, so there’s no need to also download the CreditWise app.

Consumers receive an updated VantageScore credit score from TransUnion every week and credit report updates from TransUnion and Experian in real time. Unlike other free services, CreditWise stands out by offering dark web scanning and social security number tracking.

As an added tool, you can use the credit score simulator to check the potential effect that certain actions, such as paying off debt or closing a credit card, may have on your credit score.

Best For Single Bureau Access: Credit Sesame

In addition to your TransUnion credit report information, youll also have access to your TransUnion credit score online or through the Credit Sesame mobile app. Reviewing your information often gives you an idea of where your credit stands and whether you need to improve your score. Credit Sesame analyzes your credit information to make recommendations for credit cards, loans, and other financial products, but you dont have to apply if youre not on the market for a new loan.

Read Also: Remove Inquiries In 24 Hours

Other Places To Check Your Credit Score

Although other scores arent used as often by lenders, they are still useful for tracking changes to your credit and are offered for free.

If you dont have a credit card or other product that provides free access to your score, it doesnt hurt to track one of the other scores, even though it isnt a FICO score.

You can also use these scores to check if you are making progress on your credit, and if there is a major decline or suspicious activity on your credit report, you can catch it right away. Then, you can at least investigate the activity and fix any issues.

Some of the other credit scores you might want to keep an eye on include the following:

Two Types Of Credit Scoring Models

While there are a number of credit scoring models utilized to determine a persons credit worthiness, there are essentially two distinct types of scoring models that can be validated statistically.

These models will either use a statistical or judgmental scoring analysis. In each case, the end credit score result can vary as well.

A statistical scoring model utilizes multiple factors from one or a number of credit reporting agencies, correlates them and then assigns weights to each factor. The model does not consider the individual judgments or experiences of any credit officials.

A judgmental scoring model considers an individual or organizational financial statement, payment history, bank references and even the credit officials own previous experience in handling its products and services. By including these elements in someones credit history, a subjective judgment is given more weight in determining the credit score rating scale.

11 Minute Read

You May Like: How Long Is A Repo On Your Credit Report

How Credit Scores Are Factored

Most consumers don’t realize that multiple credit scores exist for each individual, a fact that credit-scoring companies generally avoid explaining to their users. It’s important for consumers to know exactly how their credit scores are being issued and rated, so as to avoid fraud and false advertising.

In 2017, the Consumer Financial Protection Bureau ordered TransUnion and Equifax to pay more than $17.6 million in restitution to consumers for deceiving them about their personal credit scores. TransUnion and Equifax had each advertised that the credit scores they issued would be the numbers that lenders would use when making decisions, but this was determined to be a lie. The two credit bureaus also had to pay $5.5 million in fines to the CFPB.

The credit score given by providers like and are generic, educational credit scores, meant to give consumers an approximate idea of where their credit stands.

According to the CFPB, credit scores are based on the following factors:

- Your bill-paying history

- The number and type of loan accounts you have

- How long you have had your loan accounts open

- How much of your available credit you are using

- New applications for credit

- Whether you have had a debt sent to collection, a foreclosure, or a bankruptcy, and how long ago

For example, auto scores look for:

Fixing Errors In A Credit Report

Anyone who denies you credit, housing, insurance, or a job because of a credit report must give you the name, address, and telephone number of the credit reporting agency that provided the report. Under the Fair Credit Reporting Act , you have the right to request a free report within 60 days if a company denies you credit based on the report.

You can get your credit report fixed if it contains inaccurate or incomplete information:

- Contact both the credit reporting agency and the company that provided the information to the CRA.

- Tell the CRA, in writing, what information you believe is inaccurate. Keep a copy of all correspondence.

Some companies may promise to repair or fix your credit for an upfront fee–but there is no way to remove negative information in your credit report if it is accurate.

You May Like: Syncb Ppc Card

Legal Issues With Tenant Credit Reports

You are legally free to check tenant credit reports and use the information when selecting tenants, as long as you don’t illegally discriminate in doing sofor example, by only requesting credit reports from certain tenants or by arbitrarily setting tougher standards for renting to a tenant who is a member of a racial or ethnic minority or other protected class.

Also, a federal law known as the “Disposal Rule” requires you to keep only needed information from a tenant’s credit report and to discard the rest.

What Is A Credit Pull

A credit pull or inquiry is a request by a retailer, financial institution or any other individual to view your credit report. Third parties can pull your credit report to review your creditworthiness and other details before extending credit. There are two types of credit pulls, hard inquiries and soft inquiries. Only you can see your soft inquiries, but hard inquiries are visible to anyone who looks at your report.

Anytime a potential lender looks at your credit report, a hard credit inquiry occurs. An example of a hard inquiry is when you apply for a mortgage and the lender pulls your credit report to determine your worthiness for extension of credit.

On the other hand, a soft inquiry occurs when a routine check is performed on your report without your permission. Soft inquiries happen when a creditor youre currently working with checks your credit to ensure youre still creditworthy or when you check your report yourself.

Check out this infographic to learn how bad credit can affect your daily life.

Don’t Miss: Debt Recovery Solutions Verizon

Banks Are Not The Only Ones Who Care About Your Credit History

Financial institutions are not the only ones who use your credit report to figure out how trustworthy you are when it comes to paying your dues. Insurance, utility, cellphone, internet companies, and even government agencies, may also want to check it out.

Your credit history helps these companies determine how reliable you will be with payments, if they should ask for a security deposit, how much to charge you for an insurance policy, or if you are eligible for government welfare.

If you have poor credit or no credit at all you may have to pay a deposit for those types of services that somebody with good credit or excellent credit wouldnt have to pay, mentioned Lass.

Its also likely that a landlord or property manager will ask for a credit report before renting out a property. Many landlords look at credit history as one of their factors in terms of acceptance an applicant, confirmed Lass. A survey from SmartMove, a tenant background screening service offered by Transunion, found that 90% of landlords run credit checks on prospective tenants.

Employers might also be interested in taking a look. A survey by the National Association of Professional Background Screeners, in partnership with HR.com’s Research Institute, found that 16% of employers check every candidates credit report, while 31% check at least some candidates.

Which Credit Report Do Lenders Look At

Theres no way to know which credit report lenders look at unless you ask. When inquiring, its equally important to ask which version of the FICO Score they consider when making a lending decision. These could include one of the following:

- FICO® Score 2: used by Experian for mortgage lending

- FICO® Score 3: used by Experian for credit card approvals

- FICO® Score 4: used by TransUnion for mortgage lending

- FICO® Score 5: used by Equifax for mortgage lending

- FICO® Score 8: most widely used versions by Experian, TransUnion, and Equifax

- FICO® Score 9: the other most commonly used version by Experian, TransUnion, and Equifax

- FICO® Auto Score 2: used by Experian for auto lending

- FICO® Auto Score 4: used by TransUnion for auto lending

- FICO® Auto Score 5: used by Equifax for auto lending

- FICO® Auto Score 8: used by Experian, TransUnion, and Equifax for auto lending

- FICO® Auto Score 9: used by Experian, TransUnion, and Equifax for auto lending

- FICO® Bankcard Score 2: used by Experian for credit card approvals

- FICO® Bankcard Score 4: used by TransUnion for credit card approvals

- FICO® Bankcard Score 5: used by Equifax for credit card approvals

- FICO® Bankcard Score 8: used by Experian, TransUnion, and Equifax for credit card approvals

- FICO® Bankcard Score 9: used by Experian, TransUnion, and Equifax for credit card approvals

Don’t Miss: What Bank Is Syncb Ppc