Users Of Credit Ratings

Credit ratings are used by investors, intermediaries such as investment banksList of Top Investment BanksList of the top 100 investment banks in the world sorted alphabetically. Top investment banks on the list are Goldman Sachs, Morgan Stanley, BAML, JP Morgan, Blackstone, Rothschild, Scotiabank, RBC, UBS, Wells Fargo, Deutsche Bank, Citi, Macquarie, HSBC, ICBC, Credit Suisse, Bank of America Merril Lynch, issuers of debt, and businesses and corporations.

- Both institutional and individual investors use credit ratings to assess the risk related to investing in a specific issuance, ideally in the context of their entire portfolio.

- Intermediaries such as investment bankers utilize credit ratings to evaluate credit risk and further derive pricing of debt issues.

- Debt issuers such as corporations, governments, municipalities, etc., use credit ratings as an independent evaluation of their creditworthiness and credit risk associated with their debt issuance. The ratings can, to some extent, provide prospective investors with an idea of the quality of the instrument and what kind of interest rate they should be expecting from it.

- Businesses and corporations that are looking to evaluate the risk involved with a certain counterparty transaction also use credit ratings. They can help entities that are looking to participate in partnerships or ventures with other businesses evaluate the viability of the proposition.

Why Having A Good Credit Score Is Important

In general, having good credit can make achieving your financial and personal goals easier. It could be the difference between qualifying or being denied for an important loan, such as a home mortgage or car loan. And, it can directly impact how much you’ll have to pay in interest or fees if you’re approved.

For example, the difference between taking out a 30-year, fixed-rate $250,000 mortgage with a 670 FICO® Score and a 720 FICO® Score could be $72 a month. That’s extra money you could be putting toward your savings or other financial goals. Over the lifetime of the loan, having a good score could save you $26,071 in interest payments.

Additionally, credit scores can impact non-lending decisions, such as whether a landlord will agree to rent you an apartment.

Your credit reports can also impact you in other ways. Some employers may review your credit reports before making a hiring or promotion decision. And, in most states, insurance companies may use credit-based insurance scores to help determine your premiums for auto, home and life insurance.

What Factors Affect Your Credit Score

The two main credit scoring models, FICO and VantageScore, consider much the same factors but weight them somewhat differently. For both scoring models, the two things that matter most are:

-

Paying bills on time. A misstep here can be costly, and a late payment that’s 30 days or more past the due date stays on your credit history for years.

-

How much you owe. Credit utilization, or how much of your credit limits you are using, is weighted almost as heavily as paying on time. It’s good to use less than 30% of your credit limits lower is better. You can take several steps to lower your credit utilization. Scores respond fairly quickly to this factor.

Much less weight goes to these factors, but they’re still worth watching:

-

The longer you’ve had credit, and the higher the average age of your accounts, the better for your score.

-

Credit mix: Scores reward having more than one type of credit a traditional loan and a , for example.

-

How recently you have applied for credit: When you apply for credit, a hard inquiry on your credit report may result in a temporary dip in your score.

Recommended Reading: 24 Hour Inquiry Removal

How Does Your Credit Score Compare

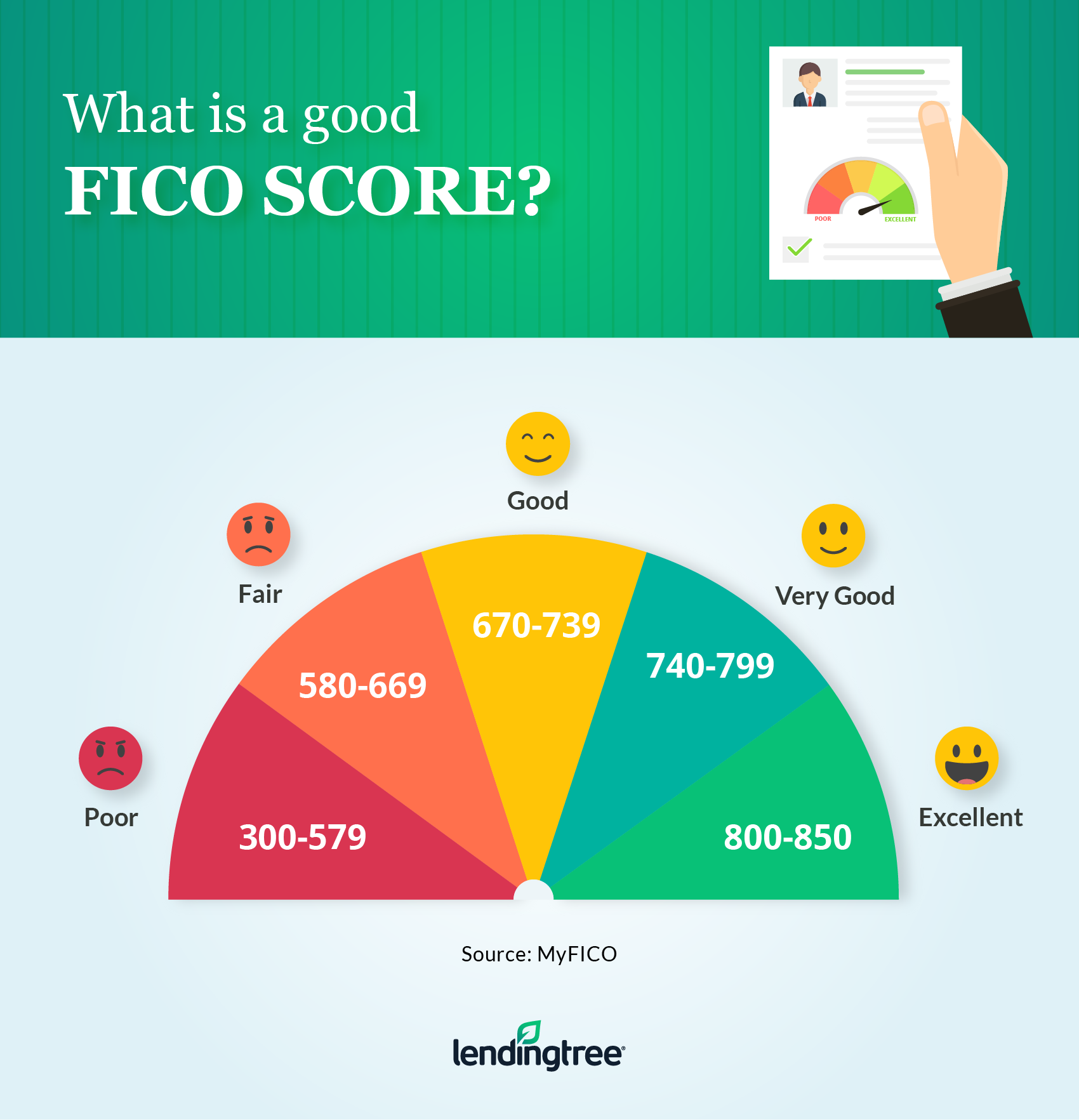

Most of the top credit rating agencies have five categories for credit scores: excellent, good, fair, poor and very poor. Each credit rating agency uses a different numerical scale to determine your credit score which means each CRA will give you a different credit score. However, youll probably fall into one category with all the agencies, since they all base their rating on your financial history.

|

Experian |

|---|

|

628-710 |

A fair, good or excellent Experian Credit Score

Experian is the largest CRA in the UK. Their scores range from 0-999. A credit score of 721-880 is considered fair. A score of 881-960 is considered good. A score of 961-999 is considered excellent .

A fair, good or excellent TransUnion Credit Score

TransUnion is the UKs second largest CRA, and has scores ranging from 0-710. A credit score of 566-603 is considered fair. A credit score of 604-627 is good. A score of 628-710 is considered excellent .

A fair, good or excellent Equifax Credit Score

Equifax scores range from 0-700. 380-419 is considered a fair score. A score of 420-465 is considered good. A score of 466-700 is considered excellent .

To get a peek at the other possible credit scores, you can go to ‘What is a bad credit score‘.

What An Excellent/exceptional Credit Score Means For You:

Borrowers with exceptional credit are likely to gain approval for almost any credit card. People with excellent/exceptional credit scores are typically offered lower interest rates. Similar to “exceptional/excellent” a “very good” credit score could earn you similar interest rates and easy approvals on most kinds of credit cards.

Also Check: Does A Repossession Stay On Your Credit

Good Credit Habits To Initiate And Maintain

Now that you know your credit score and the range it falls into, lets take a brief moment to explore the kind of healthy financial habits that lead to good credit and the improved financing and lending terms that accompany it:*

- Timely payments

- Only use the credit you really need

- Total length of credit history

- Instill a proactive approach to credit and personal finances

Learn About Credit Score Ranges From Fico And Vantagescore And How They Classify Excellent Good Or Poor Credit Scores

By Allan Halcrow | American Express Freelance Contributor

7 Min Read | January 31, 2020 in

Figuring out what a credit score of 640 means isnt really as tough as cracking the Da Vinci Code. But by the time youve considered the various credit score scales , it can certainly feel that way.

Fortunately, you dont need to be the hero of the Da Vinci Code to make sense of your . Thats because the different scales are more similar than different, and the scales are divided into credit score ranges whose names are simple and easy to remember .

Although cracking the credit code wont help you save the world, knowing the credit score range where your score lands can help you understand how lenders may view you in terms of credit risk. That could help you plan various aspects of your life, including the likely success of credit card, loan and rental applications, and whether you can expect to be offered favorable interest rates. And if you dont like the implications of your credit score range, you can take actions that could change it.

The two most commonly used credit scoring models, FICO and VantageScore, both rank credit scores on a scale from 300 to 850 and divide the scale into five credit score ranges. The ranges differ somewhat between the two models, and also have different names. If youve heard of higher scores, its either based on old information or industry-specific scoring models.

- Superprime

- Subprime

Equifax Credit Score Rangesand Others

Recommended Reading: Can A Repo Be Removed From Credit Report

Where Can I Get My Fico Score

Lots of credit card issuers and banks offer customers free FICO® Scores each month. It may be included on your billing statement, or you may be able to log in to your account to get your most recent score.

If you don’t have a financial account with access to a free FICO® Score, you can also receive one at no cost based on your Experian credit report by registering for an account on Experian’s site.

Monitor Your Credit Report And Score

Checking your credit score right before you apply for a new loan or credit card can help you understand your chances of qualifying for favorable termsbut checking it further ahead of time gives you the chance to improve your score, and possibly save hundreds or thousands of dollars in interest. Experian offers free credit monitoring for your Experian report, which in addition to a free score and report, includes alerts if there’s a suspicious change in your report.

Keeping track of your score can help you take measures to improve it so you’ll increase your odds of qualifying for a loan, credit card, apartment or insurance policyall while improving your financial health.

You May Like: Ntb/cbna

How To Check Your Credit Score

Checking your credit score was once a difficult task. But today, there are many ways to check your credit scores, including a variety of free options.

Your bank, credit union, lender or credit card issuer may give you free access to one of your credit scores. Experian also lets you check your FICO® Score 8 based on your Experian credit report for free.

The type of credit score you get can depend on the source. Some services may offer you a version of your FICO® Score, while others offer VantageScore credit scores. In either case, the calculated score will also depend on which credit report the scoring model analyzes.

Some services even let you check multiple credit scores at once. For example, with an Experian CreditWorks Premium membership, you can get your FICO® Score 8 scores based on your Experian, Equifax and TransUnion credit reportsplus multiple other FICO® Scores based on your Experian credit report.

Significance Of Credit Rating

Now let us understand what the credit rating signifies.

A credit rating determines the probability of the company paying back its financial indebtedness within the stipulated time. The ratings could be assigned to a particular company, or could also be issue specific.

Below is the chart illustrating the credit rating scale from the global credit rating agencies S& P, Moodys, and Fitch. To be noted that Indian rating agencies ICRA, Crisil, and India rating and research are Indian subsidiaries of Moodys, S& P, and Fitch, respectively. The long term ratings are usually assigned to a company, while the short term ratings are essentially for specific loans or debt instrumentsDebt InstrumentsDebt instruments provide finance for the company’s growth, investments, and future planning and agree to repay the same within the stipulated time. Long-term instruments include debentures, bonds, GDRs from foreign investors. Short-term instruments include working capital loans, short-term loans.read more.

Don’t Miss: Unlock Experian Account

What Is The Average Credit Score In Canada And How Do You Compare

What is the average credit score in Canada, and how do you rank among average Canadian credit scores? More so, what is a good credit score in Canada?

Often, Canadians want to know how they measure up to other people when it comes to their credit score. Is your credit score better than the average credit score? Maybe its worse?

First, let’s answer the question you are here to find out:

There Are 8 Steps In Our Ratings Process

- 1Contract : The issuer requests a rating and signs an engagement letter.

- 2Pre-Evaluation : We assemble a team of analysts to review pertinent information.

- 3Management Meeting : Analysts meet with management team to review and discuss information.

- 4Analysis : Analysts evaluate information and propose the rating to a rating committee.

- 5Rating Committee : The committee reviews the lead analysts rating recommendation then votes on the credit rating.

- 6Notification : We generally provide the issuer with a pre-publication rationale for its credit rating for fact-checking and accuracy purposes.

- 7Publication : We typically publish a press release announcing the public rating and post the rating on our website.

- 8Surveillance of Rated Issuers and Issues : The goal of this surveillance is to keep the rating current by identifying issues that may result in either an upgrade or a downgrade.

You May Like: How Long Do A Repo Stay On Your Credit

Very Good Credit Score: 740 To 799

A credit score between 740 and 799 indicates a consumer is generally financially responsible when it comes to money and credit management. Most of their payments, including loans, credit cards, utilities, and rental payments, are made on time. are relatively low compared with their credit account limits.

How To Maintain Your Credit Score

One way to maintain your credit score is to try to stay within the 35% ratio mentioned above.3 Add up all your credit limits and multiply the total by 35%. Thats the amount you should ideally try to avoid exceeding when borrowing money or using credit.3

Avoid applying for too much credit

There are some downsides to having too many credits cards. You may be tempted to use them and spend more.

According to the federal government, you should also avoid applying for too many loans, having too many credit cards and requesting too many credit checks in a short timeframe.3 Thats because it could negatively impact your credit score too.3

Stay within your credit limit

Avoid going over your credit limit. If you go over your limit, it could lower your credit score.3

Overall, having a good credit score can help boost your financial confidence and security. So, congrats on taking the first step by learning how credit scores work and how you can improve yours!

Legal

You May Like: Ccb On Credit Report

How Your Credit Score Is Determined

All the leading credit rating agencies rely on similar criteria for deciding your credit score. Mostly, it comes down to your financial history how youve managed money and debt in the past. So if you take steps to improve your score with one agency, youre likely to see improvements right across the board.

Just remember that it may take some time for your credit report to be updated and those improvements to show up with a higher credit score. So the sooner you start, the sooner youll see a change. And the first step to improving your score is understanding how its determined.

Here are some of the factors that can harm your credit score:

- a history of late or missed payments

- going over your credit limit

- defaulting on credit agreements

- bankruptcies, insolvencies and County Court Judgements on your credit history

- making too many credit applications in a short space of time

- joint accounts with someone with a bad credit record

- frequently withdrawing cash from your credit card

- errors or fraudulent activity on your credit report thats not been detected

- not being on the electoral roll

- moving house too often.

What Your Credit Score Means Depends On The Model

As you can see, different credit-scoring models may have different ranges and scoring criteria. That means the same credit score could represent something different depending on which credit model a lender uses.

A VantageScore 3.0 score of 661 could put you in the good range for example, while a 661 FICO score may be considered fair.

And lenders create or use their own standards when making credit-based decisions. In other words, what one lender might consider very good another could consider good.

Even with all thevariability, knowing where you generally fall on the credit score range canstill be important. Your range could help you determine which financialproducts youre eligible for and the terms a lender might offer you.

Read Also: Speedy Cash Card Balance

A Brief History Of Credit Ratings

Moodys issued publicly available credit ratings for bonds in 1909, and other agencies followed suit in the decades after. These ratings didnt have a profound effect on the market until 1936 when a new rule was passed that prohibited banks from investing in speculative bondsthat is, bonds with low credit ratings. The aim was to avoid the risk of default, which could lead to financial losses. This practice was quickly adopted by other companies and financial institutions. Soon enough, relying on credit ratings became the norm.

The global credit rating industry is highly concentrated, with three agencies controlling nearly the entire market: Moodys, S& P Global, and Fitch Ratings.

Student Loan Balances Saw Highest Increase

- 14% of U.S. adults have a student loan.

- The average FICO® Score for someone with a student loan balance in 2020 was 689.

- The percentage of consumers’ student loan accounts 30 or more DPD decreased by 93% in 2020.

Student loan balances saw the most significant spike in 2020, with consumers’ average debt growing by 9%. Much of this is attributable to the suspension of federal student loan repayment that was included in the CARES Act and subsequently extended through January 31, 2021. With fewer people actively paying down student debt, average balances will grow as others add new loans.

Student loans saw delinquency rates plunge, with the percentage of accounts 30 or more DPD decreasing by 93% in 2020. It’s important to view this number in context, however, as the automatic accommodations put in place obviously played a major role in the drop.

The CARES Act paused all federal student loan repayment, effectively placing these accounts in limbo. While paused, student loan accounts are being reported as current, although no payments are required. Once repayment begins, delinquencies may begin to climb again.

Recommended Reading: Paypal Credit Score

What Do Credit Scores Mean

Because there are so many credit scoring models in existence, you likely have multiple scores. If you pull your score from one site or product, it will likely be slightly different from one you find through another product.

So don’t get hung up on one particular score or even the exact number. Instead, pay attention to what range you fall in. Most websites and card issuers will offer some context behind the score in addition to the number.

That information will typically include where you stand and whether your score is poor, fair, good, very good or exceptional. You will also likely find information about why your score is what it is. Your score range can help you understand how lenders view your creditworthiness and what types of credit products you’re likely to be approved for.