Shield Your Credit Score From Fraud

For hackers and identity thieves, people with Very Good credit scores are attractive targets. Your score could enable crooks to open and exploit sizable bogus loan or credit-card account in your name, and then disappear, leaving you to sort out the mess with the lender. To help avoid this, consider credit-monitoring and identity theft protection services. These services can alert you when they detect applications for new credit or other unexpected changes in your credit report.

Consumers reported $905 million in total fraud losses in 2017, a 21.6% increase over 2016 with aan avergae of $429 lost.

What Is A Good Credit Score According To Lenders

Lenders, such as credit card issuers and mortgage providers, may set their own standards on what “good credit” means as they decide whether to grant you credit and at what interest rate.

In practice, though, a good credit score is the one that helps you get what you need or want, whether that’s access to new credit in a pinch or lower mortgage rates.

Excellent Credit Score: 750 850

The prime candidates, the goody-two-shoes, they are considered consistent and responsible when borrowing. They have no history of low balances or late payments. Borrowers in this credit range receive the lowest interest rates on loans, mortgages and credit lines as they pose a low risk to lenders.

You May Like: Does Balance Transfer Affect Your Credit Score

What A Fair Good Or Excellent Credit Score Means For You

The better your credit score, the more choices youll have when it comes to applying for a loan or credit card. Thats the bottom line.

If you have a fair credit score and are approved for a credit card, you may be offered a slightly higher interest rate. Your initial credit limit may also be on the lower side. But if you make your payments on time and demonstrate financial stability, you might be able to have your limit increased after 6-12 months.

If you have a good credit score, your chances of being approved for loans and credit cards increases. Youre also more likely to be offered a more competitive interest rate, as well as a more generous credit limit.

Finally, an excellent credit score makes borrowing money and getting credit cards much easier. Its also more likely to get you the best available interest rates and generous credit limits.

How To Improve A 794 Credit Score

Its a good idea to grab a copy of all three of your credit reports from Equifax, Experian, and TransUnion to see what is being reported about you. If you find any negative items, you may want to hire a credit repair company such as Lexington Law to help you dispute them and possibly have them removed.

Lexington Law specializes in removing negative items. They have over 28 years of experience and have removed over 7 million negative items for their clients in 2020 alone.

They can help you with the following items:

- hard inquiries

- bankruptcies

You May Like: Usaa Credit Repair

What Is A Credit Score

A credit score is expressed in the form of a three-digit number that ranges between 300 to 900. It is a representation of an individuals creditworthiness. Lenders refer to your credit score before approving your credit application. A good credit score is certainly a winner in every loan or credit application. A credit score of 750 and above is considered a good credit score.

In India, credit scores are generated by credit bureaus like Equifax, CIBIL, Experian, CRIF High Mark, etc. Credit scores from each credit bureau may vary slightly since they have a different algorithm for calculating credit scores.

What Does A 750 Credit Score Mean For Your Wallet

A 794 credit score is well above the national average of 679, according to the latest data from TransUnion. As a result, such a score generally gives you access to some of the best loans and lines of credit. The very best rates, rewards and fees may still be out of reach, though, as youll see in the table below.

Recommended Reading: Does Opensky Report To Credit Bureaus

What Is A Vantagescore Credit Score Experian

https://www.experian.com/blogs/ask-experian/what-is-a-vantagescore-credit-score/

VantageScore* is one of many scoring models that look at the information in your credit reports and generate a number designed to communicate the likelihood youre going to pay your bills on time. You may have seen your VantageScore delivered through educational websites or on your credit card statement. According To VantageScore Solutions, more than 1 billion VantageScore credit scores

Heres How To Get A 794 Credit Score:

Also Check: How To Clear A Repossession From Your Credit

What Affects Your Credit Score

On the list of what affects your credit score, two factors have the biggest influence: Payment history, which is whether you pay on time, and credit utilization, which is how much of your credit limits you have in use.

Other factors matter but carry a little less weight: how long you’ve had credit, whether you have a mix of credit types and how frequently and recently you’ve applied for credit.

What Is Considered A Good Cibil Score Range

A credit score ranging from 750 to 900 is considered an excellent credit score. Banks, NBFCs and other online lenders prefer candidates who have a credit score in this range. If your credit score is in this range, you will be eligible for most credit products. The following table will help you understand the CIBIL score range and its meaning.

|

Immediate Action Required |

Approval chances are very low |

As the table illustrates, having a credit score of 750 and above is considered to be excellent and it can help in easily availing several credit opportunities.

Also Check: What Is Syncb Ntwk On Credit Report

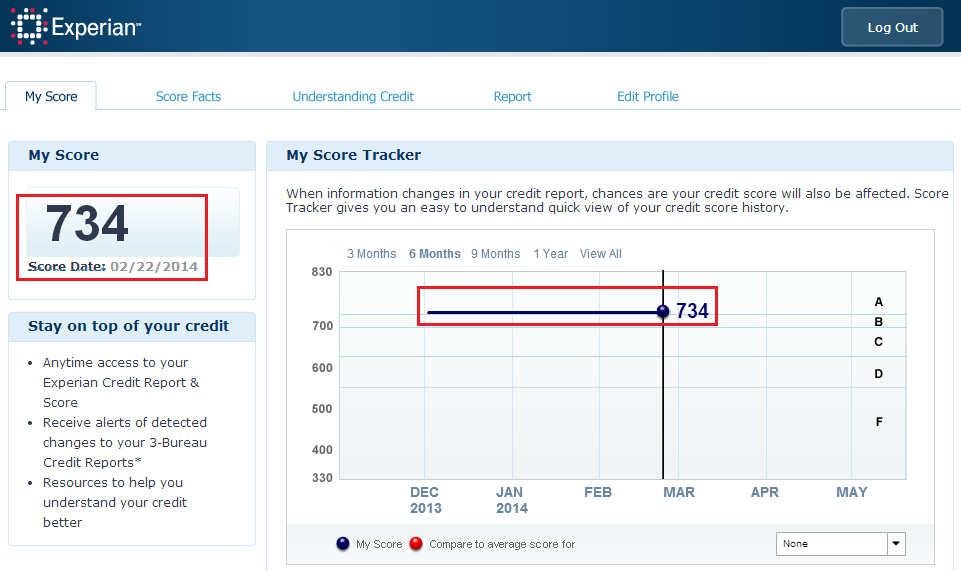

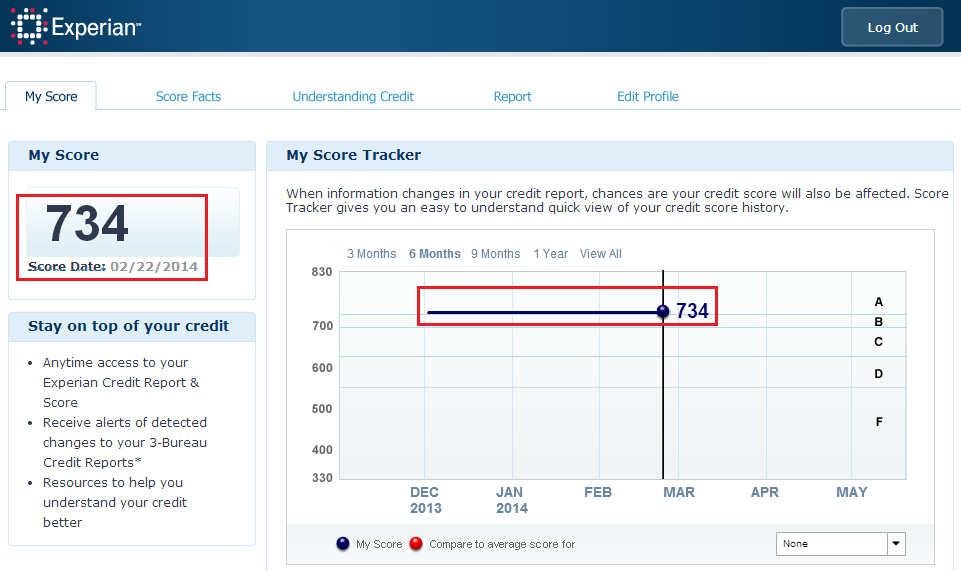

Credit Score: Is It Good Or Bad Experian

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/794-credit-score/

A 794 credit score is Very Good, but it can be even better. If you can elevate your score into the Exceptional range , you could become eligible for the very best lending terms, including the lowest interest rates and fees, and the most enticing credit-card rewards programs.

How To Read Your Credit Report

Your credit report contains both personal information and financial information. Your credit report illustrates who you are as a borrower, both the good and the bad. Checking it allows you to keep an eye on your accounts, make sure there are no errors, and even potentially prevent the damaging effects of fraud. Your credit report is the report card of your financial life and understanding how to read it can help you take control of your finances and be prepared for any of your future credit needs.

You May Like: Is 580 A Bad Credit Score

The Three Credit Reporting Agencies And Different Types Of Credit Scores

Equifax, Experian, and TransUnion are three major credit reporting bureaus. Each credit agency provides you with a credit score, and these three scores combine to create both your 794 FICO Credit Score and your VantageScore. Your score will differ slightly among each agency for many reasons, including their unique scoring models and how often they access your financial data. Monitoring of all five of these credit scores on a regular basis is the best way to ensure that your credit score is an accurate reflection of your financial situation.

How To Go From Good To Great

To borrow from Leo Tolstoy, all great credit scores are alike, but all bad credit scores are bad in their own way. That is, ideal credit scores are built on a similar set of healthy financial habits, but your scores can be damaged by any number of factors. There are many different issues that can hurt your credit, such as:

Late or missed payments. Too many open credit accounts. High credit card balances. High balances on loans. Too many credit applications.

The first step toward improving your credit health is avoiding getting trapped in the highs and lows of managing your credit.

Heather Battison, vice president of TransUnion Canada explains how consistency is key: The most important factor for building and maintaining your scores is to pay your bills on time and in full each month. This activity demonstrates your ability to responsibly manage credit and can positively impact your credit scores.

Its also key to remember that your payment history isnt just about paying your credit card bill. It also includes things like your cellphone bill, says Trevor Gillis, associate vice president of account management at TD Credit Cards.

Gillis says building good credit scores is based on using your credit card responsibly, which means making at least the required monthly minimum payment , making your payments by the payment due date and keeping your credit card utilization low.

Recommended Reading: How To Get Credit Report Without Social Security Number

Mortgage With 793 Credit Score

Mortgages are ideal to have when a person wants to purchase a first home, a second home or even a vacation home. For those that want to use the home for other purposes, this loan would be ideal. When the person has a 793 FICO score, they are then able to qualify for a wide variety of mortgage loans. They have to provide proof of income, but as far as the credit score, you should have no issue. Just ensures that your debt to income ratio is lower.

Steering Clear Of Bankruptcy

Bankruptcy is a highly feared word in the world of finances. Its something that we all hope we will never have to endure the mere thought or possibility of it is enough to make us quiver in fear.

Bankruptcy is definitely not something that should be underestimated. It will be one of the biggest blows not only to your finances, but to your state of mind and well-being as well. Plain and simple, a bankruptcy is something that you want to avoid at all costs. And as you may have guessed, a bankruptcy is not going to look good on your credit report .

But while it is universally acknowledged that bankruptcy is something that you should try to avoid at all costs, there are still many mistaken beliefs that surround how to avoid it, too. A bankruptcy will immediately lead to a huge drop in your credit rating and will be visible on your report for over ten years at least. This means that if your credit score has already fallen thanks to late/missed payments or defaults, with a bankruptcy, things arent exactly going to look so sunny.

What if you are forced to file for bankruptcy? Is it still possible to rebuild your credit?

Yes, it still is. Even though your bankruptcy will be listed on your report for ten years, you can still slowly but steadily rebuild your credit by paying each of your bills when you need to. In this scenario, however, its vitally important that you repay each of those bills without exception.

Also Check: Can You Remove Hard Inquiries Off Your Credit Report

What Happens If Your 794 Score Goes Up Or Down

If your score moves, then you have to plan accordingly and fix it accordingly. Sometimes when it moves it is only slightly, while other times it might be a drastic change that happens on your credit score. Either way, it is important to monitor your score for these changes.

If your score goes up, which it is able too a bit, then you do not want to do anything to fix it. This is a great thing. Whether you are lower or higher, having a score that gets higher is never a bad thing or something to worry about.

If the 794 score gets lower then the individual will want to look into many factors that might have caused a negative impact on the score such as just opening a new account, defaulting on a loan, being late with payments or using too much of the available credit that they have. When either of these is a problem, you can fix it according to the issue. Paying down your credit usage, making on time payments, catching up with the defaulted loan or waiting out new accounts until they become older are all fixes. Hard credit checks can also negatively impact your score, so it is important to note that these will go away with time.

As a general rule of thumb, you always want your score to go up and never down. When it goes down, it is important to note why it is and then change the issues that the score is having so that it goes back to where it was or higher.

What Lenders Like To See

Since there are various credit scores available to lenders, make sure you know which score your lender is using so you can compare apples to apples. A score of 850 is the highest FICO score you could get. Each lender also has its own strategy, so while one lender may approve your mortgage, another may noteven when both are using the same credit score.

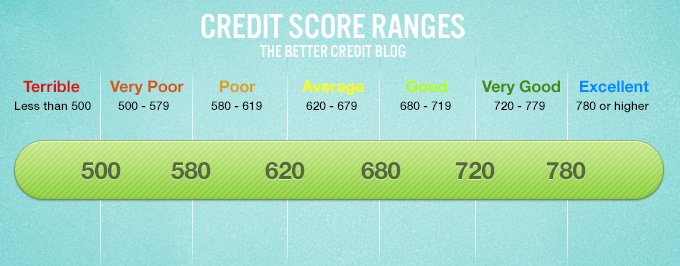

While there are no industry-wide standards for credit scores, the following scale from personal finance education website www.credit.org serves as a starting point for FICO scores and what each range means for getting a mortgage:

740850: Excellent credit Borrowers get easy credit approvals and the best interest rates.

670740: Good credit Borrowers are typically approved and offered good interest rates.

620670: Acceptable credit Borrowers are typically approved at higher interest rates.

580620: Subprime credit It’s possible for borrowers to get a mortgage, but not guaranteed. Terms will probably be unfavorable.

300580: Poor credit There is little to no chance of getting a mortgage. Borrowers will have to take steps to improve credit score before being approved.

You May Like: Does Opensky Increase Your Credit Score

The Average American Credit Score

The average FICO score in the United States is 706. But this varies based on a variety of factors. Most peoples’ . Some states have higher or lower average credit scores, too. For example, Minnesotans on average have the highest FICO credit scores in the nation at 733.

As of this report, 55% of Americans have a FICO score of 740 or higher. This has historically been the case, but the decade of steady economic growth since the Great Recession has caused Americans’ credit profiles to improve significantly. Credit scores are higher when fewer consumers have serious delinquencies weighing down their scores. The state of the economy can influence whether or not people are financially able to avoid credit score pitfalls from year to year.

Is My Credit Score Good Enough For A Mortgage

Your , the number that lenders use to estimate the risk of extending you credit or lending you money, is a key factor in determining whether you will be approved for a mortgage. The score isnt a fixed number but fluctuates periodically in response to changes in your credit activity . What number is good enough, and how do scores influence the interest rate you are offered? Read on to find out.

Recommended Reading: Does Speedy Cash Report To Credit Bureaus

How Much Cibil Score Required For Personal Loan

A CIBIL score has a range between 300 and 900. You should ideally have a score that is closer to 900 as it helps you get better deals on loans and . Generally, a CIBIL score of 750 and above is considered as ideal by majority of lenders. You can get a personal loan with a CIBIL of 750 and above. As per CIBIL data , 80% of loans get approved if the score is more than 750.

Lenders need to be sure that you have the ability to repay the borrowed sum before they approve your loan application. Your credit score helps assess your risk of default. If you have a high score it suggests you have been a responsible borrower and paid your credit card bills and EMIs on time. A lower score increases your risk for defaulting on the loan.

Monitor Your Credit Regularly

Consider credit monitoring to make sure your efforts to achieve credit score perfection are accurately reflected. Credit monitoring services can help you spot inaccuracies, and even possible identity theft. My LendingTree is one service that offers credit monitoring, and can also help you shop for loans.

Read Also: What Credit Score Does Carmax Use

What Documents Do You Need From Me

All of our personal loan applicants are required to have an acceptable form of ID. The ID we require is either an Australian passport or a current Australian drivers licence and Medicare card. Depending on the outcome of your personal loan application, we may ask to see some additional documentation.

What we ask for is different for each application, however to speed up the process it is worth ensuring you have the following to hand: Front & Back of your ID documents, Proof of employment and income, Details of your existing credit commitments, Proof of address, Details of your rent/mortgage payments, Bank statements.