What Credit Card Can I Get With A 663 Credit Score

As someone with fair credit, you may have access to a number of unsecured credit cards. Unlike secured cards, an unsecured card doesnt require you to put down a security deposit.

Thats a plus, but there are other factors to consider. For example, many unsecured cards available to applicants with fair credit may charge an annual fee. These cards may also come with a high variable APR on purchases, which can translate to high interest charges if you carry a balance instead of paying off at least your statement balance each month.

With fair credit, you might be approved for a credit card with a relatively low credit limit though some issuers will automatically review your credit limit after several months of on-time payments. Your credit limit is important, because its directly correlated with your credit utilization rate.

What Credit Score Do You Need To Buya House

You dont need perfect or even good credit to buy a house. In fact, the minimum credit score to get a mortgage is 580 which is considered only fair.

Remember, mortgage lenders dont look at your credit score in a vacuum.

They also look at your credit report, debts, and down payment. The stronger you are in these areas, the more likely you are to get away with a low credit score.

The downside to lower credit is that youll pay a higher interest rate. But many buyers with low scores choose to buy now and refinance for a better rate when their credit improves later on.

What Factors Affect Your Credit Score

Your credit score is comprised of five factors: payment history, amounts owed, length of credit history, new credit, and credit mix. When youre in the average credit score range, your credit score can be affected by any of these five factors. In fact, your payment history may not even be a major issue. Even though your payment history is flawless, your credit score can still fall below 700 if you owe too much on your credit cards, or if you have too much new credit.

Recommended Reading: Bp/syncb

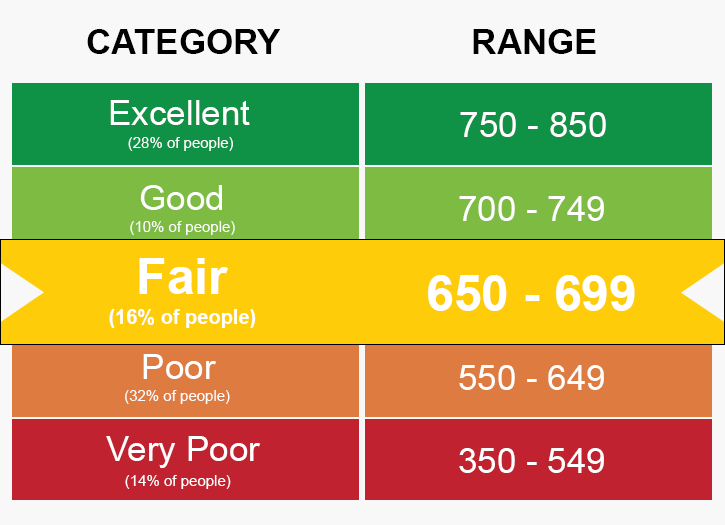

What Is A Good Credit Score In Canada

A good credit score in Canada is typically one that is 680 or higher. Of course, there are many different types of credit scores , and keep in mind that the credit scores a lender sees are usually different from those that you might have access to. Additionally, your Equifax credit scores might be different from your TransUnion scores. The image below illustrates the different credit score ranges in Canada and can help you determine if your credit score is a good credit score.

Canadian Credit Ratings And What They Mean

Lenders and creditors typically use a credit score to determine youre likelihood of making payments on time. Its important to note that your is only one of the factors that lenders will evaluate when approving you for new credit.

- Excellent Individuals with a rate of 780 or over may enjoy the best interest rates on the market. They also will typically always be approved for a loan.

- Very Good This is considered near perfect and individuals with a rate in this range may still enjoy some of the best rates available.

- Good An individual who has a credit score that falls within this range has good credit and will typically have little to no trouble getting approved for the new credit.

- Average While this is still a good range, individuals with this score may receive slightly higher interest rates than those with higher scores. According to Equifax, at the end of 2012, the average national credit score was 696.

- Poor Scores in this range indicate that the individual is high risk. It may be difficult to obtain loans and if approved, they will be offered higher interest rates.

- Very Poor Scores in this range are rarely approved for anything, but credit can be repaired.

- Terrible Individuals whose credit scores are less than 500 may not get approved for new credit and should seek credit improvement help.

Loans Canada Lookout

You May Like: When Do Companies Report To Credit Bureaus

How To Turn A 669 Credit Score Into An 850 Credit Score

There are two types of 669 credit score. On the one hand, theres a 669 credit score on the way up, in which case 650 will be just one pit stop on your way to good credit, excellent credit and, ultimately, top WalletFitness®. On the other hand, theres a 669 credit score going down, in which case your current score could be one of many new lows yet to come.

Everyone obviously wants his or her credit score to be on an upward trajectory. So whether you need to turn things around or increase the pace of your improvement, youd better get to work. You can find personalized advice on your WalletHub credit analysis page, and well cover the strategies that everyone can use below.

Your Credit Scores Are An Important Aspect Of Your Financial Profile

They may be used to determine some of the most important financial factors in your life, such as whether or not youll be able to lease a vehicle, qualify for a mortgage or even land that cool new job.

And considering 71 percent of Canadian families carry debt in some form , good credit health should be a part of your current and future plans.

High, low, positive, negative theres more to your scores than you might think. And depending on where your numbers fall, your lending and credit options will vary. So what is a good credit score? What about a great one? Lets take a look at the numbers.

Recommended Reading: Opensky Locked Account

How A Bad Credit Score Isbad

As mentioned formerly, a bad credit score is anything below 670. If you want to get more specific, a score varying in between 580-669 is thought about fair, while anything in between 300 and 579 is thought about bad. This is going off the FICO scoring thats most frequently used.

Not sure what your credit score is? . Its free!

Having a bad score can stop you from doing a lot of things. This includes getting approved for much better credit cards, mortgages, apartment or condos, personal loans, service loans, and more.

Plus, any loans or credit cards you do get approved for will be a lot more costly . This is due to the fact that lenders charge much greater rates of interest to those they consider high risk in order to balance out the extra threat they feel theyre taking by loaning you money.

How do they get more pricey? By charging higher rate of interest. If you take out a $10,000, 48 month loan on a automobile with a 3.4% interest rate, youll pay about $704 in interest over the course of the loan. If you took out that very same loan with a 6.5% rate due to bad credit, you d pay about $1,376 in interest. Thats practically double!

Save For A Down Payment

If you have a lower credit score, making a down payment on a car can increase your chances of securing and getting approved for an auto loan.

Setting aside some extra cash each month for a down payment can also offset higher interest rates caused by a less-than-stellar credit score and can lower your loan-to-value ratio, helping you qualify for better terms.

Also Check: Does Barclaycard Report To Credit Bureaus

What Is A Good Credit Score For My Age

Your age doesnât directly influence your credit scores. But as FICO and VantageScore show, the age of your credit accounts is one factor that affects how scores are calculated.

That could be a reason peopleâs credit scores tend to increase as they get older. Their accounts have simply been open longer. But credit scores can rise or fall no matter how old you are. And having good credit scores comes down to more than just your age.

Fha Loan With 663 Credit Score

FHA loans only require that you have a 580 credit score, so with a 663 FICO, you can definitely meet the credit score requirements. With a 663 credit score, you should also be offered a better interest rate than with a 580-619 FICO score.

Other FHA loan requirements are that you have at least 2 years of employment, which you will be required to provide 2 years of tax returns, and your 2 most recent pay stubs. The maximum debt-to-income ratio is 43% .

Something that attracts many borrowers to FHA loans is that the down payment requirement is only 3.5%, and this money can be borrowed, gifted, or provided through a down payment assistance program.

You May Like: No Credit Card Credit Scores

Can You Get A Personal Loan With A Credit Score Of 663

There are very few lenders who will approve you for a personal loan with a 663 credit score. However, there are some that work with bad credit borrowers. But, personal loans from these lenders come with high interest rates.

Its best to avoid payday loans and high-interest personal loans as they create long-term debt problems and just contribute to a further decline in credit score.

To build credit, applying for a may be a good option. Instead of giving you the cash, the money is simply placed in a savings account. Once you pay off the loan, you get access to the money plus any interest accrued.

How To Find The Best Credit Cards If Your Fico Score Is 650 To 699

A FICO Score between 650 and 699 is where options do begin to open up. One type of card that is less important is a secured credit card. These are much more common and are often completely necessary when your credit score is below 650, and especially when its below 600. In the average credit score range, you should be able to find unsecured cards with very little effort. What you wont find are the cards with the best terms. For example, you wont qualify for the lowest interest rates, nor will you be eligible for the cards with the most generous rewards programs. But you can still get a card with an adequate credit limit, and at least some cash back rewards. And if you pay your balance off monthlyas we will recommend throughout this guidethe high interest rate wont matter so much.

Don’t Miss: Who Is Syncb Ppc

How To Earn An Excellent/exceptional Credit Score:

Borrowers with credit scores in the excellent credit range likely haven’t missed a payment in the past seven years. Additionally, they will most likely have a credit utilization rate of less than 30%: meaning that their current ratio of credit balances to credit limits is roughly 1:3 or better. They also likely have a diverse mix of credit demonstrating that many different lenders are comfortable extending credit to them.

What Is Considered A Good Credit Score In South Africa

A good credit score is a valuable asset and worth working towards. Most South Africans find it extremely difficult to live without credit and a good score can save you a lot of money. It will give you better access to credit at a more favorable interest rate. Over time, this can save you a large amount of money.

All South Africans are entitled to one free credit report a year. It is a good idea to take advantage of this in order to monitor your credit rating and credit score. The report should show you where many of your weaknesses are and assist you in improving your score.

In order to do this, it is necessary to understand what the score says about your credit history. Scores range from 300 to 850 with the higher scores being more positive. A score in excess of 700 is a good score and should give you good access to credit at a preferential interest rate. Above 767 is excellent and shows you to be a very low-risk consumer that institutions would be happy to give credit to.

Scores below 581 are considered to be below average and a higher risk to financial institutions. Below 526 is seen as unfavorable and you will have difficulty getting finance with a score in that range. If you did manage to get credit the interest will be extremely high.

Also Check: Synbc Ppc

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our loans reporters and editors focus on the points consumers care about most the different types of lending options, the best rates, the best lenders, how to pay off debt and more so you can feel confident when investing your money.

How Your Credit Scores Are Set

Canadian credit scores are officially calculated by two major credit bureaus: Equifax and TransUnion.

They use the information in your credit file to calculate your scores. Factors that are used to calculate your scores include your payment history, how much debt you have and how long youve been using credit.

Pro Tip: You can view sample credit scores summaries from each bureau to get a sense of what to expect.

Read Also: Does Paypal Report To Credit Bureaus

What Can I Do About A Bad Credit Score

Think you have a bad score? Do not worry theres good news: credit report arent fixed! Your score will change when the info in your credit report changes. That means you can take control of your financial health now by making changes that will positively impact your credit score with time. Heres a couple of things anybody can easily do to begin:

Whats Considered Good Credit For A Mortgage

Although its possible to buy ahouse with only fair credit, youll get a lower mortgage rate and better loanterms with a higher score.

So whats considered good creditfor a mortgage? FICOs credit tiers are a good starting point, as FICO is thestandard scoring model used by mortgage lenders.

- Exceptional credit:800-850

- Fair credit: 580-669

- Poor credit: 300-579

Fortunately, you dont need anexceptional score in the 800-850 range to get a prime mortgage rate. Mosthome buyers dont have credit anywhere near that high.

In fact, the average credit score for closed mortgage loans in 2020 was just under 750.

Fannie Mae and Freddie Mac give the best rates to borrowers with scores above 740

Mortgage lenders understand thatperfect credit is not the norm, and they arent expecting sky-high scores.

Fannie Mae and Freddie Mac, the agencies that back most home loans, give the best rates to borrowers with scores above 740 which means the average buyer in 2020 qualified for prime rates.

Don’t Miss: What Credit Score Do You Need For Amazon Prime Visa

Qualifying For A Mortgage With Nocredit Score

Its possible to qualifyfor a mortgage even with no credit history.

Many individuals havepurchased everything with cash, which is a sign of fiscalresponsibility. Thats why most lenders can help you build a non-traditionalcredit report if you have no credit score or history.

The lender will take historyfrom accounts like rent, utilities, and even cell phone bills tobuild a score for you.

As long as youve managed thesetypes of accounts well in the past, theres a good chance you can get amortgage even with no credit score.

Personal Loans For Credit Score Under 663

While it is not guaranteed, one with fair credit may be a potential candidate for a personal loan. Of course, it will be more difficult for one with fair credit to receive a personal loan than for one with good or excellent credit. Fortunately, one with a 663 credit score may still be able to qualify for unsecured loans with affordable rates and payments. Still, those with fair credit will have generally higher interest rates for loans than their good and excellent credit counterparts, but some lenders may provide greater flexibility.

Also Check: What Credit Score Do You Need For Amazon Prime Visa

Tips For Improving Credit

Here are some simple steps to get you started.

Use Navy Federals Mission: Credit Confidence Dashboard to see tips and resources to build, rebuild or manage credit. Use our tools to: