Average Age By Credit Score Tier

| West | 687 |

The South has the worst credit, on average , whereas the Midwest has the best . In fact, three of the five states with the highest average credit scores are in the Midwest. With that being said, every region has at least one state whose residents boast good credit, on average.

So, while job opportunities, living costs and other local factors definitely affect credit-score averages, its also true that credit scores can flourish anywhere.

How Are Credit Scores Ranked

While each Credit Reference Agency uses a different numerical scale to determine your credit score, they all have five categories that they sort individuals into.

These are:

- Poor

- Very poor.

You will probably be put into the same category by all three agencies, as they all base their rating on your one credit record. So, if you receive a good Experian credit score, its likely the other two agencies will give you a rating of good too.

How To Check Your Credit Score

Checking your credit score was once a difficult task. But today, there are many ways to check your credit scores, including a variety of free options.

Your bank, credit union, lender or credit card issuer may give you free access to one of your credit scores. Experian also lets you check your FICO® Score 8 based on your Experian credit report for free.

The type of credit score you get can depend on the source. Some services may offer you a version of your FICO® Score, while others offer VantageScore credit scores. In either case, the calculated score will also depend on which credit report the scoring model analyzes.

Some services even let you check multiple credit scores at once. For example, with an Experian CreditWorks Premium membership, you can get your FICO® Score 8 scores based on your Experian, Equifax and TransUnion credit reportsplus multiple other FICO® Scores based on your Experian credit report.

Also Check: How Much Does Overdraft Affect Credit Rating

What Is In Your Credit Score File

Your credit report includes a number of personal and financial details:

- Personal details like age, employment and the length of time youve been at your current residential address.

- youve used in the last two years. Including the:Credit limitType of creditOpening and closing datesCredit provider details

- . Every time you apply for credit.

- . Every time a credit provider requests your credit report that is recorded.

- Defaults, including information on overdue debts or credit infringements. That includes defaults on utility bills, credit cards, loans and other finance products.

- Court writs, bankruptcies, debt agreements and/or judgements, especially those relating to financial difficulty or impropriety.

- Company directorship. If youre the director of a company, details of the company may appear on your credit report.

Why Is An Above Average Credit Score Important

Having an above average credit score is important for two reasons.

Firstly, because banks and lenders are less likely to lend money to people who they think will not repay them. Lenders arent obliged to lend to anyone, so borrowing money can become more difficult if your score is too low.

This means you can lose access to things such as:

- New credit cards

- Personal loans

- Mobile phone contracts

And even if you are approved, you may not be offered as substantial a loan as compared to someone with a score considered excellent or good.

Secondly, a good credit score is important because it will entitle you to the best rates and most generous credit limits. Often, as your credit score increases, the lower the interest rates offered to you become.

This is especially important for large loans which you will likely pay back over many years.

Recommended Reading: Credit Bureau Death Notification

Is It Important To Know My Credit Score

Yes! Knowing your score is important because you can then start working to improve it, if thats necessary.

Also, youll be able to see if there are any mistakes in your credit file, which you can ask to be removed.

Its important to check your credit score in good time so that any mistakes are removed before lenders start to investigate your financial history.

The Fico Score Is A Broad

The FICO® Score is the lingua franca, or common language, for the credit scoring industry. It serves as a broad-based, independent standard measure of credit risk. It is relied upon by stakeholders across the entire lending ecosystem from regulators, investors and boards to consumers, lenders, and brokers as a baseline metric for assessing credit risk that is fair to both lenders and consumers.

The FICO® Score model is based on data in an individuals credit report, housed by the three primary U.S. consumer reporting agencies . There are also FICO Score versions available that utilize alternative data, based on Fair Credit Reporting Act compliant sources such as landline, mobile and cable payments these scores can help address populations that were previously unable to be scored due to their sparse traditional CRA credit data.

FICO Scores, which range from 300-850, are dynamic and evolve based on continually changing consumer behavior reported to the CRAs.*

Read Also: Does Speedy Cash Report To Credit Bureaus

The Average Canadian Credit Score

According to TransUnion , the average Canadian credit score is around 650. Based on the credit score ranges we discussed above, most Canadians have average to good credit, which is great. This means that many Canadians across the country shouldnt have trouble getting approved for the loans and credit products they need, whether its a mortgage or a car loan.

Does Age Matter?

According to Equifax, Canadas second credit reporting bureau, the highest percentage of Canadian citizens with a credit score of 750 and higher are in the 65 and older age group. On the other hand, the highest percentage of Canadians with a score of 520 and under are in the 25 and younger age group.

Age does play a factor in the credit health of most Canadians. Technically, younger Canadians are more likely to have lower credit scores while older consumers are more likely to have higher scores. But, its important to keep in mind that this is not always the case, just because youre under 25 doesnt mean youll automatically have bad credit.

There are a couple of reasons why this is often the case:

- A 65-year-old has had decades longer to make responsible financial decisions that positively affect their credit score.

- Good financial habits take time to develop. Generally speaking, young adults are more likely to make irresponsible financial decisions that will negatively affect their credit scores.

Faqs About Average Credit Scores

What is the average persons credit score?

Across all age groups and locations, the average persons credit score is 711, using Experian data and the FICO Score credit scoring model.

What is the average credit score in America?

The average U.S. credit score is 711.

What is the average credit score to buy a house?

Depending on the type of mortgage loan youre looking for, you may be able to buy a house with a credit score as low as 500. However, the average U.S. homeowner with a mortgage has a FICO® Score of 753, according to Experian.

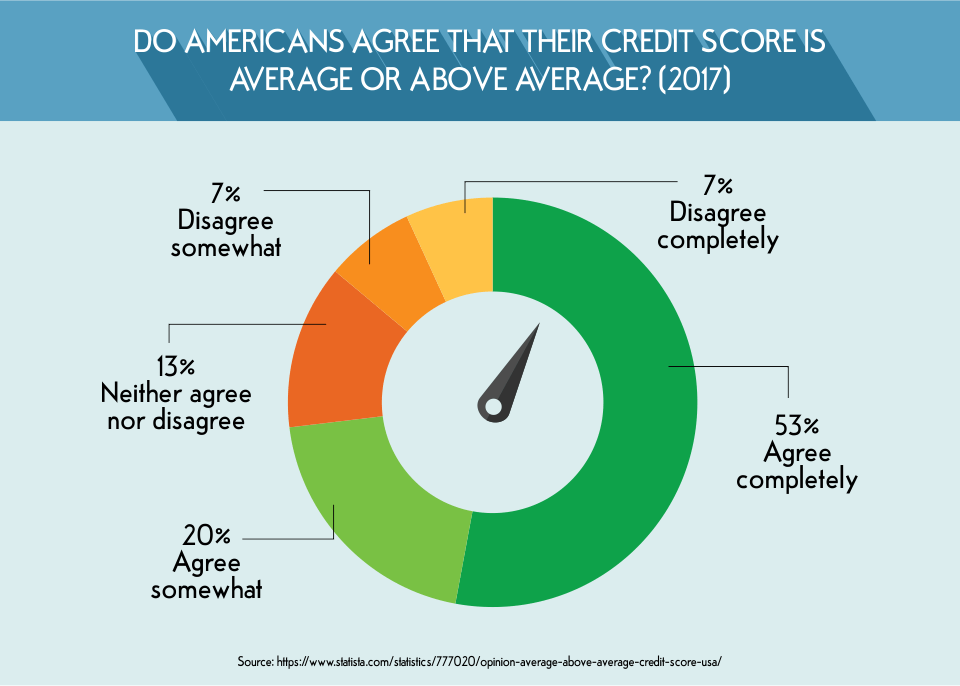

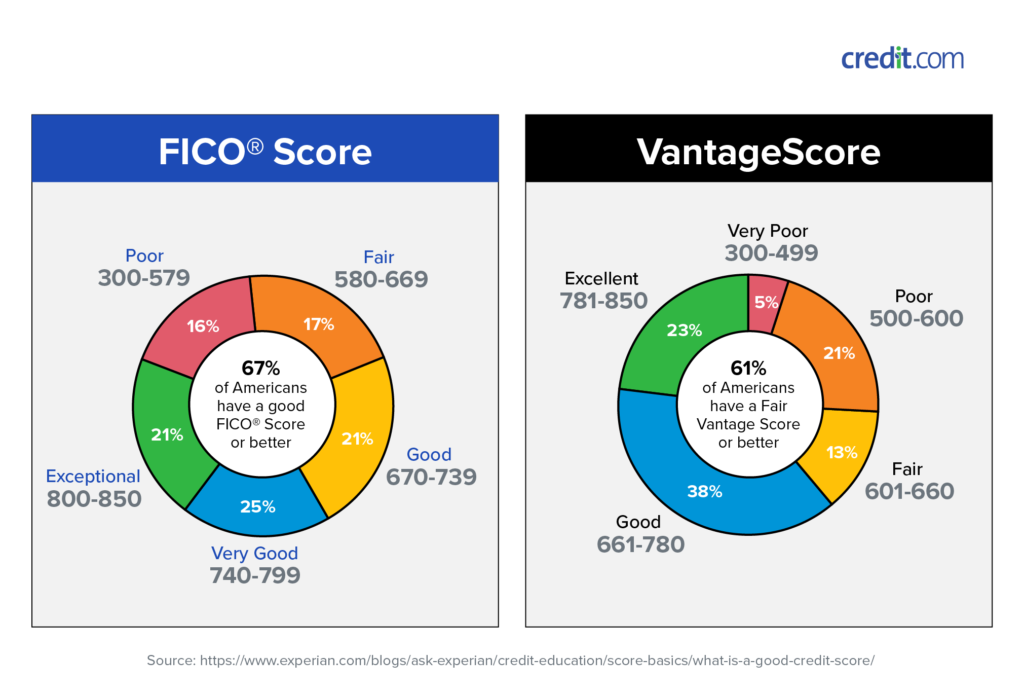

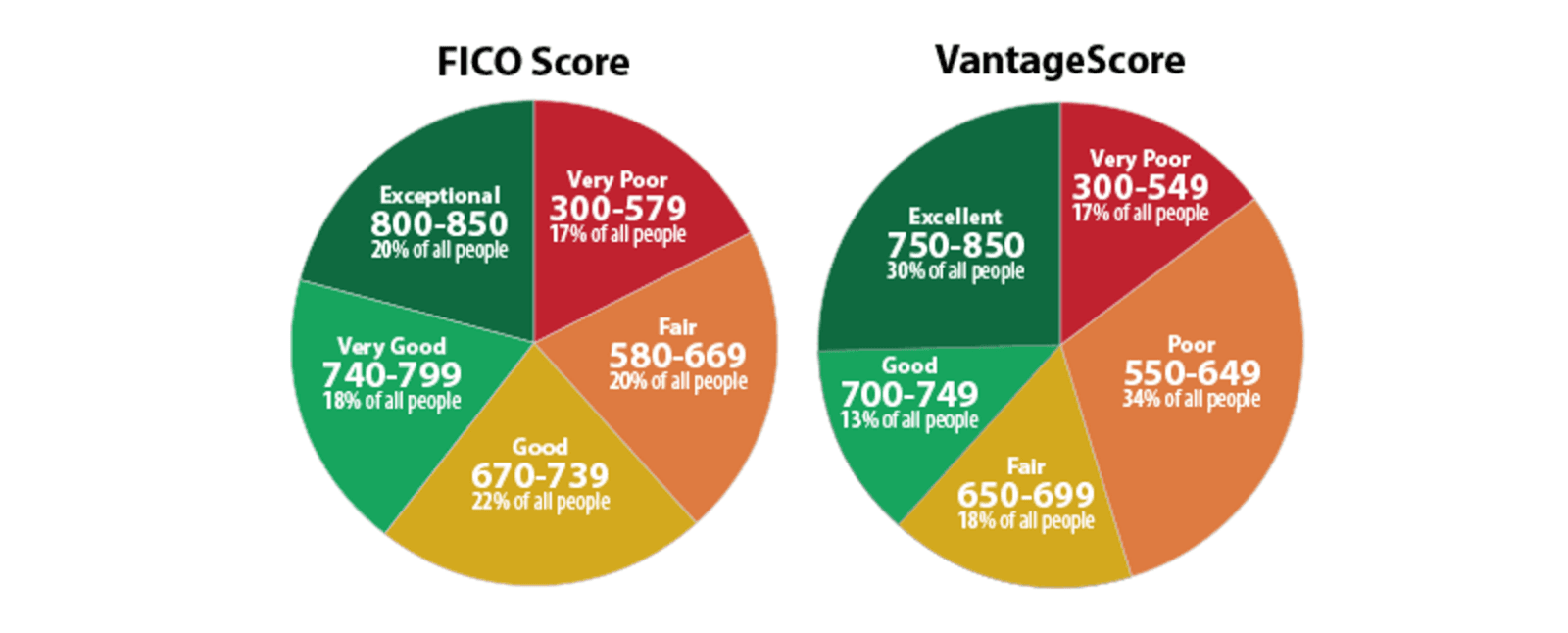

What is considered an average credit score?

There isnt a credit score range considered average. In the VantageScore credit scoring model, a score between 601 to 660 is considered fair: in the FICO Score model, a score between 580 and 669 is considered fair. However, the average FICO Score in the U.S. falls into the good range. Even in the state with the lowest average credit score, Mississippi, the average FICO Score of 675 is still good. In this case, average is much more than average.

What is a good average credit score?

There are different credit scoring models, but the most commonly used is the FICO® Score, which ranges from 300 to 850. A FICO Score of 670 to 739 is considered good. The most recent VantageScore credit scoring models, 3.0 and 4.0, also range from 300 to 850 a VantageScore range of 661 to 780 is considered good.

Also Check: Experian Unlock

What Is A Good Credit Score

For a score with a range between 300 and 850, a credit score of 700 or above is generally considered good. A score of 800 or above on the same range is considered to be excellent. Most consumers have credit scores that fall between 600 and 750. In 2020, the average FICO® Score in the U.S. reached 710an increase of seven points from the previous year. Higher scores can make creditors more confident that you will repay your future debts as agreed. But creditors may also set their own definitions for what they consider to be good or bad credit scores when evaluating consumers for loans and credit cards.

In part, this depends on the types of borrowers they want to attract. Creditors may also take into account how current events could impact consumers’ credit scores, and adjust their requirements accordingly. Some lenders create their own custom credit scoring programs, but the two most commonly used credit scoring models are the ones developed by FICO® and VantageScore®.

Fico Score Vs Vantagescore

Many people don’t realize that there are actually multiple credit scores. These are two of the most common:

- FICO® Score uses a credit scoring model designed by the Fair Isaac Corporation.

- VantageScore is an alternative to FICO developed by Equifax, Experian, and TransUnion in 2006.

Early models of the VantageScore system scored consumers on a scale of 501 to 990. Today, both are on a scale of 300 to 850.

It’s also helpful to understand how your score compares to the average, both in the United States generally and for people within your demographic group.

The data below on the average credit scores in America will tell you everything you need to know to see where you stand when it comes to your credit.

Recommended Reading: How To Get Credit Report With Itin Number

Why Having A Good Credit Score Is Important

In general, having good credit can make achieving your financial and personal goals easier. It could be the difference between qualifying or being denied for an important loan, such as a home mortgage or car loan. And, it can directly impact how much you’ll have to pay in interest or fees if you’re approved.

For example, the difference between taking out a 30-year, fixed-rate $250,000 mortgage with a 670 FICO® Score and a 720 FICO® Score could be $72 a month. That’s extra money you could be putting toward your savings or other financial goals. Over the lifetime of the loan, having a good score could save you $26,071 in interest payments.

Additionally, credit scores can impact non-lending decisions, such as whether a landlord will agree to rent you an apartment.

Your credit reports can also impact you in other ways. Some employers may review your credit reports before making a hiring or promotion decision. And, in most states, insurance companies may use credit-based insurance scores to help determine your premiums for auto, home and life insurance.

Who Will Check Your Credit And Why

It is important to keep a high credit score for multiple reasons. Creditors use your credit score to help make a decision on whether you will be able to pay back the money you are requesting to borrow. Your credit is checked when applying for things like a credit card, car loan, mortgage, apartment lease, student loans, etc.

Read Also: Does Barclaycard Report To Credit Bureaus

Factors That Affect Your Credit Score

How you use your credit to make purchases and pay bills directly affects your credit score. Below weâll list some of the factors that can affect your credit score:

Your outstanding debt. The more you owe, the lower your credit score will be. If you canât keep up with your payments, your credit score will decrease. However, if you donât owe a lot because you’re managing your payments effectively, you should see your credit score increase.

The variety of your credit. The more variety you have in terms of how you use your credit, the better. If you can manage to keep up with payments on a car loan, mortgage and credit card simultaneously, youâre showing the lender you can responsibly manage multiple credit products.

Payment history. This is a huge factor in determining your credit score. If you have a history of missed payments, your credit score will reflect that. On the other hand, if you have a history with little to no credit blemishes, you should have a great credit score. Another factor with history is the length of time in which youâve been using your credit. The longer youâve been using credit, the better.

Tips On How To Build Good Credit

If your credit score isnt where you want it to be, dont worry. There are many small changes you can make that will help you build your score over time. Here are a few of our tips:

- Take out new credit. Taking on new credit, like car payments , and making those payments on time will help you build credit.

- Automate your payments. You wont miss payments if they happen automatically! Save yourself the hassle and keep them automated.

- Pay your credit card balance in full. The less money you have on your credit card, the better. If you pay off your bill in full each month, youll avoid interest fees and build credit.

- Have more available credit than used credit. Especially when it comes to credit cards, try to use less than half the credit you have available. If you can keep your balance under half, itll give your score a boost.

- Borrow what you can afford. Try not to live beyond your means. Borrowing what you can afford means you should have the funds to pay it back and maintain good credit.

Download our guide Repairing and Rebuilding Your Credit Score to learn more about your credit score, how it works and how you can rebuild it if its not where youd like it to be.

Don’t Miss: How To Report A Death To Credit Bureaus

Very Good Credit Score: 740 To 799

A credit score between 740 and 799 indicates a consumer is generally financially responsible when it comes to money and credit management. Most of their payments, including loans, credit cards, utilities, and rental payments, are made on time. are relatively low compared with their credit account limits.

Other Credit Scores Or Fico Scores

While FICO Scores are used by 90% of top lenders, there are other credit scores made available to consumers. Other credit scores may evaluate your credit report differently than FICO Scores. When purchasing a credit score for yourself, most experts recommend getting a FICO Score, as FICO Scores are used in 90% of lending decisions.

Also Check: When Does Affirm Report To Credit Bureaus

What Is The Average Credit Score In The Us

The average FICO® Score in the U.S. rose to 711 in 2020, according to Experian data from October. That’s an eight-point increase from 2019 and is the most significant spike since 2016 when the average FICO® Score grew by four points from the prior year.

As part of our ongoing look at credit scores in the U.S., Experian analyzed consumer credit and debt data to understand how scores have changed and to identify potential reasons scores are increasing. Read on for our insights and analysis.

What Is A Good Fico Score

FICO® creates different types of consumer credit scores. There are “base” FICO® Scores that the company makes for lenders in multiple industries to use, as well as industry-specific credit scores for credit card issuers and auto lenders.

The base FICO® Scores range from 300 to 850, and FICO defines the “good” range as 670 to 739. FICO®’s industry-specific credit scores have a different range250 to 900. However, the middle categories have the same groupings and a “good” industry-specific FICO® Score is still 670 to 739.

Recommended Reading: Creditwise Dispute

How Are Credit Scores Determined

A credit score is a number that indicates your perceived creditworthiness in the eyes of credit rating companies, banks and other financial institutions. If you have a history of paying your bills on time and only using a small percentage of your available credit, you should have a high score. If youve missed bills, filed for bankruptcy, defaulted on loans or dealt with collections, then your score will likely be lower.

Heres a deeper breakdown of what goes into the creation of your credit score:

- Payment history: 35% of your score

- 30% of your score

- 15% of your score

- New credit applications: 10% of your score

- 10% of your score

The most well-known provider of credit scores is the Fair Isaac Corporation, or FICO. However, each of the three credit bureaus has its own take on your score. This is known as a VantageScore, and it is a modified version of your FICO score thats based on both the credit bureaus scoring models and their own information on your credit history.

There are also different FICO credit scores for bank cards, auto loans and more. Thats why a single person can have several credit scores. Different bureaus may treat credit events or authorized user accounts differently, so you may have excellent credit according to your Transunion credit score, but still be in the good range with your Equifax score.

A Good Credit Score Is In The Eye Of The Beholder

Although the FICO and VantageScore charts above display a general idea of how lenders may interpret different credit score ranges, lenders and other companies can, and often do, differ in their opinions of creditworthiness.

For example, just because youre considered to have a good credit score to an auto dealer doesnt mean a mortgage lender would consider that same score to be a good credit risk. Each lender has their own criteria for credit scoring as well as their own thresholds for a good score vs. a bad score.

You May Like: Does Snap Finance Report To The Credit Bureau