Welcome Bonus For The Amex Platinum

New The Platinum Card® from American Express cardmembers can earn 100,000 Membership Rewards® Points after spending $6,000 on purchases on the Card in the first 6 months of Card Membership. New cardholders also earn 10x points on eligible purchases on the Card at restaurants worldwide and when you Shop Small in the U.S., on up to $25,000 in combined purchases, during your first 6 months of Card Membership. Terms apply.

Learn more: Johnny Jet Recommended Credit Cards

This bonus can be worth $1000 in reward flights and easily offsets the $695 annual fee. Plus, you also get to accumulate points from your purchases to meet the bonus requirements.

Keep in mind that if you have received a bonus offer for the Amex Platinum in the past, you will not qualify for future offers. But, you can qualify for welcome offers from other American Express credit cards.

How To Increase Your Credit Score

Increasing your credit score is a good way to set yourself up to be approved for your desired credit limit increase. Boosting your score is actually pretty simple. Follow these basic rules to see your number grow:

- Pay your bills on time each month

- Pay your bills in full each month

- Pay off any outstanding credit card debt you may have

- Dont open too many new credit cards at one time

Why Credit Glory + Identityiq = Your Best Credit Score

- Identify errors quicker – Combining credit repair & monitoring, puts you in the driver’s seat. You’re equipped to handle any credit issues that come your way.â

- Boost your financial confidence – An expert team â ready to pounce on any credit issues â gives you the confidence to reach your financial goals. You can apply for the loans you deserve .â

- Take control of your finances – Monitoring your credit andhiring a company to correct mistakes is the smart move. It puts you in control of your credit . Nothing says you’re serious about your goals like taking charge of your finances.

You May Like: What Is Syncb Ntwk On Credit Report

Know Your Credit History

Knowing where you stand when it comes to credit history is critical to qualifying for a new credit card. Youll want to obtain a copy of your credit report, mostly to check it for any errors. You can get a free copy of your credit report via annualcreditreport.com.

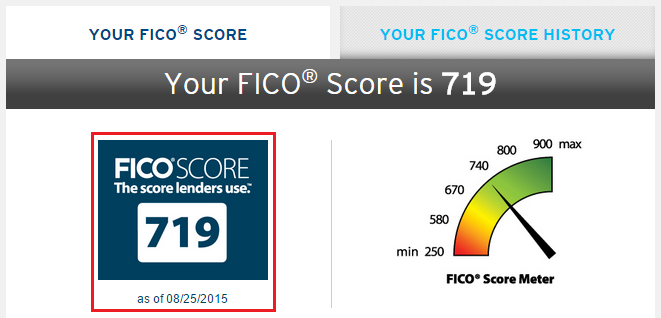

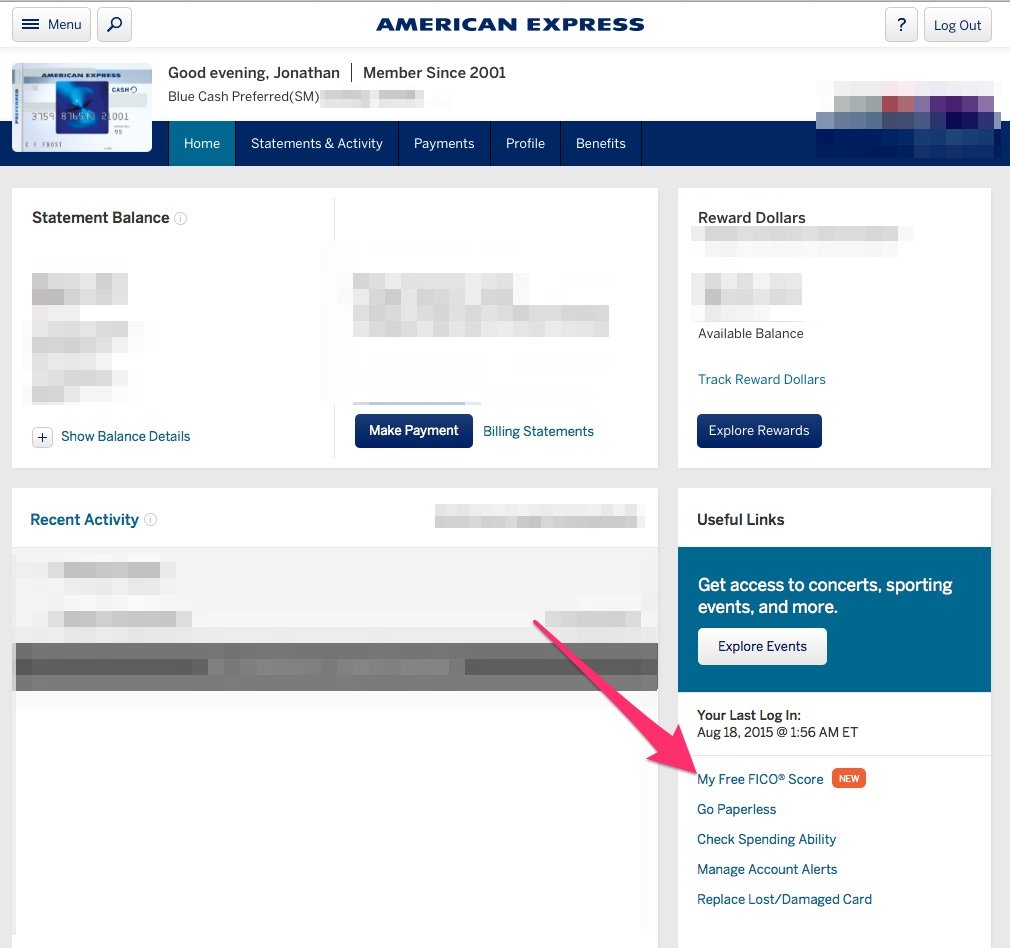

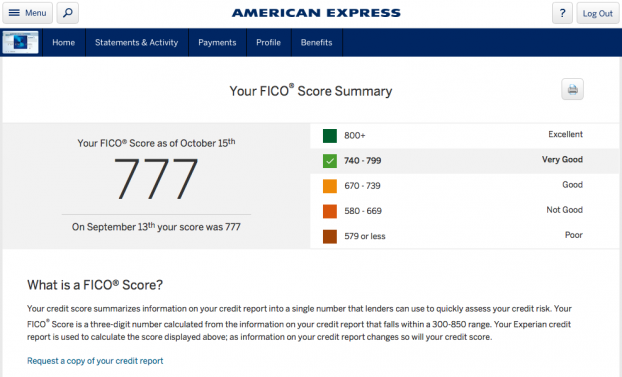

Additionally, youll want to determine your . You can do this for free via tools provided with existing credit card issuers or through , which is also at no cost to you.

Bottom Line: Prior to applying for any credit card, you should do a risk-free search for any existing offers you may have available to you, and also obtain your current credit report and credit score.

Do They Accept American Express As Payment

There are two ways to accept American Express payments online and in-store. 1. Accept through your payment service provider. Qualified small businesses can accept cards through their provider, who determines the rate at which the cards are accepted. In addition, you will receive a single statement and deposit, such as cards from any brand that your company accepts.

Recommended Reading: Syncb/ntwk Credit Card

Rebuilding Credit And Instant Approval

Sauciefarr reports having a 730 FICO 8 credit score and getting instantly approved after getting a pre-qualified offer from American Express.

A 730 FICO Score is slightly below the minimum threshold to qualify for excellent credit. But any credit score above 700 has good approval odds for most cards if you dont have any credit history surprises.

This applicant reports rebuilding their credit score for 5 years before getting above 700 FICO to try.

American Express Credit Score Requirements By Card

: 700

USAA Classic American Express®: less than 3 years of credit history

You should note that while your credit score is an important factor, there are plenty of other things that will impact your chances of being approved for an American Express credit card, too. Some other key criteria include your income, existing debt load, number of open accounts, recent credit inquiries, employment status, and housing status.

Does American Express help your credit score?

American Express can help your credit score if you are the primary accountholder or an authorized user aged 18 or older on an American Express credit card or charge card account. For an Amex card to be good for your credit score, the account must be kept in good standing with on-time monthly bill payments. Every month an open Amex account is used responsibly, positive information will be reported to the credit bureaus.read full answer

On the other hand, using an Amex card irresponsibly will often be bador at the very least, unhelpfulfor the primary cardholders credit score. Mistakes such as missed payments should have no effect on an authorized users credit score, though, because Amex will stop reporting on the additional cardholder once an account becomes delinquent.

What’s the easiest American Express card to get?

Don’t Miss: What Is Syncb Ntwk On Credit Report

The Best American Express Business Cards For Good To Excellent Credit

UPs Bonus Valuation*:$1,540Must Reads: For more info on the Amex Business Gold Card see our guide on its benefits, top FAQs and our full review. |

With 4% earnings on 2 of 6 common business purchase categories each statement period, up to $150,000 in purchases each year, youll earn lots of Membership Rewards quickly. The card, like the Amex Business Platinum card, also offers a rebate when using points to purchase flights via Amex Travel.

Bottom Line: Applicants with good to excellent credit will have dozens of Amex cards from which to select. In addition to Amex consumer and business cards, it can often be easier to get approved for Amex hotel or airline-branded cards such as the Hilton Honors American Express Card or the Delta SkyMiles® Gold American Express Card.

Continue To Monitor Your Credit After Approval

After you’ve gotten approved for a new credit card, avoid the urge to ignore your credit until the next time you want to apply for a credit card or loan. You can get a free credit report annually from all three credit bureaus through AnnualCreditReport.com. Though April 2021, reports are available once weekly, which can help you keep a close eye on any changes.

Additionally, you can use Experian’s to stay on top of your credit. Experian provides free access to your FICO® Score powered by Experian data and access to your Experian credit report. You’ll also get real-time alerts when new information is added to your report, including inquiries, accounts, personal information and suspicious activity.

Finally, if you notice something is amiss on your Experian credit report, you can file and track disputes directly through the Experian platform.

Fortunately, monitoring your credit doesn’t take as much work as actively working to improve your credit score, so it’s a good idea to keep an eye on where you stand, so you can address potential problems as they arise and help ensure you’re credit-ready the next time you want to apply.

You May Like: How To Report A Death To Credit Bureaus

Do You Have To Be An Amex Cardholder To Get A Loan

To apply for a loan, you must be an AmEx cardholder and have previously approved the loan. The company did not respond to requests for details about loan terms, but a customer service representative said the lender is considering using its AmEx cardholder card when making decisions about loan offers. American Express is better suited to borrowers who:

How To Check Your Credit Score

There are many ways to check your credit score for free. For example, some cards offer a free FICO score to all cardholders. And American Express allows everyone to use MyCredit Guide to check their TransUnion VantageScore 3.0 free of charge.

Its also possible to check your business credit score if you have one. However, youll generally need to pay to do so.

Also Check: What Credit Score Do You Need For Amazon Prime Visa

How Hard Is It To Get The American Express Platinum

If you have the credit score needed for The Platinum Card® from American Express, you will enjoy some of the best travel rewards when you are approved.

For those that dont mind the $695 annual fee on the Amex Platinum card but dont want an Amex card, the Chase Sapphire Reserve® is a good premium travel rewards credit card option. You get a $300 travel credit, 3x points for travel and dining, passes to airport lounges, and a fee credit for TSA PreCheck or Global Entry. This card is full of Visa Sapphire Reserve benefits as well. You will need an excellent credit score for this card.

Here are a few other highlights of The Platinum Card® from American Express that you can enjoy.

Related: Best Premium Credit Cards

This Card Is Best For

- Seeks to maximize cash back earnings across spending categoriesCash Back Strategist

- Motivated to create positive credit historyCredit Builder

The Credit One Bank American Express® card is best for people with average credit or above who want a simple, easy-to-use rewards card. Youll earn a flat rewards rate on every purchase, so its a good option if you dont want the hassle of remembering different spending categories or juggling multiple cards. Instead, you can use one card for all of your everyday purchases and earn the same rewards rate.

This card is good if you want a more robust credit card that you can potentially qualify for with average credit. It offers significant benefits that can enhance and streamline your travel and shopping experiences, giving you complimentary car rental and travel accident insurance and discounts on flights and hotels.

Recommended Reading: Does Paypal Credit Affect Your Credit Score

Call American Express Directly

If you are in the market for a credit limit increase, you will probably need to contact American Express and ask for it directly. Here are a few things to keep in mind before you pick up the phone.

- Be ready to tell them why you should qualify for a credit limit increase. Factors like being a long-term customer, paying your bill on time, or a recent income increase are all positive things to mention to the customer service rep when making your request.

- Know what you want and ask for a reasonable amount. If your current credit limit is $1,000, dont ask for a $10,000 limit! You are more likely to get the increase youre looking for if its a reasonable amount. A good rule of thumb is to ask for a 10%-25% increase.

- Offer to move credit. If you already have a large amount of credit from American Express, you can often move credit around from one card to another to get an increase on a specific card. If you are opening a new account, offering to take credit from one card to put toward the new one can help get you approved.

- Be polite. This one is simple, but its still important. The Amex customer service rep is just doing their job, so its never a good idea to be rude if you dont get what you want.

How To Boost Your Chances Of Prequalifying And Getting Approved For An Amex Card

Although Americans credit card debt has fallen in the last year , card issuers have been more cautious about approving new applicants during the COVID-19 pandemic. That said, you can boost your chances of prequalifying and getting approved for an Amex card by staying informed and practicing good credit habits.

Recommended Reading: 778 Fico Score

What Other Issuers To Consider If Amex Doesnt Approve You

If your application for an Amex card is denied, your best bet is to try and figure out why you werent approved and what you can do about it. That advice goes for Amex and all other issuers.

For example, if your credit score needs work, use our tips to improve your score, which will increase your odds of approval next time you want a rewards card. Regardless of whether youre applying for an Amex card, Chase card, Capital One card or Citi card, most of the top rewards cards require good to excellent credit scores and a solid credit history.

Use Your Credit Card Responsibly

Regardless of where you get your credit card, it’s crucial that you develop good credit card habits. For starters, it’s important to pay your bill on time every month to avoid missing a payment, which can hurt your credit score and result in a fee.

Also, make it a goal to pay your balance in full every month, which will ensure you never pay interest. If you can’t pay back what you charge to your card, consider using cash or a debit card to avoid overspending.

Finally, it’s critical that you keep your credit card balance as low as possible. Your credit card balances affect your , which is an important factor in your credit scores. If you’re constantly bumping up against your credit limit, that could be seen as risky behavior by lenders and credit scoring models, even if you pay your bill in full every month. When your balance climbs above 30% of your credit limit you risk credit score harm. There’s no hard-and-fast rule, but the lower, the better.

Also Check: Cbcinnovis Inquiry

What Should You Do If Your Request Is Denied

Your request for a higher credit limit was denied now what?

The first thing to do is . Make your case for why a higher credit limit should be extended , and your request may be approved.

Many unofficial sources indicate that you need to wait at least 90 days after you are denied to make a repeat request.

If your request is still denied, its time to look at your credit score and re-evaluate how you use the credit you already have.

Amex Gold Welcome Offer

Before we dive in, we wanted to make sure you were aware of the exciting welcome offer available . New American Express® Gold Card cardholders can earn 60,000 Membership Rewards® points after spending $4,000 on eligible purchases with their new Card within the first 6 months. Spending $4,000 in six months is doable for many people.

Learn more: Johnny Jet Recommended Credit Cards

Additionally, some people may pre-qualify and may be able to earn 75,000 bonus Membership Rewards after spending $4,000 in the first 6 months by trying through the CardMatch tool. Seeing if you pre-qualify with the free CardMatch tool can quickly calculate your approval odds and show your best card offers.

Note that this offer isnt available to returning applicants that have already earned a Gold Card or Premier Rewards Gold welcome offer.

Now, onto what credit score needed for the Amex Gold.

Recommended Reading: How Long Before Collections Fall Off Your Credit Report

What Stores Accept American Express

It should be noted that stores that accept American Express credit cards generally accept American Express prepaid gift cards as well. Remark. The names of the related companies will help you do a preliminary research on the payment methods of each company. Dillards Coles Macys Neiman Marcus Nordstrom Nordstrom Wreck Saks Fifth Avenue .

Be A Standout Customer

If you are generally a creditworthy customer, you have a good chance of getting your desired credit limit increase. Here are a few things American Express will be looking at:

- Have you been a customer for at least 60 days? If not, you will not get a credit limit increase. Some reports indicate you need to be a customer for at least 6 months before requesting an increase.

- Do you pay off your bill in full and on time every month? American Express will report your credit card account as delinquent to the credit reporting agencies if you dont pay your minimum balance for 2 consecutive billing periods.

- Are you using a reasonable amount of your current credit limit, or is it maxed out? Your meaning the percentage of your available credit that youre using is used to determine your creditworthiness. Try to keep this number as low as possible, ideally under 30%.

Bottom Line: If you are a brand-new customer or habitually have late or partial payments, your chances of getting a credit limit increase are slim to none.

You May Like: Does Opensky Report To Credit Bureaus

Don’t Get Scammed By Illegitimate Credit Monitoring Services

The best way to protect yourself is looking for common red flags. A few are:

- Asking for personal information over the phone or email.

- Requiring payment through money order or gift cards.

- Poor ratings or customer reviews with an accredited agency .

Last, and certainly not least, do your due diligence. Anytime you fork over personal information to a company you need to research the company & verify credibility. The good news? You’re reading this review, so you’re too smart to be grifted by con-artists.

The Platinum Card From American Express: Key Features

To view rates and fees of The Platinum Card® from American Express, see this page.

Annual fee: $695.

Bonus offer:

-

Earn 100,000 Membership Rewards® Points after you spend $6,000 on purchases on the Card in your first 6 months of Card Membership. Terms Apply.

-

10 Membership Rewards points per dollar spent on eligible purchases at restaurants worldwide and U.S. small businesses, on up to $25,000 in combined purchases, in your first 6 months. You can find eligible small businesses by searching American Express Shop Small Map for retail locations and online merchants.

Rewards:

-

5 Membership Rewards points per dollar spent on flights booked directly with airlines or with American Express Travel.

-

5 points per dollar on prepaid hotels booked with American Express Travel.

-

2 points per dollar on other eligible travel expenses booked with American Express Travel.

-

1 point per dollar on all other purchases.

-

Terms apply.

Membership Rewards points are worth a baseline value of about 0.5 cents to 1 cent each, depending on how you redeem them. Travel and gift card redemptions are generally the most valuable.

Points are also transferable to and can be worth even more if redeemed strategically after being transferred to other travel loyalty programs. Travelers can often get outsized value for their points by taking advantage of the transfer options, and NerdWallet values Membership Rewards as much as 2 cents each when redeemed this way.

Airlines:

You May Like: Experian Temporary Unlock