Student Loan Default: Seven Years

Failure to pay back your student loan remains on your credit report for seven years plus 180 days from the date of the first missed payment for private student loans. Federal student loans are removed seven years from the date of default or the date the loan is transferred to the Department of Education.

Limit the damage: If you have federal student loans, take advantage of Department of Education options including loan rehabilitation, consolidation, or repayment. With private loans, contact the lender and request modification.

The Credit Reporting Time Limit

Companies use your credit report information to gauge whether you’re a responsible borrower. Naturally, some information is more important than others. In particular, actions from your recent history are more indicative of your credit habits than things from decades ago.

While positive information can stay on your credit report forever, provided those accounts are still open. Closed accounts may eventually drop off your credit report according to the credit reporting agencies’ guidelines for keeping this information.

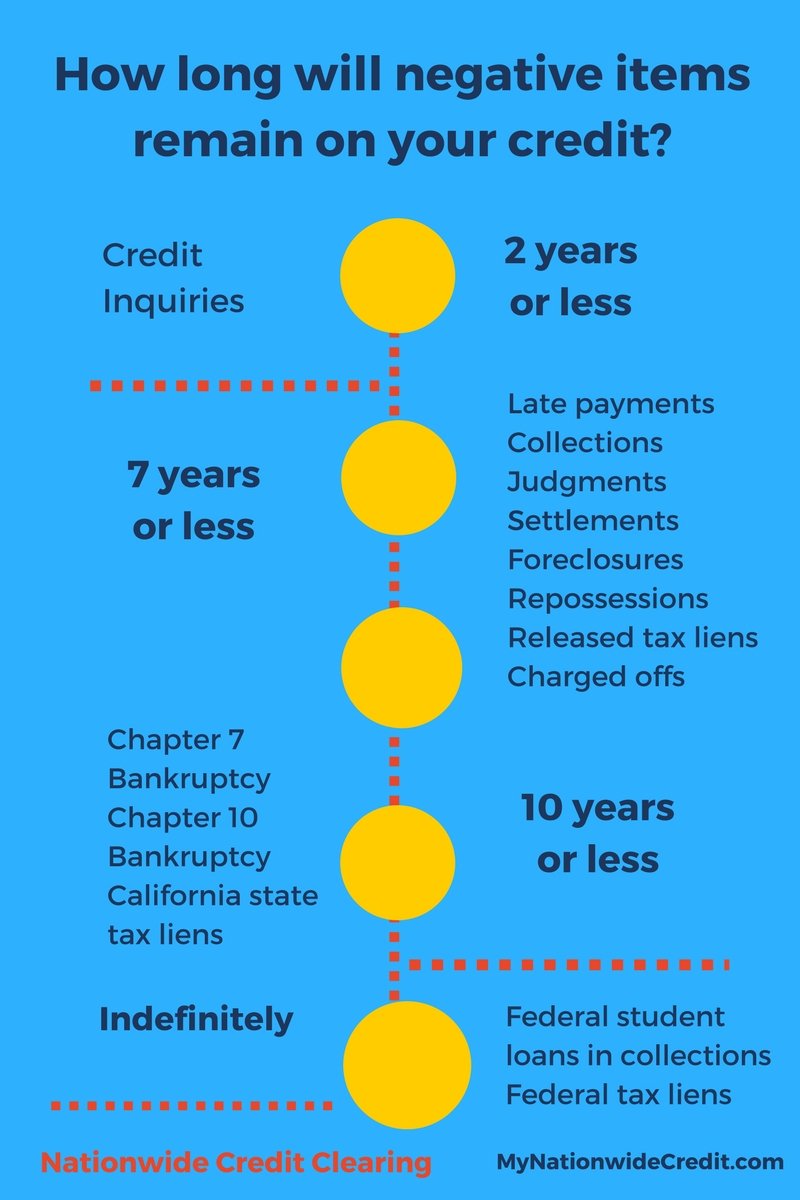

Fortunately, credit mistakes won’t follow you forever. Most negative information can only stay on your credit report for a maximum of seven years. Certain types of negative information will stay on your credit report for longer.

| Type of Information | |

| Hard inquiries | 2 years |

Tax liens and civil judgments are no longer included in your credit report based on changes the credit bureaus made to reporting practices.

How Do I Know Whats In My Credit Report

Each of the national credit bureaus Equifax, Experian, and TransUnion is required to give you a free copy of your credit report once every 12 months if you ask for it at AnnualCreditReport.com, or by calling 1-877-322-8228. Otherwise, a credit bureau may charge you a reasonable amount for another copy of your report within a 12-month period.

Consider getting your reports at least once a year. You can get your free reports from each of the credit bureaus at once, or you can spread them out throughout the year. Some financial advisors say staggering your requests during a 12-month period may be a good way to keep an eye on whether the information in your reports is accurate and complete. But since each credit bureau gets its information from different sources, the information in one credit bureaus report may not be completely the same as information in your reports from the other two credit bureaus.

Through the pandemic, everyone in the U.S. can get a free credit report each week from all three national credit bureaus at AnnualCreditReport.com. Also, everyone in the U.S. can get six free credit reports per year through 2026 by visiting the Equifax website or by calling 1-866-349-5191. Thats in addition to the one free Equifax report you can get at AnnualCreditReport.com.

Youre also entitled to another free report each year if

Recommended Reading: Syncb/ppc Account

What Happens If A Company Takes A Negative Action Against Me Because Of Something In My Credit Report

Be sure to check your reports before you apply for credit, a loan, insurance, or a job. If you find mistakes in your credit report, contact the credit bureaus and the business that supplied the information to get the mistakes removed from your report.

When a company takes adverse action against you, like turning you down for credit or a job, because of something in your credit report, youre entitled to another free credit report. To get it, ask for it within 60 days of getting notified about the action. The company must send you a notice that includes the name, address, and phone number of the credit bureau that gave the company your credit report, so youll know which credit bureau to ask.

How Long Does Positive Information Remain On Your Credit Reports

The Fair Credit Reporting Act is the federal statute that defines consumer rights as they pertain to credit reports. Among other consumer protections, the FCRA defines how long certain information may legally remain on your credit reports.

There is no requirement in the FCRA for credit reporting agencies to remove positive information such as on-time credit paymentsthey can remain on your credit reports indefinitely. Even after a positive account has been closed or paid off, it will still remain on your credit reports for as long as 10 years.

The credit bureaus keep a record of your accounts in good standing even after they’ve been closed because it’s important for credit scoring systems to see their proper management. As such, credit scoring systems such as FICO and VantageScore® still consider closed accounts that appear on your credit report when calculating your scores.

Read Also: Who Is Syncb/ppc

You Have Defaulted On An Account

An account is in default when the borrower has missed payments and the account is then closed by the lender. There is no set number of missed payments that result in a default being recorded. This is down to the individual lender, but when they believe a debt can no longer be recovered they record a default.

If a debt cannot be recovered many lenders sell the account to a debt collection agency. This will show negatively on your credit file and will remain on it for a period of six years from the default date, regardless of any settlement. After this time it is removed from your report automatically even if the full amount has not been settled.

Although a default will be removed from your report after 6 years the lender may still pursue you for the debt, unless the debt is statute barred. A statute barred debt is a debt which is seen as unenforceable as the creditor has not chased it in the period allowed. If you have not been chased for payment, have not made payment or signed any acknowledgement of a debt in writing for 6 years in England and Wales and 5 years in Scotland then it could be statute barred.

How To Remove Negative Item From Credit Report

Category: Credit 1. How to Remove Negative Credit Report Items | Bankrate.com Nov 5, 2020 It is generally not possible to remove accurate and timely data from your credit report. However, inaccuracies and out of date items on your Negative information thats too old to be reported most derogatory

You May Like: Cbcinnovis Hard Inquiry

Reporting Time Limit Vs Obligation To Pay

The expiration of the credit reporting time limit doesn’t mean you no longer owe a debt. The credit reporting time limit does not define how long a creditor or collector can go after you for an unpaid bill. As long as a legitimate debt remains unpaid, the creditor can attempt to collect from you by calling, sending letters, and any other legal action.

Dispute With The Business That Reported To The Credit Bureau

Now, you can completely bypass the credit bureau and dispute directly with the business that reported the error to the credit bureau, e.g., the credit card issuer, bank, or debt collector. You can make the dispute in writing, and the business is required to do an investigation just like the credit bureau.

When the business determines that theres indeed an error on your credit report, they must notify all the credit bureaus of that error so your credit reports can be corrected.

Don’t Miss: Does Removing An Authorized User Hurt Their Credit Score

Get A Free Copy Of Your Credit Report

The Fair Credit Reporting Act promotes the accuracy and privacy of information in the files of the nations credit reporting companies. Monitoring your credit report is a necessary practice to keep in check any negative information. Consumers should obtain their free credit report and review it at least once a year to catch any irregularities on time and keep track of disputed items.

Consumers are entitled by law to a free annual credit report from each of the three main reporting bureaus: Equifax, Experian, and TransUnion, and you can access all three of them through one single website:

AnnualCreditReport.com is the only authorized website through which you can gain free access to your credit report from the three major bureaus. Be wary of other sites that promise the same, as they may have hidden fees, try to sell something, or collect personal information.

| Mail: Download, print, fill out, and mail to: |

| Annual Credit Report Request Service P.O. Box 105281 Atlanta, GA 30348-5281 |

Equifax made headlines in 2017 due to a massive data breach, but it remains one of the top 3 services to get your credit report. The company provides a few different service levels if you want to monitor your credit score monthly . Monitoring packages start at $14.95 per month, and the $19.95 per month options include, ironically, a host of identity-theft protection options.

How Long Does The Negative Information Stay On My Credit Report

The time allotment data remains on your credit report relies upon what is being accounted for and whether the data is sure, impartial, or negative. The uplifting news is, sure and impartial data can remain on uncertainly and may help enhance your FICO assessment. Most negative data will drop off your reports following seven to ten years, yet in uncommon cases, the information will seem longer than ten years.

When Will a Negative Item Drop Off My Credit Report?

Most negative data can show up on your credit reports for seven to ten years. A couple of things can stay for considerably more. Here are some well known items and when you can anticipate them to drop off your reports.

When you experience difficulty making your charge card and advance installments on time, your bank will report those ease back and missed installments to the credit announcing organizations. Anything besides an on-time installment is viewed as a negative thing. Misconducts can be accounted for as long as seven years from the due date for the last booked installment before the wrongdoing happened. For example, you missed the installment due July 7, 2019. That missed installment wont drop off your credit report until July 7, 2026.

Repossessions and Foreclosures

At the point when your leaser grabs your security to pay for your obligation , the repossession or dispossession can remain on your credit report for a long time after your unique misconduct date.

Records in Collection

Charged Off Accounts

Also Check: How To Remove Child Support From Credit Report

Negative Credit Report Entries That Impact Your Score The Most

Accurate items will stay on the credit report for a determined period. Fortunately, their impact will also diminish over time, even if they are still listed on the report. For example, a collection from a few years ago will bear less weight than a recently-reported collection. If no new negative items are added to the report, your credit score can still slowly improve.

Can I Get Negative Information Removed From My Credit Report If Its True

Not usually. Most negative information will stay on your report for seven years, and bankruptcy information will stay on for 10 years. Companies that promise to repair your credit cant remove truthful information it takes time to go away. There are exceptions. In certain situations like when youre being considered for a job paying more than $75,000 a year, or youre trying to get a loan or insurance valued at more than $150,000 a credit bureau may include older negative information on your report that wouldnt show up otherwise.

Recommended Reading: How Long Does It Take For Opensky To Report

How Long Do Collections Stay On Your Credit Report

If a creditors information regarding an accounts delinquency is valid, the collections record will exist for seven years starting on the date it is filed.

Heres how it typically works: When a creditor considers an account neglected, the account may be handed over to an internal collection department. Sometimes, however, the accounts debt is sold to an outside debt collection agency. This often happens when you are about six months behind on payments.

Around 180 days after the original due date of the payment, the creditor might sell the debt to a collections agency, says Sean Fox, president of Freedom Debt Relief. This step indicates that the creditor has decided to give up on getting payment on its own. Selling to the collections agency is a way to minimize the creditors loss.

At that point, you will start to hear from a debt collector, who now has the right to collect the payment. Depending on the type of debt you have, a variety of countermeasures exist on behalf of creditors to prevent major financial losses.

Unsecured debts, like credit card debt and personal loans, are generally sent to a collections agency, or can even be handled internally. If you fail to pay a secured debt, like an auto loan or a mortgage, foreclosure and repossession are the most common approaches for creditors to begin regaining losses.

How To Remove Negative Information From Your Credit Report

As long as the information is accurate and verifiable, the credit reporting agencies will maintain it for the aforementioned timeframes. If, however, you have information on your report that you believe is incorrect, whether it’s positive or negative, then you have the right to dispute the information and have it corrected or removed from your credit reports.

The most efficient way to file a dispute is to contact the credit reporting agencies directly. And while Equifax and TransUnion have their own processes for consumers to dispute their credit reports, Experian makes available three dispute methods: You can do it over the telephone, via U.S. mail or online.

You May Like: Does Opensky Report To Credit Bureaus

How Long Do Collections Stay On Your Credit Reports

The short answer: Accounts in collection generally remain on your credit reports for seven years, plus 180 days from whenever the account first became past due.

The long answer: Once the original creditor determines your debt is delinquent and sells it to a collection agency, the collection account can be reported as a separate account on your credit reports.

Assuming the collection information is accurate, the collection account can stay on your reports for up to seven years plus 180 days from the date the account first became past due.

Confused? Lets look at an example:

- Your account becomes late on

- After 180 days of nonpayment, your creditor charges it off on

- The original delinquency date is Jan. 1, 2018, but the account appeared on your credit report 180 days after that date. So the account should fall off your credit report by

How Long Can Negative Information Stay On My Credit Report

Under the provisions of the Fair Credit Reporting Act, adverse informationfor example, collection actions, charge-offs, suits, and judgmentsmay remain on your credit report for seven years.

Refer to 12 CFR 1022 “Fair Credit Reporting ” for more information.

Last Reviewed: April 2021

Please note: The terms “bank” and “banks” used in these answers generally refer to national banks, federal savings associations, and federal branches or agencies of foreign banking organizations that are regulated by the Office of the Comptroller of the Currency . Find out if the OCC regulates your bank. Information provided on HelpWithMyBank.gov should not be construed as legal advice or a legal opinion of the OCC.

You May Like: Open Sky Unsecured

What Negative Information Appears On Your Credit Report

Equifax and TransUnion are the two main credit reporting bureaus in Canada. The reports are often different between the two since not all creditors communicate with both credit bureaus, and each credit reporting agency has its own purge rules as to when information is removed from your report. Thats why it is always best to understand how each credit bureau treats negative information.

Below is a list of negative items that can appear on your report and the purge periods.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Also Check: Is Chase Credit Score Accurate

How Can I Get Help With Derogatory Marks

You can remove derogatory marks from your credit report by yourself. However, getting help from a credit repair company can make the process easier and improve your chances of getting the negative mark removed.

Many consumers appreciate professional help as it saves time, energy and resources. Contact us for a free credit report consultation. Well talk about your unique situation and the ways that we can help you.

Ways To Prevent Negative Information

Your credit history comes from your credit activitiesâboth positive and negative. With that in mind, here are some ways to use your credit responsibly and prevent negative information from appearing on your credit reports:

- Pay bills on time. Your payment history is a major factor when it comes to your credit scores. Even one missed or late payment can have a negative impact on your credit.

- Stay well below your credit limits. According to the CFPB, âExperts advise keeping your use of credit at no more than 30 percent of your total credit limit.â

- Monitor your credit. With , you can access your TransUnion® credit report and weekly VantageScore® 3.0 credit scoreâwithout hurting your score. CreditWise is free for everyone. You donât even have to be a Capital One customer to enroll. You can also get a free copy of your credit report from each of the three major credit bureaus. Visit AnnualCreditReport.com to learn how.

Remember, knowledge can be power when it comes to your credit. So get proactive. The more you know about negative information on your credit reports, the more you could do to prevent it.

Learn more about Capital Oneâs response to COVID-19 and resources available to customers. For information about COVID-19, head over to the Centers for Disease Control and Prevention.

Recommended Reading: Remove Repossession From Credit Report