Who Can See And Use Your Credit Report

Those allowed to see your credit report include:

- banks, credit unions and other financial institutions

- offer you a promotion

- offer you a credit increase

A lender or other organization may ask to check your credit or pull your report”. When they do so, they are asking to access your credit report at the credit bureau. This results in an inquiry in your credit report.

Lenders may be concerned if there are too many credit checks, or inquiries in your credit report.

It can seem like you’re:

- urgently seeking credit

- trying to live beyond your means

Correct An Inaccuracy On Your Equifax Credit Report

If you find any information that you believe is inaccurate, incomplete or a result of fraud, you have the right to file a dispute with Equifax Canada. You will need to complete the enclosed with your package. You can also review how to dispute information on your credit report for additional details on the Equifax dispute process.

How Often Does Transunion Update Consumer Credit Reports

TransUnion will typically update their consumer credit reports when they receive new information from a credit reporting agency. Most agencies will send new data every month or at least every 45 days. So, from the TransUnion standpoint, credit reports are typically updating as soon as information arrives. The confusing part is that different information is sent on different days and frequencies by the reporting agencies. Due to this inconsistent send, it may be possible to see multiple credit report updates within a single week, or no updates for some weeks at a time depending on the depth and complexity of ones credit. Credit scores are typically updated in sequence as a credit report updates.

Don’t Miss: Credit Score Itin

Other Accounts Included In A Credit Report

Your mobile phone and internet provider may report your accounts to your credit bureau. They can appear in your credit report, even though they arent credit accounts.

Your mortgage information and your mortgage payment history may also appear in your credit report. The credit bureaus decides if they use this information when they determine your credit score

A home equity line of credit that is added to your mortgage may be treated as part of your mortgage in your credit report. If your HELOC is a separate account from your mortgage, it is reported separately.

Who Creates Your Credit Report And Credit Score

There are two main credit bureaus in Canada:

- Equifax

These are private companies that collect, store and share information about how you use credit.

Equifax and TransUnion only collect information from creditors about your financial experiences in Canada.

Some financial institutions may be willing to recognize a credit history outside Canada if you ask them. This may involve extra steps. For example, you may request a copy of your credit report in the other country and meet with your local branch officer.

Read Also: Aargon Agency Inc Las Vegas

How Long Does It Take For Credit To Update Instant Credit Boost

Im sure youve heard the term before. Its that 3 digit number that follows you & your financial life every where you go. You require it to get approved for loans, credit cards, homes, home mortgages & more! And because you never actually see it, its typically out of sight, out of mind but this number is something that needs to be taken severe.

Though none of us like it, the fact that a credit score is so essential to nearly everything we do financially is precisely why we stated it needs to be taken severe. It can take years to build up a good score and just a day or more to bring the whole thing crashing down.

Luckily, theres things you can do to secure and inform yourself on the topic. From techniques to give you a near-instant boost to your score to understanding what a credit score even is from a basic level, were going to stroll you through this step by step. Prepare yourself to take control of your financial freedom at last!

What To Do If You Disagree With The Outcome

If your dispute is rejected and you disagree with the outcomelike, for example, they reject your dispute after their investigation and continue to report the item in questionyou have two options. The first is to reach out to the data furnisher directly.

Ultimately, the credit bureau relies on the furnisher to look into the dispute, so if they have incorrect information, its best to go to the source. You can provide them with proof so they can update their records and notify the credit bureau.

The second alternative is to refile a dispute with the bureaus. If you resubmit the exact dispute with no new information, its unlikely youll get a different judgment.

Ideally, youd want to find new supportive evidence that backs your dispute. Additionally, you might want to consider working with a professional credit repair service to resubmit your dispute. These companies understand what credit bureaus want to see and can improve your chances of having a dispute judged in your favor.

A bureau would again have 30 45 days to investigate the new dispute.

If the above options dont work out, your last option is to request that a statement of dispute be added to your file. This wont improve your credit score, but future lenders will see the note that you disagree with the entry in your report. This may lead the lender to ask you for more details rather than immediately denying you over the item.

Youll need to contact each bureau individually to add a note to your file.

Recommended Reading: When Does Capital One Report To Credit

Submit Your Request By Mail:

First, you’ll need to download and complete the Canadian Credit Report Request Form.

Second, you must provide a photocopy of two pieces of valid, non-expired Canadian Government-issued identification. At least one of the two IDs must include your current home address. Examples of acceptable documentation include:

- Driver’s license

- Birth certificate

- Certificate of Indian Status

In order to protect your personal information, we will validate your identity before mailing your credit report to your confirmed home address. If your address is not up-to-date on either identification, you must also provide additional documentation that shows your current home address . Your copy should show the date of the document, the sender, your name, address and your account number.

- Documents must be less than 90 days old

- We recommend you blackout any transactional details.

- If you provide a credit card statement or copy of your credit card as proof, please ensure to blackout your CVV.

While providing your Social Insurance Number is optional, it helps us avoid delays and confusion in case another individual’s identifying information is similar to your own. If you provide your S.I.N., we will cross-reference it with our records to ensure that we disclose the correct information to you. We will not use it for any other purpose or share it with any third party.

As a last step, you will need to submit your completed form and proof of identity

Kindly allow 5 – 10 days for delivery.

How Often Is My Credit Score Updated

Wondering why your credit score seems different every time you check it? Credit scores can change frequently, reflecting updates to your credit files at the three national credit bureaus. Here’s what you need to know about how and why credit scores rarely remain stagnant.

Don’t Miss: Experian Boost Paypal

Why Should I Get A Copy Of My Report

Getting your credit report can help protect your credit history from mistakes, errors, or signs of identity theft.

Check to be sure the information is accurate, complete, and up-to-date. Consider doing this at least once a year. Be sure to check before you apply for credit, a loan, insurance, or a job. If you find mistakes on your credit report, contact the credit bureaus and the business that supplied the information to get the mistakes removed from your report.

Check to help spot identity theft. Mistakes on your credit report might be a sign of identity theft. Once identity thieves steal your personal information information like, your name, date of birth, address, credit card or bank account, Social Security, or medical insurance account numbers they can drain your bank account, run up charges on your credit cards, get new credit cards in your name, open a phone, cable, or other utility account in your name, steal your tax refund, use your health insurance to get medical care, or pretend to be you if they are arrested.

Identity theft can damage your credit with unpaid bills and past due accounts. If you think someone might be misusing your personal information, go to IdentityTheft.gov to report it and get a personalized recovery plan.

Does Paying Off Collections Improve Your Credit Score

Paying off an account in collections may or may not help your credit score. The impact depends on a variety of factors, including the credit-scoring model being used. Older credit-scoring models will reflect that a collection account has been paid and now has zero balance, which can positively impact your score, says Block. Newer credit-scoring models, however, will ignore the zero-balance status on a collections account.

The total number of accounts you have in collections also factors into your credit score. If the collection event is recent and is the only one of its kind, then it may be advantageous to your score to resolve it, says John Cabell, director of banking and payments intelligence for J.D. Power. However, if you have many debts in collections, then you may not see much improvement. Conversely, if the collection event is several years old, it may not actually be playing much of a role in your credit score anymore anyway.

Read Also: Carmax For Bad Credit

Length Of Credit History

The average age of your credit accounts is another important factor in determining your credit score. Having many older accounts has a positive impact on your credit score, and having several new accounts is a negative contributing factor. If you pay off debt on an older account and subsequently close it, your credit score may drop.

When Will My Report Arrive

Depending on how you ordered it, you can get it right away or within 15 days.

- Online at AnnualCreditReport.com youll get access immediately.

- using the Annual Credit Report Request Form itll be processed and mailed to you within 15 days of receipt of your request.

It may take longer to get your report if the credit bureau needs more information to verify your identity.

Recommended Reading: Paypal Credit Report To Credit Bureaus

How Can I Raise My Credit Score 100 Points

Here are 10 ways to increase your credit score by 100 points most often this can be done within 45 days. Check your credit report. Pay your bills on time. Pay off any collections. Get caught up on past-due bills. Keep balances low on your credit cards. Pay off debt rather than continually transferring it.

What Affects Credit Score Update Timing

The timing of credit score updates is based on the timing of changes to your credit report. Since your credit score is calculated instantly using the information on your credit report at a given point in time, all it takes to raise your credit score is a positive change to your credit report information.

At the same time, having negative information added to your credit report can offset positive changes you might have seen to your credit score. For example, if you receive a credit limit increase but a late payment is also added to your credit report, you may not see your credit score improve. In fact, your credit score could fall.

Seriously negative information can weigh your credit score down, making it take longer to improve your credit score. For example, it can take longer to improve your credit score if you have a bankruptcy, debt collections, repossession, or foreclosure on your credit report.

The more recent negative information is, the more it will impact your credit score.

You May Like: Does Speedy Cash Report To Credit Bureaus

How Often Can I Get A Free Report

Federal law gives you the right to get a free copy of your credit report every 12 months. Through the pandemic, everyone in the U.S. can get a free credit report each week from all three national credit bureaus at AnnualCreditReport.com.

Also, everyone in the U.S. can get six free credit reports per year through 2026 by visiting the Equifax website or by calling 1-866-349-5191. Thats in addition to the one free Equifax report you can get at AnnualCreditReport.com.

What You Should Focus On

When trying to balance paying off debts with building credit, it can be difficult to understand how to do whats good for your money while doing whats good for your credit score.

Rather than stressing, focus on paying your bills and loans in a timely fashion and do what you can to build good credit. These two actions go hand in hand.

Only take on new debt and credit cards if you think you can remain in control of the balances and pay them on time. Otherwise, you risk undoing your good work.

If you worry about how long it will take after paying off debt for your credit score to improve, be patient. Congratulations on paying off your debt.

Andrew Pentis and Alli Romano contributed to this report.

Sign up for weekly digest to receive the latest rate updates and refinance news!

Thank you! Keep an

Recommended Reading: Does Paypal Credit Report To Credit Bureaus

How Soon Will Your Credit Score Improve

Unfortunately, theres no way to predict how soon your will go up or by how much. We do know that it will take at least the amount of time it takes the business to update your credit report. Some businesses send credit report updates daily, others monthly. It can take up to several weeks for a change to appear on your credit report.

Once your credit report is updated with positive information, theres no guarantee your credit score will go up right away or that it will increase enough to make a difference with an application. Your credit score could remain the sameor you could even see your depending on the significance of the change and the other information on your credit report.

The only thing you can do is watch your credit score to see how it changes and continue making the right credit moves. If you’re concerned about inaccurate reporting on your credit score or simply want to keep a closer eye on it you could use a .

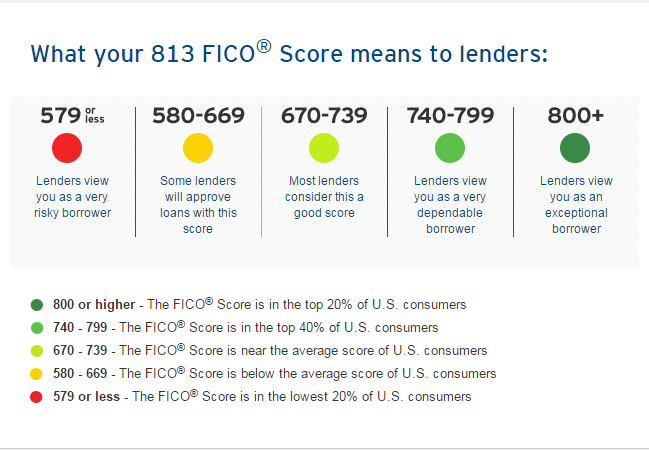

How A Credit Score Is Calculated

Its impossible to know exactly how much your credit score will change based on the actions you take. Credit bureaus and lenders dont share the actual formulas they use to calculate credit scores.

Factors that may affect your credit score include:

- how long youve had credit

- how long each credit has been in your report

- if you carry a balance on your credit cards

- if you regularly miss payments

- the amount of your outstanding debts

- being close to, at or above your credit limit

- the number of recent credit applications

- the type of credit youre using

- if your debts have been sent to a collection agency

- any record of insolvency or bankruptcy

Lenders set their own guidelines on the minimum credit score you need for them to lend you money.

If you have a good credit score, you may be able to negotiate lower interest rates. However, when you order your credit score, it may be different from the score produced for a lender. This is because a lender may give more weight to certain information when calculating your credit score.

Also Check: Does Opensky Report To Credit Bureaus

How Can I Improve My Credit Score After Paying Off Debt

While paying off your credit card debt is important, what matters more is on-time payments and your utilization rate. Many times, borrowers will ignore these factors, thinking that clearing up their debt as quickly as possible is the key to a stellar score. But there are a few other methods to consider:

- Be strategic with the order in which you pay off your debts. Personal loans and credit cards often have higher interest rates than mortgages, car loans and student loans. Paying off those first not only helps keep your credit utilization in check, but will also save you money in interest. You can also use a debt paydown calculator to help

- Check your credit utilization. If youve paid off your debt and your credit score went down, look at just how much of your credit you are using. If its above 30 percent, you might consider charging less each month. If that isnt an option, you could speak with your issuer about increasing your credit limit. Both of those should help increase your credit score.

- Open another credit card. While opening accounts could temporarily lower your score due to hard credit checks, opening a new card could increase your total available credit and spread your charging among several cards.

Not Every Lender Reports On The Same Cycle

The answer to your question depends on the lender who is reporting the information to the credit bureaus. The typical credit reporting cycle is 90 days, or quarterly so even if they update your record within 14 days, it is likely that it will not show up on your credit report until the next cycle . There is quite a bit of information on Bills.com regarding

Read Also: What Credit Score Do You Need For Care Credit