How Will Accepted Disputes Affect Your Fico Score

Often your score will improve when errors on your credit report are corrected. In some situations, however, your score may not improve when credit information is corrected or updated. For example:

- It is often thought that closing credit card accounts will improve your score. This is not true. Closing an account will neither remove it from your credit report, nor will it prevent the payment history from continuing to be displayed and considered in the calculation of your FICO Score.

- Removing negative information from your credit report may not have the impact on your FICO Score that you expect. There could be additional negative information remaining that will prevent an immediate increase in your FICO Score.

- FICO Scores only consider credit-related information on your credit report. If you change personal information , the credit information on your report will not be impacted and your FICO Score will probably not change. The FICO Score only considers credit account, collection, and public record information.

It typically takes the credit bureau 30-45 days to respond to your dispute.

How Do I Dispute Errors On My Credit Report

How to Dispute a Credit Report Error

The four national credit bureaus Experian, TransUnion, Equifax, and Innovis can exert a huge influence on your life. If you apply for a car loan, try to rent an apartment or hope to obtain a credit card, the credit history and credit score reported by those three agencies could be the difference in whether you are granted credit or rejected. Errors on your report can impact your credit score, your credit history, and in some case whether a report can be be issued at all.

So if there are credit reporting errors showing up on those reports, it’s important that you dispute the errors with the responsible credit bureaus and creditors so that the inaccurate information is removed from your report.

The Fair Credit Reporting Act provides a path to dispute and remove inaccurate information from your credit reports. Follow these steps to make sure your dispute gets to the right place and has the right information to remove any inaccurate information. If you need additional help writing your disputes, feel free to reach out for help from our team.

Get Your Credit ReportMake a Markup Copy

First, make a copy of each report that you are reviewing so you can mark up any items that you intend to dispute. You will need this “markup” later as an attachment to any credit dispute. And, in the event that you need to file a lawsuit, you will also need this “markup” copy to help your lawyer build a timeline of disputes.

Review Your Whole Credit Report

Should I Dispute A Collection Account

If the debt and the collection account in question are valid and correct, there’s no basis for submitting a dispute. However, if you believe information about the collection is inaccurate, you have the right to dispute it. Here are three instances when disputing a collection account might make sense:

- The collection account is not yours. If you find a collection account on your credit report for a debt you don’t recognize, contact the creditor or submit a dispute with the credit reporting agency that maintains the credit report it appears on. It could be the result of an error or identity theft. Once disputed, the company that reported the collection will investigate and, if it turns out not to be yours, the entry will be removed from your credit report.

- The collection is expired. If more than seven years have passed since the debt originally became delinquent, you can submit a dispute asking to have the entry removed.

- The collection is paid but it shows a balance. If you pay off a debt that is in collections, the collection account on your credit report should show a zero balance. File a dispute if the account continues to show an unpaid balance, since paying off a debt in collections may reflect positively to lenders and on your credit score, and may be a requirement for certain lenders.

Also Check: Opensky Credit Card Delivery

Common Errors That Can Impact Your Credit Score

Reviewing your credit report can help you monitor for identity theft and uncover items that could be lowering your score. However, not all errors on your report affect your credit score. Some items, such as an outdated phone number, aren’t worth the trouble of disputing.

Items that could lower your credit score and are worth disputing include:

- Incorrect account statuses, such as a bill reported as delinquent or an account in collections when you’ve always paid on time

- Derogatory marks that are older than seven years

- Addresses you don’t recognize

Errors On Your Credit Report

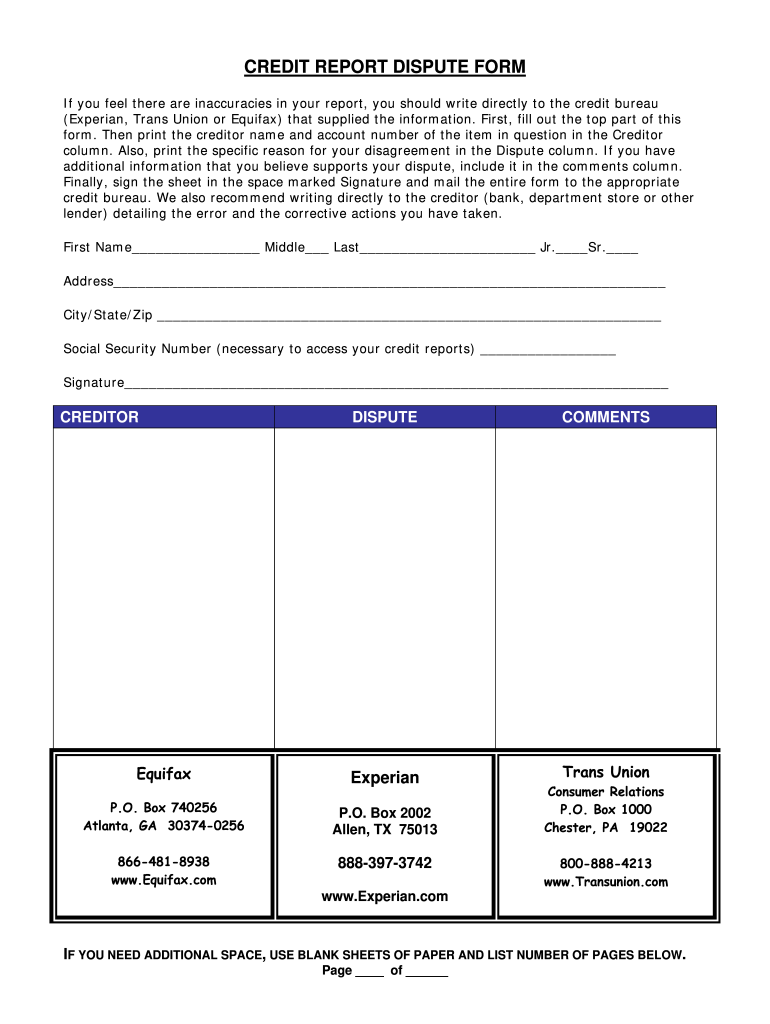

If you find errors on your credit report, write a letter disputing the error and include any supporting documentation. Then, send it to:

Find a sample dispute letter and get detailed instructions on how to report errors.

The credit reporting agency and the information provider are liable for correcting your credit report. This includes any inaccuracies or incomplete information. The responsibility to fix any errors falls under the Fair Credit Reporting Act.

If your written dispute does not get the error fixed, you can file a complaint with the Consumer Financial Protection Bureau .

Also Check: Is 688 A Good Credit Score For A Mortgage

Contact The Data Furnisher

Who you contact about fixing inaccurate information on your credit report depends on what information is incorrect. For example, in most cases if your personal informationname, addressis listed incorrectly, this is a mistake on the bureaus part and you should just contact the bureau.

If a debt am five days to report the results back to you. You can expect the same timeframe for a response from a data furnisher, although if they stand by their claim, they wont remove the error.

After the investigation, the credit bureau must provide the results in writing and give you a free copy of your report if the dispute results in a change. This free report does not count as your annual free report.

It is important to note that credit bureaus are not obligated to investigate a claim they decide is frivolous, For instance, a credit bureau may find your claim frivolous if you:

- Submit inaccurate or incomplete information on the dispute

- Try to contest the same item multiple times without new evidence

- Attempt to claim everything on your credit report is inaccurate, without proof

In these cases, the credit bureau is only required to communicate the reason for deeming the dispute frivolous within five days. If you have updated materials, you can try to submit the dispute again.

File A Dispute With The Credit Reporting Agency

Once you have your report, make sure to look through each account and see if there are creditors you dont recognize. Its also important to check whether older derogatory items are still being reported.

If you do find errors in your reports, its time to initiate a dispute directly with the reporting bureau through its website or by mail. This will prompt an investigation on the bureau’s part.

Bear in mind that you have to dispute the entry with each agency to make sure the removal is complete across the board.

How to file a dispute online

Each bureau Equifax, Experian and TransUnion has a section dedicated to walking consumers through the online dispute process. Once you create an account, you can file as many disputes as you need and check their status, for free.

How to file a dispute letter

You can also send a dispute letter to the bureaus, detailing any inaccuracies you’ve found in your credit file. When writing your letter, provide documentation that supports your claim and be precise about the information you are challenging. The Consumer Financial Protection Bureau recommends enclosing a copy of your report with the error circled or highlighted.

Depending on the information being disputed, these are some of the documents you can provide to help aid the investigation:

- Copies of checks

Include this dispute form with your letter.

Recommended Reading: Credit Score Of 611

Check For Updates To Your Credit Report

Updates to your affected credit reports may take some time to appear. It can depend on the specific credit bureaus update cycle and when the furnisher sends the new information to the credit bureau.

If the update doesnt appear on your credit reports within several months, contact the credit bureaus and the furnisher to verify its reporting your account information to the bureaus.

Strategies For Successfully Disputing Your Credit Report

Derogatory items are easy to get on a report but harder to take off. However, it is possible to get these taken off a credit report. The following are the steps in which you can try on your own to remove derogatory marks:

Correcting derogatory marks can seem daunting. With all the information and paperwork that needs to be sent to each agency, it can be a little stressful in getting all the information prepared. What if there was a simpler way to get a derogatory mark disputed? That is where DoNotPay comes in!

Don’t Miss: Realpage Consumer Report

Wait Up To 45 Days For The Credit Bureau Or Furnisher To Investigate And Respond

The credit bureau generally has 30 days after receiving your dispute to investigate and verify information with the furnisher. The credit bureau must also report the results back to you within five days of completing its investigation.

If you dispute the error with the information furnisher, that company must also report the results of its investigation to you. It also typically has 30 days to investigate. But if the furnisher stands by the accuracy of the information it reported, it wont update or remove the error.

One more thing to note is that either the credit bureau or the furnisher may decide that your dispute is frivolous. This generally happens when youve submitted incorrect or incomplete information on the dispute, but can also occur if youve tried to contest the same item multiple times without any new information or if youve attempted to claim that everything on your credit report is incorrect without proof.

If the bureau decides that your dispute is frivolous, it doesnt need to investigate it further as long as it communicates that to you within five days, along with the reasoning for deeming the dispute frivolous. If your original dispute was labeled frivolous, you can try to resubmit a dispute with updated materials.

How To Dispute Debt On Credit Report

Asked by: Maximilian Johnson

You can send a dispute using the dispute form on each credit bureau’s website. The Federal Trade Commission has sample dispute letters on its website if you need help crafting one. After you submit your dispute, a credit reporting company has 30 days to investigate your claim.

Read Also: Ccb Ppc Credit Report

Medical Id Reports And Scams

Use your medical history report to detect medical ID theft. You may have experienced medical iD theft it if there is a report in your name, but you haven’t applied for insurance in the last seven years. Another sign of medical ID theft is if your report includes medical conditions that you don’t have.

Request That Correction Notices Be Sent To Anyone Who Pulled Your Report Recently

After the credit bureau investigates your dispute, they will give you their findings in writing, in addition to a free copy of your report if there is new, corrected information.

You can also request that the credit bureau send a notification to anyone who has pulled your report in the past six months, telling them that your information has been corrected. That way, you have a record that there was an issue with your past credit reports.

For employment purposes, you can have the corrected report sent to anyone who has pulled your report in the past two years.

You May Like: Affirm Fico Score

Which Credit Report Errors Should You Dispute

The most concerning errors are those that could hurt your scores or suggest identity theft. Those include:

-

Wrong account status .

-

Negative information that’s too old to be reported most derogatory marks on your credit must be removed after seven years.

-

An ex-spouse incorrectly listed on a loan or credit card.

-

Wrong account numbers or accounts that arent yours.

-

Inaccurate credit limits or loan balances.

-

Accounts you don’t recognize.

If you suspect your identity has been stolen, follow the steps to report identity theft.

Ways To Dispute Information On Your Credit Report

TransUnion and Equifax have their own processes for disputing credit reports, but Experian provides three methods for submitting disputes:

- Online: Get access to your Experian credit report and initiate a dispute at the Experian Dispute Center . There is no cost to you for using this service.

- : To initiate a dispute by phone, you’ll call the number displayed on your Experian credit report. If you’d like to have a copy of your credit report delivered to you by mail, call 866-200-6020.

- : You can dispute without a credit report by writing to Experian, P.O. Box 4500, Allen, TX 75013. .

Read Also: Trimerge Report

Only Apply For Credit You Need

Every time you apply for a new line of credit, a hard inquiry is pulled on your report. This type of inquiry lowers your score temporarily. Applying just to see if you get approved or because you received a pre-qualified offer of credit is not a good idea.

If its a single hard credit pull, the drop will be slight. However, a string of hard inquiries could signal to lenders that you are taking on too much debt. The effects of a hard credit pull on your score, according to a representative of TransUnion, can last up to 12 months.

If you do need to apply for new credit, research your likelihood of approval to ensure youre a good candidate before applying. If possible, get a pre-approval or pre-qualification, as in many instances these result in a soft rather than hard credit pull. Soft pulls dont affect your credit score You dont want to risk lowering your score for a denied application.

You should also refrain from applying for several credit cards within a short time frame, or before taking out a large loan like a mortgage.

When you shop for a mortgage, auto, or personal loan, you can keep hard inquiries to a minimum by making rate comparisons within a short time period. Applications for the same type of loan within a designated time frame will only appear as a single hard inquiry. According to FICO, this span can vary from 14 to 45 days.

Donât Miss: Can Lexington Law Remove Repossessions

Get A Free Consultation

Most credit repair services offer a free consultation before you sign up to use their services. That call gives you a chance to review your credit history and hear their plan to fix your credit. Its a low-pressure way to get more information about how they can help you.

No matter which route you take, you should know that bad credit is not permanent. There are plenty of ways to fix it. If you avoid any new derogatory marks, then your credit scores have nowhere to go but up as current derogatory marks age and cause less damage to your credit.

You can even be more proactive by strategically disputing those derogatory marks and getting them removed from your credit reports early.

Request your credit reports today so that you can figure out the best game plan for your credit repair process. If youre intimidated, contact a professional to help point you in the right direction.

Read Also: Www Bpvisa Syncb

Check Whether Your Credit Report Has Been Updated

If you receive confirmation that the dispute has been resolved in your favor, the final step is to follow up to make sure that the mistake was actually corrected. Your information should be updated within the 30- to 45-day investigation period, but these changes might not immediately appear on your credit report.

The credit bureaus should update your reports no later than 30 to 45 days after they conclude their investigation, so you should follow up with the credit bureau if they havent updated your information after a couple of months. 7

Article Sources

How To Find Derogatory Marks On Your Credit Report

To find out which derogatory marks are currently active, youll need to order your free credit report from each of the major credit bureaus. Different creditors may only report information to certain credit bureaus, so its essential to get all three. The Fair Credit Reporting Act allows you to request a free credit report every 12 months from each credit bureau.

Once youve downloaded your credit reports, scour each one carefully. Some of the credit bureaus help you find derogatory credit items quickly. Equifax, for example, gives a quick summary at the top of your credit report that lists potentially negative information.

You can use this as guidance for spotting derogatory marks. However, its still a good idea to look at each page individually. First, check for delinquencies under all of your accounts. Then, look at anything listed under Negative Accounts, Collections, and Public Records .

Also Check: When Will A Repo Show On Your Credit

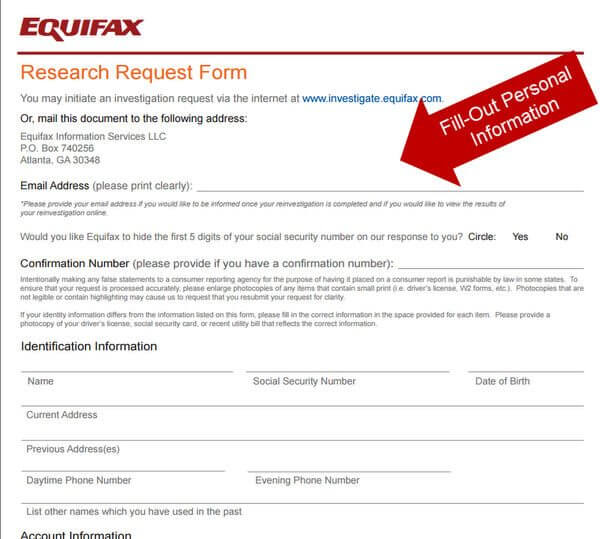

What Information Do I Need To Provide When Submitting A Dispute

Types of information you should be prepared with:

- Your full name, including middle initial and suffix, such as Jr., Sr., II, III

- Social Security Number

- Current address

- All addresses where you have lived during the past two years

Depending on how you submit your dispute , you may also be asked to provide the following additional information:

- Email address

- A copy of a government issued identification card, such as a driver’s license or state ID card

- A copy of a utility bill, bank or insurance statement

You should list each item on your credit report that you believe is inaccurate, including the creditor name, the account number and the specific reason you feel the information is incorrect.

You may also submit documents to support your dispute. Depending on the type of information disputed, the following documents may be helpful in resolving your dispute:

- Police reports or an FTC Identity Theft Report, showing that an account was the result of identity theft

- Bankruptcy schedules showing that an account was included in or discharged in bankruptcy

- Letters from creditors showing how an account should be corrected

- Student loan disability letters showing that a student loan has been discharged due to disability

- Cancelled checks showing that a collection account has been paid

- Court documents regarding public records