Correct An Inaccuracy On Your Equifax Credit Report

If you find any information that you believe is inaccurate, incomplete or a result of fraud, you have the right to file a dispute with Equifax Canada. You will need to complete the enclosed with your package. You can also review how to dispute information on your credit report for additional details on the Equifax dispute process.

Where Can I Get My Credit Report

You can request a copy of your credit file online, at any of the 62 SingPost branches, at the Credit Bureau office, at CrimsonLogic Service Bureaus or at the CASE office.

A transaction fee of $6 plus GST applies.

You can also , which checks your report daily and notifies you by email when key changes are detected. Early detection is key to minimising the damage that ID theft can have on your credit.

How To Safeguard Your Identity

If you find accounts listed on your credit reports that you did not open or if you are worried about identity theft, you might consider filing a free fraud alert on your credit file that remains active for one year through the Experian fraud center. The fraud alert notifies lenders pulling your credit report to take extra steps to verify your identity.

You can also freeze your credit reports, another free measure that prevents lenders from issuing new credit in your name altogether. Or try Experian CreditLock, a benefit of your Experian membership, which allows you to lock and unlock your report in real time, with no waiting period.

Read Also: What Credit Bureau Does Capital One Report To

How Often Should You Check Your Credit Report

Experts recommend that you check your credit report at least once a year. Taking a full deep dive with a credit report to ensure no inaccuracies, make sure you know where you stand and use a monitoring service that keeps you informed. We can help you stay informed with a credit monitoring service. Sign up for Chase Credit Journey to help monitor your credit.

If you’re planning to make a major purchase soon, or even in the somewhat distant future, you should regularly check up on your credit report. You want to make sure your report is as accurate as possible to get the best interest rates.

Enjoy 24/7 access to your account via Chases . Sign in to activate a Chase card, view your free credit score, redeem Ultimate Rewards® and more.

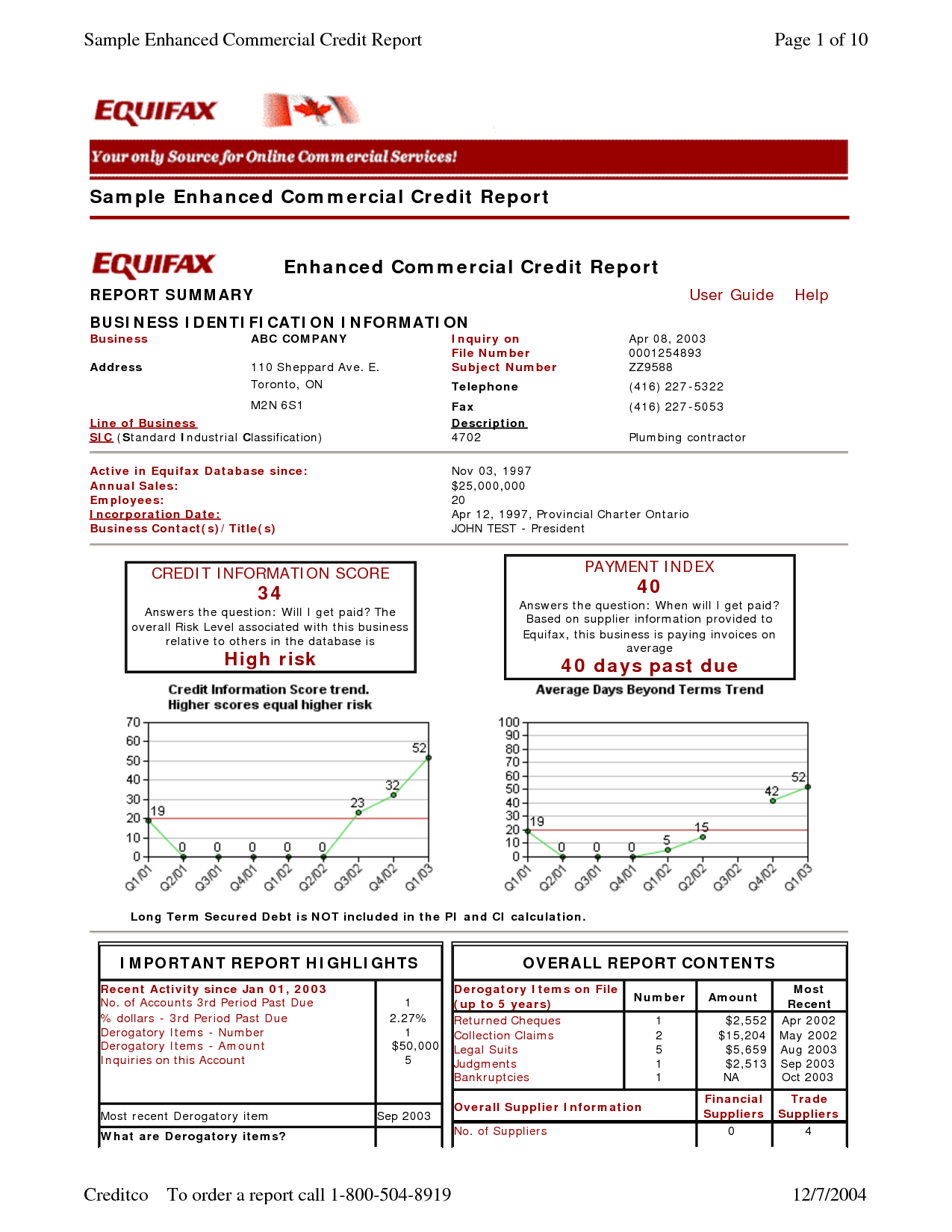

Basics Of Credit Reports And Scores

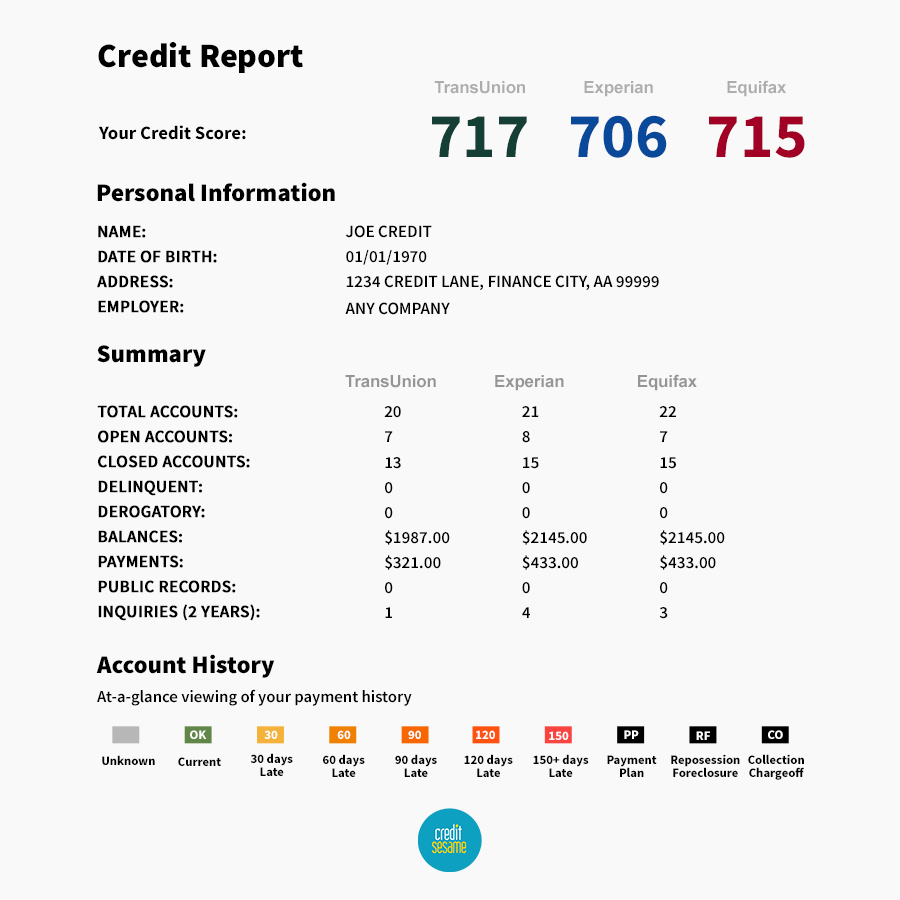

Your are statements of your . And there are three major bureaus that compile credit reports: Equifax®, Experian® and TransUnion®. Each credit bureau compiles its own credit reports, so your credit reports may be slightly different.

Your are based on the information in those credit reports. Generally speaking, the higher the score, the better. FICO® and VantageScore® provide some of the most commonly used scores. But keep in mind that you have many different credit scores that different lenders use.

As the Consumer Financial Protection Bureau explains, âYour score can differ depending on which credit reporting agency provided the information, the scoring model, the type of loan product, and even the day when it was calculated.â

Why Is Credit Important?

Your because it gives lendersâand othersâa general idea of how financially responsible you are. And many companies use your credit to predict your future financial behaviors.

So the better your credit, the better your chances of qualifying for things like credit cards, loans, mortgages and other credit products. And the better your rates might be.

You May Like: Aargon Com

What Does A Credit Score Mean

Your credit score is a numerical representation of your credit report that represents your creditworthiness. Scores can also be referred to as credit ratings, and sometimes as a FICO® Credit Score, created by Fair Isaac Corporation, and typically range from 300 to 850.

FICO® Scores are comprised of five components that have associated weights:

- Payment history: 35%

- Length of credit history: 15%

- How many types of credit in use: 10%

- Account inquiries: 10%

Lenders use your credit score to evaluate your credit risk generally, the higher your credit score, the lower your risk may be to the lender. To learn more, view how your credit score is calculated.

Did you know? Wells Fargo offers eligible customers free access to their FICO® Credit Score plus tools, tips, and much more. Learn how to access your FICO Credit Score.

How To Get Your Annual Credit Reports From The Major Credit Bureaus

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Federal law gives you free access to your credit reports from the three major credit bureaus: Equifax, Experian and TransUnion. Using the government-mandated AnnualCreditReport.com website is the quickest way to get them, but you can also request them by phone or mail. Until April 20, 2022, those reports which had been limited to once a year are available weekly to help consumers manage their finances.

Your credit reports are a detailed record of your past use of credit but they do not include your credit score. NerdWallet offers a free credit score and report, updated weekly using TransUnion data. Checking your score does not damage your credit.

Heres how to use AnnualCreditReport.com.

Read Also: Does Walmart Do Klarna

Monitor Your Credit Regularly

Monitoring your scores and reports can tip you off to problems such as an overlooked payment or identity theft. It also lets you track progress on building your credit. NerdWallet offers both a free credit report summary and a free credit score, updated weekly.

Heres how the information youll get from AnnualCreditReport.com differs from what free personal finance sites may provide:

AnnualCreditReport.com provides:

-

Data from all three major credit bureaus

-

An extensive history of your credit use

Personal finance websites, including NerdWallet, provide:

-

Unlimited access

Why Get Your Free Experian Credit Report

Gain credit insights

View the same type of information that lenders see when requesting your credit. See whoâs accessing your data and get tips on how to improve your financial health.

View your score factors

Your credit score is calculated from the information found in your credit report. See the positive and negative factors that impact your FICO® Score.

Raise your credit scores instantly

Get credit for your phone and utility bills by adding positive payments to your Experian credit file.

Average users who received a boost improved their FICO® Score 8 based on Experian Data by 12 points. Some may not see improved scores or approval odds. Not all lenders use credit information impacted by Experian BoostTM.

Don’t Miss: How To Check Your Credit Score With Itin

How Do I Fix Inaccuracies On My Credit Report

If you see something on your report that you believe is inaccurate, it may be a good idea to contact the business that reported the account, as they are the ones who can provide you more details. Your other option is to start a dispute with the credit reporting agency that issued the credit report. To start a dispute with TransUnion, visit transunion.com/disputeonline and well start an investigation.

How To Get Your Annual Credit Report From Experian

Starting April 20, 2020, Experian, TransUnion and Equifax will offer all U.S. consumers free weekly credit reports for the next year through AnnualCreditReport.com to help you protect your financial health during the sudden and unprecedented hardship caused by COVID-19.

Under federal law you are entitled to a copy of your credit report annually from all three credit reporting agencies – Experian®, Equifax® and TransUnion®– once every 12 months. Every consumer should check their credit reports from each of the 3 bureaus annually. Doing so will make sure your credit is up-to-date and accurate. Each reporting agency collects and records information in different ways and may not have the same information about your credit history.

Don’t Miss: R9 Credit Score

Read Your Reports And Fix Errors

-

Accounts that arent yours or you didnt authorize.

-

Incorrect, negative information.

-

Negative information thats too old to be included. Most negative information, other than one type of bankruptcy, should be excluded after seven years.

These errors have the potential to hurt your credit score, says Chi Chi Wu, a staff attorney with the National Consumer Law Center. You might see other types of errors, such as out-of-date employment information, she says, but those arent factored into your score.

If you find errors, dispute them. The credit bureaus will investigate and must remove information that they cant verify.

How To Get A Free Credit Report

Order a copy of your credit report from both Equifax Canada and TransUnion Canada. Each credit bureau may have different information about how you have used credit in the past. Ordering your own credit report has no effect on your credit score.

Equifax Canada refers to your credit report as credit file disclosure.

TransUnion Canada refers to your credit report as consumer disclosure.

Read Also: What Is A Leasingdesk Score

How Do I Get A Copy Of My Credit Reports

You are entitled to a free credit report every 12 months from each of the three major consumer reporting companies . You can request a copy from AnnualCreditReport.com.

You can request and review your free report through one of the following ways:

- Mail: Download and complete the Annual Credit Report Request form. Mail the completed form to:

Annual Credit Report Request ServiceP.O. Box 105281Atlanta, GA 30348-5281

You can request all three reports at once or you can order one report at a time. By requesting the reports separately you can monitor your credit report throughout the year. Once youve received your annual free credit report, you can still request additional reports. By law, a credit reporting company can charge no more than $13.00 for a credit report.

You are also eligible for reports fromspecialty consumer reporting companies. We put together a list of several of these companies so you can see which ones might be important to you. You have to request the reports individually from each of these companies. Many of the companies in this list will provide a report for free every 12 months. Other companies may charge you a fee for your report.

You can get additional free reports if any of the following apply to you:

Submit Your Request By Mail:

First, you’ll need to download and complete the Canadian Credit Report Request Form.

Second, you must provide a photocopy of two pieces of valid, non-expired Canadian Government-issued identification. At least one of the two IDs must include your current home address. Examples of acceptable documentation include:

- Driver’s license

- Birth certificate

- Certificate of Indian Status

In order to protect your personal information, we will validate your identity before mailing your credit report to your confirmed home address. If your address is not up-to-date on either identification, you must also provide additional documentation that shows your current home address . Your copy should show the date of the document, the sender, your name, address and your account number.

- Documents must be less than 90 days old

- We recommend you blackout any transactional details.

- If you provide a credit card statement or copy of your credit card as proof, please ensure to blackout your CVV.

While providing your Social Insurance Number is optional, it helps us avoid delays and confusion in case another individual’s identifying information is similar to your own. If you provide your S.I.N., we will cross-reference it with our records to ensure that we disclose the correct information to you. We will not use it for any other purpose or share it with any third party.

As a last step, you will need to submit your completed form and proof of identity

Kindly allow 5 – 10 days for delivery.

Recommended Reading: How Long Do Things Stay On Chexsystems

Generate Your Credit Report Online

You can save reports to your desktop or print them out so youll have access later.

If you need to request a report or reports by mail, send a request form to:

Annual Credit Report Request ServiceP.O. Box 105281Atlanta, GA 30348-5281

Your report or reports should be sent within 15 business days.

You can also get your credit reports by calling 877-322-8228. Visually impaired consumers can also call this number to request audio, large-print or Braille reports.

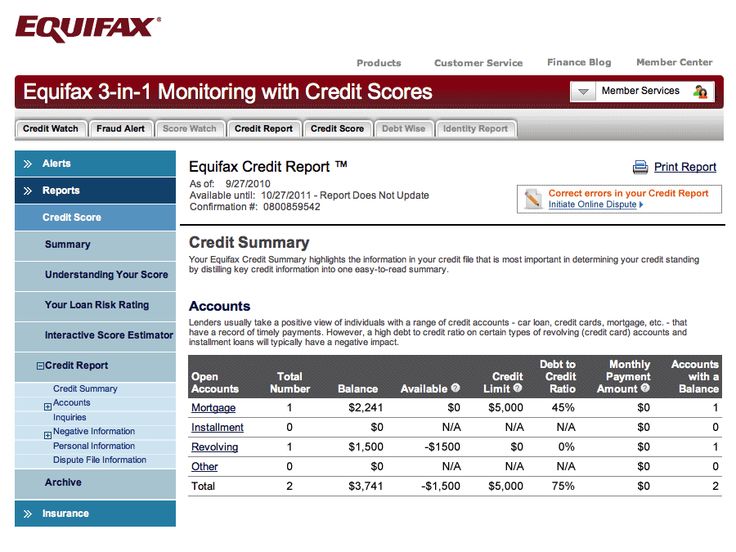

What Can Lenders See On Your Credit Report

Your creditreport provides a detailed summary of your credit history. It includes your personal information and lists details on your past and current credit accounts. It also documents each time you or a lender requests your credit report, as well as instances where your accounts have been passed on to a collection agency. Financial issues that are part of the public record, such as bankruptcies and foreclosures, are included, too.

Read Also: Ntwk Credit Card

Can Credit Karma Be Used In Canada

A number of Canadians rely on Credit Karma in Alberta, British Columbia, Manitoba, New Brunswick, Newfoundland and Labrador, Nova Scotia, Ontario, Prince Edward Island, and Saskatchewan. To open a free Credit Karma account, please visit us lvers credit monitoring service or create a free Credit Karma account, visit www. Describe creditkarma. ca .

Transunion Score Report & Monitoring

A paid subscription to TransUnion Credit Monitoring can help you improve your credit health, manage your data identity and approach credit with confidence.

A paid subscription to TransUnion Credit Monitoring includes key information and tools you can use, all in one place.

Get key information and empowering tools in one place, including:

- VantageScore® 3.0 credit score & TransUnion credit report free refreshes available daily

- Alerts to critical changes to any of your 3-bureau reports

- Educational resources to help you understand your credit report and steps you can take to reach your score goals

- Identity protection, including 1-touch TransUnion & Equifax credit locks, ID theft insurance and instant inquiry alerts

There are various types of credit scores, and lenders use a variety of different types of credit scores to make lending decisions. The credit score you receive is based on the VantageScore 3.0 model and may not be the credit score model used by your lender.

Subscription price is $24.95 per month .

You May Like: How To Report To Credit Bureaus On Tenants

What Is A Credit Report

Your personal credit report contains details about your financial behavior and identification information. Experian® collects and organizes data about your credit history from your creditor’s and public records. We make your credit report available to current and prospective creditors, employers and others as permitted by law, which may speed up your ability to get credit. Getting a copy of your credit report makes it easy for you to understand what lenders see when they check your credit history. Learn more.

Free Annual Credit Report

To support you during the uncertainty caused by COVID-19, we offer a free credit report weekly at annualcreditreport.com through April 20, 2022.

Get your free weekly report online through April 20, 2022 at annualcreditreport.com. You can always get a free report every 12 months.

With this credit report youll get:

- Fast, free access to your credit report online

- Control of your credit data, with free reports available from all three credit reporting agencies in one place

- The option to buy a one-time VantageScore® 3.0 credit score

Recommended Reading: Notify Credit Bureaus Of Death

Where Can I Get A Print Out Of My Credit Report

You can print your report, but only from a laptop or desktop. Click on Home, then on the left sidebar menu, click on credit reports. Youll then see two gauges that look like speedometer in a vehicle. One is for Trans Union and one is for Equifax. Below each gauge is a link to go to your credit report for that credit bureau .

How Do I Download My Equifax Credit Report From Pdf

You can print using File > Print by clicking on your browser. The print window should open up when you type control + P or command + P. You can then copy and paste your credit report into the print window by using the command + P. There is a Print option on the Print screen of your computer which allows you to save as a PDF.

Recommended Reading: 824 Fico Score

You Have More Than One Credit Report

When you order your free TransUnion credit report, youll also have the option to order your free Equifax and Experian credit reports. The information in these reports can differ, so its good practice to review all three. For example, some lenders choose to report account data to only one or two credit reporting agencies, not all three. Or, when you apply for a loan, a lender may only pull your credit report from one credit reporting agency, which would result in a hard inquiry on your credit report from that agency only.

Why Should I Check My Credit Report

Your credit report has information that can affect whether you’re approved for a loan or credit card and the amount you’ll be approved for. Getting a copy of your credit report is valuable to:

- Make sure the information is accurate, complete and updated before applying for a line of credit

- Help protect yourself from identity theft

Also Check: How Often Does Bank Of America Report To Credit Bureaus

What Is Credit Monitoring

Canadas credit bureaus, as well as many credit card issuers and financial institutions, offer credit monitoring services. These services provide you with a notification after certain updates to your credit file, such as a credit inquiry.

You could consider using this service if you think youve been the victim of fraud or if you have been affected by a data breach. This can help you see if somebody is trying to apply for credit in your name.

You usually need to pay for these services.