Best Secured Credit Cards Of September 2021

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

ALSO CONSIDER: Best credit cards of 2021 || Best credit cards for bad credit || Best credit cards for fair credit || Best unsecured cards for short credit histories

Whether you’re looking to build credit from scratch or rebuild credit after a bad setback, a secured credit card can be an invaluable tool. Secured cards require you to provide a cash security deposit, usually equal to your credit line. The issuer holds the deposit in case you don’t pay your bill you get the deposit back when you upgrade to a regular “unsecured” card or close the account in good standing. Because the deposit protects the issuer from losing money, secured cards are easier for people with bad credit or no credit to qualify for.

As you use the card, the issuer reports your activity to the credit bureaus the companies that compile the credit reports that form the basis of credit scores. Keep your balance relatively low and pay your bill on time every month, and you can begin to strengthen your credit. Learn more about secured cards.

How Can I Apply For A Citi Prepaid Card

If you’re looking for a prepaid card, you may want to consider applying for the Citi® Secured Mastercard® instead. Whether you’re looking to establish, improve or rebuild your credit, the Citi® Secured Mastercard® can help you get there.

This card comes with no annual fee1. However, please note that a security deposit is required for this product . The security deposit is always equal to your credit limit. If you are approved and you deposit $200, your credit limit is $200.

Take the first step toward achieving your financial goals by applying for the Citi® Secured Mastercard®.

Can I Build Credit With The Citi Secured Mastercard

Yes – you can build credit history with the Citi® Secured Mastercard®. Responsible management of your credit card account will allow you to rebuild your credit history, because we will report your account information to major credit bureaus.

We recommend that you use our helpful tools to help keep you on track, including free FICO score, online bill pay, and account alerts.

Also Check: Does Paypal Report To Credit Bureaus

No Ability To Build A Credit Score

Prepaid cards arent linked to a line of credit, so they wont help you build a credit score.

That said, increasingly, prepaid cards are just part of a broader fintech offering. And some of these fintechs have different add-ons to the basic card that add superpowers to it. In some cases, that includes a credit-builder option that will allow you to use the prepaid card to help build credit.

Alternatives To Help You Build Credit

If you can’t get a regular unsecured credit card but would still like to build credit, here are two alternatives that offer convenient ways to pay with the added benefit of reporting payments to the credit bureaus.

- Get a secured credit card.Secured credit cards work like regular credit cards, except that you put down a refundable security deposit that serves as collateral and reduces the lender’s risk. Your security deposit generally determines the card’s credit limit. Choose a card that reports to at least one credit bureau, use it for small purchases, and pay your bill on time to potentially give your credit score a lift.

- Become an authorized user. If you have a family member with a good credit score, becoming an on one of their credit cards allows you to benefit from their positive credit history. You’ll be authorized to make purchases with the card, but the primary account holder is ultimately responsible for payments. If the card issuer reports authorized user activity to the credit bureaus, the account will appear on your credit report and potentially help improve your credit score.

You May Like: Les Schwab Credit Score Requirements

How Does A Prepaid Card Work

On one level, prepaid cards work similarly to debit cards. Every time you make a purchase, your cards issuer will withdraw the amount from your balance. When your card runs out of funds, youll no longer be able to use it, at least not until you load it with more money.

Unlike debit cards, however, you must continuously load your prepaid card with funds, either through direct deposit or manually online. Once the card has money, you can use it wherever the cards payment processor is accepted .

Best For High Limits: Movo Digital Prepaid Visa Card

Heres why: The MOVO® Digital Prepaid Visa® Card has high limits: a $10,000 maximum balance on the card and a $5,500 per day withdrawal limit.

There are other limits such as how much you can load on your card over a certain amount of time, regardless of how much you withdraw. So if you plan on moving a lot of money around, check out the cards terms and conditions to get a sense of the full limits.

The MOVO® Digital Prepaid Visa® Card has

- No monthly fee

- No activation fee, though a physical card will cost $5.95

- A $2 ATM fee for domestic withdrawals

- A $4.95 per month fee if your account stays inactive for 90 days

You can add money to your card for free via direct deposit or from your bank account. If you want to load cash, you can at participating retailers but there may be a fee, and youll need to have a physical card.

Also Check: Does Capital One Report Authorized Users To Credit Bureaus

Best Secured Product For Getting A Small Loan: Self Credit Builder Account

Overview: With this financial product, you basically get a small loan that funds an FDIC-insured certificate of deposit for 12 or for 24 months. Then, once the accounts term ends, youve built your credit and your CD unlocks.

Pros: This is a good way to build credit for someone with iffy credit. Theres no hard pull on your credit, and it doesnt matter where your credit is when you begin.

Cons: Theres an administrative fee that is on a sliding scale, depending on how much you pay into your account. So, if you pay $89 a month for 12 months, you pay a $12 administrative fee and you get $1,000 at the end of the year, $68 shy of what youve put in, bringing the total finance charge to $80.

Prepaid Cards Are A Type Of Card That Let You Access Money Youve Loaded To The Prepaid Card Account

They may sometimes be called prepaid credit cards or prepaid debit cards, but unlike credit cards, prepaid cards dont involve borrowing any money, which means theres no credit check required. And unlike debit cards, prepaid cards arent linked to your bank accounts.

Instead, you load money directly to the prepaid card account. When you make purchases with the card, you use the money you loaded.

A prepaid card can be a good alternative to a credit card if you want to avoid the temptation of racking up debt. It can also provide the convenience of plastic if you dont qualify for or have a checking account.

Heres our take on the best prepaid cards of 2021, plus some alternatives to consider.

| Card |

|---|

| Cash back rewards |

Recommended Reading: What Is Cbcinnovis On My Credit Report

Easy Approval Process Even If You Have Poor Credit

Like secured credit cards, prepaid credit cards are great if you dont have the best credit history to show for yourself. Unlike secured cards though, prepaids dont require any annoying collateral and the only limits on the account are the ones you set for yourself. So, if you cant get approved for a standard bank account or credit card, you can still get a prepaid. Theyre easy to get approved for because the best prepaid credit cards arent looking at your credit score and dont require any credit check.

What Credit Score Do You Need To Be Approved For A Secured Credit Card

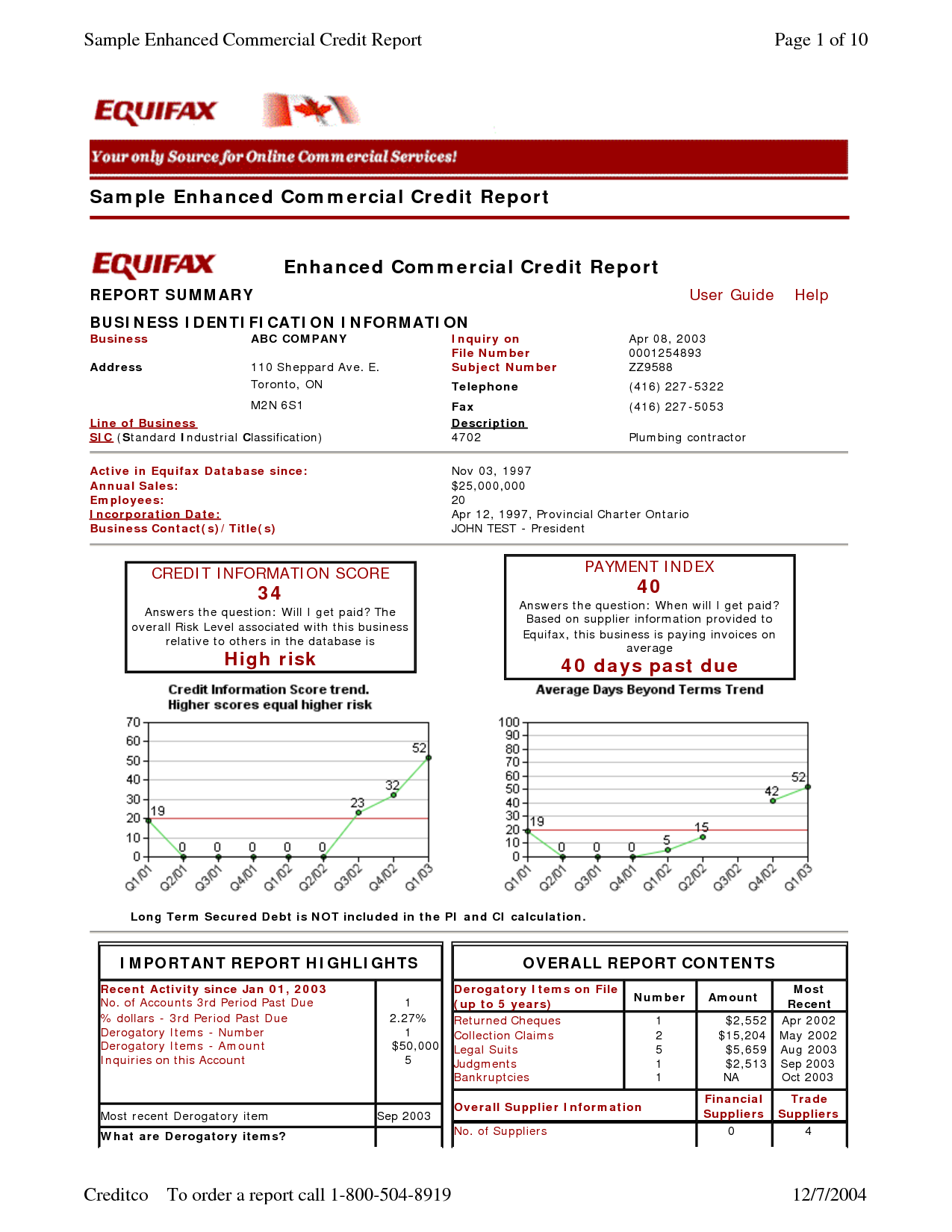

Because you are not able to spend more than the cash deposit you provide, the issuers risk is much lower than it would be lending to someone with an unsecured credit card. For this reason, applicants with minimal or bad credit history are often approved for secured credit cards. To give you a better sense of what constitutes good, fair and bad credit, FICO goes by the following range:

- Very poor: 300-579

- Exceptional: 800-850

Read Also: Does Snap Finance Build Credit

How To Use Your Secured Card To Build Credit

Now that you understand how secured credit cards work, how do you handle one correctly? It only takes 3 easy steps:

- Pay on time. While it takes months to build your credit with good payment habits, one or two late payments can cause a big drop in your score. And not only is paying on time good for your credit, it keeps you from having to pay late fees and even losing your card.

- Pay in full. In fact, pay multiple times a month to keep your utilization ratio low because you dont know when your issuer will send your account information to the 3 major credit bureaus. This will also help you avoid interest charges.

- Place a small charge on the card. Dont forget to use the card each month. If you lose your card to inactivity, you cant build credit month by month. Put a recurring reminder on your calendar to ensure that you dont forget. Or better yet, place an auto debit for a small charge on your card.

What Is A Prepaid Secured Card

With prepaid cards, you have a fixed amount that you can spend based on money you provide up front.

However, with a secured credit card, such as the Citi® Secured Mastercard®, you can start to build up your credit history, following responsible management of your account. Your credit history will be reported to major credit bureaus.

The Citi® Secured Mastercard® also offers the features and protections – of a credit card. The Citi® Secured Mastercard® requires a security deposit if approved as part of the application process. You will still need to pay at least your minimum payment due each month.

Don’t Miss: How To Unlock My Experian Credit Report

Can I Get My Security Deposit Back

1. If you pay your balance in full and close your credit card account, we’ll refund your security deposit, which can take up to two billing cycles plus ten days.2. We’ll also automatically review your credit card account monthly, starting at eight months, to see if we can return your security deposit while you continue to enjoy your card benefits. These reviews are based on responsible credit management across all of your credit cards and loans, including Discover and others.

Which Credit Cards Can Help Me Build Business Credit

Advertiser & Editorial Disclosure

Small business credit cards offer myriad benefits: rich rewards and cards with limits that are often higher than on personal cards. Plus, theres an added bonus that small business owners dont always recognize at first: A business credit card may help you build business credit.

In fact, getting one of these cards may help put your business on the map when it comes to building business credit, provided the card issuer reports information to commercial credit agencies. Not all cards have the same policy when it comes to reporting to business credit bureaus, though, and its important to understand how each one works.

Also Check: Does Carvana Report To The Credit Bureaus

Best Secured Credit Card For Low Interest: Applied Bank Secured Visa Gold Preferred Credit Card

Overview: Theres no intro 0% offer, but this low interest card comes with a top-of-the-line fixed APR: 9.99% for cardholders, and it wont increase even if youre late with a payment.

Pros: Theres no minimum score or credit check required in the application process. Also, your credit card habits will be reported to major credit bureaus Experian, Equifax and TransUnion a perk that can really help boost your credit score.

Cons: The card comes with a $48 annual fee on top of the required refundable deposit. Plus, there are no rewards to be earned here.

American Express And The Prepaid Way To Credit Cards

Via MainStreet.coms Jeanine Skowronski we learn that American Express has done a major upgrade to its prepaid cards that could be hugely beneficial to Americans with lower credit scores. Citing an AmEx executive, Skowronski tells us that the would allow prepaid users with good track records to eventually upgrade to a charge card, which would be the first such program.

What makes American Express move so unique is that in effect the issuer will be sidestepping the credit reporting agencies in its underwriting process, instead relying exclusively on its own internal data. I have to admit to being somewhat hesitant to fully accept the story without corroborating it. And sure enough, I was able to do just that on AmExs own website. The new program is called Make Your Move and does indeed offer a prepaid way to a charge card. Lets take a look.

You May Like: How Much Does Overdraft Affect Credit Rating

Is A Prepaid Card The Same As A Secured Credit Card

No. Prepaid cards are very different from secured credit cards.

The biggest difference between the two is that a secured credit card is, well, a , whereas a prepaid card isnt. Secured credit cards are designed for those who have low or no credit scores, as they require an initial deposit before you can use it. The advantage of secured cards is that you can build your credit score with good crediting activities, helping you build up to more lucrative cards.

A prepaid card, as weve discussed above, isnt linked to a line of credit. Youre not borrowing money with a prepaid card. Youre simply spending money in a cashless way. For that reason, prepaid cards wont help you build credit, nor will they allow you to leverage debt to buy things you otherwise couldnt.

Though, again, some hybrid fintech prepaid cards can be powered up to allow you to use them similar to a secured card and allow you to build or rebuild your credit.

Will Prepaid Cards Build Credit

Prepaid cards are not the same as credit cards. Unlike traditional credit cards, activity from a prepaid card is not reported to the three credit reporting agencies and will not help in establishing or maintaining your . Known as general purpose reloadable cards , prepaid cards work similarly to gift cards and likewise have no bearing on your credit score.

Although they can be used to pay for services, online purchases, pay bills, and to withdraw cash from ATMs, prepaid cards do not come with a credit limit the way credit cards do. When you make a purchase with a prepaid card, you are using your own funds that you deposited onto the card rather than a credit limit or deduction from your bank account. In other words, you are not borrowing money.

Don’t Miss: Syncb Inquiry

Capital One Platinum Secured Credit Card

Our pick for: Low deposit

The Capital One Platinum Secured Credit Card requires a security deposit, as do all secured credit cards. But while most cards require you to put down a deposit equal to your credit line, this one allows some qualifying applicants to get a $200 credit line with a deposit of $49 or $99. Further, you can be automatically considered for a higher credit line with no additional deposit in as little as six months. Read our review.

What Happens If You Have A Card That Doesnt Report To All Three

If you have a card that doesnt report your activity to any of the three credit bureaus, youll get no benefit from using it responsibly. And if it reports to only one or two, the credit benefit of using the card will be limited.

For example, lets say you have a credit card that reports to Experian and TransUnion, but not to Equifax. Over time, youve used your card responsibly and established a good history on your credit reports with those bureaus.

But if you go to apply for a loan or a new credit card and the lender calculates your credit score based on your Equifax credit report, it will be as if you never had the credit card. Again, youll get no benefit.

Recommended Reading: Does Lending Club Show On Credit Report

First Progress Platinum Select Mastercard Secured Credit Card

- Receive Your Card More Quickly with New Expedited Processing Option

- No Credit History or Minimum Credit Score Required for Approval

- Quick and Complete Online Application No credit inquiry required!

- Includes Free Real-Time Access to Your Credit Score and Ongoing Credit Monitoring powered by Experian

- Full-Feature Platinum Mastercard® Secured Credit Card Try our new Mobile App for Android users!

- Good for Car Rental, Hotels Anywhere Credit Cards Are Accepted!

- Monthly Reporting to all 3 Major Credit Bureaus to Establish Credit History

- Just Pay Off Your Balance and Receive Your Deposit Back at Any Time

- 24/7 Online Access to Your Account

- Nationwide Program though not yet available in NY, IA, AR, or WI ** See Card Terms.

- Get a fresh start! A discharged bankruptcy still in your credit bureau file will not cause you to be declined.

Getting A Secured Credit Card

Who can be approved?

Even though secured credit cards are available to people with bad credit, and even though the security deposit reduces the risk to the issuer, approval is not guaranteed for everyone:

-

The issuer will usually check your credit report for signs that you’re an unacceptable credit risk. If you’re in the middle of a bankruptcy, for example, or you’re currently delinquent on other accounts, or you’ve opened a bunch of new accounts recently, you’re unlikely to be approved.

-

You’ll also have to show that you have income so you can pay your credit card bill. Yes, the issuer has your deposit, but it will use that money to cover your bill only as a last resort. You’re expected to pay your bill every month, so you’ll need income.

How does the process work?

Every issuer handles things a bit differently, but the process of applying for, receiving and using a secured credit card works like this:

You apply for the card. The issuer evaluates how risky you are , and if you pass muster, you’re approved.

You fund the deposit. Before the issuer will open your account, you have to pay your security deposit. In some cases, you must provide bank account information with your application so the deposit can be transferred right away. Other times, the issuer will give you some time to pull together the deposit. If you neglect to fund the deposit, the issuer will change the status of your application from approved to rejected.

You May Like: Does Apple Card Pull Credit Report