Do I Need To Notify Credit Bureaus Of Paid Collections

If you pay off or settle a debt with a collection agency, the status of the collection account on your credit report should update to “paid” or “settled” within a month or two. You do not need to do anything to make that happen the collection agency should notify the three national credit bureaus to update their records.

If that doesn’t occur, you can file a dispute with each of the bureaus to have the records corrected. You’ll likely need to provide proof of payment, such as a cancelled check.

How To Start Using Credit Responsibly

After you have disputed items from your credit report its time to start rebuilding your credit. These are the next steps you should take to begin rebuilding the credit that you deserve:

- Get a secured credit card or a self credit building loan to reestablish credit. The sooner you begin to borrow and repay the money the faster you can repair your credit.

- Use a secured credit card to pay expenses or inexpensive every day items like groceries, and gas.

- Always pay on time and never carry a balance. This will create positive credit history.

How To Check Your Credit Report For Collections

Checking your credit reports regularly can help you determine whether you have any collection accounts that might be hurting your score. You can request a free copy of your Canadian credit report from Equifax Canada and TransUnion Canada in writing. If you dont have time to wait for your credit reports to be mailed out, you can purchase a copy of your credit reports from either bureau online.

Keep in mind that your credit reports and credit scores are two different things. The information in your Canada credit report is used to calculate your credit scores. If youd also like to see your scores, you can request them separately from each credit bureau for a fee.

Once you have copies of your Equifax and TransUnion credit reports, review them carefully. Look for any collection accounts and if you find them, make a note of:

- Who the debt is owed to

- The name of the collection agency, if there is one

- How much is owed

- How many payments the account is behind

Also, make sure you have the right contact information for debt collectors, which youll need for the next step. Again, some creditors will route past due accounts to their in-house collections department while others will assign or sell past due accounts to a collection agency. You need to know who to contact if you want to remove collections from your credit report in Canada.

Also Check: Does Les Schwab Report To Credit Bureaus

Can A Debt Collector Contact You If You Dispute Debt

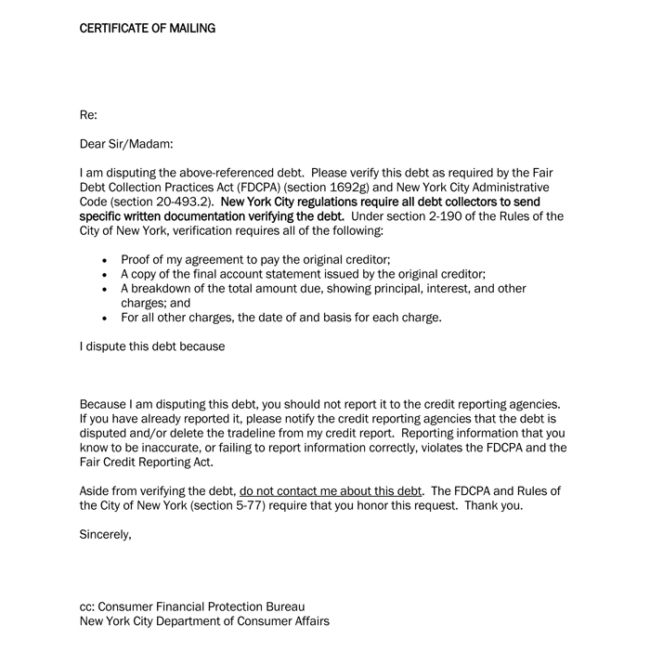

When you dispute a debt in writing, debt collectors cant call or contact you until they provide verification of the debt in writing to you.

This essentially puts everything on hold until you receive verification, but you only have 30 days from when you first receive required information from a debt collector to dispute that debt. You can lose valuable rights if you dont dispute it, in writing, within that 30 days.

Determine The Accounts Legitimacy

Is the collection account legitimate a past-due debt that you actually owe? If it is, youre going to have a tough time getting it removed from your credit reports. However, if the account is actually incorrect, or should have been removed from your reports by now, then you may be able to get it removed through the dispute process.

Also Check: Does Klarna Financing Report To Credit Bureaus

When Can You Dispute A Collection

Under the Fair Debts Collection Practices Act , you have valuable rights that allow you to dispute a debt.

Here are the reasons to file a dispute:

- If you dont remember owing money from anybody

- If you believe that the amount being collected is incorrect

- If you want to confirm that you havent paid the debt yet

- If you believe that the debt is past the statute of limitations, which may run between 4 and 6 years from the time you made your last payment

- If you believe that the debt is not yours

- If you dont want the unpaid debt to appear as a negative mark on your credit report

- If you want to stop the debt collector from contacting you

Send the debt verification letter to the debt collectors mailing address via certified mail and request a return receipt so youll have proof of delivery.

How To Dispute Collections From Your Credit Report

- If the negative item is nearing the time it will be removed you may choose to let the item drop of naturally. most negative information wont last longer than seven years from the date of the last activity. Chapter 7 Bankruptcy will show up for ten years.

- If you have accounts in collections, you can either pay them in full or offer a settlement. If you pay it off make sure you get it writing that the creditor will remove the item from your credit report. Settled accounts dont look as good on a report as those that are fully satisfied.

Recommended Reading: Zebit Pros And Cons

What Going Into Collections Means

Depending on the type of debt owed, collections can affect you in different ways. If your debt is unsecured, such as credit card debt, and you default on your payments with that debt sent to collections, the credit card company would stop trying to collect the debt from you. Instead, the collections company that your debt was sent to, would pursue the debt and try to collect money from you. If your debt was secured, such as an auto loan and you default, then the lender might repossess your car, sell it at auction, and sell the remainder of debt you owe to a collections company. Lenders can collect money from debt in the following ways:

- Contact you on their own and ask for payment using their internal collection department.

- Hire a collection agency to try and collect.

- For revolving debt, such as credit card debt, the credit card company could sell your debt to a collection agency, which would then try to get the money from you.

- For installment loan debt, such as an auto loan, the lender may repossess the car, sell it auction, and then sell the remaining debt to a collection agency.

The federal Fair Debt Collection Practices Act strictly regulates how debt collectors can operate when trying to recover a debt. For example, they can’t threaten you with imprisonment or make any other kind of threat, if you don’t pay. However, they can and typically do report the unpaid debt to credit reporting agencies.

Check The Validity Of The Collection Account

When you examine your credit report for inaccurate information, ask yourself whether each debt is yours and whether each debt amount has been correctly reported. A recent report from the Bureau of Justice Statistics states that 17.7 million people in the United States, 16 and older, are victims of identity theft annually.

The Federal Trade Commission reports that imposter scams and identity theft are the two biggest categories of fraud. The first thing you should do when youâre contacted by a collector seeking your money is to check the validity of the account. But do it fast. The Fair Debt Collection Practices Act only gives you 30 days from the first contact to confirm the validity of the debt. A debt collector must stop collection activity for 30 days if they get a request to validate an account. Keep in mind that one original creditor account can pass through the hands of different collection agencies and debt buyers, so you could have an âinitial contactâ from different agencies for the same debt.

If you want to request validation of new debt, send a letter to the collection agency with the account information and tell them that you dispute the validity of the debt. Ask them to provide information to verify the original account and the debt amount, and make sure to request contact information regarding the original creditor.

Read Also: How To Remove Repossession From Credit Report

Dispute Early For The Best Outcome

It helps to take appropriate action before inaccurate information surfaces on your credit report. By law, debt collectors must provide detailed disclosures about debt to inform you. You have 30 days from the date you receive notice of the debt before the collections can hit your credit report. Use this time wisely to take these actions:

When Negative Information Comes Off Your Credit Reports

Delinquent accounts may be reported for seven years after the date of the last scheduled payment before the account became delinquent. Accounts sent to collection , accounts charged off, or any other similar action may be reported from the date of the last activity on the account for up to seven years plus 180 days after the delinquency that led to the collection activity or charge-off.

What Is a Tradeline?

You May Like: Does Opensky Report To Credit Bureaus

Is It Possible To Remove Medical Collections From Your Credit Report

Accurately reported collections cannot be removed from your credit report. However, medical collections can be inaccurate, and if you believe your medical collections were reported inaccurately to the credit bureaus, you can dispute them with each credit bureau and may be able to get them removed or updated based on verification from the collection agency.

How Much Does A Collection Account Affect Your Credit Score

A collection account can significantly affect credit scores. Thatâs because your credit score is made up of five main factors: payment history, credit utilization, credit history, credit mix and credit inquiries.

Of the five factors, your payment history accounts for a whopping 35% of your credit score. When your habit of late payments is significant enough to have reached the collections stage, credit bureaus take that seriously and correspondingly decrease your score. In turn, potential creditors will not deem you as creditworthy, meaning it will be much harder to get credit cards, loans, and more.

You May Like: Credit Score Itin

Remove Collection Account Without Hurting Your Credit Score

Categories

Your credit score is your key to loans and low-interest rates. If your score is too low, youll end up paying more for a loan than you need to or even be denied credit altogether. Your credit score is determined by a combination of factors, including how often you pay your bills on time, how much credit you have at your disposal, how much of that credit you are currently using, and how many recent inquiries there have been about your credit history.

A single incident, like an errant collections account, can do damage to your score without you even being aware of it. Unfortunately, this happens all too often as it is very easy to simply ignore or forget about issues with your credit. Perhaps you closed a credit card account that still had a couple of charges pending or maybe you had a medical procedure that wasnt covered under your health plan and are unable to pay for it. Collection accounts are a reality for a lot of individuals. What matters is how you deal with them, and thats what sets the responsible consumers apart from the others.

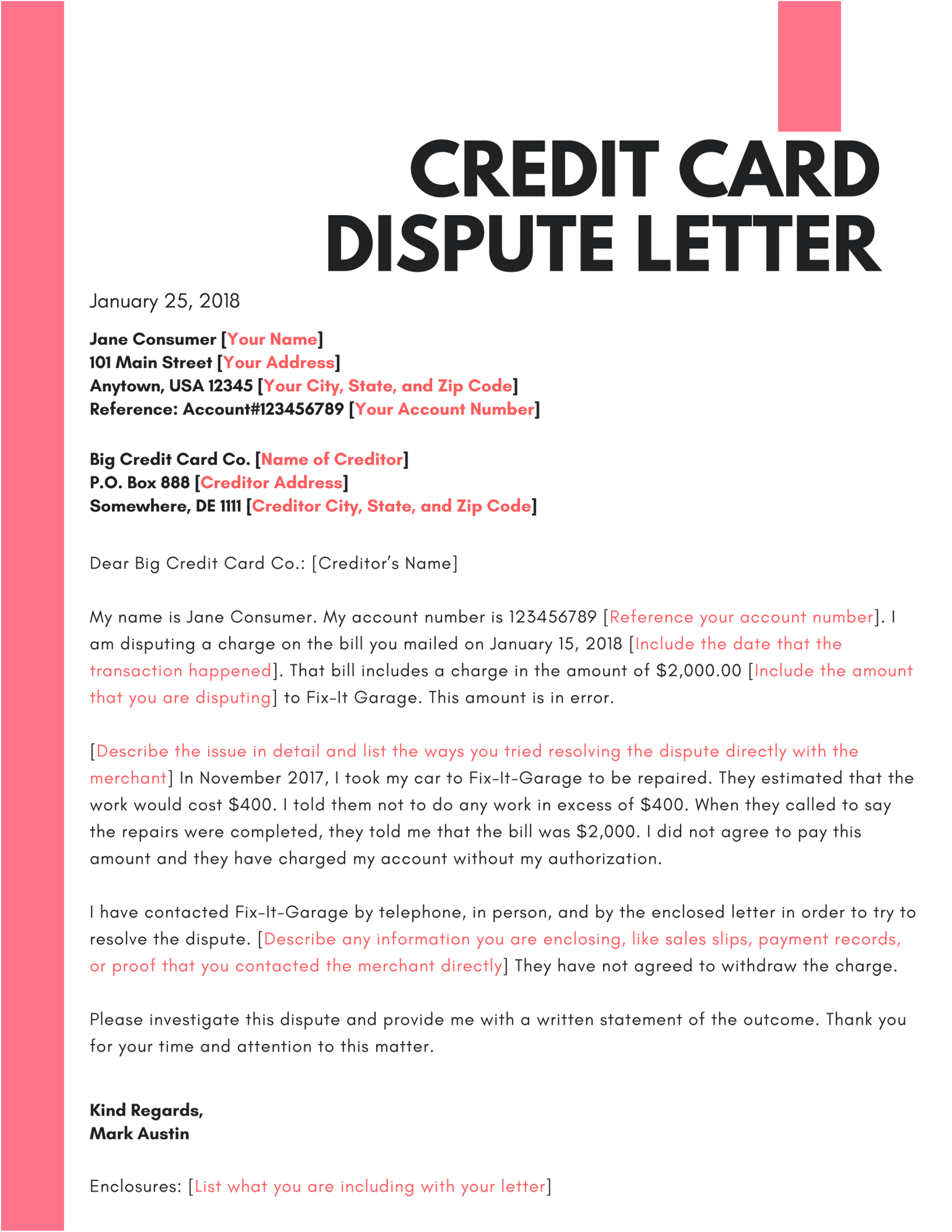

How To Dispute A Collection On Your Credit Report

by Whoosh Agency | Mar 26, 2021 |

Businesses can sell overdue debt to a debt collection agency that can report debt to a Nationwide Credit Reporting Agency. But what if the agency reports inaccurate and harmful information about your creditworthiness? Learn what to do to dispute a collection account on your credit report.

Read Also: Bp Visa/syncb Pay Bill

If Youve Spotted An Error On One Of Your Credit Reports You Should Take Immediate Steps To Correct The Inaccuracy

Around 25% of U.S. consumers found errors that could affect their credit scores in one of their credit reports, according to a 2012 study by the Federal Trade Commission. The same study reported that one in five consumers had an error that a credit bureau corrected after the consumer disputed the mistake on at least one report.

An error on your credit reports could lead to lower credit scores and impact your ability to open a new credit account or get a loan. Here are steps you can take to ask the credit bureaus to remove incorrect derogatory marks from your credit.

Best To Check Credit Reports Regularly

As Ira Rheingold pointed out above, most of the disputes you will have with debt collection agencies are the result of debts you dont even know. Collection agencies are often relying on second-hand or even third-hand information that is unreliable and unverified.

If you check your credit report regularly, you may see a problem early and get it corrected before that debt even reaches a collection agency.

If a judgment goes against you, find a lawyer, Rheingold added. If you do so within 30 days and your lawyer files a motion to reconsider, you have a chance to get it overturned. The crucial thing is to make sure the debt collector has the information necessary to bring the case to court. A lot of times, he is working off a line of data that says the amount owed, but with no real proof that you are the one who owes the debt.

If you cant find a way to stop the phone from ringing, consider call a nonprofit credit counseling agency like InCharge Debt Solutions. Their certified counselors are trained in dealing with credit problems and can steer you toward solutions.

Recommended Reading: How To Remove Repossession From Credit Report

Ways To Remove Old Debt From Your Credit Report

Having an accurate and up-to-date credit history without old collections or delinquent accounts is important when youre applying for loans or other new credit.

If youve noticed old debts on your credit report, its best to act as soon as possible to remove these items. Here are a few steps you should take.

Do Your Research & Check All Credit Reports

To get details on your collection account, review all of your credit reports. You can do this by visiting AnnualCreditReport.com. Normally, you can only get one free copy of each report annually. However, due to the Covid-19 pandemic, you can check your reports from all three credit bureaus for free weekly until April 20, 2022.

Your credit report should list whether the collection is paid or unpaid, the balance you owe and the date of the accounts delinquency. If you dont know who the original creditor is and its not listed on your report, ask the collection agency to give you that information.

Afterward, compare the collection details listed on the credit report against your own records for the reported account. If you havent kept any records, log into the account listed to view your payment history with the original creditor.

Recommended Reading: Does Paypal Credit Report To Credit Bureaus

Reviewing Your Credit Report

Anytime you are pursued for a debt, you should request an updated copy of your credit report. Youâre entitled to a free copy of your credit report from all three major credit bureaus every year. You can get your free credit report from AnnualCreditReport.com. This is the official site authorized by federal law to provide credit reports from the major credit bureaus. Note that due to COVID-19, the three credit bureaus are offering free weekly online credit reports through April 2021.

You should review all three of your credit reports from Equifax, TransUnion, and Experian. While theyâre supposed to report the same information, this isnât always the case. When reviewing your credit reports, look for any inaccurate information. Accounts you donât recognize may be tied to instances of identity theft. Youâll also want to review collection accounts and ensure the validity and accuracy of those accounts, too.

Wait For The Account To Be Sold To Another Agency And Dispute It

Debt is continually being sold and re-sold from collection agencies. When one collection agency cant get a payment on a debt, they may choose to sell the debt to another collection agency to try and collect.

At this point, the creditor listed on your credit report no longer has your account information, so you can dispute it and may have luck having it deleted.

Read Also: Does Zebit Report To Credit Bureaus

Have A Professional Remove Collections From Your Credit Report

If this all seems like too much for you to handle, and you are worried about trying to take on a collection agency on your own, theres an entire industry devoted to credit repair that is ready to help you.

A professional credit repair company like Lexington Law could help restore your credit usually within three or four months.

They wont take any action you couldnt take yourself. Since credit repair is all they do, itll work faster and more efficiently.

You would need to budget some money for the monthly payments, which average about $100 depending on the plan you choose.

Theres also a one-time set-up fee for most .

But if you want to get your personal finances back on track without spending your free time on the phone or writing letters, you should consider this kind of service provider.

Debt collections come in many forms.

Whether its an unpaid medical bill, a cell phone bill, or even an $18 library book you never returned, unpaid debt can lead to negative information on your credit report.

It looks especially bad when the negative item comes from a collection agency.

Collections accounts tell other creditors you let an old debt go three or maybe even six months without paying.

When you apply for new credit, lenders know your old lenders lost money on your accounts.

So a collection account will have a negative impact on your ability to apply for new credit whether its a mortgage, a major credit card, or a personal loan.