Ask The Collection Agency To Validate The Debt

If you cant find inaccuracies on your credit reports, write to the collection agency and ask it to validate your debt.

Under section 809 of The Fair Debt Collection Practices Act, collection agencies are required to validate debts they are attempting to collect, if you request that they do so.

The main issue here is that you have only 30 days to make the request after the collection agency first contacts you.

If they are unable to validate the debt, you can ask them to remove it from your credit report.

The Fdcpa & State Collection Laws

You have rights under the Fair Debt Collection Practices Act regarding timelines and statutes of limitations, so its critical to learn them before you take action.

If you dont, you could inadvertently reset the clock on your collection account. So settle in and get ready to go in-depth on everything you need to know about getting a collection account removed from your credit reports.

Can Paid Collections Be Removed From Your Report

Yes, particularly if there is faulty or inaccurate information in the collection item on your report. This process would work just the same as any other dispute you might file.

If the information reported for your collection account is accurate, you could instead write a Goodwill Letter to the original creditor requesting their consideration for removal of the item from your report.

Requesting removal of a legitimate negative item from your credit report does not necessarily fall within the rules laid out by the FCRA. But, by paying off the collection account & proving your credit worthiness, the creditor may consider removing the account from your report out of goodwill .

Also Check: Can Public Records Be Removed From Credit Report

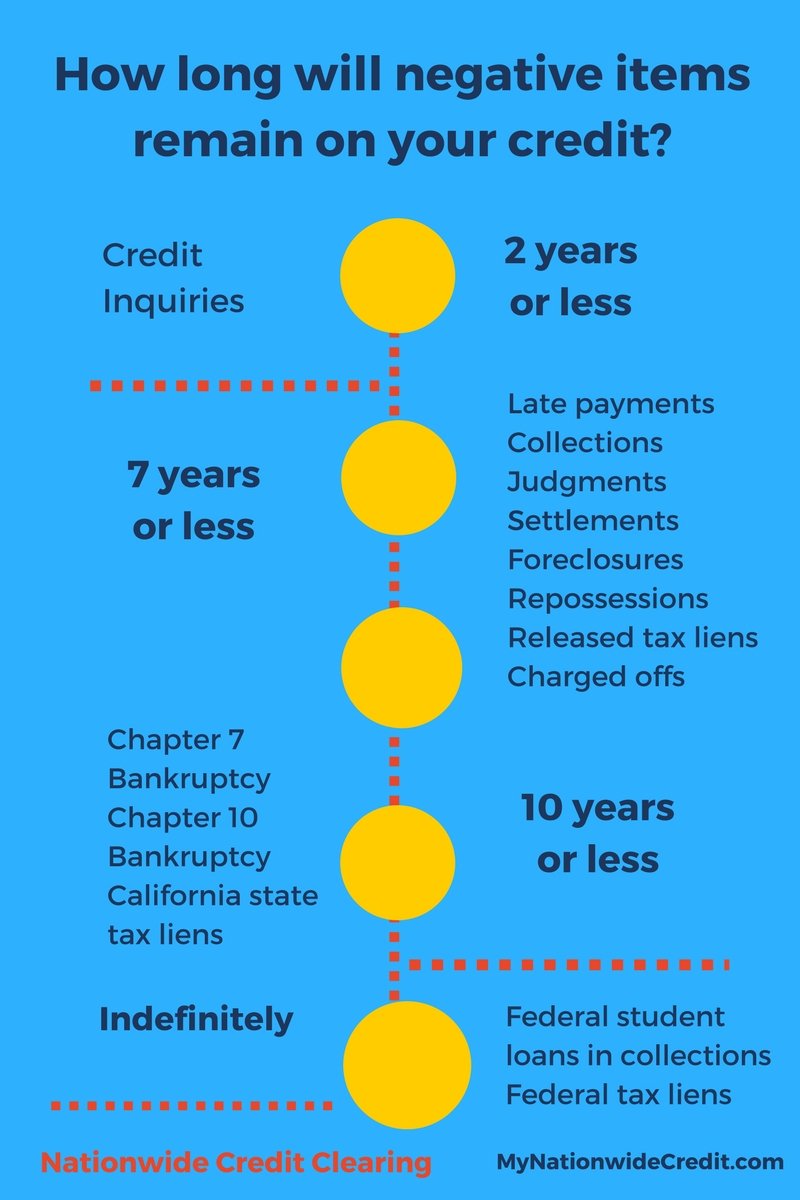

How Long Does Information Stay On My Credit Report In 2021

Rachel Surman

â¢7 min read

Article Contents

We get asked this question all the time: âHow long does information stay on my credit report?â

Itâs an understandable question, considering how important credit is to almost all of your financial decisions. Your credit report includes financial information about your credit history. Lenders report your bill payments to Canada’s credit bureaus, who update your credit report on a monthly basis. Missed or late payments are also reported, and this negative information is added to your credit report. Every time your credit report is updated, your credit score is likely to change as well.

You might be concerned about how long information stays on your report and how it will affect your credit score. You might wonder if lenders will see this information when they review your loan application, or if negative information on your credit report will impact your ability to find a rental apartment .

If youâre wondering when something will come off of your report, there are set time frames for items like bankruptcies and collections that Equifax has put in place. In general, most negative information is deleted from your file 6 years from the date of last activity.

Want to see your Equifax Credit Report?

Can You Ask Creditors To Report Paid Debts

Positive information on your credit reports can remain there indefinitely, but it will likely be removed at some point. For example, a mortgage lender may remove a mortgage that was paid as agreed 10 years after the date of last activity.

Its up to the lender to decide whether it reports your account information to the three credit bureaus. That includes your debt thats been paid as agreed. You can call the lender and ask it to report the information, but it might say no. However, you can add positive information to your credit reports by using your existing credit responsibly, like paying off credit card balances each month.

Recommended Reading: What Is Syncb Ntwk On Credit Report

Have A Professional Remove Collections From Your Credit Report

If this all seems like too much for you to handle, and you are worried about trying to take on a collection agency on your own, theres an entire industry devoted to credit repair that is ready to help you.

A professional credit repair company like Lexington Law could help restore your credit usually within three or four months.

They wont take any action you couldnt take yourself. Since credit repair is all they do, itll work faster and more efficiently.

You would need to budget some money for the monthly payments, which average about $100 depending on the plan you choose.

Theres also a one-time set-up fee for most .

But if you want to get your personal finances back on track without spending your free time on the phone or writing letters, you should consider this kind of service provider.

Debt collections come in many forms.

Whether its an unpaid medical bill, a cell phone bill, or even an $18 library book you never returned, unpaid debt can lead to negative information on your credit report.

It looks especially bad when the negative item comes from a collection agency.

Collections accounts tell other creditors you let an old debt go three or maybe even six months without paying.

When you apply for new credit, lenders know your old lenders lost money on your accounts.

So a collection account will have a negative impact on your ability to apply for new credit whether its a mortgage, a major credit card, or a personal loan.

How Late Payments Affect Your Credit Score

According to myfico.com, five metrics influence FICO credit scores:

- 30% Amounts owed

- 10% Credit Mix

- 15% Length of credit history

The category with the heaviest influence involves your payment history. This is also how well you pay on time. At 35%, this is clearly over a third of the pie.

An adverse payment history usually ends up in collections. A collection actions occurs when you fail to pay your creditor for services or loaned funds as agreed upon.

What a collection does is illustrate to other potential lenders that you neglect your fiscal responsibilities and you are a . Having no collections on your credit report is the optimal objective.

But if you do have collections on your account, there are methods of dealing with them. can ultimately remove collections from your credit report.

Well look at some methods of removing collections from your credit report. In addition, there are alternate solutions used in increasing your credit score and reducing interest rates and exorbitant finance charges.

Don’t Miss: How To Remove Repossession From Credit Report

The Credit Repair Option

Another option is to work with a legitimate company to try to get charge-offs or other negative information removed from your credit file. While this can save you time, there’s typically a fee involved, and in most cases, the credit repair company can’t do anything for you that you couldn’t do by yourself.

Worse, some credit repair companies are just thinly disguised scams whose only goal is to defraud people who need credit help.

Will My Credit Score Increase If A Collection Account Is Removed

Since payment history accounts for 35% of your FICO score, your score might build if a collection account is removed. However, how much it increases will depend on other items listed in your credit report. For example, if this negative account is the only one listed on your credit report, removing it could boost your score more than if you had several other collection accounts on your report.

Also Check: Report Death To Credit Bureaus

It’s Possible To Negotiate A Pay

Your is important for buying a home, getting a car loan in your name, or just opening a credit card account. A significant part of your score is based on how you manage payments for loans, credit cards, and other types of credit. Having an account fall delinquent can lead to a charge-off, which can cost you major credit score points.

Negative information, including charge-offs, can remain on your credit history for up to seven years. But it may be possible to remove a charge-off from your credit sooner than that so you can begin rebuilding your credit score.

What Happens To Your Debt When You Die

Debt doesnt necessarily disappear when you die, either.

The good news is that only you are responsible for unsecured debt in your name: Your spouse and children dont have to carry your unpaid credit card balance.

Unsecured creditors typically write off that debt as a loss when you die .

However, your partner or spouse will be responsible for picking up the balance left on any joint accounts, according to financial products comparisons site RateSupermarket.ca.

Recommended Reading: Does Cashnetusa Report To Credit Bureaus

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

Use Solosuit To Make Your Debt Validation Letter

SoloSuit can take care of all of this for you. Our Debt Validation Letter is the best way to respond to a collection letter. Many debt collectors will simply give up after receiving it. Just answer a few questions online, and well create your letter for you.

Fight Back with SoloSuit

Youd be silly not to drop a few bucks and possibly save yourself thousands in the process. I cant thank you all enough for making an overwhelming situation something handleable.Daniel

Dont Miss: Will Paying Off Collections Help My Credit Score

Also Check: Does Paypal Credit Report To Credit Bureaus

When Does The Reporting Clock Start

The credit reporting time period for debt collections starts from the date of the delinquency that caused the collection. With collections resulting from a charge-off, it starts the date the account was charged off . So, if you were first late in February 2013 and the account was charged off in July 2013, the account should fall off after July 2020. Some versions of your credit report may include phrasing that indicates when the collection will fall off your credit report, such as, “Scheduled to report until 06/2020.

The for debt collections is based on your delinquency with the original creditor, not when the debt collector started collecting on the debt.

Paid Or Not Paid Collections

A common assumption people often make is assuming that paying off a collection will instantly remove collections from your credit bureau.

Its important to remember that a collection entry wont disappear from your credit bureau even if you settle it and pay it off.

That means when a lender, whether its a credit card company or the bank, sees a collection entry on your credit bureau, it will likely impact their decision of whether to lend to you or not.

Even if your credit account application is approved, your interest rate will likely be higher than someone without a collection entry on their credit report. That being said, its certainly worthwhile to take the necessary steps to get rid of a collection entry on your credit report.

When theres a collection entry on your credit report, chances are pretty good that there are some late payments associated with it. This is likely due to the fact that you were late on your payments.

There is often a separate entry for this debt, apart from the collection entry. There are steps you can take to remove the late payments from your credit report too.

Recommended Reading: How To Remove Repo From Your Credit Report

How Long Medical Collections Stay On Your Credit Report

Left unchallenged, medical debt will remain on your credit history for seven years just like any other kind of debt.

You can shorten this time frame by taking steps to remove medical collections from your credit report.

Credit scoring models emphasize new debt over older accounts, so as your medical accounts age their impact on your credit score will have less weight. But any debt reported by a collections agency can harm your score.

Lenders may deny your applications for borrowing based on negative items that appear on your credit report. Removing negative items can help restore your credit.

When Removing A Charge

If you’ve tried to negotiate with a creditor for the removal of a charge-off but hit a dead end, your only option may be to simply wait it out until the seven-year mark passes. Once that period is up, the charge-off will fall off your credit report naturally and no longer be included in your credit score calculations.

Again, this doesn’t mean that you can ignore the debt altogether. You’re still legally obligated to pay it. At some point, however, the statute of limitations on the debt may expire. When that occurs, debt collectors can no longer sue you to recover the money. The statute of limitations for different types of debt varies from state to state.

Recommended Reading: Credit Score To Qualify For Amazon Card

How Long Do Collection Accounts Stay On Your Report

Paid or unpaid collection accounts can legally stay on your credit reports for up to seven years after the original account first became delinquent. Once the collection account reaches the seven-year mark, the credit reporting companies should automatically delete it from your credit reports.

If your collection account doesnt fall off of your credit report after seven years, you can file a dispute with each credit bureau that lists it on your report.

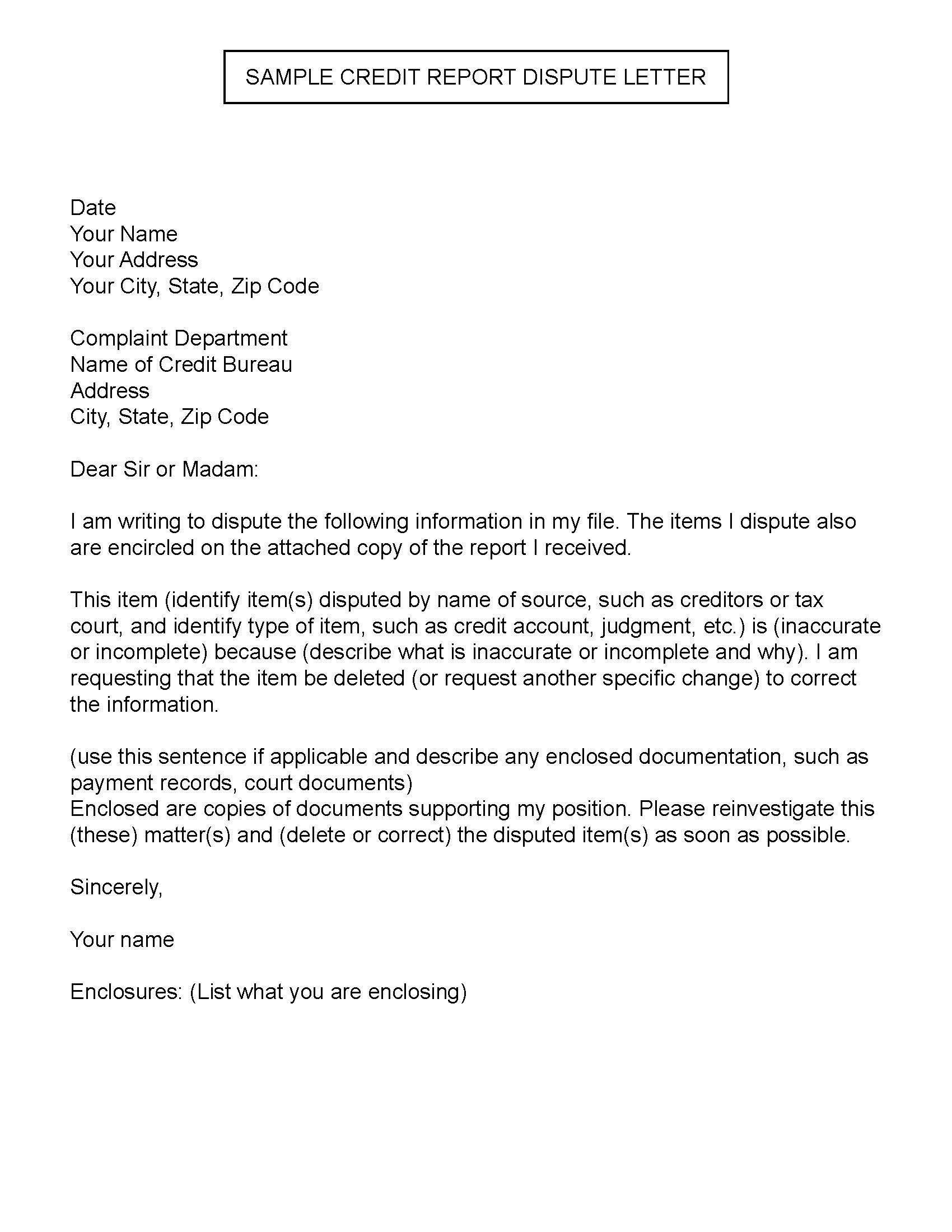

Dispute The Collection If You Found An Error

If the goodwill letter falls flat and the debt collection remains on your credit report, its time for a more advanced method.

For this, you will need a current copy of your credit report. TransUnion, Experian, and Equifax provide you with a free credit report once a year.

Once you have your credit reports in hand , find the negative item youd like removed and check it out closely.

Confirm all the details and if you see anything inaccurate, report the inaccurate information to the major credit reporting agencies.

The Fair Credit Reporting Act or FCRA requires credit reporting agencies to show only accurate information in your credit history.

If you can find inaccurate information, the credit bureau will have to fix the information. Though, if it cant fix the errors, the bureau should remove the collections from your credit report.

This method can work because, rather than simply disputing the entire entry, you are going to write an advanced dispute letter that lists especially what is inaccurate.

Using this letter, you will insist that each piece of information is corrected or that the collection be removed.

This makes it more difficult for the credit agencies to verify the collection and hopefully result in them simply removing the collection altogether.

ITEMS ON THE COLLECTION ENTRY TO CHECK FOR INACCURACIES:

- Balance

- Anything else that appears to be inaccurate

Don’t Miss: Does Paypal Credit Do A Hard Inquiry

How To Get Something Removed From Your Credit Report

Categories

When it comes to the health of your finances, one of the most important things to have is a clean . After all, its often one of the first things that a bank, credit union, or alternative lender will examine when you apply for a new credit product, such as a personal loan, a line of credit, vehicle financing, or a mortgage.

Unfortunately, negative information on your report can lead to your application being denied, especially if you arent aware of it the information is wrong. To learn more about how credit report errors can affect your credit and how to get inaccurate information removed, keep reading.

Recommended Reading: Does Barclaycard Report To Credit Bureaus

How Long Does Information Stay On My Equifax Credit Report

Reading time: 3 minutes

Highlights:

-

Most types of negative information generally remain on your Equifax credit report for 6 years

-

Closed accounts that were paid as agreed remain on your Equifax credit report for up to 10 years after they were reported as closed by the lender

-

Hard inquiries may remain on your Equifax credit report for 3 years

When it comes to credit reports, one of the most frequently asked questions is: How long does information stay on my Equifax credit report? The answer is that it depends on the type of information and whether its considered positive or negative.

Generally speaking, negative information such as late or missed payments, accounts that have been sent to collection agencies, or a bankruptcy stays on credit reports for approximately six years. Here is a breakdown of some the different types of negative information and how long you can expect the information to be on your Equifax credit report:

Here are some examples of “positive” information and how long it stays on your Equifax credit report:

- Active accounts paid as agreed. Active credit accounts that are paid as agreed remain on your Equifax credit report as long as the account is open and the lender is reporting it.

- Closed accounts paid as agreed. If the last status of the account is reported by the lender as paid as agreed, the account would stay on your Equifax credit report for up to 10 years from the date it was reported by the lender as closed to Equifax.

Also Check: Does Removing An Authorized User Hurt Their Credit Score