The Collection And Charge

Usually, creditors charge off a debt about six months after you stop making payments on the account.

- Accounts placed in collection. If your account is placed in collection, but not charged off, the original creditor still owns the debt. When you stop making payments, the creditor will often move the account into collections in-house for approximately six months. If successful, the creditor will retain all of the money it collects.

- Accounts charged off. After about six months, most creditors will sell the debt to a debt collector associated with the creditor or a company with no affiliation. Once sold, the creditor charges-off the account. A charge off doesn’t mean collection efforts will stop. Instead, the new owner of the debtthe debt collectorwill continue to take steps to collect on the account.

If I Can’t Get It Removed Will A Charge

Lenders and collection agencies are required to report the original date of the delinquency. This is the time that the seven-year timeframe starts. If you enter into a payment plan later or pay it off entirely, the clock doesn’t restart from that original date. The status will be updated once it’s paid off and won’t look as bad, but it will remain on the report.

How Much Will Your Score Drop

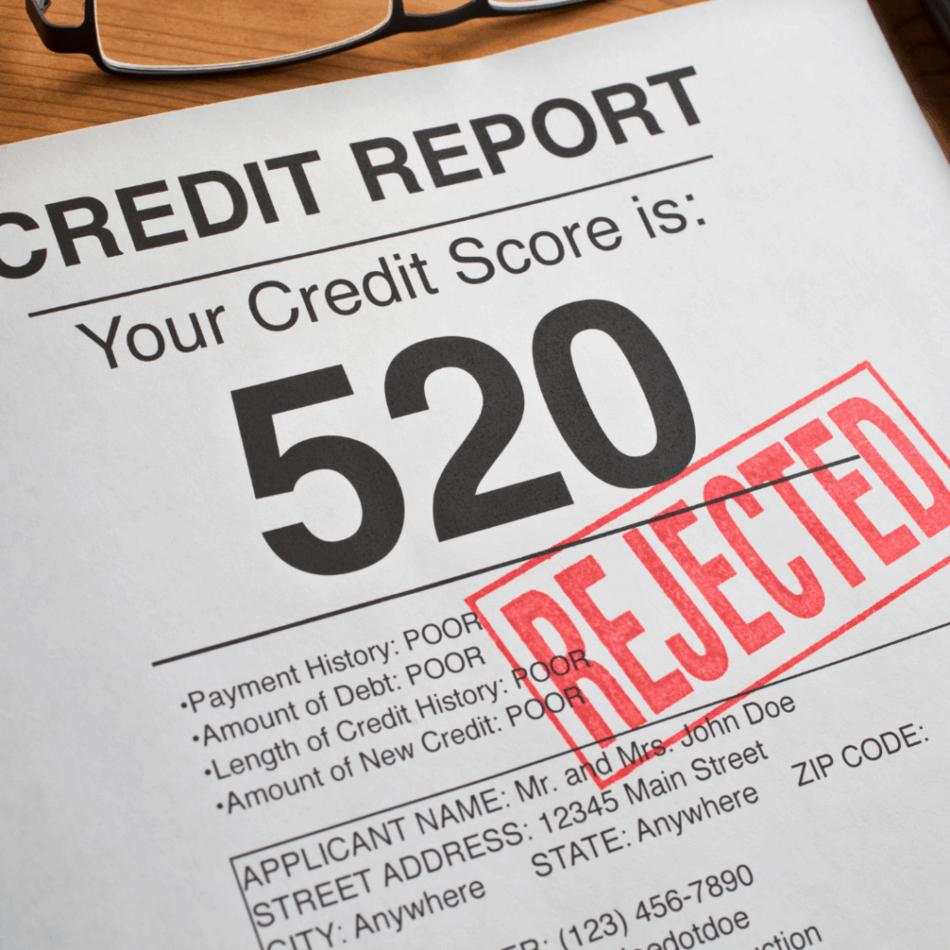

Your credit score is usually noted as a FICO score in a range from 300 to 850. If you fall into the fair to low ranges , you might find it hard to get a lender that is willing to approve your credit card or loan application.

All of your missed payments leading up to your account being charged-off will all count against you and your score will likely fall each month you are delinquent.

For example, a missed payment will hurt your score pretty badly and each additional missed payment will lower it even further. So, yes, while a charge-off will definitely lower your credit score, it is probably not looking too great by the time it hits that status anyways.

Your card issuer might have also lowered your credit limit, hurting the credit utilization portion of your credit score.

If your account has moved to collections, this could also lower your score. And not paying the collections agency isnt a great option because the agency can report missed payments to the credit bureaus.

We always recommend doing your best to satisfy all debts you owe, but unfortunately, paying off charge-offs and collections wont do much to improve your credit score.

Bottom Line: Its hard to say exactly how much your score will drop as this is dependent on several factors including what your score was before your missed payments and other negative items on your credit report.

You May Like: Does Paypal Credit Affect My Credit Score

Derogatory Mark: Missed Payments

If you are at least 30 days late, expect a derogatory mark on your credit report. Missed payments typically stay on your credit reports for 7½ years from the date the account was first reported late. The later the payment goes moving to 60 days late, 90 days late and so on the greater the damage to your credit scores.

What to do: Pay your bill as soon as you can afford to. If youve never or rarely been late before, you might be able to get the creditor to drop the late fee. Call the customer service number, explain your oversight and ask if the fee can be removed. You can also write a goodwill letter. If paying the bill is not an option, call your creditor and let them know about your financial situation to see if you can work out a hardship plan.

The negative effect on your credit scores will fade over time. Try to stay on top of all your; payments so positive information in your credit reports dilutes the effect of the missed payment.

How Does A Charge

Once the creditor writes off your account, it may report the account as charged off to the credit bureaus, which translates as a derogatory mark on your reports.

This derogatory mark can stay on your reports for up to a seven-year period from the date of the first payment you missed.

The creditor may have sold your account to a third-party collections agency if the debt was unsecured. In that case, the account could also appear as an account in collections on your reports.

If this happens, your may dip, and it may be more difficult to qualify for credit or get competitive interest rates.

Also Check: Is 524 A Good Credit Score

Will Paying A Charge

Thomas J. Brock is a Chartered Financial Analyst and a Certified Public Accountant with 20 years of corporate finance, accounting, and financial planning experience managing large investments including a $4 billion insurance carrier’s investment operations.

A charge-off is one of the worst things that can happen to your credit score because it indicates a serious payment issue. This type of derogatory credit report listing is the result of missing your payments on a debt for a time period that’s generally between 120 and 180 days.

After this period of missed payments, the creditor declares your account a loss and writes it off as uncollectible from an accounting standpoint. Your account will be closed for any new charges, however, you still owe the balance. The creditor will continue to make collection attempts on the past due balance and may even enlist the help of a third-party debt collector.

Get The Agreement In Writing

When the creditor agrees to remove the charge-off from your credit report, get the agreement in writing.

You can do this in one of two ways:

Avoid making payment until you have the agreement in writing and can prove beyond the shadow of doubt someone from the creditors office agreed. Once you have fulfilled your part of the agreement, check your credit report to make sure the creditor has removed the charge-off.

Recommended Reading: What Credit Report Does Paypal Pull

What Does Charged Off As Bad Debt Mean

If you fail to make minimum payments on your credit card for 180 days, your credit company will consider your debt a loss asset, or an asset that is uncollectible and considered a bad debt.;

This means that the credit company no longer believes that you will pay the debt back, and will consider the debt a loss on their profit-and-loss statement. Your creditor will then close your account and may sell your debt to a collections agency.

What Is The Difference Between A Charge

Both a charge-off and a collection signify a negative occurrence on your credit score. Paying off a charge-off can stop it from being sold to a collection agency, preventing both negative marks from impacting your score.;Ultimately, a charge-off is simply between you and the original lender while the collections note means it now involves a third-party agency.

You May Like: Cbcinnovis Inquiry

Working With A Debt Settlement Company

Unfortunately, there are a lot of scams out there that look like debt settlement companies. Here are a few red flags to be aware of when researching companies:

- Do they require up-front payments? The Federal Government prohibits debt assistance companies from collecting up-front fees before they deliver assistance.

- Are they making promises that sound too good to be true? Promising to make all collections calls and lawsuits stop completely, completely resolving all your debts, or reducing your debts by 70%, 80% are good indicators that theyre trying to scam you.

- Are they promising money-back guarantees? If theyre making too many guarantees, theyre probably not as legitimate as they claim.

While those are some good things to avoid, here are a few ways to ensure youre working with a reputable debt settlement company:

Does It Mean The Debt Goes Away

No. The original creditor deciding to take a loss does not make the debt disappear. By law, a consumer is responsible to pay back any debt they take on until it is paid, settled or discharged in bankruptcy. Chances are, the original creditor has sold the debt to a collection agency, who will continue to make demands of the consumer to pay the debt. These demands can be insistent and, in some cases, aggressive.

Read Also: What Credit Report Does Paypal Pull

Get A Free Copy Of Your Credit Report

The Fair Credit Reporting Act promotes the accuracy and privacy of information in the files of the nations credit reporting companies. Monitoring your credit report is a necessary practice to keep in check any negative information. Consumers should obtain their free credit report and review it at least once a year to catch any irregularities on time and keep track of disputed items.

Consumers are entitled by law to a free annual credit report from each of the three main reporting bureaus: Equifax, Experian, and TransUnion, and you can access all three of them through one single website:

AnnualCreditReport.com is the only authorized website through which you can gain free access to your credit report from the three major bureaus. Be wary of other sites that promise the same, as they may have hidden fees, try to sell something, or collect personal information.

| Mail: Download, print, fill out, and mail to: |

| Annual Credit Report Request Service P.O. Box 105281 Atlanta, GA 30348-5281 |

Equifax made headlines in 2017 due to a massive data breach, but it remains one of the top 3 services to get your credit report. The company provides a few different service levels if you want to monitor your credit score monthly . Monitoring packages start at $14.95 per month, and the $19.95 per month options include, ironically, a host of identity-theft protection options.

Is It Necessary To Pay A Charged Off Account

Again, a charge-off does NOT mean debt forgiveness. Unless the charge-off on your reports is inaccurate, youre bound to pay off that debt. The first thing to do when you learn about a charge-off on your reports is to verify the accuracy.;

Here are some things you may look for:;

- The outstanding balance: If the due balance on your account looks more than it should be, ask your creditor to explain why. If there are no explanations for the additional cost, ask them to correct the derogatory entries.;

- Collection agencies: Once your account is charged off, it could be sold to more than one third-party collection agency.;

For instance, if your account has been sold to three different agencies, ensure that each sold account is marked closed and has a zero balance. Its only accurate to have the most current collection account as open or active.;

- The original delinquency date: The charge-off date on all of your collection accounts should be identical to the original delinquency date, i.e., your first missed payment that led to a charge-off.;

If you figure out that the charge-off on your reports is legitimate, you must take action and pay it off.;

Don’t Miss: What Is Aargon Agency

How Do Others Charge

Unfortunately, youre still effected by charge offs. The credit card companies expect that some loans will not be repaid. So in an effort to stay profitable, they have to charge everyone a little higher interest rate to make up for the losses. So everyone who uses a charge card makes some small contribution.

How To Improve A Charge

Just because your debt is charged off doesnt mean youre off the hook. Youre still responsible for the debt you owe, and you have three ways you can handle a charged-off account:

One last tip once the debt has been paid off: ask for a final payment letter to keep for your records in case you need to dispute a wrongfully listed charge-off or collection.

Don’t Miss: Aargon Collection Agency

Hire A Credit Repair Service

A reputable company like may be a viable solution if your report is riddled with inaccuracies that further complicate the repair process. can help you with the following items:

- Cleaning up credit report errors

- Disputing inaccurate negative entries

- Handling creditor negotiations

If you decide to hire a credit repair service, know that laws govern how they operate and what they can do. The establishes the following regulations governing credit repair services:

- They cannot provide false or misleading information concerning a persons credit status and identification

- They must provide a detailed description of the service

- They cannot receive payment for the performance of any service until said service has been entirely performed

- There must be a written contract detailing the services to be performed, the time frame during which these services will be performed, and the total cost for those services

- They cannot promise to remove accurate information from a credit report before the term set by law

- The consumer will have three days in which to review the contract and cancel without penalty

How Do You Remove A Charge

According to Freddie Huynh, vice president of data optimization at Freedom Debt Relief, if a charge-off listed on your credit reports is legitimate, there isnt a whole lot that a consumer can do to remove it.

One thing you can do is try to negotiate with the original lender. If the lender hasnt sold the account, you can offer to pay the debt in full in exchange for the charge-off note to be removed from your reports.

Some debt collectors may offer to remove the charge-off note from your credit reports this is sometimes known as a pay for delete offer. But keep in mind that lenders are required to report accurate and complete information, so any pay for delete service is unlikely to be successful.

Otherwise, you can just wait out the clock.;A charge-off should automatically drop off your credit reports;after seven years.

Recommended Reading: How To Get A Bankruptcy Off Your Credit Report

Impact Of Identity Theft On Your Credit Report

Identity theft occurs when someone steals your personal information and uses it to apply for new lines of credit. If these new accounts go into default, they will appear on your credit report and hurt your score.

Cleaning up your credit after identity theft can take anywhere from a day to several months or even years. The longer it takes you to realize someone stole your identity, the more difficult it will be to undo the damage. Monitoring your credit report will help you to stay on top of potential fraudulent charges.

Sample Letter To Remove A Charge

Note: Use this in attempting to negotiate a complete removal or PAID AS AGREED on a debt that states CHARGE-OFF or SERIOUSLY PAST DUE on your credit report.

RE: account #

Dear Sir or Madam, After recently reviewing my credit report, I took notice that the above-mentioned account is currently in status. I sincerely would like to take care of this account as soon as possible.

Due to , I unfortunately got behind on my payments and was unable to meet my obligations. However, since then my situation has greatly improved and I am in the position to recompense this debt.

I am willing to pay equalling the amount of provided that the above account is updated on all credit reporting agencies to state: PAID AS AGREED, or completely removed from all credit reporting agencies upon my final payment.

I am not agreeing to an updated credit report that states this account as: PAID CHARGE-OFF or the like, as this will not significantly increase my credit score, nor will it reflect my sincere willingness to restore my good name and hopefully, someday, again do business with your company.

Your written response will serve as an agreement to my proposal and I will begin payments. Thank you very much for your valued time.

Best regards,

You May Like: Does Paypal Working Capital Report To Credit Bureaus

How To Remove Items From Your Credit Report In 2021

Weve outlined how to remove negative items from your credit report, the paid services you can opt to use, and additional information to have on hand. It is important to clarify that only incorrect items can be removed. If youve done this already, but your credit score is still low, you will need to repair bad credit over time. Although accurate items cannot be removed by you or anyone else, there are still many credit report errors that can damage your score, and these are worth looking out for.