Average Credit Score By Age

Making smart financial choices early in life can lead to credit score advantages as you age.

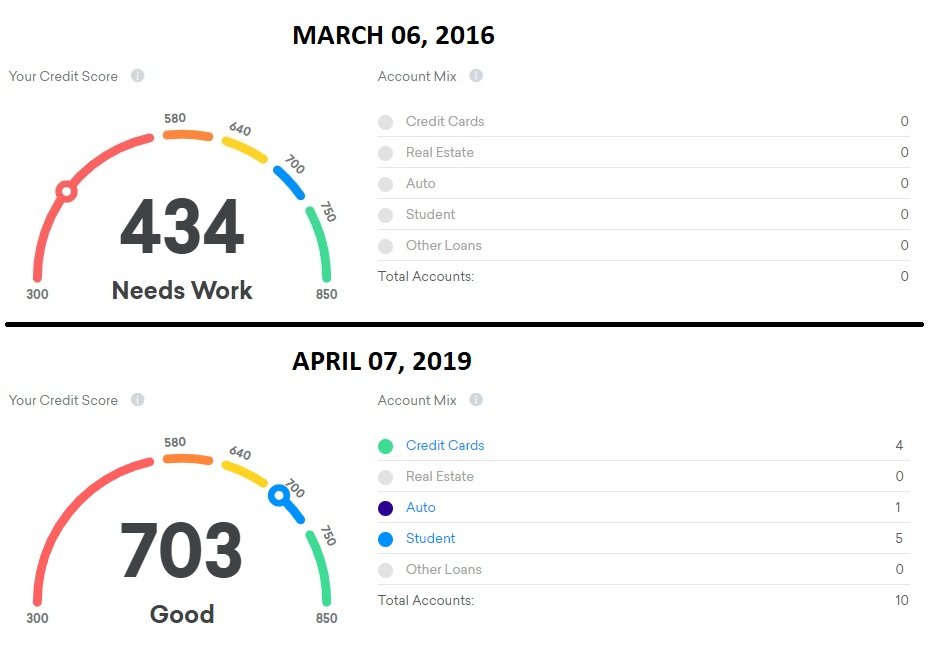

Consumers in the U.S. have an average FICO® Score of 703 and VantageScore of 711, but this can vary based on age.

. Your FICO® Score is primarily based on specific, weighted criteria including payment history , outstanding debt , credit history length , pursuit of new credit and the types of credit you use .

Regardless of your age, those who are initially building their , with those in their 20s having an average score of 660. The age group with the highest average credit score is those in their 80s, but its those between 56 and 74 that have the most consumers with a perfect score of 850. However, keep in mind that credit scores vary by age and due to a number of factors.

On This Page:

The average FICO® Score is 703, while the average VantageScore is 711.

Consumers who hit their 50s experience a significant increase in their credit score, reaching an average score of 703 and above.

What Does A 703 Credit Score Mean And How It Affects Your Life

Having a 703 FICO score means that you are in a good position when trying to obtain credit. You will not have to use expensive dealer finance when trying to buy a car, you will be in a very strong position when applying for a mortgage and you will be able to get a large monthly limit on any credit cards.

However, you probably will not have access to the most exclusive offers and lowest cost finance rates which would be reserved for those in the excellent credit score group. They would not only be able to obtain cheaper finance, but also take out that finance over a longer period which reduces the size of the monthly payment that needs to be made.

Therefore, if you have a credit score of 703 it is worth trying to push it higher. Financial institutions use computer programs to make lending decisions. Moving your credit score higher means that the automated decision making in place will allow the credit professional you are dealing with to advance you more credit at a lower rate.

Financial institutions have a fixed amount of money they can lend to borrowers in each credit score category. This is known as their Risk Appetite. The limits and measures here are approved by the lenders Board of Directors so these limits are firm and cannot be changed easily.

The lending limits are generally higher the better the credit score of the borrower, so someone wishing to borrow a large amount had better have the best credit score possible.

My Fico Score Is 703 Does This Qualify As Excellent Credit

Question: My FICO score is 703. Does this qualify as excellent credit?

Answer: A 703 score falls within the range of good credit, which FICO defines as from 670-739. A few years ago, a credit score of 703 carried more clout than it does right now. Today, an very good credit score is a little higher and is usually defined as 740-799 with scores above 800 considered exceptional. Some credit card issuers might still consider a credit score as low 720 to be excellent, but most issuers have raised the bar to 750.

Still, a 703 FICO score does put you in the “good credit” category. The range for a good credit score starts at about 670, so your 703 certainly makes the cut, but take care not to do things that might drop your score too much. For instance, if you plan to apply for a loan or mortgage anytime soon, don’t apply for new credit cards in the near future. Every time you apply for a card and an issuer looks at your credit report, this is called a “hard inquiry.” A hard inquiry can lower your score a few points. A few points doesn’t sound like much, but since you’re in the lower half of the good credit range, take care not to apply for to many loans or cards in quick succession and definitely don’t miss any payments.

Recommended Reading: How To Remove Serious Delinquency From Credit Report

Could Inaccurate Credit Information Be Hurting Your Score

The average credit score for Americans is 703 according to Experian, one of the three major credit bureaus. Experian contributes data to compile your FICO credit score.

On the credit score range, 703 is considered a good score. But its not good enough to have a full selection of loan choices when you need to borrow.

Your good credit could use some fine-tuning if you want a higher credit score.

So lets say youve already built a good credit mix, a good payment history, and an established length of credit history as I described above.

If this is true, you may be wondering whats holding you back from achieving a different credit score?

Wait Wait Then Wait Some More

You simply have to be patient. Even when you make all the right decisions, itll take some time to see results.

Part of your score relates directly to the length of credit history. But even on more important credit reporting factors such as your payment history and credit utilization ratio, time is your friend.

This is especially true if your past credit behavior has been questionable. With each passing year, your past bad decisions have less of an impact on your current credit information.

So be patient and continue making good decisions to establish a positive credit history, even if you dont see immediate results.

Keep making your payments on time and make sure you dont get any negative entries like a collection account. And let your current credit accounts grow older. The older your accounts, the better your credit score can be.

For example, my oldest credit card is 15 years old, and my average credit card is 8 years old.

Learn More:

Read Also: Carmax For Bad Credit

Build Your Credit Mix

We generally dont recommend taking out a potentially expensive loan just to build your credit scores. But its true that having a mix of different types of credit can benefit your scores over the long term. Types of credit include revolving credit and installment credit .

But theres a wrinkle: Applying for new credit can lead to a hard inquiry on your credit reports, which can have a negative impact on your scores. While this impact is typically minor, too many hard inquiries in a short time period can be a red flag to lenders. Thats why its important to have a general sense of how likely it is that youll be approved before you apply for a credit card or loan.

Why Is My Credit Score Low

Lower credit scores arent always the result of late payments, bankruptcy, or other negative notations on a consumers credit file. Having little to no credit history can also result in a low score.

This can happen even if you had established credit in the past if your credit report shows no activity for a long stretch of time, items may fall off your report. Credit scores must have some type of activity as noted by a creditor within the past six months.If a creditor stops updating an old account that you dont use, it will disappear from your credit report and leave FICO and or VantageScore with too little information to calculate a score.

Similarly, consumers new to credit must be aware that they will have no established credit history for FICO or VantageScore to appraise, resulting in a low score. Despite not making any mistakes, you are still considered a risky borrower because the credit bureaus dont know enough about you.

Read Also: How Long Is A Repossession On Your Credit

How To Earn An Excellent/exceptional Credit Score:

Borrowers with credit scores in the excellent credit range likely haven’t missed a payment in the past seven years. Additionally, they will most likely have a credit utilization rate of less than 30%: meaning that their current ratio of credit balances to credit limits is roughly 1:3 or better. They also likely have a diverse mix of credit demonstrating that many different lenders are comfortable extending credit to them.

Canadian Credit Ratings And What They Mean

Lenders and creditors typically use a credit score to determine youre likelihood of making payments on time. Its important to note that your is only one of the factors that lenders will evaluate when approving you for new credit.

- Excellent Individuals with a rate of 780 or over may enjoy the best interest rates on the market. They also will typically always be approved for a loan.

- Very Good This is considered near perfect and individuals with a rate in this range may still enjoy some of the best rates available.

- Good An individual who has a credit score that falls within this range has good credit and will typically have little to no trouble getting approved for the new credit.

- Average While this is still a good range, individuals with this score may receive slightly higher interest rates than those with higher scores. According to Equifax, at the end of 2012, the average national credit score was 696.

- Poor Scores in this range indicate that the individual is high risk. It may be difficult to obtain loans and if approved, they will be offered higher interest rates.

- Very Poor Scores in this range are rarely approved for anything, but credit can be repaired.

- Terrible Individuals whose credit scores are less than 500 may not get approved for new credit and should seek credit improvement help.

Loans Canada Lookout

You May Like: Whats A Good Credit Age

Where To Go From Here

Its important to pay down your balances and keep your credit utilization under 30%. Its also wise to have several different types of credit accounts that include a mix of installment and revolving credit.

Of course, you also want to focus on making timely payments from here on out. Even one late payment can be very damaging to your credit.

Length of credit history also plays an essential role in your credit scores. You want to show potential creditors that you have a long, positive payment history.

Building excellent credit doesnt happen overnight, but you can definitely speed up the process by making the right moves.

Give Lexington Law a call for a free credit consultation at and get started repairing your credit today! The sooner you start, the sooner youll be on your way to having excellent credit.

Categories

How To Get A 703 Credit Score

While theres no exact formula to achieve a specific score, you can aim to get within a general score range. Even taking the different credit scores and definitions of good credit into account, there are general principles that can help you build and maintain healthy credit. Sticking to these principles over time can raise your scores, making you a better credit risk in lenders eyes.

Here are some actionable tips to help you stay on top of the important factors that can affect your credit.

Also Check: Remove Repo From Credit Report

Whats A Good Credit Score For Your Age

As you age and increase your payment history, increasing your credit score should be part of your goals. While you can do many things to speed up the process and have a better credit score, a good credit score keeps up with the national average. In your 20s and 30s, a good credit score is between 663 and 671, while in your 40s and 50s, a good score is around 682. To get the best interest rates, terms and offers, aim for a credit score in the 700s.

In your 20s, youre only just starting to build your credit score, which is why it may be difficult to get the same average score of 754 that those in their 70s achieve. A number of factors can affect your score over time, such as your payment history, credit history length and revolving balance. Credit bureaus have a better idea of your creditworthiness if you have a long payment history of on-time payments.

In the meantime, focus on reducing your debt and improving your credit score by making on-time payments, reviewing your credit regularly and keeping your credit utilization as low as possible.

Average Age by Credit Score Tier

Scroll for more

Regardless of your age, its important to cut back on unnecessary expenses where possible. Having monthly savings can be used to pay down debt, invest for retirement or contribute to an emergency fund to avoid overspending on credit cards.

Staying The Course With Your Good Credit History

Having a Good FICO® Score makes you pretty typical among American consumers. That’s certainly not a bad thing, but with some time and effort, you can increase your score into the Very Good range or even the Exceptional range . Moving in that direction will require understanding of the behaviors that help grow your score, and those that hinder growth:

Late and missed payments are among the most significant influences on your credit scoreand they aren’t good influences. Lenders want borrowers who pay their bills on time, and statisticians predict that people who have missed payments likelier to default on debt than those who pay promptly. If you have a history of making late payments , you’ll do your credit score a big solid by kicking that habit. More than one-third of your score is influenced by the presence of late or missed payments.

Utilization rate, or usage rate, is a technical way of describing how close you are to “maxing out” your credit card accounts. You can measure utilization on an account-by-account basis by dividing each outstanding balance by the card’s spending limit, and then multiplying by 100 to get a percentage. Find your total utilization rate by adding up all the balances and dividing by the sum of all the spending limits:

| Balance | |

|---|---|

| $20,000 | 26% |

42% Individuals with a 703 FICO® Score have credit portfolios that include auto loan and 29% have a mortgage loan.

Also Check: Can A Repossession Be Removed From Credit Report

A 707 Credit Score Is Considered A Good Credit Score By Many Lenders

| Percentage of generation with 700749 credit scores |

|---|

| Generation |

| 14.7% |

Good score range identified based on 2021 Credit Karma data.

With good credit scores, you might be more likely to qualify for mortgages and auto loans with lower interest rates and better terms. You might also be approved for credit cards with valuable sign-up bonuses and attractive rewards programs.

Why do these three-digit numbers matter so much to your financial well-being? Well, lenders use your as a gauge of how likely you are to pay back any money they lend to you. So, a good credit score can give a lender the confidence to lend you money at terms favorable to you. It might not be enough to unlock the absolute best financial products or terms, but its a milestone indicating youre on the cusp of excellence.

People often talk about their credit score as if they have only one, so you might be surprised to learn that there are many different credit scores out there. A credit score is based on a credit-scoring model, which differs depending on the company that created it, like VantageScore or FICO. To generate your credit scores, these models can use data from different sources: Equifax, Experian or TransUnion .

Each model has its own standard for what qualifies as good. And to make matters even more confusing, its often not clear which credit score, model or bureaus data a particular lender is using and what other factors the lender may look at beyond scores.

What Is A Good Credit Score In Canada

A good credit score in Canada is typically one that is 680 or higher. Of course, there are many different types of credit scores , and keep in mind that the credit scores a lender sees are usually different from those that you might have access to. Additionally, your Equifax credit scores might be different from your TransUnion scores. The image below illustrates the different credit score ranges in Canada and can help you determine if your credit score is a good credit score.

Also Check: Paydex Score Chart

Getting Mortgages With 703 Credit Score

As with personal loans, credit scores in this range tend to produce favorable terms. With 703 FICO credit score an interest rates on a mortgage could be anywhere from four to five percent, often falling somewhere around four to four point five percent. If youre in the market for house, try pushing off your search until your credit slightly improves to lock in a more ideal rate.

Considering these things, your credit score is one of the most important numbers in your life. It can affect every action you take, from the house you live in to the car you drive. Taking steps to improve your 703 credit score is the best way to save money and make your life easier down the road. Theres no excuse to not improve your credit score!

How is a 703 credit score calculated?

The three major credit bureaus rely on five types of information to calculate your credit score. They collect this information from a variety of sources, and compile it to give you an overall score. The score is comprised of 35% payment history, 30% amount owed, 15% credit history, 10% new credit, and 10% credit diversity.

Getting A Credit Account With A 703 Credit Score

As a prime borrower, youll have plenty of options when looking for a new credit card. However, you might not qualify for the top rates that card issuers reserve for people in the highest credit score range.

The types of credit cards you can get with a credit score of 703 generally fall into two categories:

- Secured credit cards: These cards require a security deposit, which your lender will use as collateral. The amount you put down will usually be your credit limit. Secured cards are a low-risk option if you want to build credit while ensuring that you dont spend beyond your means.

- Unsecured credit cards: These cards dont require a deposit. Your card issuer will set your credit limit according to how creditworthy they perceive you to be. In many cases, these cards offer cash back on certain purchases and other rewards.

Which type of credit card is best ultimately depends on your financial situation and your reason for opening a new credit account. If youre good at controlling your spending, then its a good idea to use your good credit score to take advantage of the potential rewards and higher credit limit that come with an unsecured card.

On the other hand, if your main goal is to build credit and youre worried about overspending, then a secured credit card may be your best bet.

Takeaway: 703 is a good credit score, but its not in the top scoring range.

You May Like: Aargon Agency Payment