Who A Debt Collector Can Contact

A debt collector can only contact your friends, employer, relatives or neighbours to get your telephone number or address.

This does not apply in the following cases:

- the person being contacted has guaranteed your loan

- your employer is contacted to confirm your employment

- you’ve given your consent to the financial institution that they can contact the person

If you gave consent orally to your financial institution, you must receive written confirmation of your consent either on paper or electronically.

Does Debt Collection Affect You Legally

If you dont respond to a debt collector within a certain period of time, they can sue you in court. This period of time varies by state, so check your state regulations to find out how long an agency has to sue you. If the debt collector wins, they may receive the right to garnish your wages. Garnishing wages means they can contact your employer and ask that a portion of your paycheck be diverted to them.

They may also put a lien on any property you own, like your home. In this case, you would be unable to sell the home while the lien is in effect, and your creditor might also be able to foreclose on your home with a court judgment.

Does Debt Collection Affect Your Credit

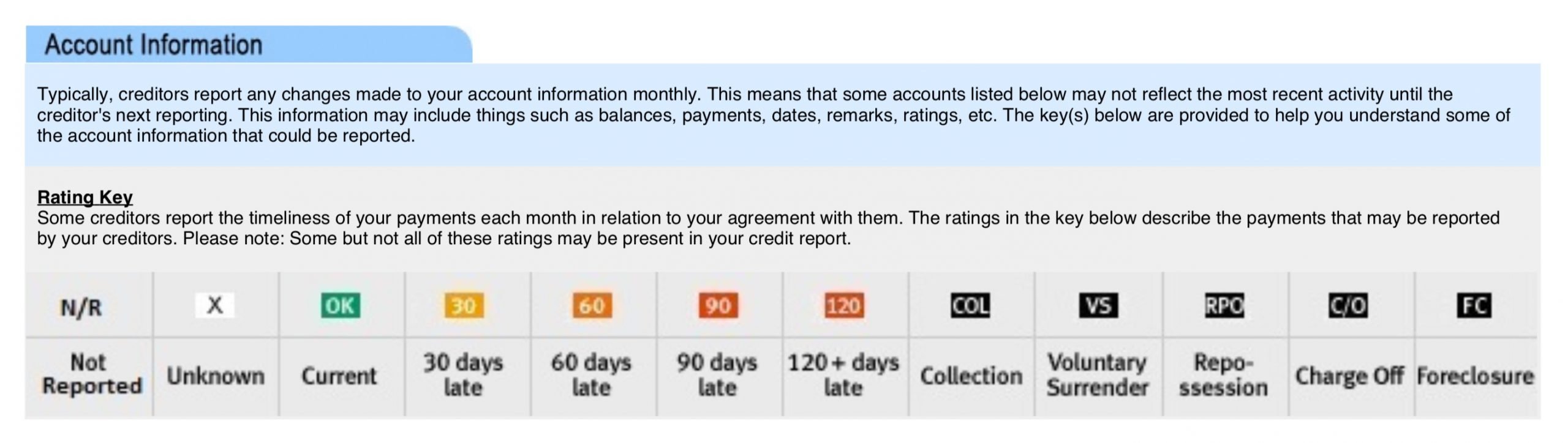

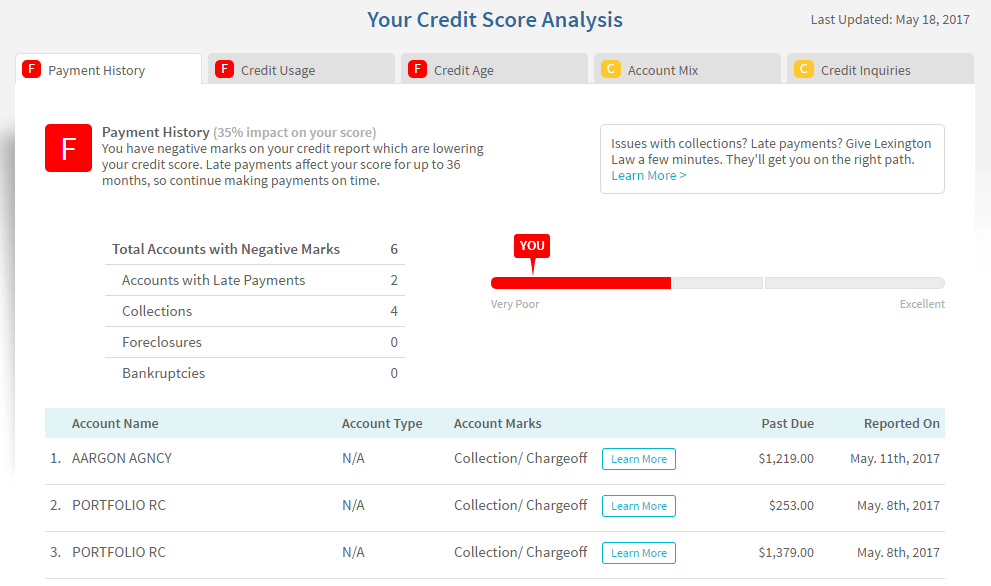

Any payment to a creditor that is at least 30 days late can appear on your credit report as a negative entry. A late payment can stay on your credit report for up to seven years. Each of these events hurts your credit score because your payment history equals 35 percent of your total score.

Once a debt goes to collections it can be added to your credit report as a separate account.When the debt is transferred to collections, your account is flagged with a collection status. While the exact point drop varies from person to person, most consumers will see a major decrease in their credit score, often several hundred points. However, the impact of these entries will decrease over time, especially if you adopt positive financial habits.

Also Check: 877-392-2016

How To Decide If You Should Pay A Debt Collection Agency

There’s no silver bullet in a debt collection case. While ignoring a debt collector may be an option in some cases, it’s not available to some debtors.

Here are some general considerations.

If you refuse to pay a debt collection agency, they may file a lawsuit against you. Debt collection lawsuits are no joke. You can’t just ignore them in the hopes that they’ll go away. If you receive a Complaint from a debt collector, you must respond within a time frame determined by your jurisdiction. For most areas in the US, that time frame is 14-30 days.

If a debt collection agency wins their lawsuit, they have several options available. For example, debt collectors may garnish earnings to collect a debt. A garnishment is a court order that takes money directly from a debtor’s earnings. This money goes towards repaying the debt they owe. Consider this possible outcome before ignoring a debt collector’s payment demands.

Here’s one more thing to keep in mind. Interest on your unpaid debt will continue to pile up as time passes. If you don’t pay a debt collection company, the amount of money you allegedly owe will keep increasing.

A piece of advice: pay the right person. If you receive a letter from a debt collector demanding money, do your research. Often, debt collection agencies sell debt to one another. Don’t just assume you’re paying the right debt collector. Make sure your debt hasn’t changed hands.

Consider these factors and situations

You may want to pay a collection agency

What Is A Debt Collector

Debt collectors are companies or agencies in the business of recovering owed money. If your debt is sent to a collection agency, you should receive a written notice before being contacted by the collector. The notice should include the debt collectors name, the name of the person or business you owe money to, and the amount owed. At this point, you have an opportunity to verify the information.

You have the following rights if your debt is sent to collections:

- The debt collector can contact your friends, employer, relatives, or neighbors to attain your phone number and address unless the person is also a guarantor, co-signer, is your employer and contacted to verify employment.

- Debt collectors can contact you between 7 am and 9 pm Monday through Saturday and 1 pm to 5 pm on Sundays, excluding holidays.

Tips for how to deal with a debt collector, .

Debt collectors cannot do the following:

- Suggest to friends, employers, relatives, or neighbours that they should repay your debts unless the individual is a co-signer.

- Utilize threatening, intimidating, or abusive language.

- Initiate excessive or unreasonable pressure to force debt repayment.

- Misrepresent the situation, including providing false or misleading information.

- Add collection-related costs to the owed amount, except legal fees and non-sufficient funds fees.

Looking for information about your credit score? .

Also Check: How To Get A Repossession Off Your Credit Report

Does The Open Date Of A Collection Account Determine When It’s Removed

It sometimes takes a year or more between an account’s charge-off and its sale to a collection agency, and collection agencies that fail to collect their debts sometimes resell them to still other agencies. That means multiple collection account entriesall related to the same unpaid debtmay appear on your credit reports.

While that’s not great news, you need not worry that each new entry has its own seven-year countdown to expiration. Any collection entries related to the same original debt will disappear from your credit report seven years from the date of the first missed payment that led up to the charge-off.

Ways To Remove Collections From Credit Report

Still, there is a chance you could get the collection removed. A collection stays on your credit report for seven years from the time of your last payment, and there are three ways to get it taken off.

Also Check: Does Sezzle Affect Credit Score

Should I Contact Or Pay Sarma Collections Inc

Nothing good can come from speaking to a debt collection agency on the phone. And making payments on the collection account will reset the clock. So instead of helping your credit, it could make it worse. Of course, there are times when its best to just pay the collection account, especially if its new and youre sure that its legit.

The best way to go about dealing with Sarma Collections is to work with a professional credit repair service. They have deleted millions of negative items from companies like Sarma Collections for millions of clients nationwide.

And they can help you too.

Do I Need To Notify Credit Bureaus Of Paid Collections

If you pay off or settle a debt with a collection agency, the status of the collection account on your credit report should update to “paid” or “settled” within a month or two. You do not need to do anything to make that happen the collection agency should notify the three national credit bureaus to update their records.

If that doesn’t occur, you can file a dispute with each of the bureaus to have the records corrected. You’ll likely need to provide proof of payment, such as a cancelled check.

Also Check: Does Care Credit Build Your Credit

How To Dispute Inaccurate Debt Collection Information On Your Credit Report

Question: I have an original debt dating back 8 years. I refused to pay the debt due to overcharging my account. A few years ago, my debt was sold to a debt collector, and they are now reporting to credit bureaus as deliquent. We have agreed to terms on the settlement under the conditions they remove it from my credit report completely. They said they will update it as settled.

My question is as follows I read that after 7 years after the last payment was posted, a debt cannot be reported to my credit report, via original creditor, or the collection agency who bought my debt. If this is true, how can i get this removed? Its only showing up as 4 years on my credit report due to the collection agency reporting the debt.

Dear Reader,

You are correct, charged-off accounts and collections will stay on your credit report for up to seven and a half years after the date of the last reported activity. In this case, its the date when your account became delinquent. Debt collectors cannot legally re-age an account just because they bought it from the original creditor or another collection agency. The only circumstance in which this could happen is if the collection became current because you resumed payments and then it became delinquent again. If thats not your case and your debt is well over eight years old without any activity during that period, it should not be in your credit report.

Sincerely,

How To Manage Debt In Collections

As a general rule, dont ignore debt collectors. While its OK to take a few days to gather your thoughts and documentation before talking to them, ignoring them entirely only makes your debt problem worse. Working with debt collectors is a process, and youll want to take the time to formulate a plan.

You May Like: Is 524 A Good Credit Score

How Many Points Will My Credit Score Go Up When I Pay Off Collections

Unfortunately, as is often the case with a credit score, there’s no definitive answer. Your credit score may gain some points, or it may not budge at all. There are numerous credit scores that lenders use, and while some newer algorithms will take into account that you paid off a debt, others won’t. Generally, you are more likely to get a better loan if lenders see that you’ve paid off debts in collections.

Offer Pay For Removal

Pay for removal is when you request that the debt collector removes a collection entry from your credit bureau for payment. Theres nothing that requires the debt collector to agree to this. Whether a debt collector agrees to this usually depends on the debts age and the amount, and your previous account history.

Before you request this, make sure youre aware that by offering pay for removal, youre agreeing to pay the full amount owing to the debt collector, plus any interest and fees. If you were in the position to do this, you probably wouldnt have ended up in collections in the first place, so this isnt always feasible.

Also Check: Credit Report With Itin Number

Dispute When Collectors Sell

Collection accounts often change hands. Debts are assigned and sold to other collectors, so theres a strong possibility the collection agency listed on your credit report isnt the agency that’s currently collecting on the debt. When this happens, you can have the older collection removed by disputing it with the credit bureaus. If the debt collector fails to respond to the dispute, the credit bureau should remove the account since it has not been verified.

How To Avoid Having Your Debt Sent To Collections

If you’ve recently lost your job or incurred an unexpected expense such as a medical bill, there are resources to help you juggle debt repayment.

“The best thing to do to avoid having your debt going to collections is contact the creditor to set up a payment plan or ask for reduction on the amount of debt owed,” says Eweka.

Do this as soon as you know you’re going to have trouble paying your bills, and you could benefit from a lower APR, temporary forbearance or deferment, waived late fees or other accommodations depending on your financial situation. Be sure to tell your creditor about any financial hardships you’re experiencing, such as a recent layoff, furlough or reduction in working hours.

“Remember that the amount ofdebt forgiven may be taxable when you file your tax return,” advises Eweka. And before you enroll in any type of financial assistance, consider what’s best for your situation.

Don’t miss: Here’s the ‘most basic rule of thumb’ when it comes to paying off your debt, according to an expert

Recommended Reading: Does Aarons Report To The Credit Bureau

How Long Do Collections Stay On Your Credit Report

Collections can remain on your credit report for up to seven years. Even if you pay it in full, its still considered a negative account and will stay on your credit report as a paid collection account for seven years.

A collection account is separate from a charge off placed by the original creditor, which will likely also show up on your credit history for seven years.

What To Do If The Debt Isnt Yours

Sometimes, a debt collector will come after somebody for money they never spent. If your ex-spouse, for instance, racked up credit card debt during your marriage, it may be something that you are legally both on the hook for. However, depending on your state’s laws, if your name wasn’t on the credit card, you’re not responsible for the debt.

If this is, say, a sibling’s debt, it may be a case where you were put down as a reference if the money wasn’t paid. If the debt isn’t yours, it’s best to dispute it by asking for proof of the debt and checking federal and state laws regarding common debts.

You May Like: Comenitycapital Mprc

How Do Collection Reports Impact Your Credit Score

While a collection report usually causes serious damage to your credit score, how much it impacts it depends on which credit scoring model you use to calculate your score. It also depends on whether the collection account is paid or unpaid. For example, FICO Score 9the latest version of the FICO credit scoring modeldoesnt report paid collection accounts.

Earlier versions of this credit scoring model, however, do include paid collection accounts. If a lender uses an earlier model to assess the likelihood you can repay a loan, its likely that it will see a lower credit score if you have a paid collection account listed on your credit reports.

S To Remove Paid Collections From Credit Report

Well, now that you are about to apply for that new loan or any other financial arrangement that will require lenders or credit bureaus to calculate for your credit score, you saw that paid collection still in your credit report as you pull it.

Here are a few things you can do that will help you remove that dreadful stain from your otherwise pretty credit report and keep the collection agency away from your credit information

Don’t Miss: Credit Karma Rapid Rescore

Can Medical Collections Be Removed From My Credit Report

Yes. Just like anything else on your credit report, you can remove medical collections.

Pay careful attention to each piece of information associated with the debt to give yourself the best chance to get it removed. When disputing medical collections, follow the same guidelines for any other type of collection account discussed below.

How To Negotiate With Debt Collectors

When you talk to a debt collector, you’ll find that the best of them are going to be sympathetic to your financial plight. In fact, you’re probably talking to somebody who isn’t exactly rich themselves. According to the job website Glassdoor.com, the average annual salary of a debt collector is about $31,000 a year.

It pays to be polite, keep your nerves steady and offer to pay what’s possible without wrecking your budget or stretching your finances too thin.

Read Also: Afni Pay For Delete

How Long Do Collection Accounts Stay On Your Report

Paid or unpaid collection accounts can legally stay on your credit reports for up to seven years after the original account first became delinquent. Once the collection account reaches the seven-year mark, the credit reporting companies should automatically delete it from your credit reports.

If your collection account doesnt fall off of your credit report after seven years, you can file a dispute with each credit bureau that lists it on your report.

Statute Of Limitations On Debt Collectors

The first thing consumers should do is verify that the debt even exists. In addition to the validation notice that debt collectors must send, there is a statute of limitations on most debts. The statute of limitations varies from state-to-state, from as little as three years to as many as 15. Most states fall in the range of 4-to-6 years.

If the statute of limitations on your debt has passed, it means the collection agency cant get a court judgment against you. It does not mean they cant still try to collect, though if you refuse to pay, they have no legal recourse against you. However, the unpaid debt remains on your credit report for seven years from the last time you made a payment on it.

Many of the problems start with the fact that debt collection agencies often buy debts from several sources and either collect the money or sell the debt a second, third, maybe even fourth time. Along the way, the original contract gets lost and specifics of how much was originally borrowed, at what interest rate, what late payment penalties are involved and how much is still owed, are lost with it.

Consumers need to keep accurate records of all transactions involved with their debt, especially the original contract, record of payments and any receipts. That information is used when filing a dispute letter with the collection agency.

Also Check: When Does Wells Fargo Report To The Credit Bureau