How Do You Dispute Late Payments On Your Credit Report

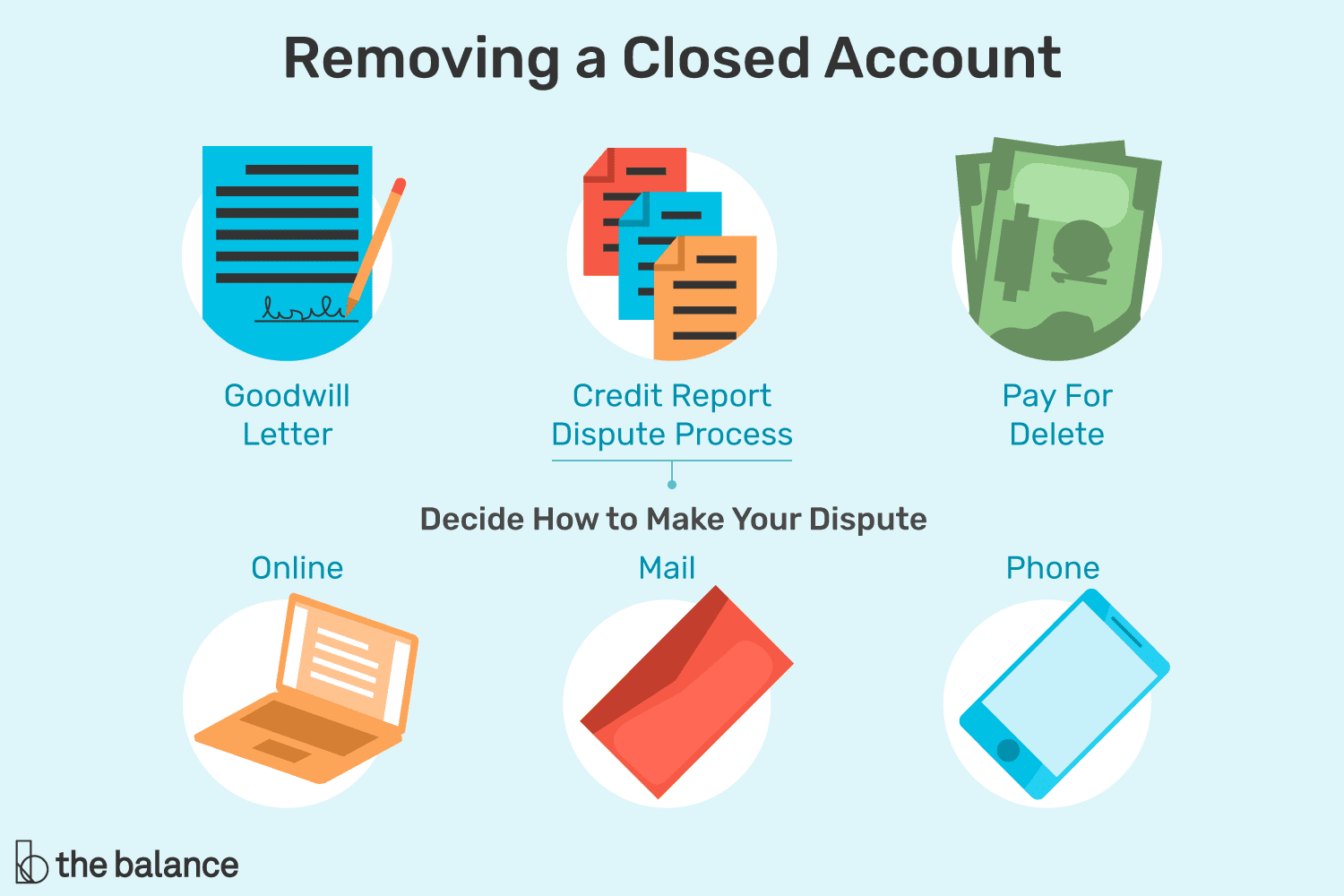

You can dispute your information with the three credit bureaus online, over the phone, or by mail. Check your report with each bureau, because you’ll need to file a dispute with each one that has inaccurate information. You can start a dispute with TransUnion, Equifax, or Experian by visiting their respective dispute pages.

How Do Late Payments Affect My Credit Scores

Late payments will have a different impact on each persons credit scores depending on the situation. That said, there are some general rules that can help you determine the severity of the impact.

- First off, a longer delinquency will have a greater negative impact on your scores than a shorter delinquency. Assuming everything else is equal, a 90-day late payment can hurt your scores more than a 30-day late payment.

- The number of delinquencies on your reports matters, too. Usually, more delinquencies result in a more significant negative impact to your scores.

- A delinquency will have the largest impact on your credit scores when its first reported. However, as the delinquency ages, the impact on your scores should decrease. The length of time your scores take to recover may depend on any other negative issues that might be affecting them.

Its important to remember that each credit bureau has its own way of evaluating your information and assigning you a credit score. A late payment could have a more significant impact on one score than on another, which is one reason why your scores may vary between credit bureaus.

How To Remove Late Payments From Your Credit Reports

Amy is an ACA and the CEO and founder of OnPoint Learning, a financial training company delivering training to financial professionals. She has nearly two decades of experience in the financial industry and as a financial instructor for industry professionals and individuals.

The Balance / Julie Bang

Don’t Miss: What Is A Factual Data Credit Inquiry

Filing A Small Claims Lawsuit Against The Creditor

Finally, if the first three steps do not yield results, I often help my clients file a small claims suit.

Heres whats great about this I have seen many judges rule in a consumers favor if they can prove wrongdoing by the creditors. Research your states civil code to see what violations were committed pertaining to credit reporting. Also check for breach of contract, or unfair business practices.

Thats not allSmall claims court also requires consumers to show monetary damages. Proof of monetary damages could include documentation that a consumer was turned down for credit. It could also be that they received unfavorable financing terms due to the specific late payment.

Something to remember when trying to remove remarks from credit reports via legal action

But make no mistake, simply filing a suit will not make the creditor buckle. The case has to be strong and well documented. What you may find surprising is, even in the event the creditor does not show up to court, the judge will still look at the merits of the case and rule accordingly.

I normally recommend hiring an experienced professional if you are going to go down this path. This is due to the complexities involved with filing and winning a small claims case to erase your late payment,

What Makes Up Your Credit Score

Your is calculated using different scoring models, such as the VantageScore and FICO. These are the two most widely used credit-scoring models, and each has its own proprietary metrics and criteria. However, both models have one thing in common: they use data from the major credit reporting agencies to generate your score.

If you want to repair bad credit, it’s important to understand what factors VantageScore and FICO evaluate when generating scores.

VantageScore 4.0 Scoring Model

VantageScore prioritizes total credit usage, balance and available credit. Basically, the model first evaluates the amount of credit you have available to use and how much of it you’re using. Using 30% or more of your available credit can lower your score since lenders usually consider it a red flag.

Other factors considered include your credit mix, payment history, credit history length and new accounts.

FICO Scoring Model

The FICO score is the industry standard its the oldest credit scoring model and what most lenders use to evaluate a person’s creditworthiness. FICO’s scoring has five categories, each with a percentage value indicating how much weight they place on each:

You May Like: Chase Sapphire Required Credit Score

How Do Multiple Late Payments Affect Credit Scores

A single late payment can drop a credit score by 60 to 110 points. Predictably, multiple late payments drop a credit score by even more. The biggest credit score damage happens when the lender gives up on the debt.

Although FICO doesnt release its exact methods for calculating drops in credit scores, the chart below by VantageScore.com provides a good general guideline.

When Do Late Payments Fall Off Your Credit Report

A late payment record can pop up on your credit report when you forget or are unable to pay a bill by the due date. The creditor can report your late payment to the credit bureaus once you’re 30 days behind, and the late payment can remain on your credit reports for up to seven years.

The rules can vary slightly depending on when and whether you bring the account current:

- If you bring your account current before you’re 30 days behind on a payment, the creditor won’t report you as late to the credit bureaus. But you may still have to pay late fees or interest.

- If you bring an account current after the creditor reports the late payment, the late payment will fall off your credit reports after seven years. When there’s a series of late payments, such as when your account goes 90 days past due, the entire series falls off seven years after the first late payment, or original delinquency date. If the account is still open, or was in good standing when it was closed, the account can remain on your credit report after the late payments fall off.

- If you never bring an account current, the creditor will likely close it, charge off the debt and send it to collections. The original delinquency date is the start of a seven-year timeline. After seven years, the entire closed account and any related collection accounts will fall off your credit report.

Read Also: Does Speedy Cash Check Your Credit

What Happens To Your Credit Score When Derogatory Marks Fall Off Your Report

Most negative items should automatically fall off your credit reports seven years from the date of your first missed payment, at which point your credit scores may start rising. But if you are otherwise using credit responsibly, your score may rebound to its starting point within three months to six years.

If a negative item on your credit report is older than seven years, you can dispute the information with the credit bureau and ask to have it deleted from your credit report.

Knowing Your Rights Can Help You Negotiate Late Payments

Congress has passed several laws to help consumers negotiate with credit reporting agencies and creditors.

The Fair Credit Reporting Act, for example, gives you access to your credit file for free every year.

Visit annualcreditreport.com to get your free credit reports from the three credit reporting bureaus.

If you discover inaccurate information, the law requires the bureaus to fix this information or remove it.

Be sure to file a complaint with the Consumer Financial Protection Bureau if your attempts to remove inaccurate negative information get no response.

You May Like: Pre Approval Hurt Credit Score

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

Beware Of Closing An Old Account

The bottom line is that paying your bills on time, each and every time, is the very best way to achieve and keep a good credit score. Thats because your payment history counts for a whopping 35 percent of your FICO score its even higher for VantageScore, at 40 percent.

The only way to max out this category is with time and consistent good payment behavior. For those of my readers not familiar with VantageScore, it is a credit score that was developed in conjunction with the three credit bureaus. It uses the same 300 to 850 scale as FICO does and is reputed to be at least as accurate. Being the new guy on the block, not all lenders use the VantageScore.

I am a little alarmed that your oldest credit card is the one you are considering closing. While not to be confused with payment history is not nearly as important to your score, it counts for 10 percent in FICOs formula. VantageScore combines this portion with credit mix and counts it at 21 percent.

Tip: How can you close a card account without hurting your credit score? One way is to pay off any other card balances you have. This will prevent a credit utilization spike that may result from having less overall available credit.

Making the decision to close an account, especially an old account, should be as carefully considered as taking on new credit. There are of course good reasons to close accounts, even old ones. But you need to weigh the risks and benefits of doing so and make an informed decision.

Also Check: What Is Cbna Bby

What Happens If I Make A Late Repayment

If you pay your credit card or loan repayments more than 14 days past the due date this can be recorded on your credit report as part of your repayment history information as a late payment. Only licensed credit providers such as banks and financial institutions are able to disclose repayment history information to a credit reporting body like Equifax. Telco and utility companies are not licensed credit providers and cannot supply or receive this information.

However, a default can be recorded on your credit report by any credit provider if you miss a payment which is more than $150 and is more than 60 days overdue. Before listing a default the credit provider must have taken steps to collect the whole or part of the outstanding debt. This means they have sent you are written notice setting out the amount overdue and seeking payment and a separate written notice advising you that the debt may be reported to a credit reporting body. A default remains on your credit report for five years.

To try and prevent this, pay bills on time, set up direct debits to pay your minimum credit card balance and schedule loan repayments for your pay day. Talk to your credit provider straight away if you are having trouble meeting your repayments they may have procedures in place to help borrowers experiencing financial hardship.

If you are struggling with debt ASIC MoneySmart also provides more information about managing debt.

When Do Late Payments Fall Off A Credit Report

A late payment typically stays on credit reports for seven years. For example, say a payment was missed on September 1, 2021. After 30 days, the issuer reports it as late to the bureaus. That means the late payment wouldnât fall off the credit report until October 2028.

But the CFPB says there are circumstancesârelated to certain job, credit or insurance applicationsâin which the seven-year limit may not apply. So even though a late payment may have fallen off a report, the information could still be in a personâs file.

You May Like: How To Remove Public Records From Credit Report

How Do Late Payments Affect Your Credit Score

Having just one delinquent account on your credit report can be devastating to your credit scores.

Whether its a late car payment, credit card payment, or mortgage payment, a recent late payment can cause as much as a 90-110 point drop in your FICO score.

As time goes on, the late payment will hurt your credit score less and less until it drops off. However, potential creditors can still see that history as long as its listed on your report.

Late payments appear on your report as either 30 days late, 60 days late, 90 days late, or 120-plus days late. Each of these degrees of delinquency has a different impact on your credit.

The later you are, the more damage it does to your credit. More recent delinquent accounts also have a greater impact than older ones.

When Is A Late Payment Reported To Credit Bureaus

Just because a payment is late doesnât mean it will be reported. If a payment is made before itâs 30 days past due, it likely wonât show up on credit reports from the three major credit bureaus: Experian®, Equifax® and TransUnion®.

There are a few reasons for that. One is because those bureaus have standardized the way negative information is reported. That includes late payments. And within that system, thereâs no method or code available to report payments that are between one and 29 days late.

What Happens if a Payment Is Between 1 and 29 Days Late?

Even if a late payment isnât reported, there could still be consequences. Your issuer can charge a late fee, even if itâs the first time your credit card payment is late. And being late again within the next six billing cycles can result in an even higher fee.

Late payments could also affect your interest rate. You can check with your credit card issuer or read your card agreement for more information.

What Happens if a Payment Is More Than 30 Days Late?

Late payments are also typically reported at 60 days, 90 days, 120 days and 150 days. At 180 days, an account is required to be charged off. That means the account is closed and written off as a loss by the issuer.

But be aware that some lenders may charge off accounts earlier than 180 days. And even when an account is charged off, the debt is still owed. And it could be sent to collections.

Don’t Miss: 820 Fico Score

What If I See Something On My Report That Shouldnt Be There

When you get and read your credit report from Borrowell, you might see something that doesnât look right! If itâs regarding a specific item, we recommend contacting the credit grantor or collections agency. If itâs regarding incorrect personal information, such as your date of birth or your address, please contact Equifax directly. You can reach them here: +1-866-828-5961. Here at Borrowell, we canât change or modify any information on your credit report.

How Long Will Late Payments Stay On Your Credit Reports

A late payment will stay on your for seven years from the date of the delinquency, even if you catch up on payments after falling behind. If you leave the bill unpaid, it will still fall off your credit reports in seven years, but youll suffer severe penalties in the meantime.

Your lender may start by levying a late fee and raising your interest rate to a penalty APR. The issuer can also cancel the card so you arent able to make any further charges.

Eventually, unpaid debts are typically sent to collections, after which the collection agency that now owns the debts will repeatedly contact you and try to get you to pay what you owe. In the case of auto loans and mortgages, you risk potentially more serious repercussions, such as losing your vehicle or home as the lender tries to recoup their losses.

If a late payment is incorrectly listed on your credit reports, you can file a dispute with the credit bureaus to get it removed. However, accurate listings will generally remain on your reports even once you pay.

You can send a goodwill letter to your issuer explaining why you paid late and highlight your previously solid payment history, and ask the issuer to remove the late payment from your credit reports. Just know theyre under no obligation to grant this request.

Don’t Miss: How To Get Public Records Removed From Credit Report

How Long Late Payments Stay On Your Credit Report

Late payments typically stay on your credit report for up to seven years and can negatively impact your credit score as long as they remain in your credit history. Thats seven years of struggling to get new credit or facing higher interest rates. However, there are things that you can do to remove negative late payments from your credit report.

How Long Do Derogatory Marks Stay On Your Credit Report

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been previewed, commissioned or otherwise endorsed by any of our network partners.

A poor credit score can make a lot of things harder. It can make borrowing difficult or more expensive. It can even cause your insurance premiums to rise or make it harder to rent an apartment.

All of which means that if you have derogatory marks on your credit report that are dragging down your score, youd like them to be cleared up as soon as possible.

So how long do derogatory marks stay on your credit report? In many cases, theyll stay for seven years, but it depends on the specific type of derogatory mark. This article lays it out mark-by-mark and explains exactly how you can get each one removed.

In this article:

Don’t Miss: 728 Fico Score