How To Freeze Your Credit With Experian

If you want an easy and free way to minimize your chances of identity theft, you should freeze your credit. Once you do, only companies with which you already do business will be able to view your credit files, and it will be nearly impossible for someone else to open a new account in your name.

The drawback to freezing your credit is that you won’t be able to open a new account either. This can be a big problem when you’re trying to buy a car or a house, or even to get a new cellphone or cable-TV contract. Because of this, the credit bureaus make it easy to temporarily or permanently “unfreeze” your credit.

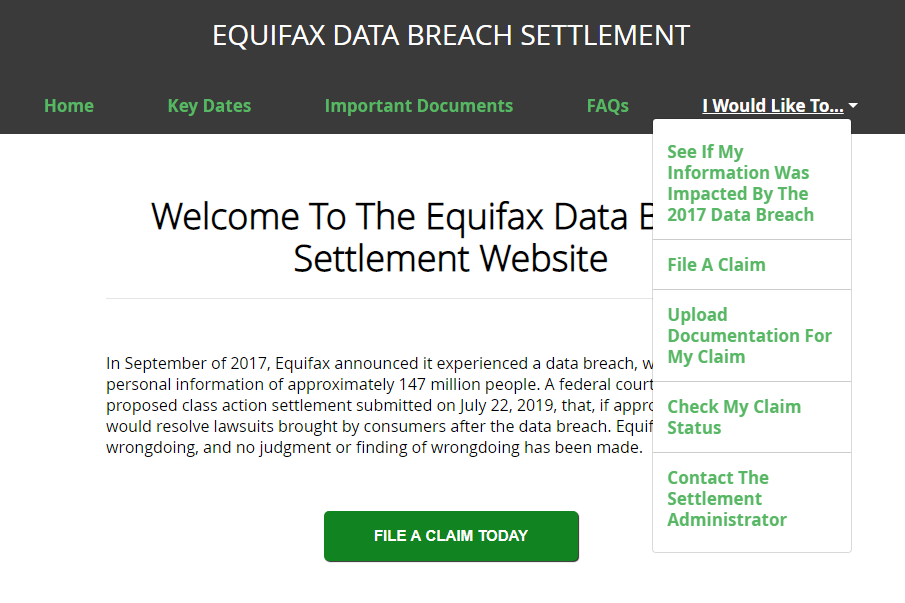

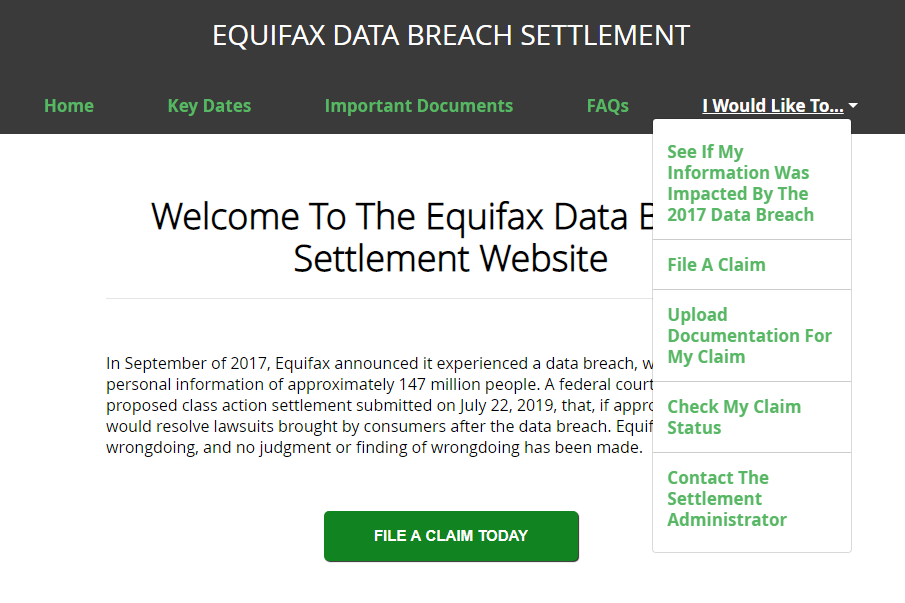

Unlike fraud alerts, you have to set up a credit freeze with each of the Big Three credit-reporting agencies Equifax, Experian and TransUnion individually. Fortunately, freezing and unfreezing your credit is now free across the United States thanks to a law that went into effect one year after 2017’s massive Equifax data breach.

Unlike Equifax or TransUnion, Experian doesn’t require you to set up an account with it to freeze your credit. You simply verify your identity, and then you’ll create a 5-to-10 digit PIN with which you can temporarily or permanently “lift” the freezes.

You can set the dates and duration for temporary “thawing” periods. Experian also lets you create a one-time PIN that you can give to a potential creditor such as a company offering you a car loan so that it can see your credit file just once.

A Credit Freeze Can Help Protect Against Identity Theft

Chip Stapleton is a Series 7 and Series 66 license holder, CFA Level 1 exam holder, and currently holds a Life, Accident, and Health License in Indiana. He has 8 years experience in finance, from financial planning and wealth management to corporate finance and FP& A.

Protecting your credit is important since your can impact your financial life in many ways. A credit freeze is a security measure you might consider if you want to prevent unauthorized people from accessing your credit file. Freezing and unfreezing your credit is a relatively simple process, but it helps to understand how it works to know when it’s the right move.

Facts About Security Freezes

Reading time: 3 minutes

- Security freezes are now free under federal law

- Freezes must be placed separately at each nationwide credit bureau

- Freezes will not impact your credit scores

A security freeze, also known as a credit freeze, is one way you can help protect your personal information against fraud or identity theft. While you may know that, and may even have a security freeze on your credit reports, here are some facts you may not know about security freezes.

1. Security freezes are free

A federal law that went into effect in September 2018 made placing, temporarily lifting, or permanently removing a security freeze free nationwide.

2. Security freezes and fraud alerts are not the same

A fraud alert is a notice placed on your credit reports that alerts credit card companies and others who may extend you credit that you may have been a victim of fraud, including identity theft. With a fraud alert, if anyone including you! tries to open a new credit account in your name or make changes to an existing account, the company must take reasonable steps to confirm your identity, such as contacting you by phone at a number you provide, before granting the request.

With a security freeze, your credit reports cannot be accessed to open new credit unless you temporarily lift or permanently remove the credit freeze.

3. Security freezes must be placed separately at each of the three nationwide credit bureaus

4. Security freezes can be temporarily lifted

Also Check: Does Paypal Credit Report To Credit Bureaus

How To Freeze Your Credit Report After Identity Theft

Freezing your credit report is sometimes necessary. It can help prevent identity thieves from opening new lines of credit and other accounts in your name. Its often recommended when youre dealing with the ramifications of identity theft.

A credit freeze allows you to restrict access to your credit report. When you freeze your credit file, you prevent potential creditors from accessing certain financial and personal information. Creditors are unlikely to let you or an identity thief open, say, a new credit card, if they cant access your credit report. Thats because they wont be able to assess your creditworthiness.

If you need to freeze your credit, you can get a free credit freeze by requesting one at each of the three major credit reporting agencies. More on that later.

How To Lock Your Credit Report At Experian

Experians program, CreditLock, is offered as part of a larger service, Experian CreditWorksSM Premium. It costs $4.99 the first month, and $24.99 a month after that. The program comes with other perks, like credit monitoring for all three bureaus, monthly FICO® credit scores and reports for all three bureaus, up to $1 million in identity theft insurance, and a dedicated agent to help you if you think youre a victim of fraud or identity theft. You can enroll on Experians website.

Don’t Miss: Does Zzounds Report To Credit Bureau

How To Unfreeze An Experian Report

Experian has a “Freeze Center” dedicated to helping you remove or lift a security freeze.

The credit bureau will grant you an unfreeze online after you fill out the form on its website.

You can specify how long you want the freeze to be lifted, and even allow a specific lender to access your frozen report. If you want to completely unfreeze your file, you can request removal by phone or by mail.

Contact info: Experian Security Freeze, P.O. Box 9554, Allen, TX 75013.

Should I Freeze My Credit Report

A credit freeze is a free tool available to help victims of identity theft protect themselves and their credit. But it is an extreme step, and there are some drawbacks. When you have a freeze on your credit report, you will need to remember to lift the freeze prior to applying for credit.

If you have had your personal information compromised and are concerned about credit fraud, there are some other free fraud tools to consider:

- An initial security alert: This alert is also called a temporary security alert or temporary fraud alert. It lets lenders know that someone may be trying to apply for credit fraudulently and asks them to take extra steps to verify your identity before extending credit. Initial alerts are automatically removed after one year.

- A fraud victim statement: Also called an extended fraud alert, this alert also lets lenders know that you have been a victim of identity theft and asks them to contact you at the number you provide if someone applies for credit in your name. To add an extended alert, you must submit a copy of your police report or identity theft report. Extended fraud alerts remain on credit reports for seven years.

- An active-duty alert: Members of the armed forces on active duty can add an active-duty alert to their credit report to help protect themselves from fraud and identity theft while deployed. Active-duty alerts remain on the credit report for one year.

For more information on file freezing, visit Experian’s Freeze Center.

Don’t Miss: Can A Repo Be Removed From Credit Report

How To Unfreeze A Transunion Report

You can lift a credit freeze with TransUnion one of the following ways:

For digital unfreezing, you may be prompted to sign up for a new TransUnion account. If you’re a returning user, simply log in with your username and password. You can also perform the move by downloading the myTransUnion app, available in the Apple or .

The app gives you the ability to “Temporarily Lift Freeze yourself. You just enter the dates you want the lift to happen, so the report can be accessible to lenders.

Over the phone, a customer service representative can help you with the process at 888-909-8872. Or, you can mail your removal requests to the agency directly.

Contact info: TransUnion TransUnion LLC, P.O. Box 2000, Chester, PA 19016.

How Do I Unfreeze My Credit With Equifax

To unfreeze your credit report online with Equifax, you’ll need to sign up for a myEquifax account. Once you have an account, you can lift the freeze temporarily for just one creditor, like Goldman Sachs, or for a specific period of time. You pick the start and end dates. You can also call Equifax directly, but you’ll need a PIN to request the lift.

Don’t Miss: Why Is There Aargon Agency On My Credit Report

How Do I Unfreeze My Credit With Experian

If you want to unfreeze your credit report online with Experian, you’ll be asked to fill out a form and specify the dates that you would like to remove and add back the security freeze. You’ll be asked to confirm your information by providing the PIN you were given when you put the original freeze on it. You can also call Experian directly, but you’ll need the PIN for that, too.

Who Can Access My Frozen Credit Report

A prevents most credit inquiries, but certain parties can still access a frozen report under specific circumstances, such as:

- You, when you view your own credit report.

- Lenders and card issuers with whom you have accounts, who use credit checks in their account management processes.

- Landlords and rental agencies, screening you as a potential tenant.

- Phone carriers and utility companies, to set the amount of security deposit required on equipment.

- Debt collection agencies, when attempting to obtain a payment.

- Child support agencies, for purposes of determining child support.

- Credit card issuers who have prescreened you for credit offers

- Auto insurance companies, which may include credit scores in their rate-underwriting process.

- Potential employers you’ve authorized, conducting background checks.

- Government agents, executing court orders or warrants.

You May Like: 626 Credit Score Good Or Bad

Freezing Your Experian Credit Report Via Postal Mail

If you prefer to use the mail, you can send your request to Experian Security Freeze, P.O. Box 9554, Allen, TX 75013.

Experian has information on its website that should help you figure out what information and documents you may need.

In general, youll need to include your full name , Social Security number, birthdate, two years worth of addresses, a government-issued ID card, such as a drivers license, and a utility bill or other acceptable proof of address.

Youll receive your PIN via postal mail.

Pros Of Locking Your Credit

- A credit lock can reduce your chances of becoming an identity theft victim, since lenders cant check your credit reports while theyre locked.

- You can lock and unlock your reports yourself at any time, making it faster than a freeze if you need to authorize a legitimate credit check.

- TransUnion and Equifax allow you to lock and unlock your credit for free.

You May Like: How To Remove Repossession From Credit Report

How To Set Up A Credit Freeze With Experian By Mail

Write a business letter including your full name, date of birth, Social Security number and any address at which you have lived in the past two years. Include copies of a driver’s license or state ID card AND a utility bill or bank statement.

Send the whole thing to:

Experian Security FreezeP.O. Box 9554Allen, TX 75013

You’ll get a mailed response about whether your freeze was successful, along with a PIN if it was.

How To Freeze Your Childs Credit

There are rules about how old you have to be to get a credit card. And because most children canât open an account on their own, people might think thereâs nothing to worry about.

But fraud and identity theft can still happen to children. And just because theyâre underage doesnât mean scammers canât use their information to open credit cards, bank accounts and more.

If your child is 15 or younger, you can freeze their credit as a precaution. Once they turn 16, they can do it themselvesânot that you canât help.

In cases where a scammer has already used your childâs information, the FTC says you should immediately freeze your childâs creditâamong other steps.

If you decide to freeze your childâs credit, youâll need to make separate requests to each bureau. Those requests have to be done through the mail. Between that and gathering paperwork, the process can take a little time. And if you have more than one child, youâll have to submit separate requests.

Hereâs how to get started with each bureau:

- Equifax has a dedicated page to answer questions about freezing your childâs report. It also has a minor freeze request form to help you get started.

- Experian also has a page that details the basics and a formal request form to help you get started.

- TransUnion provides step-by-step directions about how to freeze your childâs report and what to include with your request.

Recommended Reading: Does Paypal Credit Report To Credit Bureaus

When Should I Consider A Credit Freeze

You might consider a credit freeze if you know your information has been exposed in a data breach. Why? Cybercriminals may have accessed your personal information, which could be used to commit financial fraud.

Often, the exposed information which might include personally identifiable information like your name, address, date of birth, and Social Security number is sold on the dark web. If you think youve been a victim of identity theft, a credit freeze might be a smart move.

Other examples? You might also consider freezing your credit if you start to receive bills for credit accounts you didnt open. For instance, it could be a medical bill you dont recognize. Or you might receive calls from a collection agency seeking payment on a credit line you never opened. These are signs that youre a victim of identity theft.

How Can I Lift A Credit Freeze

The same webpages used to set up credit freezes can be used to remove or suspend them. All three bureaus also provide instructions for lifting a freeze by phone, using the password or PIN connected to your freeze at each bureau.

In addition to your ability to permanently unfreeze your credit, you may have the option to lift the freeze temporarily, either by granting one-time access to a specific creditor, or by indicating a length of time you want the freeze to be suspended. Policies vary by bureau so make sure you understand what your options are before you begin the process.

When you enter your password or PIN online or by phone, your credit will be thawed within one hour. If you lose your password or PIN, the credit bureaus will need to verify your identity, which will delay the process.

You May Like: What Is Factual Data On Credit Report

Get Started With Freeze For Free Through Our Transunion Service Center Where You Can:

- Control who can access your credit information with Credit FreezeAre you applying for credit or has a lender referred you here to lift a freeze on your TransUnion credit report? Youre in the right place.

- Manage or fix any inaccuracies on your credit report

- Place Fraud Alerts to protect your identity

- Add a note to your report around any COVID-19 or other financial considerations

What Credit Card Can I Use At Costco

Category: Credit 1. What credit cards does Costco accept? CNBC Since Costco has a contract with Visa, shoppers cant use credit cards backed by the other three main networks, American Express, Mastercard or Discover, at Costco shoppers can only use Visa credit cards in-store. Here are the best credit

Don’t Miss: How Long Does It Take Capital One To Report Authorized User

Help When You Need It

Our dedicated team of Credit and Fraud Resolution Agents give you personalized support.

If you think you have an issue with fraud or identity theft, rest assured that weâre here to help with toll-free support available 7 days a week. A Fraud Resolution Agent is assigned to work with you closely every step of the way until your issue is resolved.

When Is A Pin Necessary To Unfreeze Your Credit

The need for a PIN to unfreeze your credit depends on the specific credit bureau.

Both Equifax and TransUnion let you unfreeze your credit online without your PIN by entering your account username and password on their websites. While TransUnion requires a PIN to unfreeze your credit over the phone, there may be ways you can unfreeze your credit with Equifax over the phone without a PIN.

Experian is the only credit bureaus that requires a PIN to thaw a credit freeze regardless if you do it online, over the phone or by mail.

Also Check: Speedy Cash Collection Agency

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Lifting A Freeze For A Single Lender

Read Also: Does Zzounds Report To Credit Bureau