Your Income May Be More Important Than Your Credit Score

In the wake of the coronavirus pandemic, lending has dramatically changed over the past few months. Credit card companies have started to cut customers’ credit limits to lower the risk of defaulted payments. Meanwhile, on the home lending side, investors are pulling back on jumbo loans and non-qualified mortgages for borrowers with variable income

But for more conventional borrowers who still have a consistent source of income, Gage says there are viable options.

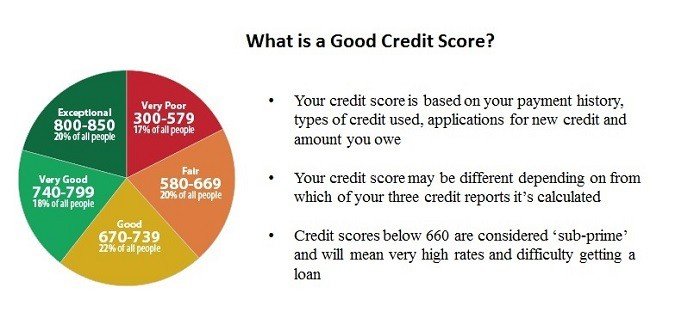

“Many lenders are still lending to borrowers with 620 scores,” says Gage, as long as the borrower has proof of sufficient income. A 620 score falls in the fair/average range according to both the FICO and VantageScore scoring models.

Keep in mind: A good or excellent credit score will qualify you for better interest rates and terms, but mortgage lenders can work with a lower score as long as your income checks out, Gage says. It also helps if you have a down payment of at least 20%.

However, showing proof of stable income has become even more essential.

“The biggest challenge we’ve encountered on the lending side is layoffs and furloughs,” Gage says.

Throughout the mortgage application process, your employment must be re-verified several times. If you’re laid off at the same time you’re applying for a mortgage, you may have to wait and apply again, no matter how good your credit score is.

“In many cases, we’ve seen buyers and sellers have to exit the market due to a layoff,” says Gage.

Get Hold Of Your Existing Credit Reports

Forewarned is forearmed, as they say. Before you even think about looking for mortgage deals, find copies of your current credit reports to see which credit issues are still showing up, and which have already dropped.Lenders will usually source reports from the three main credit agencies Experian, Equifax and TransUnion which will each contain information on your previous loans, credit card bills, overdrafts and utility accounts. To access your free credit reports . Remember, each of these reports may display slightly different information. If you spot something on any of them that you believe is incorrect, contact the credit provider to ask them to update their records, or ask the agency themselves to look into the problem.

Should You Get A Mortgage Or Increase Your Credit Score First

If you look at the loan savings chart above you can see two things: First, bad credit means higher mortgage loan costs. Second, although the chart doesnt go below 620, you can guess that credit scores below 620 lead to even higher financing costs.

So, should you take out a mortgage now or increase your credit score before you apply for financing? The best answer is to plan ahead.

A few straightforward ways to improve your credit score are to pay down existing debts, make sure you stay current on your bills and avoid opening new lines of credit while youre applying for a mortgage. For more advice, check out Bankrates guide to improving your credit.

Don’t Miss: Zzounds Payment Plan Denied

What Do Mortgage Lenders Look For When Conducting A Credit Search

Some lenders will want you to have a certain credit score, a numerical value assigned to your financial conduct by the UKs three main credit reference agencies: Checkmyfile, UKCreditRatings and Experian.

Mortgage providers who base their lending decision on credit scores can vary dramatically in terms of what they will and wont accept, but keep in mind that there are also lenders who dont use credit scores at all so for a joint application, there is no joint credit score needed for a mortgage as each credit report will be searched separately.

These lenders simply search your credit report for the presence of adverse. If you have bad credit, this could mean that a bad credit mortgage lender is called for. They have the flexibility to take the age, severity and the reason for your credit issues into account when assessing your application.

Mortgage Underwriting: Manual Or Automatic

Mortgage underwriting is the process a lender uses to determine whether a borrower is qualified for a loan. It usually follows the three Cs of underwriting credit, capacity and collateral.

There are two paths manual and automatic.

Under manual underwriting, you are assigned a person to review your application. They will review documents such as credit score, debt-to-income ratio, bank statements and pay stubs, then make a decision on your ability to repay. If the underwriter is satisfied, your loan application will be approved.

Under automatic underwriting, its a computer-generated decision based on logic and algorithms, thus eliminating human bias. With systems that retrieve relevant data, such as the borrowers credit history, it gives a near-instantaneous loan approval or denial. Some factors, such as income and assets, must be verified. Occasionally, applications might be referred to manual underwriting, which can require up to 60 days.

Manual or automatic: which is the better choice?

Also Check: Does Applying For Paypal Credit Affect Credit Score

Should You Take Out A Mortgage Or Increase Your Credit Score

So how badly do you want that house? Or, better yet, how badly do you need that house?

Because if youve got some time at least six months, preferably a year you can take steps to increase your credit score by 100 points. The first two steps are

- Start making on-time payments every month

- Stop using your credit cards until you paid them all off

Paying on time accounts for 35% of your credit score. Credit utilization how much of your available credit you use every month accounts for another 30%.

If you are on time with at least the minimum payment every month and use cash or checks to pay all bills , you are taking positive steps to address 65% of the factors that determine your credit score.

Is it easy? No, but its certainly doable if you really want that house at a payment level you can afford for the next 15-30 years.

Loan Options For Buying A House With Bad Credit

Recently, the median FICO Score for newly originated mortgages hit 786, which is higher than the average credit score. Fortunately, buyers with scores well below those numbers or with adverse events in their credit history can pursue homeownership through one of these low credit score home loans.

| Loan Program |

*Some programs may permit a higher DTI under certain circumstances.

Read Also: Does Affirm Show Up On Credit Report

How Can I Make My Credit Score Higher

If you have a bad credit rating, then there are still some things that you can do in order to improve your score. Improving your credit rating will make it more likely that you will get approved for mortgages and other types of loan in the future. In addition to this it also means that you will probably not have to pay as much interest on future debts.

- Don’t fall behind on bills or debt repayments

- Add yourself to the electoral roll

- Don’t have any unused credit accounts

- Use a credit builder credit card

- Take out loans with a guarantor

None of these things will make certain that your credit score goes up but it is likely that if stick to the things on this list, you will see an overall improvement in your credit rating.

Can I Remortgage My Home With Bad Credit

It is certainly possible to switch to another mortgage deal at the end of your current term if you have a history of adverse credit. You will be able to access a better range of deals if you can settle as many of your outstanding debts as possible before your mortgage is up for renewal, and if you can prove that you have stayed on top of your mortgage repayments to date .If youre concerned that your bad credit history may affect your remortgaging prospects or you are worried that having little to no credit activity might hinder your chances of securing good terms speak to the team here at CLS Money well before your existing term is due to end. We have helped many applicants find suitable remortgaging options even when there is evidence of defaults, CCJS, IVAs and other marks on their credit files.

Don’t Miss: Does Zebit Report To Credit

Close Old Inactive Accounts They Can Kill Your Application

If you’re not using an account, it may be worth closing it. Leaving it open might be a fraud risk, and it could display out-of-date details.

Having said that, when applying for a mortgage, longer, stable credit relationships are a positive. So, if you’ve two credit cards, one recently opened and an older one, it’s probably not worth closing the older one before the mortgage application as you could lose the credit score boost it gives you.

See the Should I Cancel? section of our Credit Scores guide for full information on why you should close old accounts. Remembered, if you are closing an account, just cutting up the card isn’t good enough you must tell the bank you want it closed.

Tip Email

Great Work Very Reliable

My wife and i went with Dominion Mortgage Pro’s off of an add we saw on the internet, and we are very happy we did. From day one, Narish Maharaj and Lisa Vetsby have been amazing and answered all our questions and provided us with the correct guidance we needed. They were extremely prompt with getting back to emails and even calling me on the phone when we needed that little bit more of an explanation. Narish and Lisa took the stress out of this part of the buying process and i would recommend Dominion to anyone looking for a personable and caring experience.

Yung L. –

Also Check: Which Business Credit Cards Do Not Report Personal Credit

Learn More About Mortgages In The Uk

How do mortgages work in the UK?

Buying a home or land is expensive. A mortgage is a financial product that helps people purchase their own home or land.This is especially true for a first time buyer, as it might be the only route onto the property ladder.

The minimum credit score for a mortgage

ou can still be approved for a mortgage to buy a property if you have a poor credit score. However, someone with a poor credit score will probably have a higher interest rate than someone whose credit score is good. Buyers with a low credit score may also need to pay a bigger deposit.

fixed term Contract Mortgages

A fixed term contract is a way of describing certain types of employment. If your current employment contract is due to end after a certain period of time, or after a specific piece of work is complete, you are likely on a fixed term contract.

how long does a mortgage application take?

After sending off the final application waiting for the decision can be frustrating. Many prospective homeowners ask how long does it take? but the truth is the mortgage approval process is always different for each customer.

how long does conveyancing take?

The entire conveyancing process will normally take anywhere between 8-12 weeks, however you should be prepared for this to take much longer depending on your circumstances and wider factors. This articles explores what the timescale involves.

Mortgages if You are bankrupt

what stops you getting a mortgage?

IVA Mortgage

Avoid Delays Fill Out The Application Form Correctly

Here are our top five tips for filling in the paperwork or online application. Even if you end up getting a broker to help you, its normal for you to be asked to check it first so make sure you:

DO state your income exactly. Dont round up.

DO give your FULL NAME even middle names are necessary.

DO declare ALL your debts.The lender will find them anyway and withholding the info can mean a quick decline.

DO get your three-year address history exactly right, including postcodes.

DO give honest answers when asked about how much you spend.

You May Like: When Does Capital One Report To Credit

What Kinds Of Specialist Mortgages Could I Get With Adverse Credit

Depending on your circumstances, you may need your broker to look at a more niche mortgage arrangement. Requiring a complex mortgage may narrow your chances of being able to get a deal but because there are more lenders in the market who are specialising in adverse credit mortgages, its always worth checking to see what kinds of products are out there before giving up on your dream of owning your own property.

How Do I Know If I Have Bad Or Adverse Credit

There are lots of ways you can unintentionally damage your credit score. Thats why its always a good idea to have a look at your credit report before you apply for any kind of mortgage bad credit or not.

But there are also some clear reasons why you might have a bad credit rating. These include:

-

Having been declared bankrupt, or having had a debt management plan, IVA etc.

-

Missing credit card, loan or mortgage payments

-

Having County Court Judgements against your name

The good news is there are also lots of ways to improve your credit rating – check out our tips below.

Read Also: Does Paypal Credit Report To Credit Bureaus

How Much Extra Will A Low Credit Score Cost You

Interest rates for new and refinanced mortgages hit record lows over the course of 2020. The average 30-year fixed mortgage rate was 4.87 percent in November 2019, according to Freddie Mac, but by the start of 2021, interest rates were hovering around 3 percent.

Those record-low rates might not be available to borrowers with bad credit, however. While rates are lower across the board than they were a year ago, applicants with low credit scores should expect to pay more than borrowers with stronger credit.

The table below shows that home loans for bad credit borrowers are significantly more expensive than mortgages for borrowers with good credit. Examples are based on national averages for a 30-year fixed loan in the amount of $248,640 the national median home price, less 20 percent, according to the National Association of Realtors using myFICO.coms loan savings calculator.

Heres how much youd pay at rates available at the time of publication, depending on your credit score range:

| $176,532 |

How To Improve Your Credit Record

The best way to improve your credit record is to stay on top of what you borrow. Make sure you:

-

Always make your repayments in time

-

Stay in your credit limit or overdraft limit

-

Avoid applying for too much credit

-

Keep your name and address details up to date

If your credit record improves, you may be able to:

Also Check: Check Credit Score Without Social Security Number

What Is A Credit Search

A credit search is a review, conducted by a company, with the specific aim of gaining a clear understanding of your financial behaviour up to that point. Although your consent is not mandatory the company must have a legitimate reason for the credit search a lender with whom youve applied for credit or, perhaps, a prospective employer as part of their recruitment process.

There are two types of credit search : a soft check and a hard check.

How To Get A Mortgage If You Have A Bad Credit Rating

One rule that applies generally when getting a mortgage, not just to those with bad credit, is that you should check your credit score in advance. This will allow you to know where you stand when it comes to your application.

Another thing that you should do is compare mortgages out there on the market at the moment. By doing this you will have a better idea of what kind of mortgage deals are available and therefore you should know roughly what to expect to pay.

You should also avoid making too many applications for mortgages because do so can often affect your credit rating negatively. For this reason it is a better idea to go into a bank and talk to someone “unofficially” about what your options are and how likely you will be to have a successful application.

Talking to your current account provider can also be a good idea. This will allow you to explain your situation and the reasons that you have a poor credit rating. It may be the case that they do not have any mortgages on offer that are appropriate for your needs but it avoids you having to make an unnecessary application.

Also Check: Does Capital One Report Authorized Users To Credit Bureaus

What Credit Score Do Mortgage Lenders Use

As explained above, the most commonly used mortgage credit scores are the FICO credit scores that you have with the UKs main three credit reference agencies: TransUnion, Experian, and Equifax.

Mortgage lenders will normally look at your credit score from each of the CRAs when you apply for a mortgage. If a borrower has three different scores according to each scoring system, then they will use the middle credit rating to assess your application.

But, if two credit agencies agree on your credit score, the mortgage lender will just use that credit rating in their assessment.

Jeff Was Super Approachable

I thought the whole process was smooth and worthwhile. You were always accessible and any questions or concerns I had you addressed very quickly. I also appreciate how personable you were and did not make the process feel strictly like a business transaction . I will most certainly be recommending you to anyone looking for a broker and hopefully we can still use you again in 5 years.

Thomas C. –

Recommended Reading: Paypal Credit Credit Report